Synthetic intelligence (AI) is a transformational know-how. Due to AI, some established companies will develop extra sources of income, and others will battle to discover a place within the new enterprise and tech setting.

Nonetheless, different corporations, typically not considered AI stocks, may expertise speedy progress and presumably emerge out of nowhere to develop to a market cap of $1 trillion and past. Though it is tough to precisely predict which progress shares will obtain such a milestone, three Motley Idiot contributors have concepts on which of those much less apparent AI shares can develop their market cap past $1 trillion.

An old-school tech inventory income from the AI revolution

Jake Lerch (Oracle): My choose is Oracle (NYSE: ORCL), due to its resurgent cloud enterprise that is being fueled by skyrocketing demand for synthetic intelligence knowledge servers.

On the corporate’s most up-to-date earnings name (for the three months ending on Feb. 29), Oracle chairman Larry Ellison was very simple in admitting that Microsoft‘s explosive cloud progress is driving knock-on success for Microsoft’s suppliers, together with Oracle. “We’re constructing 20 knowledge facilities [for] Microsoft and Azure. They simply ordered three extra knowledge facilities this quarter,” Ellison stated.

In flip, Oracle’s general income rose 7% 12 months over 12 months in its most up-to-date quarter to $13.3 billion. Higher but, administration gave upbeat steerage, indicating that future gross sales targets could also be met sooner than anticipated, as the corporate’s cloud providers phase is rising at a 25% year-over-year charge.

As for the corporate’s inventory, it is likely to be a shock that Oracle is already America’s Twentieth-largest firm with a market cap of $345 billion, making it greater than twice the dimensions of iconic corporations like Verizon, Caterpillar, and American Categorical.

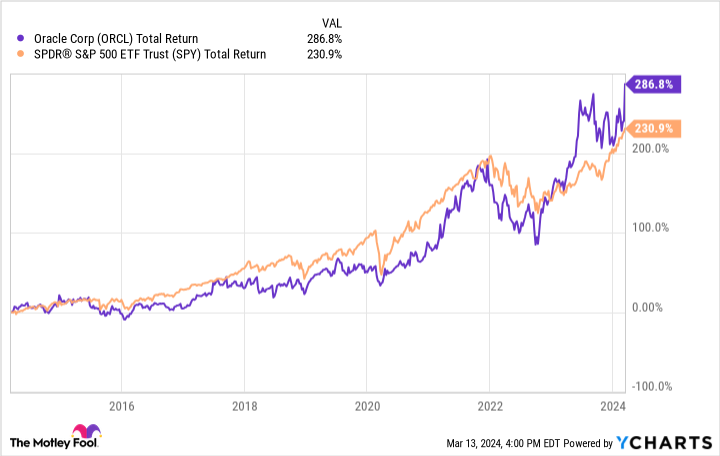

What is maybe extra surprising, significantly to these of us who lived by the inventory’s utter collapse within the wake of the dot-com bubble, Oracle has really been a strong funding for greater than a decade. In actual fact, Oracle’s shares have outperformed the S&P 500 over the past decade.

So, it is likely to be time for buyers to provide Oracle one other look. Due to its red-hot cloud enterprise, this Net 1.0 identify may very well be on the quick observe to a $1 trillion market cap.

TSMC would not get the credit score it deserves

Justin Pope (Taiwan Semiconductor Manufacturing): Semiconductors have turn into the constructing blocks of AI; the chips energy the huge computer systems wanted to crunch the information to coach AI fashions. Nvidia, the present king of AI chips with a lot of the market share, is doing simply over $60 billion in companywide gross sales yearly. CEO Lisa Su of Superior Micro Units, Nvidia’s rival, believes the AI chip market will develop as massive as $400 billion over the approaching years.

Regardless of being well-known chip giants, neither Nvidia nor AMD really manufacture their chips. That job belongs to manufacturing specialists like Taiwan Semiconductor Manufacturing (NYSE: TSM). TSMC is the world’s largest semiconductor producer, with an estimated 56% share of the world’s chip manufacturing. Because the market chief, you may ensure that TSMC is the go-to for these new, extremely superior chips powering the most recent improvements like AI.

The market is not precisely sleeping on TSMC inventory. In spite of everything, the corporate is price over $600 billion at present. Nevertheless, it is nonetheless moderately priced at 23 occasions analysts’ estimated 2024 earnings of $6.17 per share.

Give it some thought. If semiconductor demand pushes the AI chip market to such huge progress (a number of occasions its present dimension if Lisa Su is right), a lot of that enterprise will trickle right down to TSMC. It isn’t a stretch to see the corporate’s earnings doubling over the following decade, which might be greater than sufficient to push TSMC previous a trillion-dollar market cap.

The long run seems to be vibrant for the world’s main chip fab, and a trillion-dollar valuation appears extra like a matter of when not if.

This journey inventory ought to proceed to e-book AI-driven good points

Will Healy (Airbnb): Most customers see Airbnb (NASDAQ: ABNB) as a tourism firm, and understandably so. It has turned the holiday rental business on its head, altering any residence into a possible trip property. Furthermore, it has bolstered this popularity by providing actions that may attraction to vacationers.

Nonetheless, it could probably shock many shoppers and even some buyers to know that Airbnb most likely owes its success to AI. For one, it isn’t a primary mover on this area. That declare belongs to Expedia‘s Vrbo. Moreover, not like a resort chain like Hilton, it would not personal the properties it helps lease.

In actuality, Airbnb is little greater than an internet site for listings with a excessive stage of identify recognition. The corporate fosters its aggressive benefits by AI. The know-how helps with challenges comparable to figuring out correct pricing ranges in a given space or estimating the reputations of potential tenants.

Airbnb has additionally discovered uncommon functions for AI. The know-how performs a job in implementing vacation exercise restrictions and estimating the probability a tenant may violate such guidelines.

Additionally, Airbnb has begun testing its AI chatbot to deal with many buyer assist inquiries. To this finish, it just lately purchased GamePlanner, an organization that may presumably make AI experiences on Airbnb appear extra human.

Furthermore, the corporate is likely to be nearer to a $1 trillion market cap than some may assume. Due to its 7.7 million listings and 448 million nights and experiences booked in simply the fourth quarter of 2023 alone, the inventory has already grown to a market cap of $105 billion — which means it has to double roughly 3.2 occasions to take the market cap to $1 trillion.

Admittedly, such a feat will probably take a number of years for the reason that market cap will nonetheless must develop by virtually ninefold to realize that milestone. Additionally, Airbnb’s P/E ratio of 23 was skewed decrease by a one-time earnings tax profit, making its true earnings-based valuation increased than it’d seem.

Nevertheless, its price-to-sales ratio of 11 will not be removed from report lows, an element that ought to function a catalyst as income and earnings rise additional. With AI persevering with to extend the corporate’s productiveness, the $1 trillion market cap ought to finally be inside attain.

Must you make investments $1,000 in Oracle proper now?

Before you purchase inventory in Oracle, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Oracle wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

American Categorical is an promoting associate of The Ascent, a Motley Idiot firm. Jake Lerch has positions in Airbnb, Caterpillar, and Nvidia. Justin Pope has no place in any of the shares talked about. Will Healy has positions in Superior Micro Units. The Motley Idiot has positions in and recommends Superior Micro Units, Airbnb, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Verizon Communications and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

3 Surprise AI Stocks Headed for a $1 Trillion Market Cap was initially printed by The Motley Idiot