The S&P 500 had its second-best begin to a 12 months up to now 25 years, fueling a way of optimism amongst traders. Nevertheless, this achievement has not been a very powerful story of the 12 months. The truth is, the Bellwether Index’s 16% year-to-date features have been fully overshadowed by the dominance of the know-how sector. With the AI hype driving the rise, it has develop into the very best performing sector in 2023, up 31.5%.

That is a big quantity and, the truth is, represents the business’s greatest opening half of a 12 months on file, because it retreated from the S&P 500 by the most important margin in a six-month interval since 1999.

Is know-how poised for additional features within the second half of the 12 months? That is still to be seen, although the phase is actually not the one sport on the town. There are different corners of the market that may current alternatives for traders, and Raymond James analysts are joyful to level them out. They’re searching for the shares that may transfer ahead for the remainder of the 12 months and have labeled some non-technical names as Robust Buys.

We went by means of a couple of of their picks TipRanks database for a broader view of the outlook and it appears the remainder of the Avenue agrees with the Raymond James pundits – each are additionally rated “Robust Buys” by the analyst consensus. Let’s take a more in-depth take a look at that.

Everest Group (Eg)

Let’s admit insurance coverage would not have the identical attraction as know-how and AI, however as funding legend George Soros stated, “investing effectively is boring,” which brings us to Everest Group, a number one international supplier of reinsurance and insurance coverage options.

Based in 1973, the corporate is a longtime insurance coverage title and its international presence permits it to serve clients in over 100 nations on 6 continents. Everest affords tailor-made options to fulfill the distinctive wants of purchasers, operates by means of its subsidiaries and affords a various portfolio of merchandise, together with property, casualty, specialty and life reinsurance, in addition to insurance coverage protection.

Everest has managed to publish sequential enhancements in income over the previous few quarters and that was the case once more within the first quarter of 2023. Income reached $3.29 billion, up from the $3.25 billion reported within the fourth quarter was achieved and amounted to a 12 months of 13.8% annual improve. The determine additionally beat the consensus estimate by $190 million.

On the different finish of the dimensions, boosted by continued enchancment within the insurance coverage margin, internet working earnings reached $443 million, translating to earnings per share of $11.31 and an enchancment from the $10.31 recorded in similar interval final 12 months. Nevertheless, the bottom-line determine missed the analysts’ forecast at $1.23.

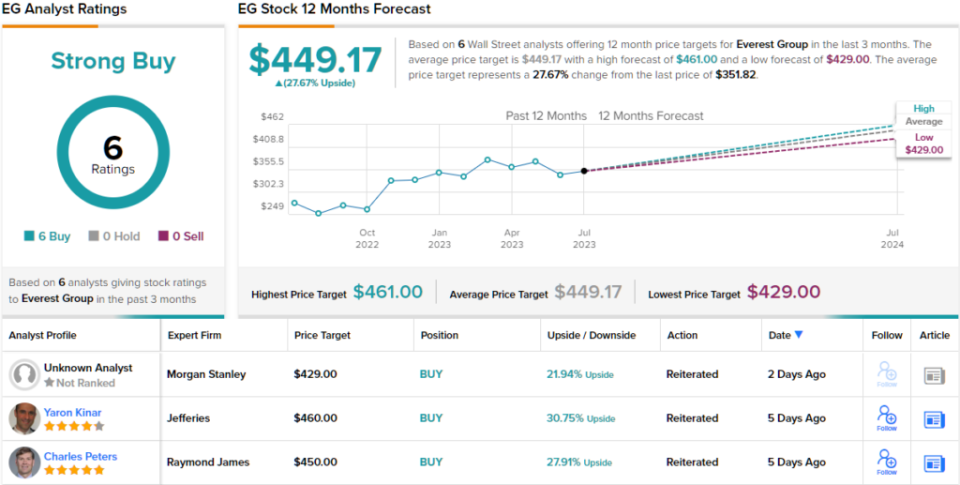

Raymond James analyst Charles Peters critiques the corporate’s prospects and maintains its Robust Purchase score, citing “optimistic outlook for Everest to report accelerating income and earnings progress.”

The 5-star analyst commented, saying: “Our evaluation displays enhancing reinsurance market circumstances with robust pricing and phrases tendencies persevering with by means of the mid-year renewals. Whereas acknowledging hurricane/catastrophe-related considerations in 2H23, we imagine the danger reward [Everest] because of the tough market and our outlook for operational ROBEs of 19%+ over the subsequent two years.”

“We proceed to imagine that our estimates may very well be optimistic if the corporate achieves the underside line of its 2023 administration targets with additional enhancements in 2024,” Peters summarizes.

Along with the Robust Purchase score, Peters’ value goal of $450 on EG permits for 12-month returns of ~28%. (To view Peters’ monitor file, click here)

Trying on the consensus breakdown, the remainder of the road agrees with Peters evaluation. With 6 Buys and no Holds or Sells, the phrase on the road is that EG is a Robust Purchase. The typical value goal of $449.17 is virtually the identical as Peters’ goal. (To see EC stock forecast)

Copa holdings (CPA)

Now let’s transfer from insurance coverage to the aviation business. Copa Holdings is a Panama-based firm that operates as a holding firm for Copa Airways and Copa Colombia (Wingo). The corporate has positioned itself as a serious participant within the Latin American area, offering connectivity between cities in South America, Central America, North America and the Caribbean, with a large community of 79 locations in 31 nations. Copa operates a contemporary fleet of plane (totaling 99 on the finish of the primary quarter) and has constructed a popularity for high quality service, punctuality and environment friendly operations.

Demand for journey has elevated after the lull attributable to Covid and Copa is benefiting from this growth. Within the first quarter, income elevated 51.7% from the identical interval a 12 months in the past to $867.3 million, beating Avenue’s forecast by $27.94 million. The determine additionally represented a 29% improve from pre-Covid 1Q19 ranges. The corporate has additionally been economical on prices and that resulted in adj. EPS of $3.99, a determine that beat Avenue’s $3.25 forecast.

Not solely know-how shares outperformed the market this 12 months. That show has helped the inventory make year-to-date features of 32%. However in keeping with Raymond James analyst Savanthi Syth, there’s extra to return.

The analyst charges Copa shares as a powerful purchase, whereas her $155 value goal implies a 40% upside for the approaching months. (To view Syth’s monitor file, click here)

Explaining her optimistic stance, the 5-star analyst wrote: “We imagine the relative attractiveness of Copa’s geographically advantageous and defensible hub has improved. Whereas aggressive capability bending in opposition to a decrease gas backdrop is prone to weigh on revenues, Copa’s value initiatives mixed with an general engaging aggressive construction (additional supported by international provide constraints) ought to help robust margins.”

Total, that is one other inventory that will get full road help. With a unanimous 8 Buys, the inventory has a Robust Purchase consensus score. If the typical value goal of $148.63 is met, traders will pocket a return of ~35% a 12 months from now. (To see CPA Holdings stock forecast)

To seek out nice concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best stocks to buya lately launched software that unites all of TipRanks’ inventory insights.

Disclaimer: The opinions expressed on this article are solely these of the really helpful analysts. The content material is for informational functions solely. It is rather vital to do your personal evaluation earlier than investing.