We’re within the midst of a significant financial transition, one that will ultimately match the modifications of the Industrial Revolution. The change, in fact, is the appearance of the inexperienced financial system, and the swap from fossil gasoline power sources to renewable power. Whereas wind and solar energy are absorbing the headlines, a extra believable long-term inexperienced energy supply is already close to at hand: hydrogen.

Hydrogen is essentially the most considerable of all of the chemical components, and likewise the only by molecular construction. It’s discovered in every single place; with carbon and oxygen, it types the idea of the natural compounds that make life attainable, and within the coronary heart of the solar, its nuclear fusion generates the sunshine and power on which all of us rely. With out hydrogen, we couldn’t exist.

Hydrogen additionally affords excessive potential as gasoline. It’s extremely reactive, and amenable to our technological management. As a gasoline, it may be burned with oxygen to launch each mild and warmth; as a component in gasoline cells, it could actually generate clear electrical energy. Being so widespread, comparatively easy technological processes – electrolysis powered from renewable sources and steam methane reforming related to carbon seize and storage, to provide ‘inexperienced’ and ‘blue’ hydrogen respectively – can produce hydrogen at scale for trade and utilities.

A latest report from Deutsche Financial institution’s David Begleiter factors out that, attributable to latest initiatives of the Biden Administration, it pays for corporations to provide clear hydrogen. The Division of Power has introduced $7 billion in funding for regional clear hydrogen hubs within the US, and the US authorities is working to advertise demand for clear hydrogen.

Begleiter, a 5-star analyst, has additionally been declaring shares that stand to realize as hydrogen use expands. We’ve used the TipRanks platform to search for the small print on two of these picks, producers and distributors of business gasses, which are leaders within the sector – and that buyers ought to watch them carefully.

Linde plc (LIN)

Linde, the primary firm we’re , was based in Germany and traces its roots again to 1879. At present, the agency operates with a world footprint and has turn into the main supplier of atmospheric gases – argon, nitrogen, and oxygen – for industrial use, in addition to different pure gases similar to hydrogen, carbon monoxide, ammonia, and methanol. The corporate’s merchandise have discovered makes use of in aquaculture, agriculture, chemistry, development, electronics, healthcare; there’s hardly a sector of our financial system that doesn’t make use of gases ultimately.

All of this isn’t simply massive enterprise, it’s large. Linde has a market cap of $185 billion and generated over $33 billion in whole revenues final yr. Its fuel enterprise is supplemented by engineering companies, in separating and pressurizing gases, growing and constructing programs for the liquefaction and storage of gases, thermal processes for recovering gases from industrial feedstocks, and growing the specialist tools for the manufacture of business gases.

In relation to hydrogen, Linde has the long-term expertise, the technical experience, and the prevailing infrastructure to quickly generate the fuel in giant portions, to retailer it safely, and to ship it when and the place it’s wanted. Linde already supplies hydrogen for a number of industrial purposes, together with aviation, heavy trade, mobility, and energy buffering.

Linde’s outsized footprint within the industrial fuel area of interest has been useful for each the corporate and its buyers. Earnings are trending upward in latest quarters, and the agency’s inventory is up 18% year-to-date. In its final quarterly monetary launch, for 2Q23, Linde confirmed an adjusted EPS of $3.57, beating the forecast by 9 cents and rising 15% from the prior-year quarter. The highest-line outcome, nonetheless, was down ~5% year-over-year and missed the estimates by $500 million.

For analyst Begleiter, all of this may be summed up in a easy checklist of achievements: “With Linde executing nicely on pricing and productiveness, 18 consecutive earnings beats, a extremely resilient enterprise mannequin, a $50B-plus and rising slate of fresh power funding alternatives and valuation a good 27.0x ’23E EPS and 16.6x ’23E EBITDA, we reiterate our Purchase score.”

That Purchase score comes together with a $450 value goal suggesting ~19% one-year upside potential for the inventory. (To observe Begleiter’s observe document, click here)

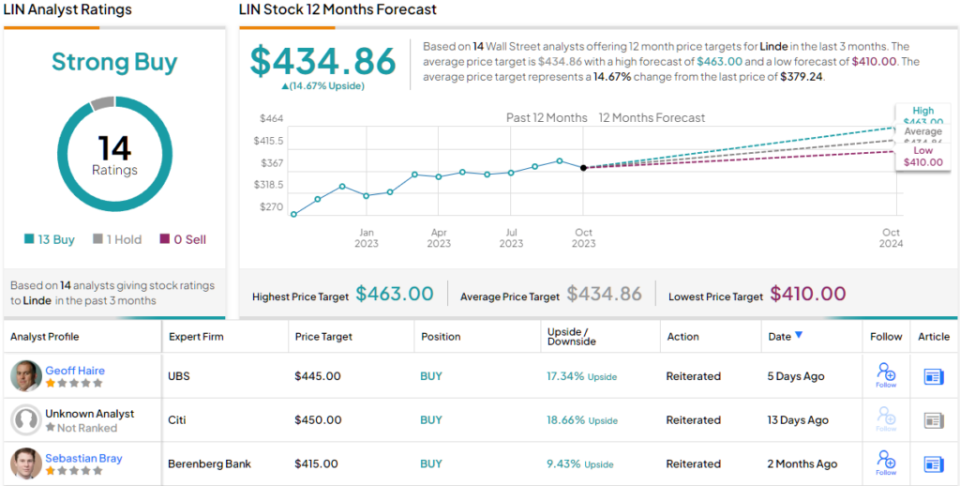

General, Linde will get a Sturdy Purchase consensus score from the Avenue’s analysts, supported by a decisive 13 to 1 Purchase-over-Maintain margin among the many 14 analyst evaluations on document. The shares are buying and selling for $379.24, and the $434.86 common goal value factors towards ~15% upside on the one-year horizon. (See Linde stock forecast)

Air Merchandise and Chemical substances (APD)

Subsequent up is Air Merchandise and Chemical substances, a Pennsylvania-based industrial fuel agency. Like Linde above, Air Merchandise supplies a variety of gases, together with hydrogen, helium, carbon monoxide, and carbon dioxide, in addition to the widespread atmospheric gases argon, nitrogen, and oxygen, together with the engineering and storage experience to make use of them effectively. The corporate’s merchandise are discovered throughout the financial system, in electronics, meals and beverage, cement and lime, pulp and paper, rubber and plastics, meals and medication – the checklist is almost limitless.

By the numbers, Air Merchandise has a formidable footprint. The corporate operates in over 50 nations, using greater than 21,000 individuals to serve over 200,000 industrial prospects. APD generates its merchandise in a community of 750+ services and may transport gases via 1,800 miles of pipelines. The corporate posted $12.7 billion in gross sales for fiscal yr 2022 and has ~$64 billion market cap.

Earlier this yr, Air Merchandise introduced that it had ‘closed the deal’ on an settlement with two companions, ACWA Energy and NEOM Inexperienced Hydrogen, within the improvement of the world’s largest inexperienced hydrogen manufacturing facility. Air Merchandise and NEOM concluded contracts price $6.7 billion for engineering, procurement, and development actions within the mission.

This announcement was solely the most recent in Air Merchandise’ hydrogen actions. The corporate is deeply linked to the North American inexperienced hydrogen trade as a part of its work to create a decarbonized financial system.

Air Merchandise reported its outcomes for Q3 of the fiscal yr 2023 in early August, displaying income of $3.03 billion. This was down 5% year-on-year and got here in $260 million under expectations. Nevertheless, the corporate’s backside line was stronger. Earnings have been rising regularly over the previous a number of quarters, and the fiscal Q3 2023 backside line was $2.98, up 13.7% from fiscal Q3 2022 and seven cents higher than had been anticipated.

As soon as once more, we’re a fuel inventory that Deutsche Financial institution’s David Begleiter sees in a usually bullish place. The analyst writes of Air Merchandise, “With a big, inexperienced (blue/inexperienced hydrogen, carbon seize, SAF) and mission backlog underpinning Air Merchandise’ power transition progress technique and offering a line of sight to 10%-plus EPS progress over the following 5 years, a rising observe document of huge mission execution and valuation a good 22.3x ’24E EPS, we reiterate our Purchase score.”

Wanting forward, Begleiter provides the shares a value goal of $330 to go together with the Purchase score, implying a 15% potential acquire within the coming yr.

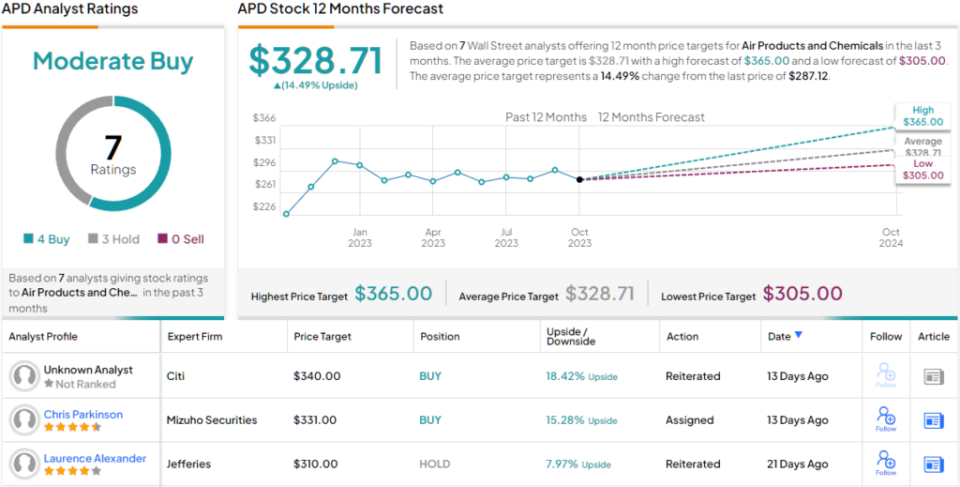

Zooming out, we discover that Air Merchandise shares get a Average Purchase consensus from the Avenue, primarily based on 7 evaluations that break all the way down to 4 Buys and three Holds. The inventory’s common value goal of $328.71 suggests a acquire of 14.5% from the present promoting value of $287.12. (See APD stock forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely necessary to do your personal evaluation earlier than making any funding.