Whereas 2022 was among the many worst years in latest reminiscence for a lot of buyers, the market restoration over the previous yr is offering welcome reduction. The Nasdaq Composite has helped lead the cost, up 42% to date in 2023, sitting simply 7% beneath its all-time excessive (as of this writing). As soon as the index exceeds that benchmark, it can have checked off the ultimate standards essential to sign the arrival of the brand new bull market.

But, the restoration has been remarkably uneven. Whereas an awesome many shares are nonetheless struggling to realize floor, the so-called Magnificent Seven (listed beneath in alphabetical order) have outpaced the broader market by a large margin to date this yr (returns are as of market shut on Friday):

-

Alphabet: Up 50%

-

Amazon (NASDAQ: AMZN): Up 78%

-

Apple: Up 52%

-

Meta Platforms: Up 177%

-

Microsoft: Up 54%

-

Nvidia (NASDAQ: NVDA): Up 235%

-

Tesla (NASDAQ: TSLA): Up 106%

Even after the stellar performances this yr, sure Wall Avenue analysts counsel that three of those shares nonetheless have important upside potential and will achieve between 50% and 125% over the course of 2024.

Magnificent Seven purchase No. 1: Tesla (50% implied upside)

There is no getting round the truth that Tesla has revolutionized the car business, driving mainstream adoption of electric vehicles (EVs). The truth is, in 2023, Tesla did what would have been unthinkable just some years in the past. The corporate’s hottest automotive — the Mannequin Y — crashed via the glass ceiling, turning into the world’s best-selling automotive. To place the icing on the cake, Tesla was the primary ever EV to attain this distinction, in line with automotive business publication GreenCars.

The ultimate numbers aren’t but in, however Tesla is predicted to promote 1.8 million vehicles this yr, which might signify development of about 38% — exceptional contemplating the financial headwinds of the previous couple of years. Over the long term, Tesla is working to extend automobile manufacturing by a compound annual development price of fifty%. As soon as the financial headwinds subside, demand will possible ramp up.

Regardless of Tesla’s lofty positive aspects to date this yr, Morgan Stanley analyst Adam Jonas continues to be remarkably bullish, sustaining a purchase ranking on the inventory with a worth goal of $380, implying extra upside of fifty%. He believes buyers underestimate the potential of Tesla’s ancillary companies, together with batteries and full self-driving. Moreover, he suggests the competitors is outmatched, and Tesla will proceed to seize even higher EV market share.

Tesla stays a battleground inventory. Of the 47 analysts who issued an opinion in November, 18 rated the inventory a purchase or robust purchase, 21 rated it a maintain, and eight advised promoting, with most citing the inventory’s frothy valuation. That actually bears consideration, as Tesla is at present promoting for 9 occasions gross sales. That stated, it is a important low cost to Tesla’s three-year common price-to-sales ratio of 15.

To be clear, Tesla inventory will not be for everybody, however for these prepared to just accept some extra threat, a bit bit can go a good distance.

Magnificent Seven purchase No. 2: Amazon (58% implied upside)

There’s rather a lot to love about Amazon, significantly the varied nature of the corporate’s enterprise pursuits. Not solely is Amazon the business chief in digital retail and cloud infrastructure, however it’s a rising drive in internet marketing. The challenges of the previous couple of years however, Amazon has a strong basis upon which to construct its future development.

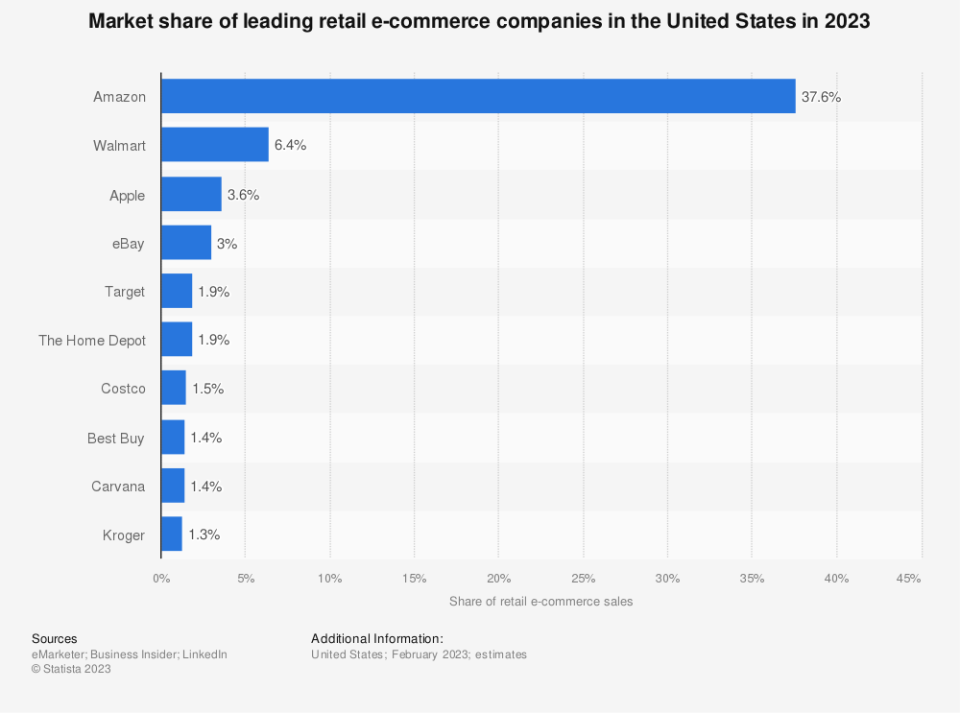

For instance, Amazon stays the undisputed e-commerce chief, controlling roughly 38% of the market final yr, in line with on-line information supplier Statista. For context, that is greater than the subsequent 14 digital retailers mixed. The enhancing financial atmosphere will little question enhance Amazon’s fortunes as customers breathe a sigh of reduction and resume their historic spending patterns.

Companies additionally reined in spending in 2023, which has weighed on Amazon’s cloud enterprise. Moreover, all through the downturn, Amazon maintained its place because the No. 1 supplier of cloud infrastructure companies, with 31% of the market within the third quarter, in line with market analyst Canalys. The rise of generative synthetic intelligence (AI) over the previous yr represents a compelling alternative for Amazon, as the corporate expands the checklist of AI companies it makes out there to its cloud computing prospects.

Even after Amazon’s strong efficiency to date this yr, Redburn analyst Alex Haissl believes there’s nonetheless rather more to return for the corporate. The analyst maintains a purchase ranking on the inventory and a worth goal of $230, implying an extra upside of 53%. He suggests the market underestimates how shortly Amazon’s development will ramp again up, saying “The outlook for Amazon is outstanding.”

The analyst is not alone in his bullish outlook. Of the 54 analysts who issued an opinion in November, 53 rated the inventory a purchase or robust purchase, and not one beneficial promoting. That is exceptional, contemplating Wall Avenue by no means agrees on something.

Lastly, Amazon’s valuation stays extraordinarily compelling. Even after a big transfer larger this yr, the inventory continues to be promoting for roughly 2 occasions subsequent yr’s gross sales. Given its development potential, that is purpose sufficient to purchase the inventory.

Magnificent Seven purchase No. 3: Nvidia (125% implied upside)

The robust and rising demand for generative AI has been the massive tech story of the yr, and nowhere is that extra obvious than Nvidia. Because the gold commonplace in machine learning and different established areas of AI, the corporate shortly pivoted to adapt its expertise to usher on this newest technology of algorithms.

The corporate wasn’t content material to relaxation on its laurels, releasing the H200 Tensor Core GPU, particularly designed for the trials of AI processing. The brand new AI superchip delivers “almost double the capability and a couple of.4x extra bandwidth in contrast with its predecessor, the Nvidia A100.”

After delivering two consecutive quarters of triple-digit, year-over-year development, administration is guiding for extra of the identical. Nvidia is asking for income of $20 billion, a rise of 231% yr over yr, fueled by file adoption of AI.

These outcomes propelled Nvidia inventory larger this yr, however Rosenblatt analyst Hans Mosesmann stated he believes there’s much more upside forward. The analyst maintains a purchase ranking on Nvidia with a worth goal of $1,100, suggesting the inventory may surge 125% from right here. The analyst cited the corporate’s triple-digit income development, saying efficiency of that caliber is “unprecedented.”

He additionally believes buyers are underestimating the development by information facilities to undertake extra strong processors to deal with the trials of AI and high-performance computing. With an put in base estimated at $1 trillion, that means numerous upgrades forward, with Nvidia main the cost.

Of the 53 analysts who issued a ranking in November, 51 rated Nvidia a purchase or robust purchase, and not a single one beneficial promoting.

Many buyers will level to Nvidia’s valuation as a purpose to keep away from the inventory, however that view is myopic. The inventory trades at a price/earnings-to-growth ratio (PEG ratio) of lower than 1, in comparison with greater than 2 for the S&P 500. By that valuation measure — which components in its outsized development — it is the most affordable of all of the Magnificent Seven shares.

Speedy adoption of AI is simply starting, which ought to gasoline Nvidia’s development for years to return.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Danny Vena has positions in Alphabet, Amazon, Apple, Carvana, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Greatest Purchase, Costco Wholesale, Dwelling Depot, Meta Platforms, Microsoft, Nvidia, Goal, Tesla, and Walmart. The Motley Idiot recommends Kroger and eBay and recommends the next choices: quick January 2024 $45 calls on eBay. The Motley Idiot has a disclosure policy.

3 “Magnificent Seven” Stocks With 50% to 125% Upside in 2024, According to Wall Street Analysts was initially printed by The Motley Idiot