-

A protracted-time market veteran anticipates a bear market and recession to hit the US.

-

Jon Wolfenbarger pointed to falling earnings and the inverted yield curve, amongst different elements.

-

He mentioned the prolonged period of the yield-curve inversion suggests an extended recession.

Longtime market watcher and strategist Jon Wolfenbarger expects shares to crater and the US economic system to tip into a protracted recession.

In a word printed Monday, the 32-year investing veteran pointed to a number of financial indicators which are flashing warnings of a downturn, in addition to a deterioration in earnings, overvalued shares, and “irrational exuberance” just like that of the early-2000s Tech Bubble.

The Convention Board’s Main Financial Index, for one, has continued to say no at an annualized tempo solely seen throughout recessions, he mentioned.

On prime of that, the inverted yield curve — one of the crucial well-known predictors of a downturn that has been correct over the prior eight recessions — has remained inverted for the longest stretch in over 5 a long time.

“The depth of the most recent yield curve inversion has solely been matched or exceeded by these previous the Nice Melancholy and the key recessions of the mid-Seventies and early Eighties,” mentioned Wolfenbarger, who’s the founding father of the location Bull and Bear Profits and a former banker at JPMorgan. “That isn’t a comforting signal, to say the least.”

The ten-year and three-month Treasury yields stay inverted at present by about 1.29%, the strategist added, and historical past suggests the intense size of time it has been flipped will result in an extended recession than many have forecasted.

The Convention Board, for its half, predicts a coming recession to final two quarters, however Wolfenbarger disagrees.

“We count on it to possible final a minimum of a yr, primarily based on the size of the yield curve inversion,” he maintained.

The bear case for shares

It isn’t simply the financial outlook that seems bleak to Wolfenbarger. He is bracing for a recent bear market to start on account of a deteriorating earnings panorama and overextended valuations.

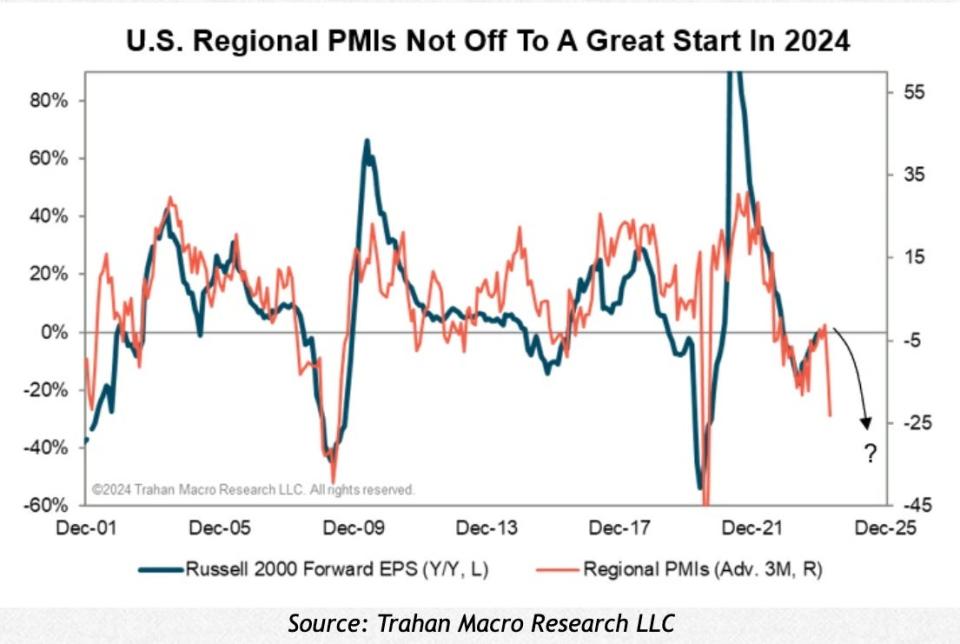

“According to these bearish main indicators, the 4 regional Buying Supervisor Indexes (“PMIs”) reported for January thus far have been very weak,” he wrote in a word, including that almost all banks have missed expectations on their most up-to-date earnings reviews.

The regional PMIs usually lead ahead earnings per share for the Russell 2000, as proven within the chart beneath.

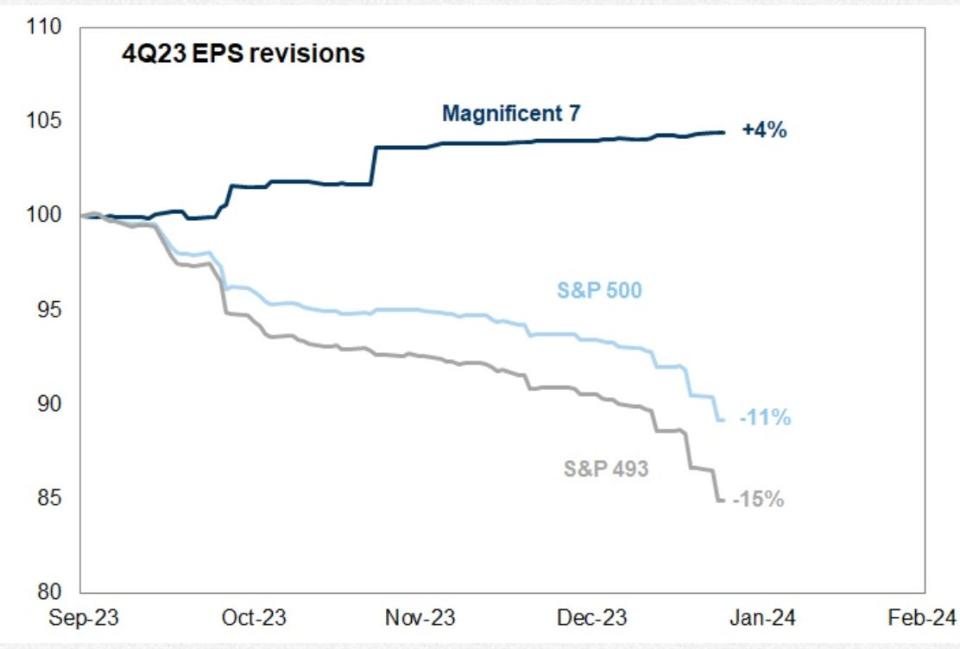

Plus, although the “Magnificent Seven” — Apple, Amazon, Tesla, Microsoft, Nvidia, Alphabet, and Meta — have seen their fourth-quarter earnings per share revised up by 4%, the broader S&P 500 has seen a downward revision of 11%.

“A market this slim just isn’t a bullish market, no matter what the headline worth indexes are doing,” Wolfenbarger mentioned.

In any case, the Large Tech stalwarts seem far overvalued and overbought at this level, in his view, and their affect has pushed an “irrational exuberance” just like that of the early 2000s, when the Nasdaq crashed about 80%.

Strategists at Amundi, a European asset-manager large that oversees roughly $2 trillion, shared an identical outlook in a panel final week, saying that the Magnificent Seven are set to underperform within the yr forward.

“[T]he market is extremely weak to falling to new bear market lows,” Wolfenbarger maintained. “Most buyers don’t see this coming, as they’re being mislead by the persistent energy of a handful of megacap Tech shares. They’ve already forgotten how a lot these shares fell in 2022. We consider they are going to be reminded quickly how a lot overvalued Tech shares can fall in a recession.”

Learn the unique article on Business Insider