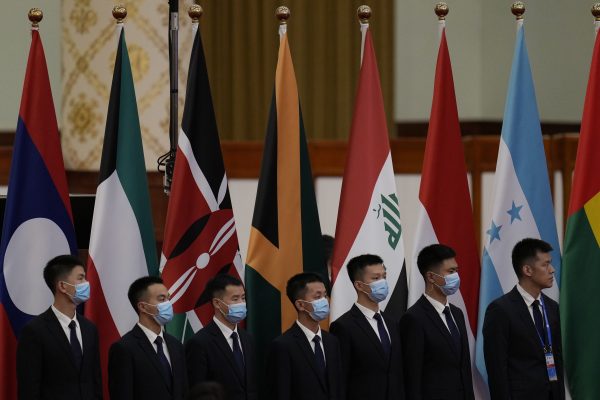

The third Belt and Highway Discussion board (BRF), which doubled as a celebration of the tenth anniversary of the Belt and Highway Initiative (BRI), was hosted in Beijing, China from October 17-18 2023. As with the earlier BRF, Africa was effectively represented, with 5 heads of state or authorities attending from Kenya, Ethiopia, Republic of Congo, Mozambique, and Egypt, together with the vice chairman of Nigeria. 5 high leaders from African nations attended the second BRF in 2019.

There was a lot discuss of a perceived slowdown in Chinese language lending globally, and to Africa particularly, over the previous few years, and of the BRI’s supposed pivot away from massive scale infrastructure initiatives. But African leaders haven’t been content material to swallow this narrative and as a substitute proceed to take opportunities to instantly reinforce African growth priorities with China, considered one of their key growth companions. The BRF was one other such alternative, providing seemingly promising outcomes however with extra work forward for African nations.

With the mud now settled on the discussion board, have been the priorities of African leaders taken under consideration?

To reply this query, you will need to first overview the important thing BRF outcomes. Three stand out.

First, the cash will preserve flowing however will turn into extra focused, and inexperienced.

In his opening speech, President Xi Jinping indicated that China would proceed to finance “signature initiatives,” however the BRI would additionally develop its focus to incorporate “smaller but smarter” initiatives, with better emphasis on decrease threat and extra socially and environmentally impactful initiatives. The renewed dedication to signature initiatives specifically was accompanied by an announcement of over $100 billion in new funding for BRI cooperation initiatives from Chinese language Growth Finance Establishments (DFIs). Each the China Export and Import Financial institution and the China Growth Financial institution will obtain a brand new financing window of roughly $50 billion whereas the Silk Highway Fund, additionally part of the BRI financing mechanism, will obtain a capital infusion of $10 billion.

The truth that the BRI’s pivot to “smaller however smarter” initiatives won’t come on the expense of signature infrastructure initiatives, coupled with a brand new capital infusion for BRI initiatives, is a hopeful signal for African nations. With an estimated annual infrastructure financing hole of over $100 billion, funding for infrastructure growth stays essential for the continent’s development prospects.

Second, small and medium enterprises (SMEs) are getting a lift. On the discussion board, China Growth Financial institution signed a Time period Facility Settlement with the African Export-Import (Afrexim) Financial institution for a mortgage of $600 million to assist SMEs in Africa. This funding seeks to advertise financial cooperation between Afrexim Financial institution member states and China, in addition to enhance Africa’s export manufacturing capability. That is essential as a result of there are an estimated 44 million SMEs throughout Africa, which drive financial development and supply an estimated 80 percent of jobs throughout the continent.

Third, though hardly publicized, on the BRF China agreed to fund a number of infrastructure initiatives in a spread of African nations. For example, China will finance two main railway initiatives in Nigeria – the Abuja-Kano and Port-Harcourt-Maiduguri railways – at a value of roughly $3 billion. A facility settlement was additionally signed for China to finance development of a 25MW photovoltaic solar energy plant in Burkina Faso. China additionally dedicated to fund the growth of the Sagana-Marua freeway in Kenya, the Niayes street, and enchancment of the Dakar street community in Senegal (via China Growth Financial institution), and, via the Silk Highway Fund, China will invest within the Africa Funding Fund IV underneath the Outdated Mutual Fund based mostly in South Africa.

Nevertheless, though these look like promising outcomes for Africa, there may be fantastic print to concentrate on, and will probably be essential to proceed to trace post-BRF progress.

First, the pivot towards “smaller but smarter” initiatives implies that Chinese language lenders will intention for extra inexperienced growth and digital connectivity initiatives, in addition to place better emphasis on noneconomic facets of initiatives, similar to environmental and social impacts. Thus, to progress additional African nations could effectively have to suggest extra of a majority of these initiatives to credible Chinese language stakeholders and localize them. Panda Bonds, issued in Chinese language capital markets and focusing concentrate on local weather financing and sustainable growth initiatives, can be an choice to discover. Egypt not too long ago turned the primary African nation to issue a Panda Bond.

Second, Xi additionally said that the brand new funding for the BRI initiatives can be based mostly on “enterprise and market ideas.” This language – China’s model of the “leveraging the personal sector” rhetoric that’s well-liked in growth finance circles – sounds engaging, nevertheless it additionally means going ahead, Chinese language lenders are prone to emphasize industrial ideas similar to a low-risk urge for food and desire for public-private partnerships (PPPs) relative to sovereign lending. However personal sector financing – particularly of fundamental utilities – can create important issues for populations. Given fiscal house challenges, it might be higher for African nations to work tougher and extra well to barter for long term, and extra concessional financing from China to satisfy their growth wants.

Final however not least, this better emphasis on industrial ideas additionally signifies that Chinese language lenders are prone to be extra threat averse and require in depth due diligence for proposed initiatives than has been the case up to now. This isn’t to say that previous initiatives financed by Chinese language banks on the continent have been white elephants (we have now not seen sturdy proof for this), nevertheless it may imply tougher work for African governments to show challenge viability.

On this regard, and as we have now beforehand argued, sturdy emphasis ought to be placed on initiatives that promote regional integration, similar to these underneath the African Union’s Program for Infrastructure Development for Africa (PIDA). Total, regional, cross-country infrastructure initiatives are prone to have better industrial viability as they reap the benefits of economies of scale offered by regional financial blocs in addition to the broader African Continental Free Commerce Space (AfCFTA). The Mombasa-Nairobi Commonplace Gauge Railway, acknowledged as an current “flagship challenge” of the BRI, for example, would have better industrial viability whether it is prolonged to Uganda, Rwanda, Tanzania, and South Sudan as initially conceived underneath the East-African Standard Gauge railway plan. Moreover, given the present fiscal house challenges confronted by many African nations, regional initiatives present a chance for particular person African nations to pool collateral for vital regional infrastructure.

Total, the third BRF carried some optimism for African nations and their growth aspirations with China’s new funding commitments for BRI cooperation initiatives in addition to China’s renewed dedication to “signature initiatives.” Nevertheless, and maybe partly attributable to China’s personal financial issues in addition to (pointless) calls from the G-7 and others for China to lend “extra responsibly,” it appears African nations could effectively need to work tougher to make sure the alternatives introduced by the BRF improve the continent’s financial development and growth.