2023 turned out to be an excellent yr for equities because the inventory market carried out shockingly properly in an surroundings of rising rates of interest and considerations about an financial downturn. The S&P 500 and NASDAQ indices each posted stable beneficial properties of 17% and 33% respectively.

Whereas shares are rising to their all-time highs, that does not imply buyers have misplaced their likelihood to leap on the bandwagon. In response to banking large Deutsche Financial institution, there may be nonetheless sufficient room for them to take part.

Towards this background, let us take a look at Deutsche Financial institution’s quarterly Contemporary Cash Checklist, the just lately up to date compilation of DB analysts’ “prime concepts” for the yr forward. The funding financial institution began this listing in 2017 and since then these picks have constantly outperformed the S&P 500. The index is up 124% over the previous 6 years; the Deutsche Financial institution Contemporary Cash Checklist has gained 167%. This outstanding monitor file makes Deutsche Financial institution a gorgeous choice to discover.

The habits TipRanks database, we discovered particulars on three of the shares the financial institution’s analysts tapped as Buys. All of them have stable upside potential forward – certainly one of which is predicted to generate returns of 160% within the coming months. The truth is, Deutsche Financial institution is not the one agency to sing the praises for these shares. In response to TipRanks, they’re all rated as Sturdy Buys by The Avenue’s analysts.

SeaWorld Leisure (SEA)

On the planet of theme park leisure and zoological organizations, SeaWorld stands out. The Florida-based firm, which has been in enterprise for practically 60 years, operates a series of parks, that includes live-animal rides that includes dolphins, killer whales, and sea lions, in addition to the extra conventional theme park fare of curler coasters, splashdowns, and different thrill rides. The corporate operates 12 locations in key native markets within the US.

Along with working theme park locations, SeaWorld can be energetic within the rescue and rehabilitation of marine and aquatic animals. The corporate has rescued greater than 40,000 animals over the previous 50 years and has constructed a zoological assortment that it shows in its parks and makes use of as ambassadors to advertise ranching and rescues.

SeaWorld reported its first quarter ’23 outcomes earlier this yr, displaying each important beneficial properties and an equally important miss. On the brilliant facet, the corporate’s complete income was $293.3 million, a file first quarter that mirrored 8.4% year-over-year development — coming in at practically $12 million greater than forecasts. On the destructive facet of the ledger, a web loss per diluted share of 26 cents was 9 cents larger than anticipated.

Digging deeper, some operational highlights present that SeaWorld’s Q1, the slowest quarter of the yr, had some measure of success. The corporate’s per capita admissions had been up 9.4% y/y to $48.51, and complete income per capita grew 9.2% y/y to $86.84. Each numbers, like complete gross sales, had been Q1 data for SeaWorld.

Among the many bulls is Deutsche Financial institution analyst Chris Woronka, who sees SeaWorld as having a stable area of interest and appears ahead to the corporate’s efficiency through the historically busy summer time season.

Woronka believes the inventory is priced low in comparison with friends, writing: “We consider SEAS is properly positioned to ship regular free money circulation throughout a reasonably broad vary of macroeconomic environments and consider the The corporate’s current margin beneficial properties are extra sustainable than maybe initially thought. The present valuation displays an unreasonable (in our view) decoupling from a number of different journey/leisure sub-sectors, together with cruise traces and choose areas of gaming and lodging. SEAS maintains a powerful steadiness sheet with restricted – and predictable – capital wants, and we consider administration will proceed to opportunistically return capital to shareholders (traditionally, via share buybacks).”

Woroka’s feedback on SeaWorld assist his purchase score for the inventory and his $84 worth goal implies a very good 53% upside over the following 12 months. (To view Woroka’s monitor file, click here)

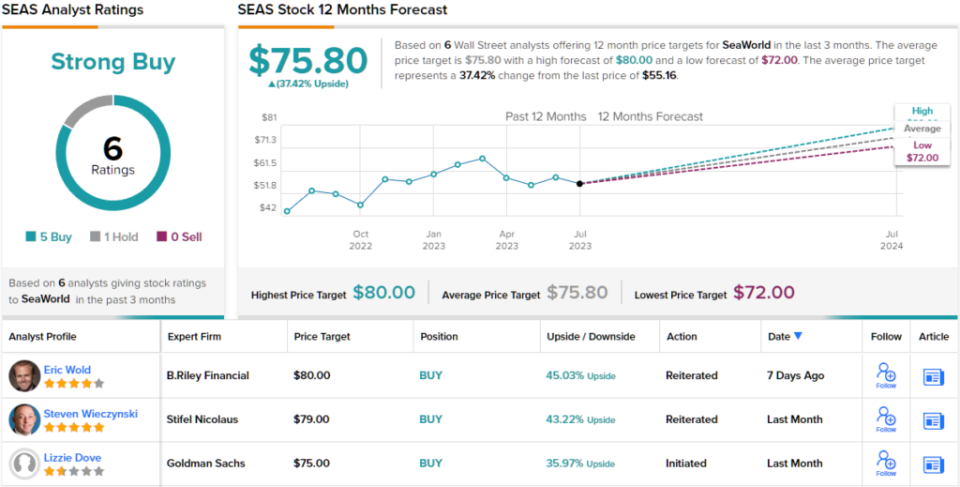

General, SeaWorld’s Sturdy Purchase consensus rating rests on 6 current analyst rankings, together with a 5-1 cut up of Buys over Maintain. The shares are buying and selling at $55.10 and have a median goal of $75.80, suggesting a possible one-year acquire of ~37%. (To see SeaWorld Stock Forecast)

Planet Labs (PL)

We stay within the house age, and whereas human spaceflight has been restricted to low Earth orbit (LEO) for the previous 50 years, authorities and worldwide house businesses – and more and more non-public corporations – are nonetheless difficult the ‘Remaining Frontier’ . Collectively they’ve launched constellations of satellites round our planet, despatched unmanned probes to the farthest reaches of our photo voltaic system, and even despatched robotic automobiles and a robotic helicopter drone to Mars, our closest neighbor.

Planet Labs is utilizing house expertise to develop high-resolution real-time Earth statement, bringing house expertise to influence our personal world. The corporate operates a fleet of 200 Earth imaging satellites, the biggest non-public fleet in existence, accumulating detailed photos of your complete Earth’s floor each day. Planet Labs is utilizing this satellite tv for pc imagery database to alter the way in which private and non-private actors use such information. The corporate’s imagery and information units present day by day perception into modifications on the Earth’s floor, giving decision-makers new information throughout mapping, forestry, agriculture and different industries.

Within the first quarter of fiscal 2024, Planet Labs posted income of $52.7 million, barely decrease than forecast at $212,000. The corporate’s earnings per share had been a lack of 7 cents per share by non-GAAP measures, although it beat estimates by 3 cents per share.

The larger downside with Planet Labs’ monetary launch was much less the outcomes than the steering. The corporate forecasts income between $53 million and $55 million for fiscal 2Q24 — however the consensus was searching for $60 million.

Shares in PL fell sharply after the discharge of fiscal Q1 information. The inventory fell 30% and has nonetheless not recovered. For Deutsche Financial institution analyst Edison Yu, this quantities to a inventory that’s undervalued, representing an reasonably priced purchase for buyers proper now.

“Planet Labs shares are beneath strain on account of macroeconomic headwinds hurting business enterprise prospects. We consider this presents a gorgeous shopping for alternative on condition that PL’s information analytics platform is exclusive within the aerospace {industry} and we anticipate development/margin to enhance considerably in 2H… We consider the significance of Earth statement as a essential strategic functionality is tremendously undervalued. Nearly each main nation is creating or increasing capabilities on this space and we anticipate Planet to learn tremendously from this pattern,” mentioned Yu.

To that finish, Yu charges PL shares as a purchase, whereas his $5 worth goal signifies he believes in 47% upside potential over the following 12 months. (To view Yu’s monitor file, click here)

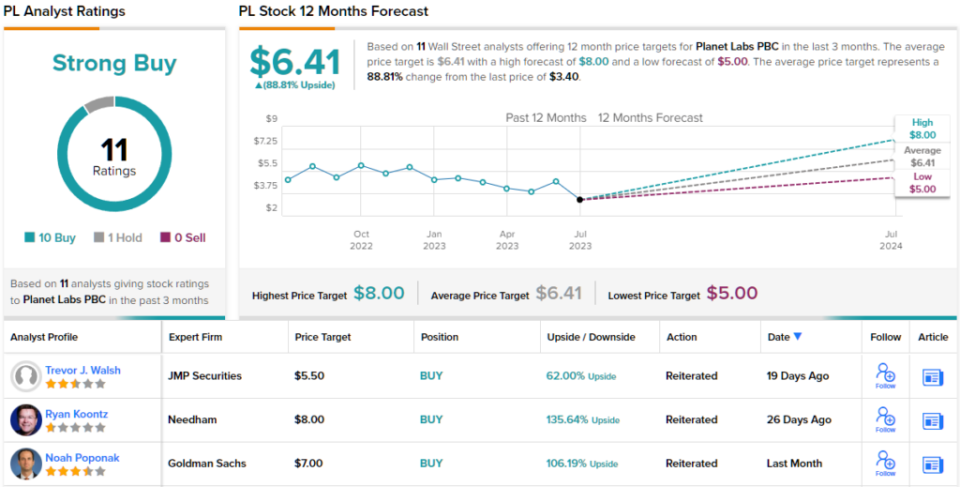

Typically, expertise and aerospace are thrilling, and Planet Labs has picked up 11 current analyst rankings — together with 10 Buys and 1 Maintain — for a Sturdy Purchase consensus score. The typical worth goal of $6.41 and the present share worth of $3.40 mix to supply upside potential of about 89% over a yr. (To see PL stock forecast)

Warner Bros. Discovery (WBD)

Final however not least, Warner Bros. Discovery, an leisure conglomerate and mass media firm based mostly in New York Metropolis. It stands as the fashionable incarnation of the well-known Warner Bros., who introduced us the beloved Looney Tunes through the Golden Age of animation. Warner Bros. Discovery was created as a public entity final April via the merger of TimeWarner, an AT&T spin-off, and Discovery, Inc. This newly fashioned entity, with a market cap of $32 billion, has a big presence in all kinds of leisure channels.

WBD’s property are legion and embody the Warner Bros. Photos and Tv Teams; DC studios; DC Leisure, the writer of DC Comics; HBO and CNN; and the cable channels previously generally known as the Discovery Channel – and that is only one instance of the listing. The mixed firm will provide viewers every thing from superhero motion pictures to meals and cooking reveals to the newest sports activities to information and even gaming. With its various portfolio of each leisure and non-fiction, the corporate is a pacesetter in world media and content material distribution.

The worldwide urge for food for leisure is big and WBD noticed income of $10.7 billion within the first quarter of 2023. This was a 238% year-over-year enhance (we should always be aware that the primary quarter of a yr in the past was the corporate’s first report within the WBD incarnation and was nonetheless impacted by the corporate’s launch), however got here in additional than $65 million under forecast. Earnings per share, a lack of 44 cents by GAAP measures, additionally got here in worse than anticipated, lacking steering by 23 cents per share.

These outcomes had been described as ‘disappointing’ and mirrored each elevated competitors because the web and social media proceed to develop the vary of content material out there, and the influence of secular decline tendencies in conventional media typically.

However, for analyst Bryan Kraft, who covers the shares for Deutsche Financial institution, WBD presents a chance. The inventory’s worth has steadily declined in its 15 months of buying and selling, whereas the corporate’s content material portfolio stays a robust asset — and that mixture is very engaging, in line with Kraft.

“We consider Warner Bros. Discovery provides a gorgeous danger/reward given its low valuation, industry-leading total leisure content material portfolio, progress towards DTC scale and enhancing DTC EBITDA, robust FCF development prospects, and a transparent path to downsizing of the steadiness sheet,” Kraft opined.

Primarily based on the above, Kraft is inserting a Purchase score on WBD together with a $35 worth goal. Bringing that concentrate on ahead, the analyst sees a robust 160% upside forward for these shares. (To view Kraft’s monitor file, click here)

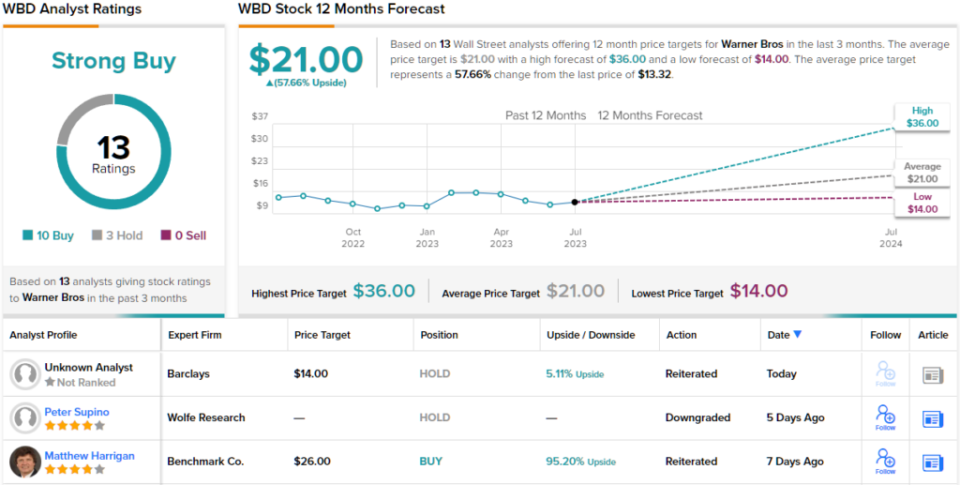

Like the opposite shares on this listing, Warner Bros. Discovery a powerful purchase by analyst consensus. The inventory’s score is predicated on 13 current opinions, with a breakdown of 10 Buys and three Holds. The typical goal worth right here is $21, indicating a ~58% enhance from the present buying and selling worth of $13.30. (To see WBD stock forecast)

To seek out nice concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best stocks to buya instrument that unites all TipRanks wealth insights.

disclaimer: The opinions expressed on this article are solely these of the named analysts. The content material is for informational functions solely. It is vitally essential to do your personal evaluation earlier than investing.