What ought to we consider the markets at present? That is the query on the minds of each market and economics skilled – and it is a difficult one.

Inflation has fallen to three% per yr and the labor market is sizzling. Equities have risen, indicating that traders have priced within the threat of a possible recession. Nonetheless, this results in an issue highlighted by Piper Sandler’s chief strategist, Michael Kantrowitz. He factors out that estimates for future earnings should not holding tempo with optimistic sentiment. Kantrowitz provides that as inflation falls, pricing energy declines, and so does future income development. In consequence, earnings expectations have now soured.

“We nonetheless consider that the second half of 2023 will present the lingering results of financial coverage, notably on revenue and labor, resulting in detrimental returns in H2,” stated Kantrowitz. , “Weak development prospects and already excessive worth multiples may imply poor inventory market efficiency…”

In such a state of affairs, it turns into essential to take a defensive place. An efficient solution to navigate unsure instances is to embrace the time-tested technique of investing in excessive yield dividend stocks. By doing so, traders can safe a constant and dependable stream of revenue whether or not the general inventory market is in revenue or loss.

Towards this backdrop, Piper Sandler analysts have recognized two potential alternatives, considered one of which has a skyrocketing 13% yield. Let’s take a more in-depth have a look at that.

Annaly Capital Administration (NLJ)

We’ll begin with Annaly Capital Administration, a mortgage actual property funding fund, or mREIT. Actual property funding funds are sometimes dividend champs, required by tax regulation to distribute income on to shareholders – and Annaly can depend on a worthwhile firm to assist that return via dividend funds.

Annaly owns a portfolio of mortgage and mortgage-backed securities, with $86 billion in whole property and $12 billion in everlasting capital. The corporate’s portfolio consists of securities, loans and equities within the mortgage financing market.

This can be a main firm within the mREIT phase, nevertheless it confirmed combined ends in its newest quarterly monetary report. That report, for 1Q23, confirmed income of $19.46 million, a complete that was down about 96% yr over yr. The underside line, nevertheless, was wholesome earnings, at 81 cents per share in non-GAAP phrases — and 6 cents per share above estimates.

Along with the combined earnings and earnings, Annaly ended Q1 with $1.79 billion in money and different liquid property, a determine considerably greater than the $955 million reported in 1Q22. Money reserves are of direct curiosity to dividend traders as they assist distributions.

And they’re substantial funds. Annaly introduced its Q2 dividend cost in June and the cost was due on June 29. The dividend was set at 65 cents per frequent share and the annual charge of $2.60 per frequent share provides a yield of 13%.

Analyst Crispin Love takes an optimistic stance in his protection of Annaly for Piper Sandler, based mostly partly on the power of mREITs normally, and says of Annaly, “We proceed to consider that now’s a lovely time to spend money on mortgage-backed Company REITs. as spreads stay large, rate of interest volatility ought to lower because the Fed approaches closing charges, and valuation is engaging at a reduction to tangible e book worth. As well as, Annaly can profit from its differentiated mannequin that features house mortgage methods along with brokerage rights and mortgage rights.”

“Primarily based on administration commentary and our core earnings forecast, we count on the dividend to stay secure with core earnings protection via the top of 2024, together with much less rate of interest volatility because the Fed approaches closing charges,” added Love.

These feedback assist Love’s ranking for Annaly inventory, an Chubby (i.e. Purchase), and his $21.50 worth goal reveals his perception in a 6% upside for the inventory. Primarily based on present dividend yield and anticipated worth appreciation, the inventory has a possible whole return profile of ~19%. (To view Love’s monitor file, click here)

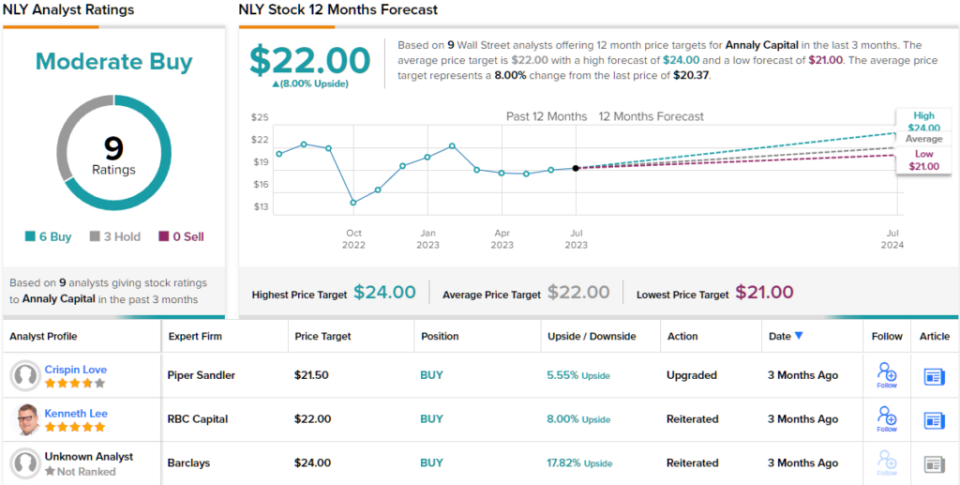

General, the 9 latest analyst scores on this inventory are cut up 6 to three in favor of Buys over Holds, for a reasonable purchase consensus ranking. The shares are priced at $20.37 and have a mean worth goal of $22, implying an 8% acquire over the following 12 months. (To see NLY stock forecast)

VF Company (VFC)

The following dividend inventory we have a look at is VF Company, a pacesetter within the international attire and footwear business. Previously often known as Self-importance Honest Mills till 1969, the corporate was based in 1899 and operates a dozen manufacturers from its Colorado headquarters. VF’s portfolio contains a number of the most acknowledged names within the Outside, Energetic and Work niches, together with Vans, The North Face and Timberland, amongst others. 4 of VF’s manufacturers – JanSport, Eastpak, Timberland and The North Face – dominate the backpack market in the US.

VF transitioned to its present incarnation as an outside, activewear-focused firm in 2018 after spun off its denims and outlet shops as a separate entity. VF is now the nation’s chief in energetic way of life attire manufacturers. The corporate’s income and earnings present a transparent seasonal sample, with gross sales and income peaking from August via January, in VF’s fiscal second and third quarters. Though VF has a number one place in its markets, its share is down 27% thus far this yr.

The share worth decline occurred regardless of VF’s revenues and earnings beating expectations within the firm’s most up-to-date fiscal quarter, 4Q23. VF reported $2.74 billion in income, down 3% from the prior yr, however $20 million greater than anticipated. Web revenue, as measured by non-GAAP numbers, reached earnings per share of 17 cents per share, beating the forecast of 14 cents by 3 cents. Of the VF manufacturers, The North Face carried out the strongest, with gross sales up 12% year-over-year.

On the dividend aspect, VF made its ultimate assertion in Might for a June 20 payout, saying a cost of 30 cents per frequent share. Projected ahead, this dividend pays $1.20 per share and offers a yield of 6.25%, properly above common and greater than double present annual inflation.

For Piper Sandler analyst Abbie Zvejnieks, VF’s portfolio of manufacturers is the corporate’s underlying power. She writes, “We consider the detrimental catalysts at VFC are largely behind us, and the corporate is coming into FY24 as a yr of progress with turnaround initiatives underway. We’re inspired by the continued momentum at The North Face, inexperienced shoots for brand spanking new merchandise at Vans, and the accelerating development of Dickies and Supreme. Strict price controls, in addition to promotion and provide chain enhancements ought to drive margin enlargement, as VFC invests in product innovation and advertising and marketing, and we stay assured within the means to generate FCF from these massive, highly effective manufacturers… With a powerful portfolio of manufacturers, we consider VFC has the very best turnaround story in our area.”

Unsurprisingly, Zvejnieks charges VFC inventory as chubby (i.e. purchase), with a $29 worth goal implying a possible upside of 51% over a yr. (To view Zvejnieks monitor file, click here)

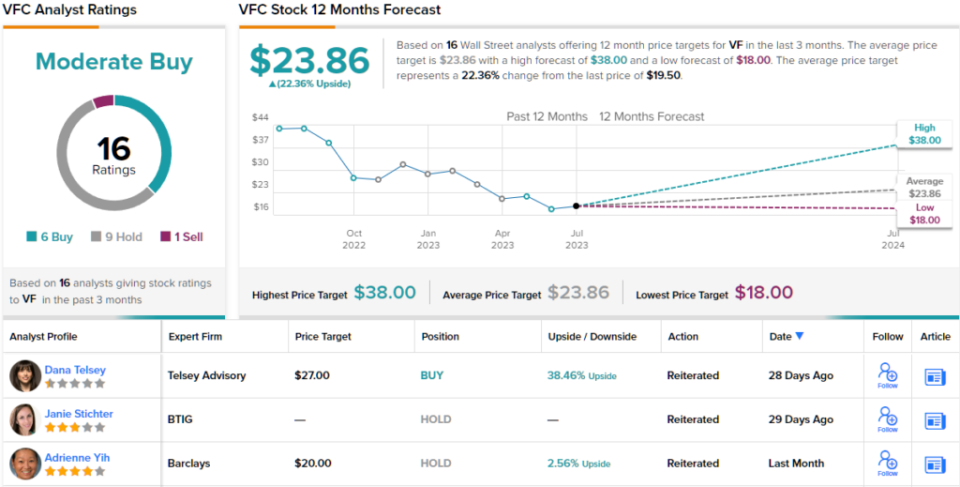

Wanting on the consensus breakdown, there have been 6 Buys, 9 Holds, and 1 Promote printed within the final three months. In consequence, VFC will get a consensus ranking from Reasonable Purchase. The inventory is buying and selling for $19.50, and its $23.86 common worth goal suggests it has ~22% upside for the yr forward. (To see VFC stock forecast)

To seek out nice concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Best stocks to buya software that unites all TipRanks wealth insights.

disclaimer: The opinions expressed on this article are solely these of the named analysts. The content material is for informational functions solely. It is extremely necessary to do your personal evaluation earlier than investing.