Nvidia has been a prime synthetic intelligence (AI) inventory prior to now yr because the semiconductor bellwether is taking part in a pioneering position within the proliferation of this know-how with its graphics playing cards, whose huge computing energy is permitting tech titans to coach giant language fashions (LLMs) resembling ChatGPT.

Nvidia’s eye-popping income and earnings progress have led to a pointy surge within the firm’s inventory worth, which has gone up 223% prior to now yr. That red-hot rally explains why Nvidia inventory is now buying and selling at a wealthy 30 instances gross sales and 72 instances trailing earnings. Nonetheless, Nvidia appears attractively valued so far as its forward earnings and gross sales multiples are involved, because of its capacity to keep up its excellent progress.

In any case, Nvidia leads the profitable marketplace for AI chips by fairly a ways, which explains why analysts predict its earnings to double yearly for the subsequent 5 years. Because of this, Nvidia can justify the wealthy multiples it’s commanding proper now, however value-oriented traders might wish to have a look at cheaper choices to capitalize on the AI growth.

That is the place Zoom Video Communications (NASDAQ: ZM) and Confluent (NASDAQ: CFLT) step in. Each firms might develop into huge beneficiaries of AI adoption in the long term, and the great half is that traders can purchase them at enticing multiples proper now. Let us take a look at the the explanation why traders ought to take into account shopping for these two Nvidia options.

1. Zoom Video Communications

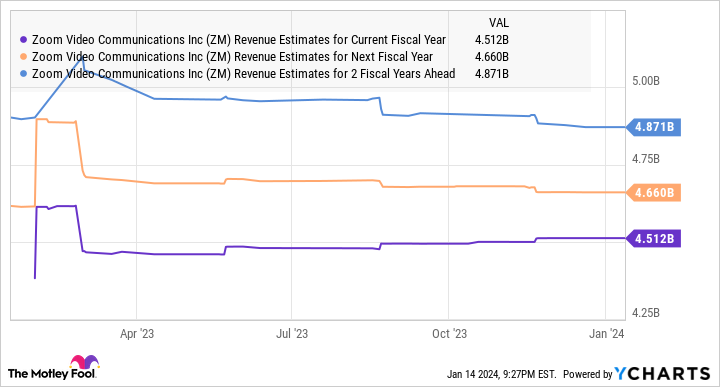

Shares of Zoom Video Communications have remained virtually flat prior to now yr, underperforming the broader market. That is not shocking, as the corporate’s progress has slowed down in a post-pandemic situation. The corporate is anticipated to complete the continuing fiscal 2024 (which is able to finish this month) with a rise of simply 2.7% in income to $4.5 billion. As the next chart signifies, consensus estimates aren’t anticipating a lot of a soar in Zoom’s income over the subsequent couple of years as effectively.

Nonetheless, AI might assist supercharge the corporate’s progress. That is as a result of the adoption of generative AI within the video conferencing market ought to unlock a brand new progress alternative for Zoom. In accordance with third-party estimates, generative AI adoption in video conferencing might develop at an annual tempo of 18% by means of 2032. That might be quicker than the expansion of the general video conferencing market, which is anticipated to develop at virtually 13% a yr over the identical interval and generate $28 billion in annual income.

Zoom is already taking steps to make sure it does not miss this chance. Its Zoom AI Companion gives clients with a number of AI options, resembling summarizing conferences, getting suggestions on the shows they make, drafting responses in chats, composing emails, and even asking questions in a number of languages.

Moreover, Zoom is bringing AI options to its contact middle platform as effectively. The corporate has launched three pricing tiers for its Zoom Contact Heart clients, giving them entry to AI capabilities resembling permitting customer support brokers to supply personalised help and improve agent productiveness by recommending the subsequent finest motion, amongst different issues.

It’s price noting that Zoom Contact Heart ended the earlier quarter with 700 clients, which is spectacular contemplating that the service was launched a few years in the past. Because of this, Zoom has now elevated its share of the contact middle market to six.8%. This bodes effectively for the corporate’s long-term prospects as the scale of the worldwide contact middle market is anticipated to develop from an estimated $42 billion this yr to $164 billion in 2030.

If Zoom can nook even 10% of this house by the top of the last decade, it might generate a further $16 billion in income. On the similar time, Zoom is ranked No. 1 out there for videoconferencing software program, with a formidable share of 57%. The addition of AI options ought to enable Zoom to keep up its sturdy share of this house and provides its prime line a pleasant enhance in the long term as this market expands.

It will not be shocking to see Zoom popping out of mediocrity and stepping on the fuel because of AI, which most likely explains why famous investor Cathie Wood’s Ark Invest believes that the stock could hit a whopping $1,500 by 2026. That might be a large soar from present ranges, so traders ought to take into account shopping for Zoom inventory earlier than it goes on an AI-fueled surge.

Zoom at the moment sports activities a price-to-sales ratio of simply 4.6 together with a ahead earnings a number of of 16, which implies traders are getting a great deal on this videoconferencing and get in touch with middle firm, which might win huge from AI in the long term.

2. Confluent

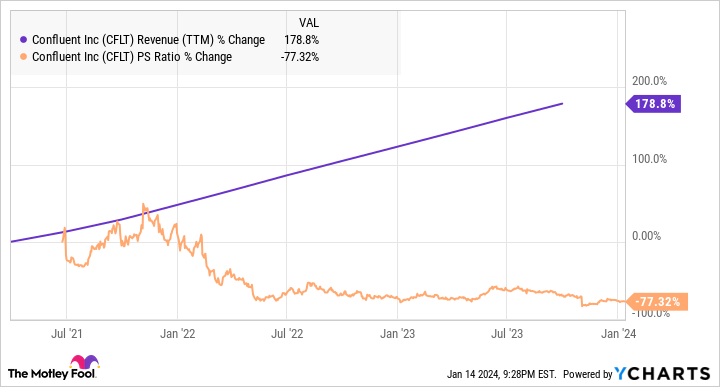

Confluent inventory fell sharply in November final yr after the corporate launched its third-quarter outcomes, however savvy traders ought to take into account shopping for this cloud-native information streaming platform hand over fist, contemplating its valuation and spectacular progress. As the next chart tells us, Confluent’s prime line has elevated at a pleasant tempo through the years, however its price-to-sales ratio has moved in the other way.

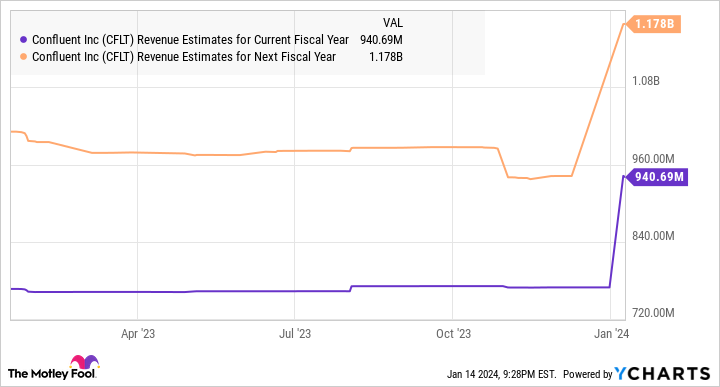

Confluent is now buying and selling at 9 instances gross sales, which makes it considerably cheaper than Nvidia. Additionally, the corporate expects to ship $768.5 million in income for 2023, which might be a 31% improve over final yr. Even higher, analysts have raised their income progress expectations for Confluent, which factors towards stable progress for the subsequent couple of years as effectively.

AI, nevertheless, might enable Confluent to clock quicker progress. That is as a result of Confluent’s information streaming platform, which permits its clients to attach their information and course of it in actual time versus storing that information in silos and processing it afterward, might play a central position in serving to organizations construct AI purposes which are powered by real-time information.

Confluent says that the real-time information streams fed into AI programs and purposes may also help “ship production-scale AI-powered purposes quicker.” Because of this, AI purposes will not should depend on previous information, and they’ll have the ability to ship extra correct outcomes. In accordance with a survey of 300 organizations utilizing information streaming platforms carried out by platform supplier Redpanda, 75% of the respondents have been trying to incorporate real-time analytics to energy their AI purposes.

As such, Confluent might witness a pointy soar within the demand for its information streaming platform in the long term. It’s price noting that the info streaming market that Confluent serves is anticipated to clock an annual progress of 28% by means of 2030, producing $125 billion in income on the finish of the forecast interval in comparison with $18 billion in 2022.

Because of this, Confluent ought to have the ability to maintain its wholesome progress for a very long time to return. That is why traders ought to take into account making the most of the current pullback in its shares and make investments on this potential AI winner whereas it stays comparatively low cost.

Do you have to make investments $1,000 in Zoom Video Communications proper now?

Before you purchase inventory in Zoom Video Communications, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Zoom Video Communications wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 8, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Confluent, Nvidia, and Zoom Video Communications. The Motley Idiot has a disclosure policy.

Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now was initially revealed by The Motley Idiot