Within the basic tune by Kenny Rogers, ‘The Gambler,’ he sang, ‘Each hand’s a winner and each hand’s a loser…’ These phrases maintain worthwhile knowledge that ought to resonate with each investor. No matter your chosen funding technique, reaching success within the inventory market finally hinges on mastering the artwork of balancing threat and reward.

Few segments of the inventory market provide a better potential return for the danger concerned than the penny stocks, these equities priced at $5 or much less. These are shares with a really rock-bottom value of entry.

This low entry value carries the potential for substantial positive factors, as even a modest improve in share value can translate into a big proportion return. On the subject of penny shares, it isn’t remarkable to search out upside potentials of 300%, 400%, and even higher. In fact, the flip-side can also be true; with the excessive reward comes elevated threat.

Given the character of those investments, Wall Road analysts suggest performing some due diligence earlier than pulling the set off, noting that not all penny shares are certain for greatness.

With this in thoughts, our focus turned to 2 penny shares which have obtained a thumbs-up from Baird analysts. After operating the tickers by TipRanks’ database, we discovered that each have been cheered by the remainder of the Road as properly, as they boast a ‘Sturdy Purchase’ analyst consensus. To not point out, there may be substantial upside potential on the desk – we’re speaking about over 500% right here.

Leap Therapeutics (LPTX)

We’ll begin with Leap Therapeutics, a clinical-stage biopharma firm targeted on creating new remedies for quite a lot of cancers. The corporate is working within the subject of immune-oncology to create drug candidates primarily based on monoclonal antibodies.

Leap’s main candidate, DKN-01, is a humanized monoclonal antibody designed to battle esophagogastric, gynecologic, and colorectal cancers by concentrating on the DKK1 protein. FL-301, Leap’s second candidate, is an anti-CLDN18.2 antibody and is underneath analysis as a therapy for gastric and pancreatic cancers. The corporate has two extra drug candidates in preclinical phases of improvement.

Within the analysis clinic, Leap’s main candidate is presently present process three separate trials. Probably the most superior of those, the DisTinGuish examine, is a Part 2 trial of DKN-01 in opposition to gastric cancers. In not too long ago launched knowledge on Half A of the examine, protecting the long-term follow-up for first-line sufferers, Leap confirmed that the general response price was 73% within the modified intent-to-treat inhabitants. The corporate has additionally introduced optimistic preliminary outcomes from Half A of the Part 2 DeFianCe examine, specializing in DKN-01 within the therapy of colorectal most cancers. Primarily based on the Half A outcomes, the DeFianCe examine will probably be expanded right into a 130-patient randomized management trial for Half B, anticipated to begin enrolling members within the coming 12 months.

Primarily based on the potential of DKN-01, and the corporate’s $1.26 share value, Baird analyst Joel Beatty thinks that now’s the time to get in on the motion.

“We view LPTX as a promising small-cap focused oncology biotech firm… Enrollment continues to be robust within the 160-patient randomized-controlled Half C of the DisTinGuish examine in gastric most cancers, which Leap expects to finish enrollment in 4Q23. This units up preliminary ORR knowledge from this examine coming round YE23/1Q24. We view this as crucial catalyst for the inventory. We anticipate the inventory would commerce a number of occasions larger if this trial is a transparent success…”

Waiting for potential expansions of Leap’s program, Beatty factors out that DKN-01 could have broader functions past its present scientific trial targets. He writes, “We imagine credit score for DKN-01 in extra cancers past gastric/GEJ is lacking from the inventory value. The robust and constant ph2a knowledge in gastric/GEJ most cancers suggests to us that there’s a very good chance that DKN-01 may present a profit in different cancers past gastric with excessive DKK1. Potential settings with some early supportive knowledge embody endometrial, colorectal, lung, and prostate.”

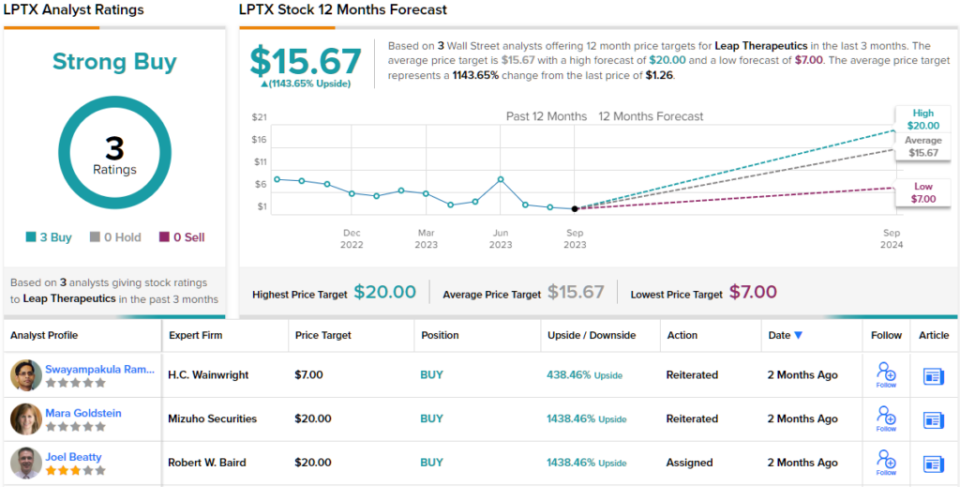

To this finish, Beatty charges LPTX a Purchase together with a $20 value goal. This places the upside potential at an enormous 1,438%. (To look at Beatty’s observe file, click here)

Turning now to the remainder of the Road, 3 Buys and no Holds or Sells have been revealed within the final three months. Due to this fact, LPTX has a Sturdy Purchase consensus score. With the typical value goal clocking in at $15.67, the upside potential lands at 1,143%. (See LPTX stock forecast)

Cellectis SA (CLLS)

The subsequent penny inventory we’ll have a look at is Cellectis, an immunotherapy biopharmaceutical firm engaged on new most cancers remedies; particularly, Cellectis’ work is targeted on chimeric antigen receptor (CAR) T cell know-how, a biotech strategy that fights cancers by enlisting the affected person’s personal immune system to inhibit rising tumors.

Cellectis is utilizing a proprietary gene enhancing platform, TALEN, to develop a line of anti-cancer therapies that can be utilized ‘off the shelf,’ decreasing the time wanted to begin efficient therapies for sufferers. The corporate has created a line of in-house CAR T cell medicine, the UCART line, as allogenic merchandise, designed to focus on a number of indications. This is a vital benefit for Cellectis’ product line, as current CAR T medicine are usually personalized for every affected person.

The road of in-house UCART merchandise consists of three drug candidates within the scientific trial phases – UCART22, a possible therapy for acute lymphoblastic leukemia; UCART123, a possible therapy for acute myeloid leukemia; and UCART20x22, concentrating on non-Hodgkin lymphoma.

Cellectis has not too long ago launched optimistic knowledge derived from the BALLI-01 trial, a Part 1/2a scientific examine of UCART22. The subsequent knowledge set is scheduled for launch later this 12 months. Turning to the AMELI-01 trial, the Part 1 dose escalation examine of UCART123, Cellectis has launched optimistic major knowledge and is presently enrolling sufferers for additional research.

From an investor’s perspective, maybe essentially the most thrilling of Cellectis’ scientific research is the NATHALI-01 trial, the Part 1/2a scientific trial of UCART20x22 within the therapy of non-Hodgkin lymphoma. It is a goal situation with a big addressable market and excessive revenue potential for any firm that may develop a brand new, efficient therapy. Cellectis’ candidate, UCART20x22, is the primary twin allogenic CAR T product designed to focus on each CD20 and CD22 within the therapy for NHL. The examine is ongoing and provides a near-term catalyst as first-in-human knowledge is predicted to be launched earlier than the top of this 12 months.

The potential success of UCART20x22 is a fundamental function that caught the eye of Baird analyst Jack Allen, who writes, “We anticipate the information surrounding UCART20x22 will achieve the vast majority of investor consideration, as traders are properly conscious of the industrial alternative for CAR-T in NHL, which is presently ~$2B yearly primarily based on the gross sales of the accredited autologous merchandise.”

“Given the success of different CAR-Ts on this area, we imagine Cellectis is taking a considerate strategy to the event of UCART20x22, specializing in CD19 skilled sufferers (inclusive of antibody, bispecific, and CAR-T) and notice latest knowledge from Adicet’s CD20-targeted gamma delta, ADI-001, in an analogous affected person inhabitants lead us to be optimistic that Cellectis will see a significant price of response to their remedy (whereas Cellectis’ utilization of T cells additionally leads us to be optimistic in regards to the potential sturdiness as properly), which lead us to be optimistic on shares forward of this dataset,” the analyst added.

Consistent with his optimistic strategy, Allen provides CLLS shares an Outperform (i.e. Purchase) score and his $10 value goal suggests a sturdy 566% potential upside for the approaching 12 months. (To look at Allen’s observe file, click here)

General, the Sturdy Purchase consensus score on Cellectis relies on 5 analyst evaluations set in latest months, together with 4 Buys and 1 Maintain. The shares are priced at $1.50, with a mean goal value of $8.5 suggesting ~466% upside potential heading out to the one 12 months horizon. (See CLLS stock forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.