org

-

Mega-cap tech shares dominated the inventory market in 2023, however that would change in 2024.

-

Morgan Stanley advised buyers to anticipate sharp outperformance from small-cap shares subsequent 12 months.

-

“There may very well be a way more sustainable relative commerce away from high quality and towards small caps.”

Mega-cap tech giants have dominated the inventory market all through 2023, however the torch may very well be handed to small-cap shares in 2024, in accordance with a current notice from Morgan Stanley.

A group of analysts led by Mike Wilson mentioned that whereas small caps are likely to underperform each earlier than and after the Federal Reserve cuts rates of interest, this time may very well be totally different.

“If the sooner than anticipated dovish shift within the context of a nonetheless wholesome financial backdrop can drive a cyclical rebound in nominal development subsequent 12 months, small caps seemingly look compelling over an extended funding horizon,” Wilson mentioned. “In our view, the chance of this final result has gone up just lately given final week’s FOMC assembly.”

The Fed is now expected to ease monetary policy several times in 2024. Traditionally, that has been a unfavorable for small-cap shares as a result of price cuts are typically accompanied by an economic downturn, and smaller firms are most delicate to macro-level ups and downs.

However with the economy in solid shape, inflation moderating, and the roles market nonetheless robust, the Fed may very well be reducing charges not due to a slowdown, however as a result of central bankers completed their aim of taming inflation.

That might be nice information, particularly for small-cap shares, as decrease rates of interest ought to translate right into a decrease value of capital, and smaller corporations sometimes pay greater borrowing prices relative to bigger firms.

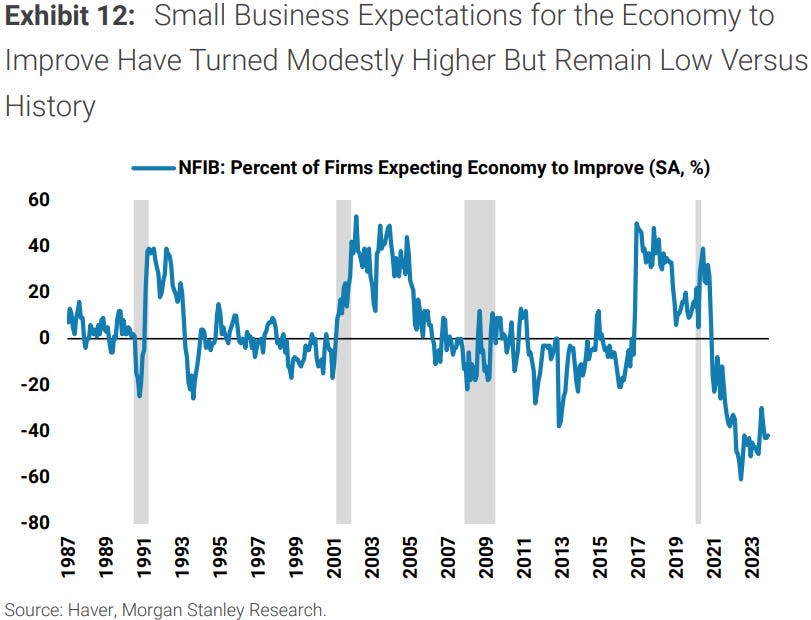

To gauge whether or not small caps are going to outperform their larger-cap friends in 2024, Wilson really helpful buyers monitor earnings revisions and small-business confidence.

“For now, relative earnings revisions stay unfavorable for small caps and relative margin estimates have only recently taken one other flip decrease,” he defined. “And small enterprise confidence stays low in a historic context and has but to show convincingly greater.”

However these two indicators would possibly lastly flip greater following the Fed’s dovish pivot, which might bode effectively for small-cap shares.

If that occurs, “there may very well be a way more sustainable relative commerce away from high quality and towards small caps,” Wilson mentioned.

In the meantime, Goldman Sachs is taking the opposite side of that trade, saying in a notice final month that it expects the mega-cap tech shares to proceed their streak of outperformance all through 2024.

Learn the unique article on Business Insider