To hike or to not hike?

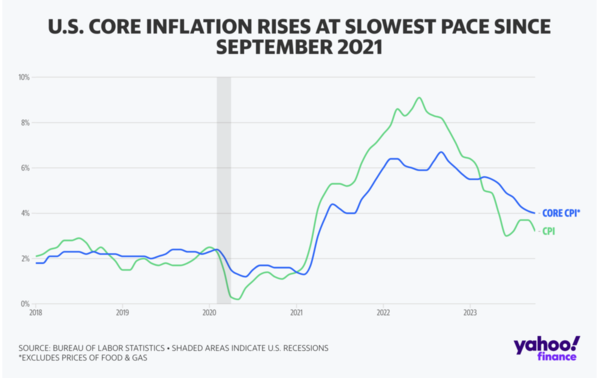

A cooler-than-expected inflation print has each traders and Wall Avenue economists assured the Federal Reserve is completed elevating charges — no less than via the top of yr.

Instantly following the discharge of the information, markets had been pricing in an almost 100% probability the Federal Reserve retains charges unchanged in December, based on knowledge from the CME Group.

“October CPI was delicate on the companies facet, and a November print like this may not meet the bar we beforehand set for a further hike in December,” wrote Ellen Zentner, chief economist at Morgan Stanley. “We predict delicate inflation and nonetheless tight monetary circumstances will hold the Ate up maintain.”

Nonetheless, that does not imply the central financial institution can declare a win over inflation simply but.

Outdoors of shelter, which elevated simply 0.3% month-over-month in October, Oxford Economics lead US economist Michael Pearce warned, “There are indicators that companies inflation will show sticky, reflecting tight labor market circumstances, with the prospect of a return to the two% goal nonetheless a way off.”

“General the October CPI report offers Fed officers extra confidence that inflation is on a agency downward trajectory, which ought to keep their hand on any extra fee hikes,” Pearce continued.

“Nonetheless, the disinflation course of nonetheless has some solution to go, and the trail to weaker companies inflation relies on a continued cooling in labor market circumstances, so it’s going to nonetheless be a very long time earlier than the Fed is in a position to consider reducing rates of interest.”