Current indicators of financial resilience have an increasing number of buyers giving credence to the “mushy touchdown” narrative, a situation wherein the Federal Reserve efficiently tames inflation with out inflicting a recession. This rising conviction on this fairly uncommon consequence helped propel the three main U.S. monetary indexes increased in 2023.

12 months up to now, the blue-chip Dow Jones Industrial Common climbed 13% and set new all-time highs, the broad-based S&P 500 (SNPINDEX: ^GSPC) elevated 23%, and the technology-heavy Nasdaq Composite soared 42%.

But, analysts at JPMorgan Chase and Deutsche Financial institution, amongst different monetary establishments, nonetheless see a recession as a definite risk within the subsequent 12-18 months. They’re involved that the influence of upper rates of interest has but to completely make its manner by the financial system, and shoppers have propped up the financial system to date with outsized spending that’s depleting financial savings and inflicting many to tackle added debt. Some analysts argue that an financial downturn is feasible (and even possible) as these conditions evolve.

A possible affirmation of the analysts’ fears will be seen within the bond market, which is sounding its most extreme recession alarm in many years. Learn on to study extra.

The Treasury yield curve stays inverted

Treasury bonds are government-issued debt securities that pay curiosity primarily based on their maturity date. The rate of interest these bonds supply consumers is named the yield. When the yields on Treasuries with totally different maturity phrases (from three months to 30 years) are plotted graphically, they type a line referred to as the yield curve.

That line usually begins low for short-term bonds and slopes upward for longer-term bonds underneath regular circumstances. Bonds with longer maturities pay increased rates of interest than bonds with shorter maturities so as to appeal to consumers. Buyers want more compensation when locking cash away for longer time durations.

In periods of financial duress, the Treasury yield curve can grow to be inverted, the place long-dated bonds supply much less yield than short-dated bonds (one thing that is occurred during the last two years). Aggressive rate of interest hikes meant to curb inflation despatched recession fears by Wall Avenue, and buyers hedged towards the chance of an financial downturn by shifting to long-dated Treasuries.

Demand drives bond costs increased and yields decrease. So demand for long-dated Treasuries has pushed yields decrease (relative to short-dated Treasuries), inflicting the yield curve to start out out excessive and get decrease with longer-term bonds, thus inverting.

The yield-curve inversion is the bond market’s most extreme recession alarm in many years

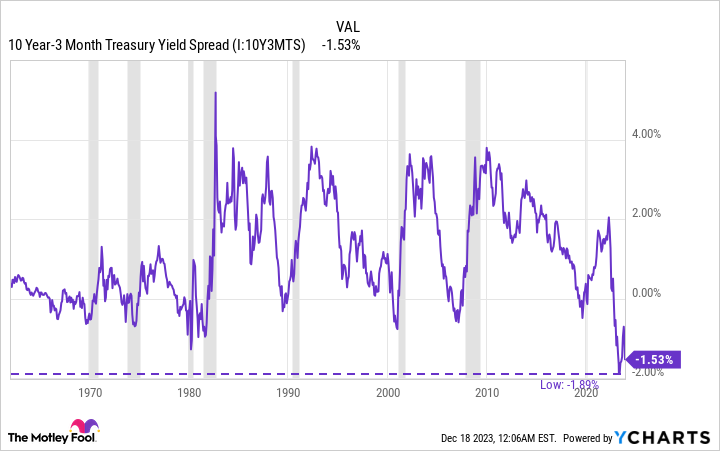

The unfold between the yields of the 10-year Treasury and 3-month Treasury is a carefully watched financial indicator. That portion of the yield curve has inverted (the unfold has turned destructive) earlier than all eight recessions since 1968, with just one false constructive within the mid-Nineteen Sixties, in line with the Federal Reserve Financial institution of New York.

That portion of the yield curve inverted in October 2022, and it stays inverted in the present day. Previously, a recession has adopted inside two years, excluding the one false constructive, that means the yield curve indicators a excessive likelihood that the U.S. slips right into a recession by October 2024.

That alone is regarding, however the present scenario is definitely extra vital. The unfold between the 10-year and 3-month Treasuries reached -1.89% in June 2023, marking its steepest inversion in additional than 50 years. The unfold has since moderated, however the curve remains to be extra steeply inverted in the present day than it has been since 1980.

The chart beneath exhibits the unfold between 10-year and 3-month Treasuries. The yield curve is inverted when the unfold is destructive, and the inversion turns into steeper because the pattern line travels deeper into destructive territory. The areas shaded grey point out recessions.

To summarize, the yield curve has persistently predicted recessions with exceptional accuracy throughout the previous few many years. Sure, there was a false constructive within the mid-Nineteen Sixties, however the unfold was a lot much less destructive than it’s in the present day.

Certainly, the present inversion is essentially the most extreme recession warning the bond market has sounded in additional than 50 years as a result of the unfold between the yields for the 10-year Treasury and the 3-month Treasury reached -1.89%. That has not occurred in over 5 many years.

To that finish, if the present inversion shouldn’t be adopted by a recession, it could be traditionally unprecedented, in line with the Federal Reserve Financial institution of St. Louis.

So, right here is the massive query: What might a recession imply for the inventory market?

A recession might sink the inventory market, however there’s a silver lining

The U.S. financial system has suffered 10 recessions because the S&P 500 was created in 1957. For every recession, the height decline within the S&P 500 is detailed within the chart beneath.

|

Recession Begin Date |

S&P 500 Peak Decline |

|---|---|

|

August 1957 |

(21%) |

|

April 1960 |

(14%) |

|

December 1969 |

(36%) |

|

November 1973 |

(48%) |

|

January 1980 |

(17%) |

|

July 1981 |

(27%) |

|

July 1990 |

(20%) |

|

March 2001 |

(37%) |

|

December 2007 |

(57%) |

|

February 2020 |

(34%) |

|

Common |

(31%) |

Supply: Truist. Notice: Percentages have been rounded to the entire quantity.

As proven above, historical past says the S&P 500 would fall about 31% if the financial system slips right into a recession. For context, the index is at the moment 2% beneath its file excessive, so the implied draw back is about 29%.

That mentioned, drawdowns have diverse tremendously in severity, just because every recession is a product of distinctive circumstances. So any future financial downturn might entail a a lot smaller (or a lot larger) decline within the S&P 500 than the historic common implies.

No forecasting device is ideal. Whereas traditionally unusual, the Federal Reserve could certainly engineer a mushy touchdown that brings inflation underneath management with out eliciting a recession. However even when a recession had been a assured consequence, it could nonetheless be prudent to remain invested. Trying to time the market — promoting earlier than the recession begins and shopping for again in when it ends — will nearly actually backfire.

The S&P 500 has traditionally rebounded 4 to 5 months earlier than recessions finish, producing a median return of 30% throughout that point interval, in line with analysts at JPMorgan Chase. Buyers who sit on the sidelines till financial knowledge proves the financial system is in restoration will miss these good points, doubtless resulting in long-term underperformance.

This is the silver lining to any recession: The S&P 500 has returned a median of about 10% yearly since its inception regardless of struggling financial downturns, bear markets, and corrections. There is no such thing as a purpose to count on a distinct consequence sooner or later. In that context, affected person buyers who purchase and maintain good shares (or an S&P 500 index fund) will nearly actually be properly rewarded over time whether or not or not a recession materializes in 2024.

10 shares we like higher than Walmart

When our analyst workforce has an investing tip, it might probably pay to hear. In any case, the publication they’ve run for over a decade, Motley Idiot Inventory Advisor, has tripled the market.*

They simply revealed what they consider are the ten best stocks for buyers to purchase proper now… and Walmart wasn’t one in all them! That is proper — they suppose these 10 shares are even higher buys.

*Inventory Advisor returns as of 12/18/2023

JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. Trevor Jennewine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends JPMorgan Chase. The Motley Idiot has a disclosure policy.

The Bond Market Just Sounded Its Most Severe Alarm in 50 Years. It Could Signal a Big Move in the Stock Market in 2024 was initially printed by The Motley Idiot