(Bloomberg) — Buyers have pulled over a half of a billion {dollars} from the Grayscale Bitcoin Belief throughout its first days of buying and selling as an ETF.

Most Learn from Bloomberg

The fund, which gained US Securities and Change Fee approval to transform to an ETF from a belief final week, has seen outflows totaling about $579 million, in response to information compiled by Bloomberg. It’s a stark distinction from the opposite 9 spot Bitcoin ETFs, which have pulled in a complete of practically $1.4 billion.

“Because of the ETF conversion that is the primary time we’ve had clear sight into flows of GBTC,” mentioned James Seyffart, an ETF analyst at Bloomberg Intelligence, who famous that buyers could also be profit-taking.

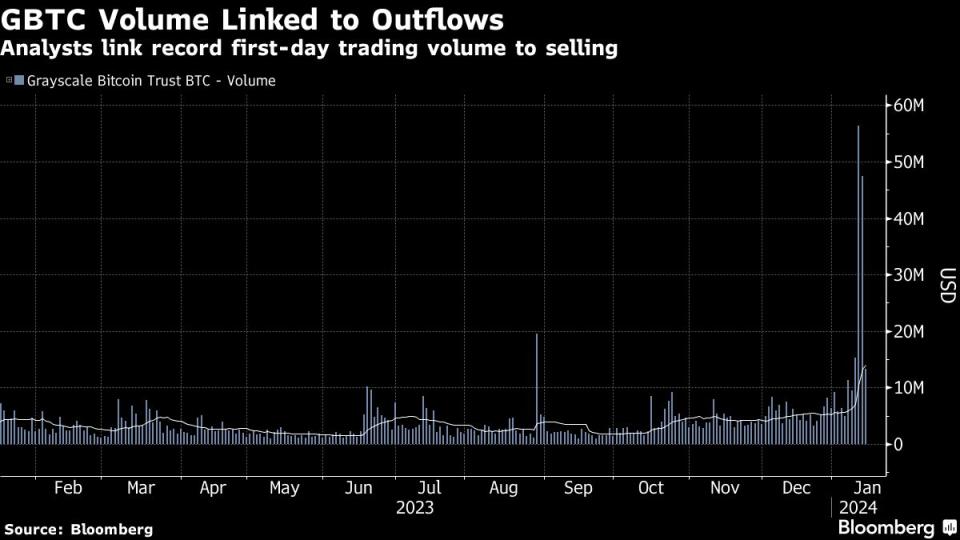

The move information is a extra full take a look at how the ETF fared within the wake of SEC approval. Whereas over $2.3 billion of GBTC shares modified arms its first day, the outflows now point out {that a} portion of that quantity was on account of promoting.

“Grayscale has dominated the marketplace for regulated Bitcoin investing for over a decade. Now that different issuers have come to market, we’re naturally seeing some rotation into these new merchandise,” mentioned Zach Pandl, Grayscale’s managing director of analysis. “Whole web inflows into Bitcoin funding merchandise are what issues for costs, not substitution from one product to a different.”

The outflows from Grayscale’s ETF aren’t fully surprising. Bloomberg Intelligence forecasted that the fund will drain over $1 billion over the approaching weeks.

“A lot of this capital will discover its approach again into different Bitcoin exposures,” Seyffart mentioned.

Some buyers are fleeing to cheaper spot Bitcoin ETFs. With an expense ratio of 1.5%, GBTC is the costliest US ETF that invests immediately in Bitcoin. The second-most costly fund, the VanEck Bitcoin Belief, prices 0.25%.

Different spot Bitcoin ETFs have all seen web inflows, with BlackRock’s IBIT pulling in practically $500 million in its first two days of buying and selling, and Constancy’s FBTC getting roughly $421 million. The inflows recommend that even outdoors of potential seed funding from fund issuers, demand is powerful for Bitcoin publicity in a bodily backed ETF.

(Updates with remark from Grayscale. Earlier model corrected complete quantity of inflows for 9 spot Bitcoin ETFs in second paragraph.)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.