Inventory efficiency clobbered dwelling costs in 2023, the 12 months after the reverse was true.

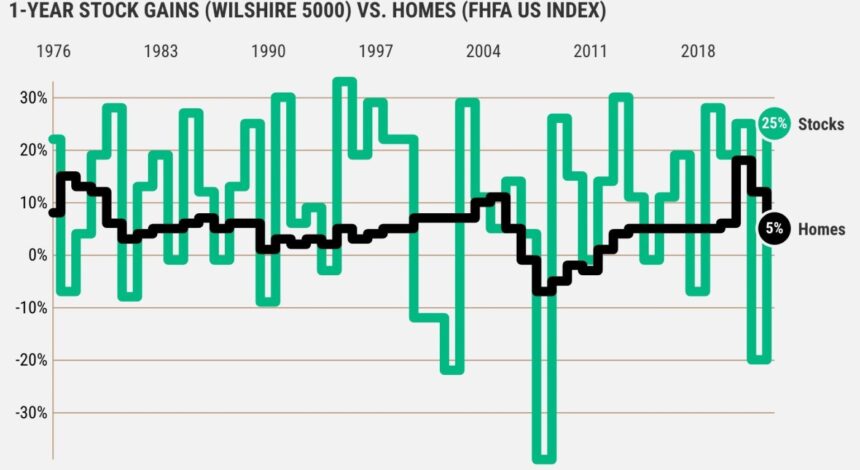

My trusty spreadsheet checked out a half-century of stock-trading patterns (the Wilshire 5000-stock index) and home-price swings (the Federal Housing Finance Agency US index) to find out how these two belongings range in value fluctuations.

Think about that the Wilshire was up 25% in 2023. Solely 12 years have fared higher since 1974.

Why the pop? Inventory traders spent a lot of 2023 anxious a few recession. It was solely late within the 12 months that dealer sentiment turned towards an financial “mushy touchdown” – motivation to bid up share costs anticipating a less-than-horrific 2024.

By the way in which, an identical “no deep recession” mentality helped US dwelling costs a bit in 2023, too.

- REAL ESTATE NEWSLETTER: Get our free ‘Residence Stretch’ by electronic mail. SUBSCRIBE HERE!

The FHFA dwelling index was rising at a 5% annual fee as of September, the most recent studying accessible. That will rank because the Twenty ninth-best 12 months.

But that seemingly substantial 2023 efficiency unfold between shares and houses – 20 proportion factors of efficiency – was solely the 14th widest on file.

Final 12 months was fairly a change from 2022.

That 12 months, the Wilshire tumbled 20% when recession fears have been excessive – the inventory market’s fourth-worst efficiency in 50 years. But the FHFA dwelling index was up 12% in 2022, its fifth-best 12 months, as home hunters ignored Wall Avenue worries and rushed to purchase on the finish of an inexpensive cash period.

And please notice that 2022’s efficiency chasm – 32 proportion factors – was the biggest on file.

Particulars

The spreadsheet reveals extensive variations between inventory and housing costs to be the norm. A typical 12 months has a 14-percentage-point hole between annual performances.

Mainly, shares and housing dance to completely different drums. Look what historical past tells us …

- ECONOMIC NEWS: What’s the massive pattern? Ought to I be anxious? CLICK HERE!

Common 12 months: 10% acquire for shares vs. housing’s 5% appreciation.

Down years: There’s a 29% likelihood inventory costs will decline over 12 months vs. 10% for properties.

Finest 12 months: Up 33% in 1995 for shares vs. housing’s 18% in 2021.

Worst 12 months: Each took historic spills in 2008 amid a world monetary disaster. Shares misplaced 39%, US properties have been down 7%.

These extremes reveal the volatility of the inventory market’s rollercoaster trip – 72 proportion factors between Wilshire’s finest and worst years whereas housing’s unfold was simply 25 factors.

Backside line

What does it take to slim this efficiency hole?

Whenever you rank the previous half-century from thinnest to widest gaps, after which ponder key financial stats, you see it takes near-perfect enterprise situations to have shares and houses with comparatively equal outcomes.

Small-gap years see common US job creation at 2.1% vs. 1.1% when gaps are largest. In the meantime, inflation was milder, with a median 3.3% enhance within the Client Value Index vs. 3.8%.

Curiously, when value swings for shares and houses are shut, shares are gaining at a below-average fee of seven% vs. an above-par 6% for properties.

- HOW NIMBY ARE YOU? Ponder widespread objections to new housing. TAKE OUR QUIZ!

But when gaps are the widest, in dicier financial instances, shares appear to thrive. The Wilshire averaged 11% yearly positive factors when stock-housing spreads have been at their peaks, in contrast with a 5% appreciation fee for properties.

Why? My guess is that inventory merchants usually guess forward of the curve, hoping for higher instances forward. Homebuyers choose calmer instances.

Jonathan Lansner is the enterprise columnist for the Southern California Information Group. He could be reached at [email protected]