Certainly, many synthetic intelligence (AI) traders are kicking themselves for lacking out on Nvidia‘s massive features. With the replenish 280% within the final 12 months and over 1,800% in 5 years, it is without doubt one of the main beneficiaries within the AI house.

Nonetheless, Nvidia is just not the one AI stock within the chip trade, and AI is a lot greater than semiconductors. With the breadth of AI investing choices, the trade ought to proceed to convey alternative. Three Idiot.com contributors have concepts on the place AI traders can look subsequent: Amazon (NASDAQ: AMZN), The Commerce Desk (NASDAQ: TTD), and Tesla (NASDAQ: TSLA).

Amazon has some ways to win with regards to AI

Jake Lerch (Amazon): There are hotter AI shares on the market, however Amazon stays one price watching, and shopping for. This is why:

First, the corporate is the most important cloud providers supplier. Amazon Net Providers (AWS) is estimated to have about 31% of the worldwide cloud providers market. That is necessary as a result of new generative AI instruments and purposes typically make the most of cloud providers like AWS. Because the AI revolution rolls on, Amazon is poised to revenue due to its lead within the cloud infrastructure market.

Second, Amazon’s huge e-commerce enterprise dovetails properly with many alternative AI purposes. For instance, the corporate has already launched Rufus, a brand new AI-powered purchasing assistant designed to assist folks by answering questions, making pricing comparisons, and producing product suggestions.

As well as, Amazon is utilizing AI in lots of different areas of its operations, reminiscent of:

-

Streamlining prescription drug supply time and price by Amazon Pharmacy.

-

Reducing the corporate’s environmental affect by AI-generated suggestions to cut back packaging use.

-

Enhancing purchasing suggestions through Amazon Vogue.

-

Updating Alexa-enabled gadgets to reinforce dialog and dialogue between customers and Alexa.

On prime of all of that, Amazon stays one of many world’s best-run corporations. Shares are up 73% during the last 12 months, whereas income progress has bounced again to a strong 13%.

In brief, Amazon stays a sensible alternative for AI-focused traders.

The Commerce Desk advantages from AI and digital promoting tailwinds

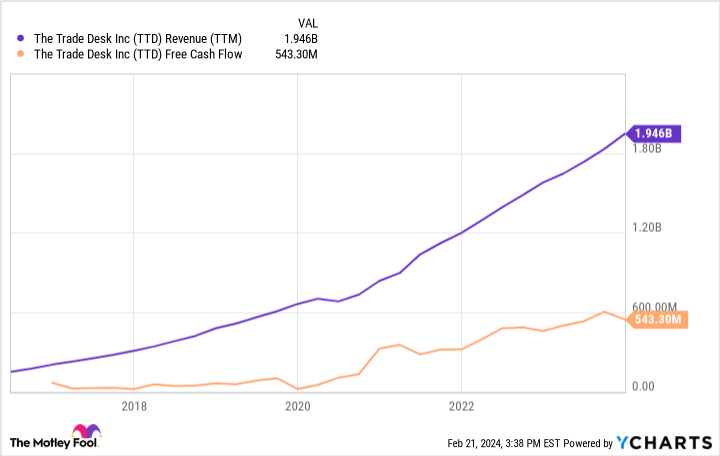

Justin Pope (The Commerce Desk): Synthetic intelligence is a scorching subject right now, but it surely started disrupting the promoting enterprise a number of years again when The Commerce Desk was in its infancy. Manufacturers and different corporations should purchase promoting on The Commerce Desk’s platform, which makes use of AI and consumer knowledge to match advertisements to potential prospects. That is far simpler than conventional promoting, which might broadcast to broad audiences on tv, radio, or in print.

The Commerce Desk has thrived, rising profitably since its 2016 preliminary public providing. The rationale? The Commerce Desk sits in a great spot within the trade. Promoting {dollars} are shifting to digital mediums and whereas rivals like Meta Platforms and Alphabet function with restricted transparency, The Commerce Desk affords extra data to its shoppers, and that’s successful over prospects.

Whole worldwide advert spending in 2023 was an estimated $830 billion, which signifies that The Commerce Desk’s $9.6 billion in gross advert spending interprets to simply over 1% of market share. That leaves an incredible progress runway for this firm working exterior the closed ecosystems of massive know-how corporations.

The Commerce Desk’s long-term progress alternatives and worthwhile enterprise mannequin make the inventory a no brainer AI funding you may maintain for the long run.

Tesla doubtless has some AI-driven surprises beneath the hood

Will Healy (Tesla): Traders might have a tendency to take a look at Tesla as an automaker, but it surely’s truly a various enterprise additionally creating battery know-how, photo voltaic power options, and AI breakthroughs.

As an alternative of counting on chip corporations like Nvidia for its know-how, Tesla has developed its personal semiconductor and robotics options. Amongst these are the Dojo chip, designed to energy neural networks, and the FSD (full self-driving) chip, which might energy totally autonomous automobiles.

CEO Elon Musk desires to launch a robotaxi enterprise based mostly on Tesla know-how. With robotaxis, analysts at Cathie Wooden’s Ark Make investments imagine Tesla’s income may attain a minimal of $600 billion by 2027, over seven instances the 2023 stage of $82 billion.

Wooden believes that progress would take Tesla’s inventory worth to $2,000 per share, a greater than tenfold achieve from right now’s ranges.

Whereas that will appear outrageous, and Musk has a monitor report of being overly formidable in his guarantees, Wooden predicted a split-adjusted worth goal of $267 per Tesla share in 2018. Inside lower than three years, Wooden’s prediction got here to go, so she might be proper once more.

Tesla’s inventory worth has pulled again as Tesla has minimize costs on electrical automobiles (EVs) to spice up gross sales and keep aggressive with rising rivals. That pessimism has taken its P/E ratio right down to 45, a low valuation not often seen within the inventory’s historical past.

Though earnings are anticipated to fall 1% this 12 months, analysts predict a 36% improve in 2025. These earnings forecasts give some validation to Wooden’s thesis. A few of that optimism could also be associated to the discharge of the lower-cost, compact Mannequin 2 EV anticipated for 2025, and traders are additionally prone to soar in as the corporate improves its AI and self-driving capabilities.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Amazon wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 20, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, Nvidia, and Tesla. Justin Pope has no place in any of the shares talked about. Will Healy has positions in The Commerce Desk. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, Tesla, and The Commerce Desk. The Motley Idiot has a disclosure policy.

Missed Out on Nvidia? Buy These Artificial Intelligence (AI) Stocks Instead. was initially printed by The Motley Idiot