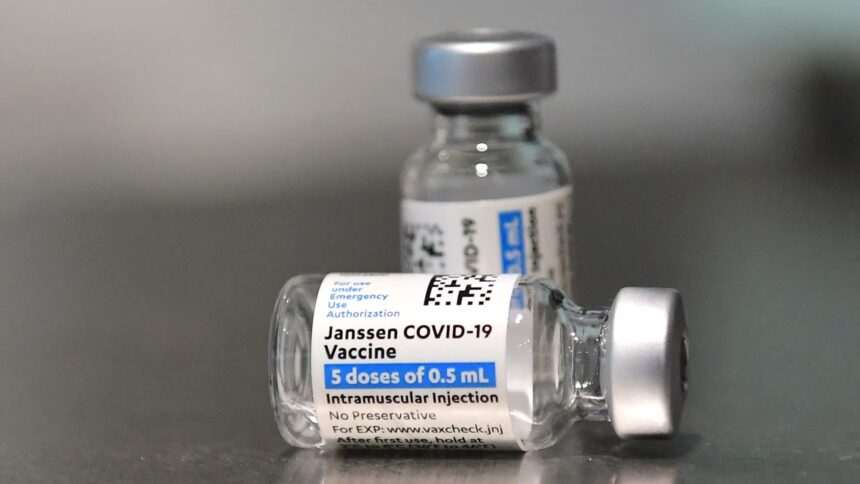

Johnson & Johnson Covid-19 vaccines lie on a desk in Los Angeles, Could 7, 2021.

Frederic J. Brown | AFP | Getty Pictures

Take a look at the businesses making headlines throughout noon buying and selling.

Netflix — Netflix fell greater than 8% after reporting combined quarterly outcomes Wednesday. The streaming big beat earnings per share for the second quarter, however income of $8.19 billion fell in need of the $8.30 billion anticipated by analysts polled by Refinitiv.

Tesla — Tesla shares plunged greater than 9%. The electrical-vehicle maker beat Wall Road’s expectations, however confirmed a decline in working margins attributable to current worth cuts and incentives.

US airways – The airline misplaced greater than 6% even after posting sturdy quarterly outcomes and elevating its 2023 earnings outlook. American Airways reported adjusted earnings of $1.92 per share on $14.06 billion in income. Analysts had anticipated earnings per share of $1.59 on income of $13.74 billion.

IBM — The know-how inventory rose greater than 2% after the corporate reported second-quarter earnings that exceeded analyst estimates as the corporate expanded its gross margin. IBM did, nonetheless, report a turnover loss, partly brought on by a malaise within the infrastructure division.

Johnson & Johnson — The inventory rose 6%, pushing the Dow Jones Industrial Common up 30 shares after Johnson & Johnson posted second-quarter income and adjusted earnings that beat Wall Road expectations. Johnson & Johnson additionally lifted its full-year expectations as gross sales of the corporate’s medtech enterprise surged.

Abbott Laboratories — Shares of the healthcare merchandise firm rose 4.2% after Abbott beat high and backside line estimates for the second quarter. The corporate reported $1.08 in adjusted earnings per share on $9.98 billion in income. Analysts have been on the lookout for $1.05 per share on $9.70 billion in income, in accordance with Refinitiv. The corporate’s gross sales fell greater than 11% 12 months over 12 months as clients purchased fewer Covid-19 assessments.

Uncover monetary providers — Shares fell 15.9% after the corporate’s second-quarter outcomes missed analyst estimates on each income and earnings. The corporate additionally introduced that it’s below investigation by the Federal Deposit Insurance coverage Company over a “misclassification concern of card merchandise.”

Zion Ban Company — Shares of the regional financial institution rose practically 10% after second-quarter earnings matched estimates. Zions posted earnings per share of $1.11, according to Refinitiv’s forecast. The financial institution’s internet curiosity revenue fell in need of expectations.

Vacationers — The insurance coverage firm gained 1.8% after asserting second-quarter earnings. Adjusted earnings got here in at 6 cents per share. In the meantime, income of $10.32 billion beat expectations of $10.02 billion.

Estee Lauder — Shares of the cosmetics giants fell 4.5% after Barclays downgraded them from chubby to equal weight. The corporate expressed considerations a couple of weak restoration in China and strain on margins within the medium time period.

Freeport-McMoRan — Shares rose 3% after the corporate launched its quarterly outcomes Thursday morning. The mining firm posted earnings of 35 cents per share on revenues of $5.74 billion. Analysts polled by StreetAccount had estimated earnings per share of 36 cents on income of $5.61 billion.

Authentic components — The auto alternative components enterprise misplaced 7.6% after publishing its second-quarter outcomes. Whereas the corporate’s income and earnings beat analyst expectations, earnings within the auto and industrial segments fell in need of Wall Road estimates.

MarketAxess — The digital buying and selling platform elevated by 2.2% after the publication of the second quarter outcomes. Whereas income and earnings per share got here in increased than anticipated, adjusted earnings got here in decrease than analysts anticipated.

Equifax — Shares plummeted practically 9% following the announcement of the corporate’s quarterly earnings report Wednesday after the bell. Whereas earnings per share got here in above analyst expectations, income fell in need of expectations.

— Yun Li, Jesse Pound, Samantha Subin and Michelle Fox of CNBC contributed to the reporting.