As you could have discovered not too long ago, the “Magnificent Seven” is a gaggle of powerhouse shares together with Nvidia, Apple, and Microsoft, most of which have benefited considerably from the keenness surrounding their synthetic intelligence (AI) efforts. However which might be the equal companies if the identical idea had been utilized to the healthcare sector quite than the know-how sector?

Because it seems, there are solely 4 shares which have the fitting mixture of ongoing progress and market-outperforming returns. All 4 of those magnificent healthcare corporations have strong enterprise fashions, upwardly trending share costs, and, sadly, considerably frothy valuations.

However in addition they have very lengthy progress runways and a historical past of excellent execution, so there is a strong probability that their worth tags shall be justified by continued sturdy efficiency. Let’s meet the gamers.

Eli Lilly and Novo Nordisk

Eli Lilly (NYSE: LLY) and Novo Nordisk (NYSE: NVO) are two huge pharma stocks that do not want a lot introduction because of the more and more absurd reputation of their smash-hit medicines for weight problems and kind 2 diabetes.

Eli Lilly makes the drug Mounjaro for diabetes in addition to Zepbound, which is similar remedy however formulated for weight reduction. It is the most important healthcare firm by market capitalization with a dimension of $729 billion.

Novo Nordisk is the second-largest healthcare competitor by market cap, clocking in at $549 billion. It is liable for the kind 2 diabetes medication Ozempic, in addition to the obesity-oriented model of the identical drug, Wegovy.

Each corporations plan to proceed the method of penetrating those self same metabolic-disease markets, along with others, over the remainder of the last decade and past. Their pipelines are full of mid-stage and late-stage applications that might turn into the proper instruments in a smattering of various medical niches, or which may broaden the indications and addressable market of their already-approved medicines.

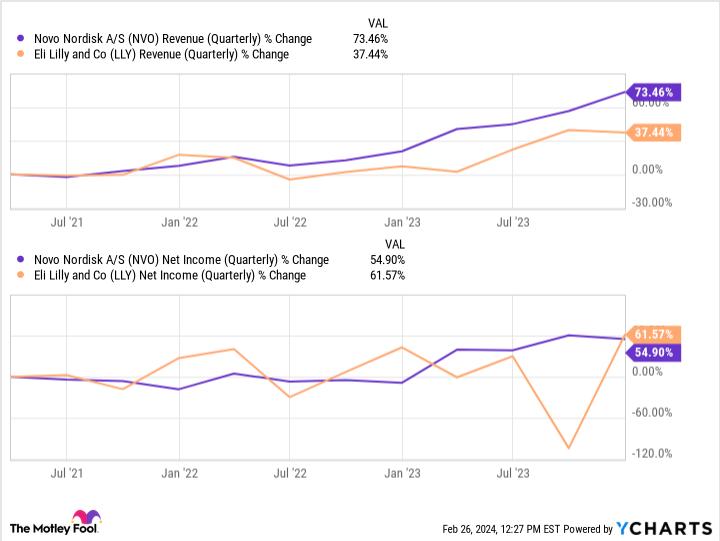

And neither firm anticipates a lot of an issue with competitors over market share, on condition that the markets they’re serious about are tremendously deep and anticipated to continue to grow. Not satisfied that their trajectories are in step with magnificence? Take into account this chart beneath. As you possibly can see, they’re ramping up sharply, and so they’re price shopping for for those who do not thoughts their valuations.

Vertex Prescribed drugs

Vertex Prescribed drugs (NASDAQ: VRTX) is a drug developer specializing in uncommon illnesses like cystic fibrosis (CF). Just lately, it commercialized a brand new gene remedy known as Casgevy for each sickle cell illness (SCD) and beta thalassemia with the assistance of CRISPR Therapeutics. Its market cap is $111 billion. And in fittingly magnificent style, its shares are up by a formidable 45% within the final 12 months.

One of many key issues that drives Vertex’s inventory to higher and higher heights is that its cystic fibrosis medicines, of which it is at all times producing and testing extra, are deeply entrenched available in the market. Actually, of the 92,000 recognized sufferers with CF within the Western world, Vertex is at the moment treating all however 20,000 of those that are eligible.

On prime of that, there isn’t any direct competitor for its gargantuan market share. And sufferers have to take its medicines for all times to manage their signs.

With a secure base of income from gross sales of its CF medication, the corporate has leeway to spend money on analysis and growth (R&D) focused at bigger and extra aggressive markets, like for acute ache therapies. Which means it may afford to take a variety of formidable pictures on purpose with out overextending. And that is an enormous a part of the explanation its trailing-12-month web revenue rose by 68% during the last 5 years, reaching $3.6 billion. As extra of its applications get authorised on the market, that determine will solely enhance, as will its share worth.

Intuitive Surgical

Final however not least is the robotic surgical procedure firm Intuitive Surgical (NASDAQ: ISRG), which boasts a market cap of $136.9 billion and a prime line of $7.1 billion in 2023.

In its line of enterprise, prospects in hospitals first buy its da Vinci model robotic surgical items. Then they pay Intuitive for upkeep contracts, spare elements, new surgical toolheads, and coaching applications for surgeons, producing an extended tail of recurring income through the years.

The extra procedures prospects carry out with their da Vinci items, the extra recurring income it rakes in, and the extra the machine turns into established as a workhorse in bariatric, urologic, and basic surgical procedure working rooms.

And the competitors is, for now, nowhere to be seen. So it is no shock that Intuitive’s revenue margin, at 25%, is as vast as it’s. Contemplating that the demand for surgical procedure shouldn’t be going to say no anytime quickly, the shocking half is that the corporate is not already included within the current set of Magnificent Seven shares.

Do you have to make investments $1,000 in Eli Lilly proper now?

Before you purchase inventory in Eli Lilly, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Eli Lilly wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Alex Carchidi has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Apple, CRISPR Therapeutics, Intuitive Surgical, Microsoft, Nvidia, and Vertex Prescribed drugs. The Motley Idiot recommends Novo Nordisk and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

These 4 Stocks Are the “Magnificent Seven” of Healthcare was initially printed by The Motley Idiot