Lower than three months into 2024, the same old suspects are lifting the inventory market increased. The so-called “Magnificent Seven” (Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla) stay a few of the hottest shares on Wall Road.

However traders wish to know which of those shares, if any, stay screaming buys. Here are the 2 that I imagine nonetheless have loads of gasoline left within the tank.

1. Amazon

Topping my record is Amazon. Shares of the e-commerce chief are up 88% over the past 12 months, serving to founder Jeff Bezos climb again atop the record of richest Individuals.

However what places Amazon on the prime of my record is not its latest efficiency — it is the corporate’s long-term prospects.

Because the world’s prime cloud companies supplier, Amazon Net Providers (AWS) stands to reap huge advantages from the bogus intelligence (AI) revolution. That is as a result of builders will look to AWS for assist, steerage, and infrastructure to scale their AI-powered functions.

Merely put, hyperscalers like Amazon, Microsoft, Alphabet, and Meta Platforms personal a good portion of knowledge facilities globally, with some estimates placing the determine at 40% of general capability.

Financially, the consequences of the AI revolution are already evident. In Amazon’s most up-to-date quarter (the three months ending on Dec. 31, 2023), the corporate reported AWS income of $24.2 billion, which was up 13% from a yr earlier.

Amazon’s new generative AI assistants like Q (a chatbot for companies) and Rufus (an internet buying assistant) symbolize alternatives for Amazon to have its personal ChatGPT second. And, with 500 million Alexa-enabled gadgets already offered, Amazon already has a {hardware} foothold in lots of households. It merely wants the software program buzz to really seize the second.

In any occasion, Amazon’s mixture of unbelievable management, excellent financials, and main market share in cloud companies make it a screaming purchase in my e book.

2. Nvidia

Sure, Nvidia remains to be a screaming purchase, too. I do know that is likely to be exhausting to imagine, with shares lately up an astounding 600% in solely 18 months.

Nonetheless, similar to how the results of one coin flip would not impression the end result of the next one, Nvidia’s unbelievable final 18 months say nothing about the place the inventory is headed. In a nutshell, previous efficiency would not indicate future returns.

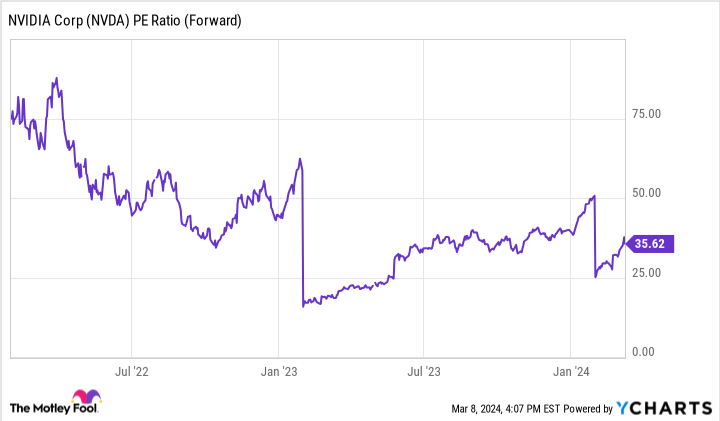

There may be, nonetheless, one attention-grabbing pattern that potential traders ought to be mindful: That is the corporate’s valuation. And opposite to what you may assume, Nvidia’s shares maintain getting cheaper — no more costly.

In actual fact, as you may see within the chart beneath, Nvidia’s ahead price-to-earnings (P/E) ratio has decreased by greater than 50% over the past three years.

And P/E ratios are risky as a result of they’re based mostly on both trailing earnings or future earnings estimates — which means they usually soar or collapse round earnings bulletins, as you may see within the chart above.

At any charge, Nvidia’s ahead P/E ratio has considerably dropped as a result of analysts count on the corporate to attain from rising gross sales of its graphics processing models (GPUs), that are used to energy a lot of at the moment’s cutting-edge AI functions.

In abstract, traders should not shrink back from Nvidia simply because its inventory has been on a tear. On the contrary, Nvidia’s future seems vivid because of the skyrocketing demand for AI chips. Granted, its not a inventory for each investor. However for many who are prepared to purchase and maintain, Nvidia may nonetheless be a screaming purchase proper now.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

2 “Magnificent Seven” Stocks That Are Screaming Buys in March was initially revealed by The Motley Idiot