Know-how shares had been in high-quality kind in 2023, which is clear from the excellent acquire of just about 67% on the Nasdaq-100 Know-how Sector index through the 12 months, and the nice half is that the sector is exhibiting promising indicators as soon as once more this 12 months.

The Nasdaq-100 Know-how Sector index is up roughly 7% to this point in 2024, and historical past means that it might end the 12 months with a lot stronger good points. Barring 1999, the Nasdaq-100 has delivered a median acquire of 24% within the 12 months following one during which the index clocked 40%-plus good points, in line with brokerage agency Capex.com.

Favorable elements equivalent to a sturdy U.S. financial system and declining inflation might help the Nasdaq repeat historical past in 2024 and soar larger. That is why now can be time for buyers to purchase tech stocks equivalent to Microsoft (NASDAQ: MSFT) and Micron Know-how (NASDAQ: MU).

These two firms not solely commerce at enticing valuations, however they’re additionally on observe to capitalize on fast-growing alternatives within the cloud computing and semiconductor markets. Let’s take a better have a look at the explanations Microsoft and Micron are value shopping for proper now.

1. Microsoft

Microsoft inventory presently trades at 36 occasions trailing earnings. That is barely larger than the Nasdaq-100’s common price-to-earnings ratio of 33. Nonetheless, Microsoft’s ahead earnings a number of of 31 is sort of in step with the index’s common.

Shopping for Microsoft at this valuation seems like a sensible factor to do, contemplating the corporate’s rising dominance within the cloud computing market. Within the fourth quarter of 2023, Microsoft’s Azure cloud managed 24% of the cloud infrastructure market, in line with Synergy Analysis Group, up by one share level from the prior-year interval.

It is also value noting that cloud infrastructure spending was up 20% 12 months over 12 months within the fourth quarter of 2023, barely larger than the 19% development the market recorded for your entire 12 months. Synergy Analysis factors out that generative synthetic intelligence (AI) was a key driver behind the market’s stronger development final quarter.

Nonetheless, that is just the start of AI adoption within the cloud computing house. Mordor Intelligence estimates that the cloud AI market could possibly be value $67 billion in 2024, indicating that it might account for an enormous chunk of the general cloud computing market, which was value $270 billion final 12 months. However by 2029, the cloud AI market is predicted to generate a whopping $274 billion in annual income.

The excellent news for Microsoft buyers is that the corporate is making good progress on this fast-growing area of interest. Its Azure cloud income was up 30% 12 months over 12 months final quarter, in contrast with the 13% development at market chief Amazon Net Companies. AI drove six share factors’ value of development in Microsoft’s cloud enterprise final quarter, permitting it to shut the hole with the market chief.

The profitable alternative within the cloud computing market together with different areas the place Microsoft has been integrating AI for a long time explains why analysts count on the corporate’s prime and backside strains to obtain a pleasant enhance in the long term. Impartial funding banking agency Evercore estimates that AI might add $82.5 billion in annual income for Microsoft by 2028 whereas boosting its earnings by $5.10 per share.

That factors towards an enormous enhance, provided that Microsoft is predicted to ship $11.66 per share in earnings within the present fiscal 12 months on income of $244.3 billion. Traders, subsequently, would do effectively to purchase this tech titan earlier than it soars larger and turns into costly on the again of the rising demand for AI functions throughout a number of industries.

2. Micron Know-how

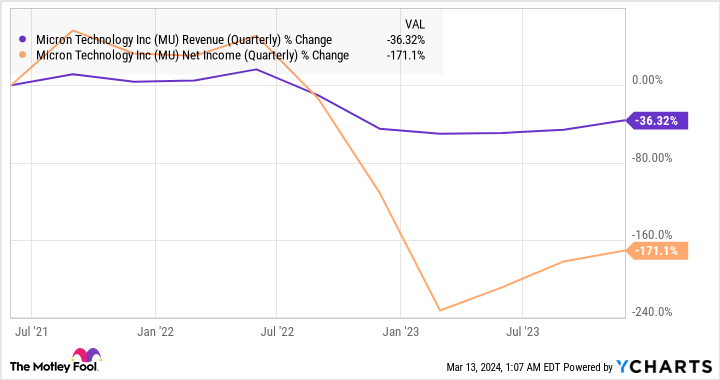

The reminiscence market noticed a turnaround in 2023 after being beneath the climate for round two years. Costs of dynamic random entry reminiscence (DRAM) chips fell from the top of 2021 to the top of 2023, crushing Micron’s prime and backside strains within the course of.

The excellent news for Micron is that DRAM costs are anticipated to leap between 10% and 15% within the first quarter of 2024. The worth rise was pushed by development in a number of areas, starting from private computer systems to smartphones to servers, and that is not shocking contemplating the rising adoption of AI in these areas.

AI servers, for instance, create the necessity for extra high-bandwidth reminiscence chips as main chipmakers use the sort of reminiscence of their AI accelerators. Equally, the appearance of AI-enabled PCs and smartphones ought to drive a stronger demand for reminiscence chips. All this explains why Gartner forecast an 88% enhance within the reminiscence market’s income this 12 months to $87 billion, pushed by stronger pricing and volumes. In the meantime, storage reminiscence income can be predicted to extend by nearly 50% in 2024 to $53 billion.

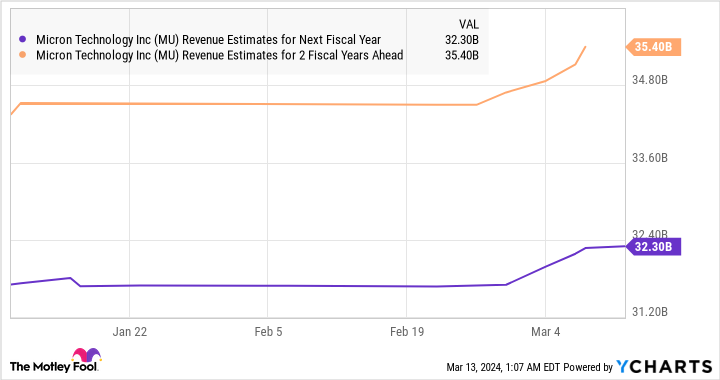

The reminiscence market’s restoration is the explanation Micron’s income is forecast to extend a formidable 46% within the present fiscal 12 months to $22.7 billion, in line with consensus estimates. Analysts count on the momentum to proceed over the following couple of fiscal years as effectively.

Micron inventory presently trades at 6.6 occasions gross sales. That is decrease than the Nasdaq-100’s price-to-sales ratio of seven.3, suggesting that buyers are getting deal on this semiconductor inventory now. That is as a result of a gross sales a number of of even 6 after a few fiscal years signifies that Micron could possibly be sitting on a market cap of $212 billion. That is nearly double its present market cap of round $107 billion, which is the explanation buyers ought to contemplate shopping for this Nasdaq inventory earlier than it skyrockets.

The place to speculate $1,000 proper now

When our analyst crew has a inventory tip, it will possibly pay to pay attention. In any case, the publication they’ve run for twenty years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they imagine are the 10 best stocks for buyers to purchase proper now… and Microsoft made the checklist — however there are 9 different shares you could be overlooking.

*Inventory Advisor returns as of March 11, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Microsoft. The Motley Idiot recommends Gartner and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

2 Top Tech Stocks to Buy Hand Over Fist Before the Nasdaq Jumps Higher in 2024 was initially revealed by The Motley Idiot