The Nasdaq-100 Know-how Sector index has gained 7% throughout the first two months of 2024, and it will not be shocking to see it leap larger because the 12 months progresses, because of the proliferation of synthetic intelligence (AI).

AI shares have performed a giant function in boosting the Nasdaq-100 previously 12 months, sending the index up almost 54% as its elements, corresponding to Nvidia (NASDAQ: NVDA) and Meta Platforms (NASDAQ: META), have delivered beautiful beneficial properties of 233% and 181%, respectively. Historical past means that the Nasdaq-100 tends to leap 24% on common following a 12 months during which it achieved beneficial properties of 40% or extra.

So, it will not be shocking to see the Nasdaq leap larger in 2024, particularly contemplating the newest outcomes from Nvidia and Meta Platforms. Let’s take a look at the the reason why these two tech giants are all set to spice up the Nasdaq and likewise examine why now might be a very good time to purchase them.

1. Nvidia

Nvidia’s inventory market rally acquired a pleasant enhance after the corporate launched fiscal 2024 fourth-quarter outcomes (for the three months ended Jan. 28, 2024) on Feb. 21. The chipmaker cruised previous consensus estimates with document quarterly income of $22.1 billion, a leap of 265% from the year-ago interval.

The corporate was initially anticipating its fiscal This fall income to land at $20 billion. Nevertheless, its efforts to extend the provision of its flagship H100 AI graphics processing unit (GPU) to fulfill the sturdy demand from prospects helped it ship stronger-than-anticipated development.

That is not shocking as Nvidia’s foundry associate, Taiwan Semiconductor Manufacturing, popularly referred to as TSMC, has been aggressively increasing its advanced packaging capacity in order that it may well churn out a larger variety of AI chips. Provide chain sources point out that TSMC’s chip-on-wafer-on-substrate (CoWoS) manufacturing capability, which is used for making AI chips, is about to broaden to 33,000 to 35,000 wafers a month by the fourth quarter of 2024. That will be greater than double TSMC’s estimated month-to-month CoWoS capability of 15,000 wafers in December 2023.

Not surprisingly, Nvidia administration identified on the newest earnings convention name that the provision of its AI graphics playing cards is enhancing. However what’s fascinating to notice right here is that Nvidia expects the demand for its GPUs to outpace provide regardless of the efforts it’s enterprise to supply extra chips. In accordance with CFO Colette Kress, the corporate expects its “next-generation merchandise to be provide constrained as demand far exceeds provide.”

Nvidia will begin ramping up the shipments of its next-generation H200 AI GPU within the second quarter. The corporate is claiming that this chip “almost doubles the inference efficiency of H100,” which does not appear shocking as it’s anticipated to be manufactured utilizing a extra superior 3-nanometer (nm) chipmaking course of as in comparison with the H100’s 5nm course of. Furthermore, Nvidia is packing the H200 with extra reminiscence bandwidth and capability.

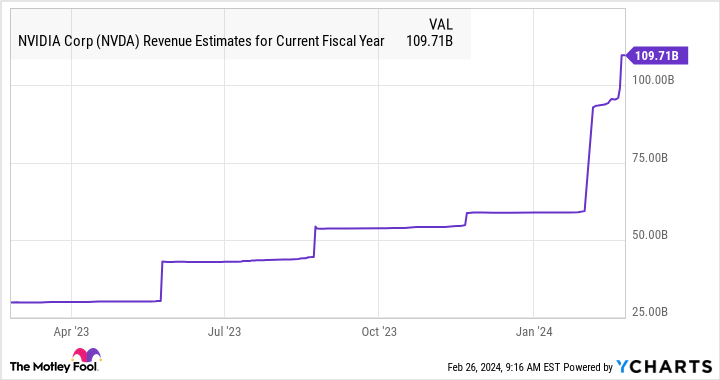

Because of this, Nvidia appears to be in a strong place to take care of its spectacular share of the $67 billion AI chip market in 2024. Gartner estimates that $53 billion price of AI chips have been offered final 12 months, and Nvidia’s information heart income of $47.5 billion signifies that it managed 90% of this market final 12 months. An identical share this 12 months may also help Nvidia maintain its momentum, which explains why its fiscal 2025 income is predicted to extend 83% to $110 billion.

The market might reward such spectacular development with extra upside. With shares of Nvidia buying and selling at 33 occasions forward earnings, which is decrease than the Nasdaq-100’s earnings a number of of 34, buyers would do effectively to purchase this AI inventory instantly since its bull run appears right here to remain.

2. Meta Platforms

Identical to Nvidia, Meta Platforms is buying and selling at a horny 24 occasions ahead earnings. Shopping for Meta inventory at this valuation seems like a no brainer, contemplating that its backside line is predicted to leap a powerful 34% in 2024 to $19.91 per share. Even higher, analysts are anticipating Meta’s earnings to extend at an annual price of 26% for the subsequent 5 years, a giant enchancment over the 11% annual earnings development it has clocked previously 5 years.

Assuming Meta can obtain this tempo of bottom-line development, its earnings might improve to $47.22 per share after 5 years, utilizing its 2023 earnings of $14.87 per share as the bottom. If we multiply the projected earnings after 5 years with Meta’s five-year common ahead earnings a number of of 21, its share value might improve to $991. That will be a strong leap of 105% from present ranges.

AI is a key cause why Meta ought to be capable of ship the strong earnings development that analysts expect from it. The corporate has been integrating generative AI into its promoting instruments to assist advertisers enhance concentrating on and generate stronger returns on the promoting {dollars} they spend. From serving to advertisers create a number of backgrounds for his or her advert campaigns based mostly on product photos to producing advert texts, Meta believes that its Advertisements Supervisor platform can “unlock a brand new period of creativity that maximizes the productiveness, personalization and efficiency for all advertisers.”

Meta factors out that utilizing generative AI in promoting has the potential to assist advertisers save 5 or extra hours each week whereas additionally boosting returns on advert spending by 32%. Because of this, it will not be shocking to see Meta cornering a much bigger share of the digital advert market, much like what it did final 12 months. The corporate’s 2023 income elevated by 16% to $134.9 billion, outpacing the ten.7% improve in digital advert spending.

This 12 months, analysts are forecasting a 17.3% improve in Meta’s income to $158.2 billion, suggesting that it’s on monitor to outpace the 13.2% projected development in digital advert spending, as per eMarketer. The digital advert market is predicted to leap to an estimated $1.5 trillion in 2030 as in comparison with $531 billion in 2022. So, Meta’s concentrate on utilizing AI to enhance its affect on this market means that it’s setting itself up for long-term development, which is why buyers ought to contemplate shopping for Meta inventory earlier than it soars additional.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Gartner. The Motley Idiot has a disclosure policy.

2 Artificial Intelligence (AI) Stocks to Buy Hand Over Fist Before the Nasdaq Soars Higher in 2024 was initially printed by The Motley Idiot