Shares of Meta Platforms (NASDAQ: META) have crushed the broader market handsomely up to now yr with spectacular positive aspects of 154%, pushed by strong development in its prime and backside strains. It appears like its eye-popping rally is right here to remain following its newest earnings report.

Meta Platforms launched its fourth-quarter and full-year 2023 outcomes on Feb. 1. Shares of the corporate jumped 20% the next day due to its better-than-expected numbers and steering. The nice half is that Meta inventory stays reasonably priced, and buyers who have not purchased this tech large but ought to take into account shopping for it hand over fist proper now.

Meta Platforms is changing into an even bigger participant within the digital advert market

Meta Platforms reported This autumn income of $40.1 billion, a rise of 25% over the year-ago interval. Moreover, the corporate diminished its prices and bills by 8% through the quarter, which allowed it to triple its adjusted earnings on a year-over-year foundation to $5.33 per share. The numbers had been higher than consensus expectations of $4.96 per share in earnings on income of $39.2 billion.

It’s price noting that Meta’s This autumn income grew on the quickest tempo for the reason that center of 2021 and outpaced the corporate’s full-year income improve of 16%. The tech large’s full-year earnings had been up 73% to $14.87 per share on account of its deal with controlling costs and improving the efficiency of its enterprise operations in 2023.

Meta benefited from an enchancment in digital advert spending final yr. In response to eMarketer, digital advert spending elevated 10.7% in 2023 to $627 billion. So, Meta grew at a quicker tempo than the market by which it operates. Furthermore, its 2023 income signifies that it managed 21.5% of the digital advert area final yr. That is an enchancment over the 20.5% share in 2022.

Even higher, Meta’s income forecast for the primary quarter of 2024 signifies that it may proceed to nook an even bigger share of the digital advert market. The corporate is anticipating nearly $36 billion in income within the present quarter on the midpoint of its steering vary. That may be a 25% improve over the prior-year interval’s determine of $28.6 billion. In the meantime, general digital advert spending is estimated to leap 13.2% in 2024.

Artificial intelligence (AI) could possibly be a key motive why Meta is gaining floor within the digital advert area. The corporate identified on its newest convention name with analysts that it continues to “leverage AI throughout our advertisements programs and product suite” in a bid to enhance monetization effectivity. Meta’s choices resembling Benefit+, which permits advertisers to create automated advert campaigns with the assistance of AI and optimize these campaigns to drive better returns on advert {dollars} spent, are gaining strong traction amongst its prospects.

The corporate additionally launched new generative AI options within the earlier quarter for advertisers, with which they’ll generate a number of background photographs that complement product photographs and create various variations of promoting textual content in order that they’ll select the one that can assist them enhance attain. Meta administration says that the “preliminary adoption of those options has been sturdy and checks are displaying promising early efficiency positive aspects.”

The adoption of AI within the digital advertising and marketing area is forecast to extend at an annual fee of just about 27% by means of 2030. AI in digital advertising and marketing is predicted to generate annual income of $79 billion in 2030 in comparison with simply $1.8 billion in 2022. So, Meta is pulling the suitable strings to make sure that it will possibly hold profitable an even bigger share of the digital advert market by giving advertisers extra AI-focused instruments.

Stronger development may result in extra upside

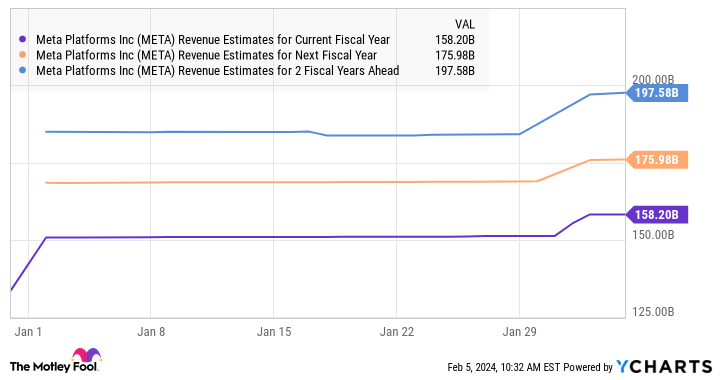

It’s not stunning to see analysts anticipating Meta’s development to stay strong within the coming years.

Because the chart above exhibits, Meta has acquired a pleasant bump in analyst income estimates for 2024, 2025, and 2026. What’s extra, analysts predict Meta’s earnings to extend at a compound annual development fee (CAGR) of 32% for the following 5 years. That may be a giant bounce over the 8.5% CAGR the corporate has clocked within the final 5 years.

Assuming Meta does clock 32% annual earnings development over the following 5 years, its backside line may improve to nearly $60 per share in 2028. Multiplying that 2028 determine by the corporate’s five-year common ahead earnings a number of of twenty-two factors towards a inventory value of $1,320. That means 180% positive aspects from present ranges.

On condition that Meta is buying and selling at 25 occasions ahead earnings proper now, buyers appear to be getting an excellent deal on the inventory.

Must you make investments $1,000 in Meta Platforms proper now?

Before you purchase inventory in Meta Platforms, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Meta Platforms wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Meta Platforms. The Motley Idiot has a disclosure policy.

Up 154%, This Magnificent Artificial Intelligence (AI) Stock Is a Screaming Buy Before It Skyrockets was initially revealed by The Motley Idiot