On the earth of Indian startups, securing funding has grow to be a formidable problem in 2023, marked by a notable downturn in enterprise capital investments in comparison with the earlier 12 months. From January to June 2023, the collective enterprise capital injection barely crossed the $4 billion threshold, signifying a dramatic plunge from the substantial $18.4 billion amassed throughout the identical timeframe in 2022. This growth coincides with a interval during which the vast majority of startups discover themselves in a state of monetary hibernation, colloquially known as a “funding winter.” This phenomenon is pushed by international traders who’re adopting a cautious method because of pervasive worldwide uncertainties and heightened issues concerning a possible financial downturn in Western nations.

The variety of unicorns – that is a private company with a valuation of $1 billion or more – created shrank from 44 to 23 over 2021-22, however for the second 12 months in a row, India added extra unicorns than China. India emerged because the fourth-most popular destination for startups on the earth in 2022, attracting 4.2 p.c of world enterprise capital, behind america, China, and United Kingdom.

Japan, an rising financial and political ally of India and presently the fifth-largest contributor of international direct funding (FDI), presents potential options. Almost 10 percent of its gross domestic product (GDP) is derived from earnings generated abroad. Japanese enterprise capital companies are exhibiting rising curiosity in India as they search promising funding prospects in a world the place the startup panorama is dealing with challenges. Vital Japanese firms like Suzuki, Toshiba, Toyota, and Denso have already initiated partnerships with Indian startups. Notably, SoftBank has emerged as a outstanding and substantial investor in Indian startups spanning numerous industries with firms like Flipkart, Paytm, Delhivery, Policybazaar, Swiggy, and OYO, amongst others a part of its extensive portfolio. However, the prevailing financial uncertainties have led SoftBank to considerably curtail its funding initiatives inside the Indian startup panorama.

Japan has risen because the second most favored vacation spot for Indian entrepreneurs searching for international capital. Nonetheless, it’s noteworthy {that a} vital 79 percent of Indian startups have by no means engaged in any type of collaboration with organizations of Japanese origin. In a 2022 survey performed by the Japan Financial institution for Worldwide Cooperation (JBIC) concerning Abroad Enterprise Operations by Japanese Manufacturing Firms, India emerged as the top choice of promising medium- to long-term enterprise vacation spot international locations. This implies two issues. One, there’s curiosity in collaboration from either side. Two, whereas India’s development figures are certainly engaging to Japanese traders contemplating long-term methods, there’s a problem in changing this curiosity into short-term funding plans.

In New Delhi, there’s an rising settlement concerning the importance of Tokyo, and over the previous decade, quite a few measures have been carried out to boost Japanese investments in India. In 2014, a Japan Plus desk was established at Make investments India – India’s Funding Procurement Company (IPA). In 2018, an MoU was signed between Make investments India and the Japan Exterior Commerce Group (JETRO), together with institution of the Japan-India Startup Hub. The identical 12 months additionally noticed the “Tech4Future” Grand Challenge organized by Make investments India and SoftBank Group to establish and assist progressive startup enterprises within the fields of AI, machine studying, face recognition, and cybersecurity for funding and potential incubation alternatives.

Lately, the Nationwide Funding and Infrastructure Fund (NIIF) entered right into a collaboration with the JBIC to launch a $600 million India-Japan Fund (IJF). It can deal with investing in environmental sustainability and low carbon emission methods and goals to play the position of being a “associate of selection” to additional improve Japanese investments into India. Whereas Indian Ambassador to Japan Sibi George attends enterprise seminars throughout the nation, the Indian embassy in Tokyo additionally holds pitching events every month for each Japanese and Indian startups.

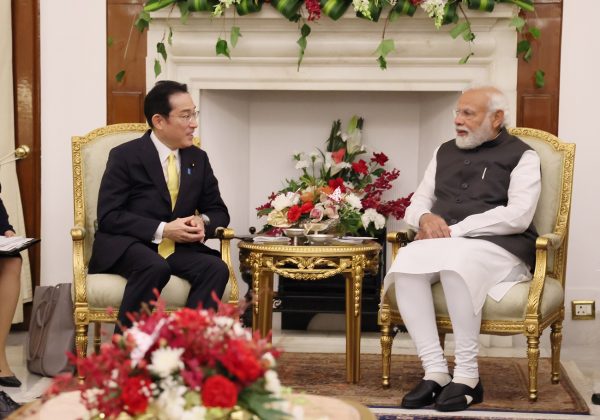

In precept, every little thing seems to align completely to facilitate Japanese investments, with curiosity, establishments, and authorities willingness in place. The one lacking piece of the puzzle is people-to-people contact. Regardless of India and Japan’s strategic partnership, cultural similarities, and virtually half a decade of Modi-Abe bromance, people-to-people contact between the 2 international locations has been underwhelming.

JET – the Japan Training and Coaching Program, based by the Japanese authorities in 1987 – supplies a possibility for younger school graduates to help with worldwide alternate and international language schooling all through Japan. This system has over time grow to be a key basis for the Japan-U.S. alliance. India joined the JET Program in 1998, however, till just lately solely 43 recorded JETs had been in this system. In 2023, just one particular person was recruited. Sadly, applications like JET have historically targeted on native-English talking international locations – thereby placing India, regardless of its big English-speaking inhabitants, at a drawback. Regardless of top-ranking universities, as of 2020, merely 1,675 Indian national students had been enrolled in larger schooling establishments in Japan.

Enhancing interpersonal connections depends on the joint assist of each governments; one facet alone can’t increase this engagement. The governments of India and Japan must take proactive measures to advertise higher interplay. Collaborative efforts ought to deal with bolstering academic initiatives, notably by increasing scholar alternate applications, with a particular emphasis on language coaching. Platforms just like the Ministry of Training, Tradition, Sports activities, Science, and Know-how (MEXT)-sponsored Japan-India Change Platform Program (JIEPP) have to be strengthened by each the governments. Moreover, tourism needs to be actively inspired, and efforts to combine the Indian diaspora into Japanese society needs to be heightened. Elevated exchanges of enterprise leaders will lead to higher understanding of on-ground realities and a fast-changing enterprise surroundings in India.

Understanding Japanese tradition and enterprise etiquettes is an important prerequisite for conducting profitable enterprise with the Japanese. Over the long run, this lays a stable basis of belief between the residents of each nations, with potential ripple results extending to different sectors similar to commerce and the financial system. Whereas people-to-people contact is a constructive leverage with long run dividends, the enduring advantages make it a worthwhile endeavor, notably because the pursuits of India and Japan more and more align within the Indo-Pacific area. This mutually helpful partnership not solely contributes to the expansion of India’s startup ecosystem, positioning it to compete with international counterparts like the UK, China and finally america, but additionally reinforces the present Particular Strategic and International Partnership between India and Japan.