At this second, a fast-moving growth is unfolding in Europe’s power trade that’s gaining extra consideration by the day.

Europe’s power disaster, triggered by Russia’s early 2022 invasion of Ukraine, put an finish to many years of reliance on low cost pure fuel provides from Russia.

Within the brief time period, this meant considerably greater power costs all through Europe, with power prices rising by 40.8% yearly throughout the EU as of September 2022.

And whereas pure fuel costs have pulled again a bit over the previous a number of months, the actual fact stays that Europe is badly in need of a long-term solution for its pure fuel wants.

After many years of dependence on low cost Russian fuel, the state of affairs inside Europe has modified in a significant manner.

– The European Union has acknowledged that their power reserves and safety can not be depending on low cost Russian fuel. This has spurred a renewed curiosity in creating doubtlessly vital reserves inside Europe which were largely ignored for many years…

– The EU has now endorsed natural gas as “green” and designated it a transition gasoline as we transfer towards a renewable power future…

– Germany has moved away from nuclear power generation, resulting in a rise in its want for pure fuel…

– And the continued warfare in Europe – together with sabotaged pipelines connecting Russia and Germany – has dramatically elevated the urgency for bringing new provides of pure fuel on-line inside Europe.

However one firm is rising as a possible chief within the race for home-grown options to power disaster: MCF Vitality (TSXV:MCF; OTC:MCFNF). That is an thrilling participant in Europe, with an array of property that provide distinctive publicity to home pure fuel.

The group main MCF shortly acknowledged this chance to assist strengthen Europe’s power safety…

And so they carry with them in depth experience within the European power markets and geology, in addition to a powerful observe file in capital markets.

Doubtlessly Large European Pure Assets… Missed for A long time

As a result of most of Europe was so depending on low cost Russian fuel, various doubtlessly large useful resource alternatives inside Europe have been sitting idle.

With many years of expertise within the power sector, and a deep understanding of Europe’s geology, the group was uniquely certified to seek for probably the most promising property to assist spur European manufacturing.

The corporate’s two highest-priority tasks have a transparent path to market, and are situated in two of Europe’s most supportive jurisdictions.

Welchau: As much as a Trillion Cubic Ft Prospect in Austria

Situated within the foothills of the Austrian Alps, the Welchau Fuel Prospect incorporates over 140 meters of potential oil and gas-bearing thickness and carries the potential for as much as a trillion cubic ft of pure fuel. The property is analogous to giant anticline buildings found in Kurdistan and the Italian Apennines. In reality, the construction at Welchau is so giant you possibly can really see it from area.

One other properly was drilled again within the Nineteen Eighties simply 5 kilometers away from Welchau, the Molln-1 properly flowed at 3.5 million per day and had 40 barrels of condensate for each 1000 cubic ft of pure fuel. This properly was by no means produced most likely on account of financial causes at the moment when corporations had been primarily on the lookout for oil.

The existence of this properly strongly suggests that there’s fuel and condensate within the system with a great sealing layer, serving to considerably de-risk the challenge for the corporate.

The corporate is shifting shortly on the Welchau fuel prospect agreeing to fund the Welchau-1 properly prices as much as 50% of the cap of EUR 5.1 million to earn a 25% financial curiosity within the Welchau Funding Space. The Welchau fuel prospect has vital fuel useful resource potential, situated within the coronary heart of Europe at a comparatively shallow drill depth and proximal to fuel pipelines. Welchau is concentrating on the identical reservoirs because the close by Molln-1 properly, which examined fuel in 1989.

The corporate introduced that its funding accomplice and operator, ADX Vitality Ltd., had spudded the Welchau properly on February 24, 2024 Drilling is predicted to take 39 days.

German Property: Genexco Acquisition Brings Licenses for 4 Massive-Scale Undertaking Areas

In April 2023, MCF Vitality (TSXV:MCF; OTC:MCFNF) acquired 100% of Genexco GmbH, a personal German oil and fuel firm. This acquisition helped place the corporate as a future chief in pure fuel exploration in Germany with 100% possession of 4 licenses of German pure fuel exploration and growth tasks with an area German talking employees and workplace.

These tasks embody:

Lech:

Lech is a concession in Bavaria protecting 10 sq. kilometers with three beforehand drilled wells and two discoveries. One properly examined fuel at a price of over 24 MMCFD and a second, deeper properly which produced oil with fuel at a price of about 180 BOPD. The third properly encountered the Oil/Water contact in a separate fault block from the invention wells.

Reentry of the property’s Kinsau #1 properly is deliberate in Q2 of 2024. That is the fuel properly which examined at a most circulation price of over 24 MMCFD in 1983. ? With improved stimulation know-how over the previous 40 years the corporate hopes to enhance on these manufacturing charges.

The corporate has a 20percentinterest in an oil and fuel exploration license held by Genexco Fuel GmbH. MCF’s 20% curiosity within the first properly is carried (i.e., doesn’t bear the prices of drilling) as much as EUR 5,000,000.

Lech East

The corporate additionally acquired Lech East, a considerable pure fuel exploration license spanning roughly 100 km² in Southwest Bavaria, Germany, granted by the Bavarian State Ministry of Financial Affairs, Regional Growth, and Vitality for an preliminary time period of three years.

Lech East is adjoining to the Lech license space described above.

Trendy 3D seismic interpretation, aided by Machine Studying and AI, has yielded very promising prospects, offsetting the numerous historic fuel and oil discoveries within the Lech license. The corporate plans a EUR 4.6 million exploration program at Lech East, together with properly drilling.

Reudnitz Fuel Discipline

Reudnitz is situated roughly 70 kilometers southeast of Berlin in a rural space, with confirmed phases: Helium (Approx. 0.2%) and methane (14-20%) related to excessive nitrogen content material (>80%). The fuel separation applied sciences and economics are properly established to seize these assets.

Gaffney Cline & Associates (“GCA”) has independently assessed the very best estimate (P50) of 118.7 Billion cubic ft (BCF) of Methane, and 1.06 BCF of Helium useful resource. Individually, GCA has 4.4 million barrels of oil within the shallower Zechstein formation. Crimson circles are beforehand drilled wells that discovered fuel.

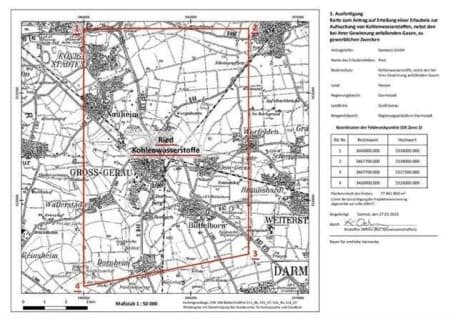

Erlenwiese Exploration License

The corporate additionally acquired a major exploration concession named Erlenwiese, spanning 87 km² in Western Germany.

Erlenwiese is positioned throughout the Central Rhein Graben hydrocarbon system, important for Europe’s long-term power safety. This block has two properly outlined drill prospects on seismic.

MCF has acquired the newest 2D and is within the technique of acquiring the out there 3D seismic knowledge. The corporate plans to carry out its personal AI and Machine-Studying evaluation to additional complement and de-risk its geological and geophysical evaluation of the realm.

MCF Vitality Ltd. is Led by a Staff with a Confirmed Monitor File of Success

One of the intriguing points of the corporate’s story is its management group. They’re a group of executives with a confirmed historical past of delivering worth for stakeholders in a giant manner.

For instance, again in 2004, a number of of the principals of MCF Vitality co-founded Bankers Petroleum Ltd. to revitalize the Patos Marinza oil subject in Albania. The outcomes had been nothing in need of astounding. This group helped ship manufacturing development of over 2,000% by 2015…and so they took the corporate from an preliminary $7.8 million financing all the way in which to an acquisition of C$575 million, representing a premium of 98% over its newest closing worth.

Then, only a few years later, they did it once more. In 2008, BNK Petroleum was spun out of Bankers Petroleum to probe for shale-gas in Europe with two of the group members main the way in which. Stakeholders on this spin-off noticed the corporate’s share worth shoot up 4,000% and hit a peak market cap of over $900 million.

In reality, BNK Petroleum established explorations in six international locations, and have become the biggest oil and fuel rights holder in Europe.

This “Dream Staff” main the way in which for MCF Vitality (TSXV:MCF; OTC:MCFNF) contains…

Jay Park, KC – Government Chairman & Director

Mr. Park is a famend power lawyer and entrepreneur based mostly in London, UK advising world power tasks for over 40 years. Founding father of Park Vitality Legislation and former CEO and Chairman of Reconnaissance Vitality Africa.

James Hill, P. Geo – CEO & Director

Mr. Hill is an expert geologist with over 40 years of technical and govt stage expertise in petroleum and pure fuel exploration and growth. Former Vice President of Exploration for BNK Petroleum and Bankers Petroleum.

Aaron Triplett, CA, CPA – CFO & Company Secretary

Mr. Triplett is a Chartered Accountant (2008) and Chartered Skilled Accountant (2015) serving the pure assets trade. Skilled Chief Monetary Officer previously with Hillcrest Vitality, Angkor Gold and others the place he was accountable for all points of an organization’s monetary operations.

Peter Eckhard Oehms – Managing Director, Germany

Mr. Oehms is a geologist and challenge supervisor with over 40 years of expertise, together with beforehand from 1998 to 2008 at Wintershall, Germany’s largest crude oil and pure fuel producer; Co-founder of Genexco Gmbh, MCF Vitality’s 100% owned subsidiary.

Common Wesley Clark – Director

Common Clark was NATO’s Supreme Allied Commander and the Commander-in-Chief of the U.S. European Command. He has obtained quite a few honorary levels and awards together with the Presidential Medal of Freedom, the Silver Star, Purple Coronary heart and honorary knighthoods from the UK and the Netherlands.

Richard Wadsworth – Director

Mr. Richard Wadsworth is a petroleum engineer with over 30 years’ expertise in operations and administration internationally. He was a co-founder, director, and President of Bankers Petroleum. Mr. Wadsworth not too long ago led and developed a 55,000 BOPD oilfield in Iraq with growth deliberate to 230,000 BOPD .

Jeffrey More durable, FCPA, FCA, FCBV, ICD.D – Director

Mr. Jeffrey More durable has greater than 40 years’ expertise within the pure assets sector. He held a number of management positions with Deloitte Canada, together with: Workplace Managing Associate, Canada enterprise chief, Americas enterprise chief, International govt committee member and Board of Administrators member.

Government Abstract:

6 Causes Why MCF Vitality Needs to be Added to your Watchlist:

1. Large Shift in European Vitality Demand: After many years of reliance on low cost Russian pure fuel, Europe is now aware of the necessity for home manufacturing in an effort to meet its power and safety wants. The corporate is strategically positioning itself to capitalize on the continued European power disaster by tapping into vital exploration websites in Austria and Germany with different potential alternatives forthcoming.

2. First-Mover Benefit: The corporate is the primary new public enterprise to consolidate large-scale fuel prospects in Europe for the reason that outbreak of warfare in Ukraine.

3. Confirmed Monitor File: Led by an completed management group with a powerful observe file within the European power and capital markets.

4. Excessive-Upside Strategic Property: The corporate has acquired large-scale, top-tier Austrian and German prospects with a transparent path to market and can be evaluating further potential acquisitions shifting ahead.

5. First-Fee Technical Staff: A extremely expert technical group with in depth expertise in geosciences, geology and operations to determine and develop doubtlessly profitable European pure fuel reserves.

6. Clear Imaginative and prescient: The imaginative and prescient is evident as the corporate is leveraging its in depth experience and capital to construct the dominant new clear oil and fuel firm in Europe whereas delivering worth for all stakeholders. Different corporations to look at because the world races for brand spanking new oil and fuel assets:

TotalEnergies (NYSE:TTE) has firmly positioned itself as a frontrunner within the transition to cleaner power, navigating the complexities of the worldwide power panorama with a multifaceted technique. Past its substantial investments in pure fuel and LNG infrastructure, TotalEnergies is aggressively pursuing renewable power tasks, together with photo voltaic and wind, to diversify its power portfolio. This strategic pivot is emblematic of the corporate’s dedication to turning into a net-zero emission entity by 2050, in alignment with the Paris Settlement.

TotalEnergies’ strategy to grease, its conventional stronghold, is equally forward-thinking. The corporate is pioneering carbon seize, utilization, and storage (CCUS) applied sciences and biofuels, aiming to scale back the carbon depth of its merchandise. Its analysis and growth efforts are geared in the direction of enhancing power effectivity and pioneering low-carbon options, reflecting a deep dedication to sustainability throughout all its operations.

TotalEnergies represents a balanced alternative, combining strong conventional power operations with bold forays into the renewable sector. Its proactive stance on local weather change and power variety indicators a long-term development trajectory aligned with the evolving power calls for of the worldwide market.

Eni (NYSE:E) distinguishes itself with a strategic focus that balances its wealthy heritage in oil and fuel with a transparent imaginative and prescient for the power future. Eni’s developments within the pure fuel sector, significantly its vital discoveries within the Mediterranean, underscore its position in securing Europe’s power provide whereas transitioning to cleaner power sources. The corporate’s dedication to sustainability is additional evidenced by its investments in renewable power tasks, together with photo voltaic, wind, and biomass, aiming to scale back its carbon footprint and foster a extra sustainable power ecosystem.

Innovation lies on the coronary heart of Eni’s operations, with a major emphasis on creating superior applied sciences to boost the environmental sustainability of its oil and fuel operations. Its initiatives in inexperienced refining and the event of proprietary applied sciences to transform fossil fuels into renewable power sources spotlight Eni’s proactive strategy to addressing the twin problem of assembly world power demand whereas lowering environmental influence.

Eni not solely values its conventional power roots however can be deeply invested within the transition to a extra sustainable power future. Eni’s strategic investments and dedication to innovation and sustainability place it properly to navigate the uncertainties of the worldwide power market whereas providing potential for development and stability.

Equinor (NYSE:EQNR), with its strategic pivot in the direction of renewable power, is rising as a key participant in Europe’s inexperienced transition. Norway’s power powerhouse is leveraging its in depth expertise in offshore operations to guide in offshore wind, a important element of Europe’s renewable power technique. Equinor’s funding in carbon seize and storage (CCS) and hydrogen tasks additional underscores its dedication to a low-carbon future, aligning its enterprise mannequin with world sustainability targets.

Equinor’s oil and fuel operations proceed to be optimized for effectivity and sustainability, with a deal with lowering emissions and enhancing security measures. The corporate’s management in electrifying offshore platforms, a transfer aimed toward reducing greenhouse fuel emissions from oil and fuel manufacturing, exemplifies its revolutionary strategy to conventional power sectors.

For traders, Equinor gives an attractive mixture of conventional power experience and management within the renewable power sector. Its strategic investments in inexperienced power and dedication to sustainability make it a gorgeous possibility for these trying to put money into the power transition, with Equinor positioned as a frontrunner in shaping the way forward for world power.

BP plc (NYSE:BP) stands as a beacon of innovation and flexibility within the world power sector, notably inside Europe’s evolving power panorama. In response to the continental shift in the direction of cleaner power sources, BP has considerably elevated its investments within the pure fuel area, together with the event of pipelines and liquefied pure fuel (LNG) terminals. This strategic pivot not solely aligns with the demand for cleaner-burning fuels but additionally underscores BP’s dedication to a sustainable power future.

Regardless of the burgeoning deal with pure fuel, oil stays a cornerstone of BP’s enterprise mannequin. The corporate has launched into a number of initiatives aimed toward guaranteeing that its oil exploration and manufacturing processes are sustainable, emphasizing the discount of environmental impacts and the optimization of manufacturing effectivity. These efforts spotlight BP’s recognition of the necessity to stability conventional power sources with the worldwide shift in the direction of sustainability.

BP presents a multifaceted alternative, characterised by a mix of conventional energy in oil and proactive growth into pure fuel and hydrogen. BP’s strategic initiatives in sustainable exploration, mixed with its adaptation to rising power developments, place it as a number one entity within the drive in the direction of a extra diversified and sustainable power portfolio.

Shell plc (NYSE:SHEL) is navigating the advanced dynamics of the worldwide power market with a diversified and forward-thinking technique. The corporate has considerably expanded its ventures in pure fuel and LNG terminals, reflecting a concerted effort to adapt to Europe’s altering power consumption patterns in the direction of cleaner power sources. Shell’s investments in conventional fuel pipelines and state-of-the-art LNG services are pivotal to its technique, underscoring its position in facilitating the continent’s power transition.

Shell’s strategy to the power sector is characterised by its dedication to variety and innovation. The corporate’s in depth oil operations present a basis of stability and robustness, whereas its strategic investments in pure fuel and rising applied sciences like hydrogen and carbon seize underscore its imaginative and prescient for the way forward for power.

Shell gives a complete strategy to the power sector, combining the reliability of conventional power operations with strategic development in cleaner power sources. Shell’s efforts to combine technological developments and uphold environmental requirements place it as a compelling alternative for these in search of to put money into the sustainable transformation of the worldwide power panorama.

MEG Vitality Corp. (TSX:MEG) exemplifies innovation throughout the Canadian oil sands sector, driving ahead with its sustainable in situ oil sands growth and manufacturing methods. By means of the deployment of its proprietary HI-Q® know-how, MEG Vitality is setting new requirements for operational effectivity and environmental stewardship in Alberta, Canada. This know-how is a game-changer, aimed toward lowering operational prices and enhancing useful resource restoration charges, underscoring MEG’s dedication to accountable growth by way of diminished greenhouse fuel emissions and water utilization.

With a strategic deal with maximizing the worth of its appreciable oil sands property, MEG Vitality has established a framework for monetary self-discipline and operational excellence. This strategy has positioned MEG to generate substantial free money circulation, showcasing the corporate’s strong manufacturing base and dedication to value discount and operational enhancements.

Wanting forward, MEG Vitality’s trajectory in the direction of operational excellence and monetary robustness is evident. The corporate’s unwavering deal with sustainable growth and technological efficiencies marks it as a gorgeous funding alternative for these excited about an organization that locations a excessive precedence on environmental and financial sustainability throughout the Canadian oil sands sector.

Whitecap Assets Inc. (TSX:WCP) operates as a growth-oriented firm, skillfully navigating the acquisition and growth of standard oil and pure fuel assets within the Western Canadian Sedimentary Basin. Whitecap’s strategic synthesis of disciplined acquisition and growth of low-decline property, coupled with a robust deal with operational efficiencies and value management, delineates its pathway to creating sustainable shareholder returns.

The corporate’s dedication to accountable power growth is mirrored in its initiatives to scale back its carbon footprint and improve total sustainability. Whitecap’s dedication to environmental stewardship, bolstered by its efforts to keep up sturdy governance practices and foster optimistic group relations, positions it as a frontrunner in sustainable power growth.

Canadian Pure Assets (TSX:CNQ) instructions a various and formidable portfolio, significantly highlighted by its ventures into the pure fuel sector throughout the Montney and Duvernay areas. This strategic engagement displays a broader ambition to harness Canada’s huge fuel potential successfully.

Oil, nonetheless, stays a pivotal factor of CNRL’s success narrative. With a diversified asset base spanning oil sands to heavy crude, CNRL demonstrates operational versatility and a dedication to sustainable practices and value efficiencies.

Traders taking a look at CNRL are introduced with a powerhouse within the power sector, the place the amalgamation of in depth pure fuel tasks and a stable basis in oil operations positions it as a dominant contender, prepared to satisfy the longer term power calls for with a sustainable and environment friendly strategy.

Birchcliff Vitality Ltd. (TSX:BIR) is an organization within the Canadian oil and pure fuel sector, with a major deal with high-quality property within the Montney/Doig Useful resource Play. This strategic emphasis permits Birchcliff to harness the potential of one in every of North America’s premier useful resource performs, contributing considerably to its manufacturing and reserve development. The corporate’s dedication to operational excellence and value effectivity has positioned it as a low-cost producer, optimizing returns even in fluctuating market situations.

Birchcliff Vitality is targeted on sustainable development, leveraging its sturdy asset base and operational efficiencies to navigate the evolving power panorama. With an eye fixed in the direction of enhancing shareholder worth, the corporate is well-positioned to capitalize on alternatives throughout the Montney/Doig Useful resource Play, making it a gorgeous proposition for these invested within the Canadian power sector.

By. Tom Kool

Ahead-Wanting Statements

This publication incorporates forward-looking data which is topic to a wide range of dangers and uncertainties and different elements that might trigger precise occasions or outcomes to vary from these projected within the forward-looking statements. Ahead wanting statements on this publication embody that enormous oil and fuel corporations will proceed to deal with offshore pure fuel assets; that home onshore pure fuel property in Europe will present a extra inexpensive power supply than offshore assets; that demand for pure fuel will proceed to extend in Europe and Germany; that Russia is not going to provide the vast majority of pure fuel in Germany and Europe; that pure fuel will proceed to be utilized as a foremost power supply in Germany and different European international locations and demand for pure fuel, and specifically home pure fuel, will proceed and enhance sooner or later; that MCF Vitality Ltd. (the “Firm”) can replicate the earlier success of its key traders and administration in creating and promoting helpful power property; that the pure fuel tasks of the Firm will probably be efficiently examined and developed; that the Firm can develop and provide a secure, home supply of power to European international locations; that pure fuel will probably be reclassified as sustainable power which can assist the event of the Firm’s property; that imports of liquified pure fuel is not going to be sustainable for Europe and that European international locations might want to depend on home sources of pure fuel; that the Firm expects to acquire vital consideration on account of its upcoming drilling plans mixed with Europe determined for home pure fuel provide; that the upcoming drilling on the Firm’s tasks will probably be profitable; that the Firm’s tasks will include business quantities of pure fuel; that the Firm can finance ongoing operations and growth; that the Firm can obtain its enterprise plans and targets as anticipated. These forward-looking statements are topic to a wide range of dangers and uncertainties and different elements that might trigger precise occasions or outcomes to vary materially from these projected within the forward-looking data. Dangers that might change or stop these statements from coming to fruition embody that enormous oil and fuel corporations will begin specializing in the event of home pure fuel assets; that the pure fuel assets of rivals will probably be extra profitable or get hold of a better share of market provide; that offshore liquified pure fuel property will probably be favored over home assets for numerous causes; that different applied sciences will substitute pure fuel as a mainstream power supply in Europe and elsewhere; that demand for pure fuel is not going to proceed to extend as anticipated for numerous causes, together with local weather change and rising applied sciences; that political modifications will lead to Russia or different international locations offering pure fuel provides in future; that the Firm could fail to duplicate the earlier success of its key traders and administration in creating and promoting helpful power property; that the pure fuel tasks of the Firm could fail to be efficiently examined and developed; that the Firm’s tasks could not include business quantities of pure fuel; that the Firm could also be unable to develop and provide a secure, home supply of power to European international locations; that pure fuel might not be reclassified as sustainable power or could also be changed by different power sources; that the upcoming drilling on the Firm’s tasks could also be unsuccessful or could also be much less optimistic than anticipated; that the Firm’s tasks could not include business quantities of pure fuel; that the Firm could also be unable to finance its ongoing operations and growth; that the Firm can obtain its enterprise plans and targets as anticipated; that the Firm could also be unable to finance its ongoing operations and growth; that the enterprise of the Firm could also be unsuccessful for numerous causes. The forward-looking data contained herein is given as of the date hereof and we assume no accountability to replace or revise such data to replicate new occasions or circumstances, besides as required by legislation.

DISCLAIMERS

This communication is for leisure functions solely. By no means make investments purely based mostly on our communication. We’ve got not been compensated by MCF Vitality Ltd. for this text however could sooner or later be compensated to conduct investor consciousness promoting and advertising for MCF Vitality Ltd. Whereas the opinions expressed on this article are based mostly on data believed to be correct and dependable, such data in our communications and on our web site has not been independently verified and isn’t assured to be appropriate. The content material of this text relies solely on our opinions that are based mostly on very restricted evaluation and we’re not skilled analysts or advisors.

SHARE OWNERSHIP AND NOTIFICATION OF BIAS. The proprietor of Oilprice.com owns shares of MCF Vitality Ltd. and due to this fact has an incentive to see the featured firm’s inventory carry out properly. The proprietor of Oilprice.com is not going to notify the market when it decides to purchase extra or promote shares of MCF Vitality Ltd. out there. The proprietor of Oilprice.com will probably be shopping for and promoting shares of this issuer for its personal revenue. Accordingly, our views and opinions on this article are topic to bias, and we stress that it is best to conduct your personal in depth due diligence relating to the Firm in addition to search the recommendation of your skilled monetary advisor or a registered broker-dealer earlier than you take into account investing in any securities of the Firm or in any other case.

NOT AN INVESTMENT ADVISOR. Oilprice.com isn’t registered or licensed by any governing physique in any jurisdiction to offer investing recommendation or present funding advice. You shouldn’t deal with any opinion expressed herein as an inducement to make a specific funding or to comply with a specific technique, however solely as an expression of opinion. The opinions expressed herein don’t consider the suitability of any funding together with your explicit targets or danger tolerance. Investments or methods talked about on this article and on our web site might not be appropriate for you and usually are not supposed as suggestions.

ALWAYS DO YOUR OWN RESEARCH and seek the advice of with a licensed funding skilled earlier than making any funding. This communication shouldn’t be used as a foundation for making any funding in any securities. Previous efficiency isn’t indicative of future outcomes.

RISK OF INVESTING. Investing is inherently dangerous. Don’t commerce with cash you can’t afford to lose. There’s a actual danger of loss (together with whole lack of funding) in following any technique or funding mentioned on this article or on our web site. That is neither a suggestion to buy, nor a solicitation of a suggestion to promote, subscribe for or purchase any securities or the solicitation of any vote in any jurisdiction. No illustration is being made as to the longer term worth of securities talked about herein, or that any inventory acquisition will or is more likely to obtain earnings.