Anybody concerned in investing is aware of that it is all about “choosing shares.” Selecting the best shares to depart your cash with is important to making sure a robust return on an funding. Due to this fact, when the Wall Avenue professionals contemplate a reputation to be a “High Choose,” buyers ought to take observe.

The habits TipRanks platformwe seemed up particulars about two shares that just lately acquired the “High Choose” designation from a few of Avenue’s analysts.

So let’s dive into the small print and discover out what makes them so. Through the use of a mix of market information, firm reviews, and analyst commentary, we are able to get a way of what makes these shares compelling selections for the rest of 2023, and why each are rated Sturdy Buys by analyst consensus.

EyePoint Medicines (EYPT)

We’re beginning within the biotech sector with EyePoint Prescription drugs, a small-cap biopharmaceutical firm that operates in each the scientific and industrial phases. The corporate is actively creating a brand new drug for the therapy of varied eye situations, has one other product in the marketplace and just lately bought a profitable industrial product.

EyePoint has two drug supply platforms, Durasert and Verisome, that allow injectable, sustained drug supply. The primary, Durasert, is getting used with the drug candidate EYP-1901, a possible therapy for moist age-related macular degeneration (wAMD) and non-proliferative diabetic retinopathy (NPDR). The second platform, Verisome, is used with the industrial product DEXYCU, a drug for the therapy of postoperative irritation after eye surgical procedure. The platforms supply the benefit of being dosed on a schedule of months reasonably than days or hours.

A more in-depth take a look at EyePoint’s pipeline reveals that the EYP-1901 candidate dominates the corporate’s analysis program. This drug is the topic of two main scientific trials: the DAVIO trial, which focuses on the therapy of wAMD, and the PAVIA trial, which focuses on NPDR. In late March, EyePoint accomplished enrollment within the Section 2 DAVIO trial, which was described as “oversubscribed.” Publication of topline information is predicted by the top of 4Q23. In a latest June 5 press launch, EyePoint introduced the completion of enrollment within the Section 2 PAVIA trial of EYP-1901 for NPDR therapy. The trial aimed to enroll 60 sufferers, however ended up enrolling 77. Topline information is predicted to be launched in 2Q24.

On the industrial facet, the corporate’s present industrial drug is DEXYCU, a one-time injectable therapy for irritation that may happen after eye surgical procedure. DEXYCU skilled a big decline in product gross sales in the course of the first quarter, which was attributed to the top of the pass-through payment interval on January 1 of this 12 months. However, the corporate is actively concerned in commercialization actions for the drug.

EyePoint additionally reported outcomes for a second industrial product in 1Q23. This product, YUTIQ, accounted for almost all of the corporate’s gross sales, contributing roughly $7.4 million out of a complete of $7.7 million. YUTIQ gross sales elevated 60% year-on-year. Following the quarter, EyePoint introduced in Could that it had bought YUTIQ to Alimera Sciences for a complete of $82.5 million in money, together with royalties. The sale enabled EyePoint to repay its excellent financial institution debt and lengthen its money runway by means of 2025.

Nevertheless, the principle story right here is concerning the analysis pipeline, based on Cantor analyst Jennifer Kim. She writes about EyePoint: “We’re drawing consideration to EYPT as considered one of our high picks [for] 2H23. We imagine that continued administration execution and up to date scientific and aggressive developments deserve extra consideration forward of key upcoming readouts: 1) Section 2 DAVIO 2 information in moist age-related macular degeneration (wAMD) in December ’23, and a couple of) Section 2 PAVIA information in non-proliferative diabetic retinopathy (NPDR) in 2Q24. We proceed to imagine the height gross sales alternative for EYP-1901 is undervalued, and imagine the chance/reward is favorable on the way in which to the DAVIO 2 information.”

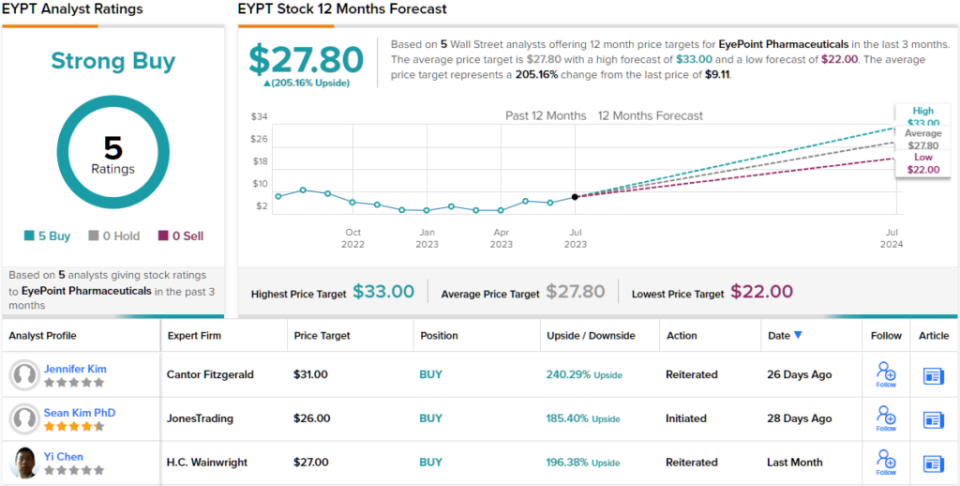

Kim places her stance in quantifiable mode, charges EYPT inventory as Chubby (ie Purchase) and units her value goal at $31, implying a robust 240% upside over the subsequent 12 months. (To view Kim’s monitor file, click here)

Total, this inventory’s robust upside has impressed the road; all 5 of the latest analyst critiques are optimistic, for a Sturdy Purchase consensus score. The buying and selling value of $9.11 and the typical value goal of $27.80 collectively counsel a 205% one-year upside potential. (To see EYPT stock forecast)

Cogent Biosciences (COGT)

Subsequent, we take a look at Cogent Biosciences, a precision drugs firm targeted on treating genetically decided illnesses. These can embody autoimmune and different uncommon illnesses, and even some harmful cancers. Sometimes, these situations have massive unmet medical wants. Cogent is engaged on options to enhance sufferers’ high quality of life by concentrating on the genetic mutations behind the illness states.

The corporate’s give attention to the genetic causes of illness is essential to its method – Cogent strives to transcend treating signs and convey about cures. To that finish, the corporate’s drug pipeline consists of bezuclastinib, a precision drug designed to particularly goal exon 17 mutations when discovered within the KIT receptor tyrosine kinase. The KIT receptor KIT D816V might be locked in an ‘on’ state, inflicting systemic mastocytosis or AdvSM. It is a illness situation through which mast cells accumulate within the inside organs. Mutations in exon 17 are additionally concerned in GIST, gastrointestinal stromal tumors. Bezuclastinib is a potent inhibitor of KIT exercise and is extremely selective in its exercise. The drug candidate has proven nice potential in early stage research for the therapy of exon 17-related issues.

Cogent is at present conducting a number of scientific trials with bezuclastinib, with a selected give attention to the 2 most superior trials. The primary trial is the Section 2 APEX trial for the therapy of AdvSM. Half 1 of the continued Section 2 trial accomplished enrollment and Half 2 began enrollment in April with a objective of 65 sufferers. The corporate expects to launch information from 30 sufferers in Half 1 of the APEX trial within the second half of 2023.

The second superior scientific trial is the Section 3 PEAK trial within the therapy of GIST. Knowledge launched in June confirmed a 55% illness management fee in closely pretreated GIST sufferers, and confirmed that bezuclastinib together with sunitinib was properly tolerated with a suitable security profile. The corporate is now actively enrolling sufferers in Half 2 of the PEAK trial, with additional information anticipated to be launched in 2H23.

Piper Sandler analyst Christopher Raymond is impressed with bezuclastinib, particularly the APEX and PEAK research. In help of designating this inventory as a ‘High Choose’, Raymond confidently states: “Our rivalry on this title is that bezuclastinib’s distinctive mutation selectivity and security profile place it properly within the spectrum of SM illness. With early AdvSM information favoring avapritinib, we’re assured that updates later this 12 months in each AdvSM and ISM will proceed to help bezuclastinib’s best-in-class potential. In GIST, though the ASCO replace was early, we imagine the thesis is popping out precisely as hoped, with indications of significant scientific progress as mixture remedy with sunitinib in 2L GIST. We stay patrons of this title for some high-risk information occasions this later 12 months.

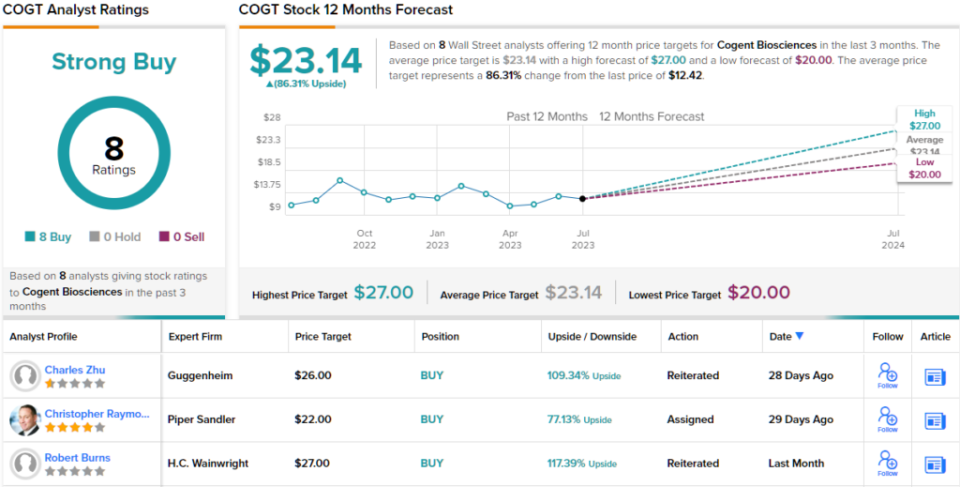

Unsurprisingly, Raymond charges Cogent as chubby (ie purchase), whereas his $22 value goal for the inventory implies 77% upside potential on the one-year horizon. (To view Raymond’s monitor file, click here)

Total, there are 8 latest analyst critiques on this inventory and all are optimistic, for a unanimous Sturdy Purchase consensus. The shares are promoting for $12.42 and the $23.14 common value goal implies an 86% acquire over the subsequent 12 months. (To see COGT stock forecast)

To search out nice concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best stocks to buya software that unites all TipRanks wealth insights.

disclaimer: The opinions expressed on this article are solely these of the named analysts. The content material is for informational functions solely. It is extremely vital to do your personal evaluation earlier than investing.