“What lies forward for the inventory market?”

That’s the burning query on the minds of each market and financial skilled on the market, and it’s undoubtedly a difficult one.

Inflation has moderated to an inexpensive 3% yearly, and the job market is displaying indicators of energy. Shares are surging, indicating that traders have factored within the threat of a possible recession. Nonetheless, this results in an issue highlighted by B. Riley’s chief funding strategist, Paul Dietrich. He factors out that the most recent earnings figures are lagging far behind the surging optimistic sentiment. This discrepancy between market optimism and lukewarm earnings may spell bother for traders.

“It doesn’t take a inventory market historian to know that one thing horrible will occur when the inventory market surges and the S&P 500 firms’ earnings decline -6.8% in Q2 2023,” Dietrich opined. “In line with FactSet, the quarter will mark probably the most vital earnings decline reported by the index since Q2 2020 when the Covid pandemic closed down the nation. This was the third consecutive straight quarter of year-over-year earnings declines. That’s formally an ‘earnings recession.’”

As Dietrich sees it, the decline is actual and its solely a matter of time earlier than it impacts sentiment and investing exercise.

A cautious method would naturally pull traders towards dividend stocks, the basic defensive play. Dividends supply a gentle, passive earnings stream, offering traders with a level of safety – and usable money – for an unsure market setting.

Following this cue, B. Riley’s 5-star analyst, Bryce Rowe, goes bullish on two dividend shares particularly. These dividend payers supply excessive yields of 9% or extra and current compelling funding theses. Let’s take a better look.

Blue Owl Capital Company (OBDC)

First up is Blue Owl Capital, a enterprise improvement company working underneath the umbrella of the bigger Blue Owl Capital asset supervisor. Fashioned within the first half of 2021 by a SPAC merger between Owl Rock and Dyal Capital with Altimar Acquisition, the brand new agency has been shifting its branding to the Blue Owl identify earlier this month.

Below the Blue Owl branding, the enterprise improvement company will get a brand new ticker and a spot within the bigger Blue Owl group, whereas retaining its present BDC portfolio and historic monetary information. Like its BDC friends, Blue Owl Capital Company invests in small- and mid-sized enterprise enterprises, offering entry to capital for corporations which have issue coming into the standard banking system. The corporate’s portfolio comprises 187 firms and boasts a good worth of $13.2 billion. The portfolio is made up of 85% senior secured investments, and 98% is in floating charge debt investments.

The corporate will launch its 2Q23 monetary outcomes on August 9, however we are able to look again at Q1 to see the place Blue Owl stands now. The highest line, of $377.6 million, was up nearly 43% year-over-year and beat the forecast by $12.7 million. On the backside line, the corporate’s non-GAAP EPS determine was 45 cents per share, displaying a forty five% progress in comparison with the earlier 12 months and beating the estimates by 2 cents per share.

Monetary outcomes aren’t the one knowledge level that Blue Owl inherited from the outdated Owl Rock identify; the corporate additionally retains its dividend historical past. The final dividend cost, declared on Might 10 for a July 14 payout, was set at 33 cents for the common quarterly frequent share cost, together with a 6 cent irregular cost. The corporate’s common dividend annualizes to $1.32 per frequent share and yields 9.34%; it has added an irregular dividend cost in every of the final three quarters.

Turning to the B. Riley view, as articulated by high analyst Bryce Rowe, we discover that he’s impressed by Blue Owl’s mixture of low share worth, stable dividend, and robust enterprise. In Rowe’s phrases, “We see the chance/reward profile as favoring reward given our view of restricted draw back potential with a reduced valuation, the supportive earnings setting, wholesome dividend protection, and the scale and scale of Blue Owl’s direct lending platform that we imagine ought to enable the corporate to benefit from the continued shift from extra conventional financing sources to personal debt. Primarily based on $1.59/share of projected common and supplemental dividends (3Q23– 2Q24), Blue Owl Capital trades with an ~11% dividend yield and at 92% of NAV.”

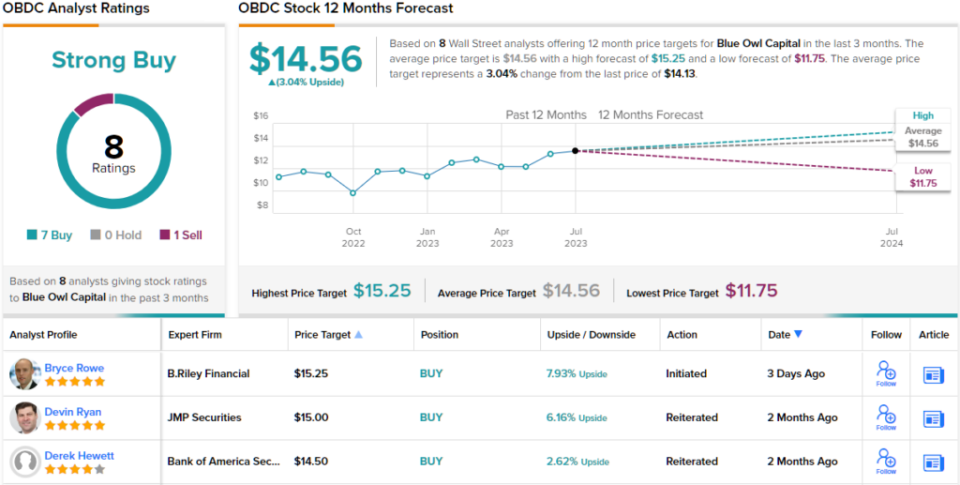

Rowe goes on to present Blue Owl inventory a Purchase ranking, whereas his $15.25 worth goal suggests an 8% upside for the 12 months forward. Primarily based on the present dividend yield and the anticipated worth appreciation, the inventory has ~17% potential complete return profile. (To look at Rowe’s observe file, click here)

Total, Blue Owl Capital Company has picked up 8 latest Wall Road analyst opinions, together with 7 to Purchase and 1 to Promote, for a Robust Purchase consensus ranking. (See OBDC stock forecast)

FS/KKR Capital Company (FSK)

Subsequent up is FS/KKR, one other enterprise improvement company working with personal center market corporations within the US small enterprise sector. FS/KKR focuses primarily on senior secured debt and has a lesser curiosity in subordinated debt, with a long-term objective of offering the very best risk-adjusted returns for its traders.

FS/KKR has put an awesome majority of its portfolio into senior secured debt, accounting for 69% of the whole. Of the debt investments, 89% are floating charge. FS/KKR has investments in 189 firms, with a median firm earnings of $114 million as of the tip of Q1. By truthful worth, this BDC’s portfolio is price $15.3 billion.

Once we flip to the corporate’s monetary outcomes, it’s clear that FS/KKR can generate a revenue even whereas revenues seem shaky. Over the previous few years, the highest line has been risky whereas earnings have proven a modest enhance. The final reported quarter was 1Q23, and the agency’s high line, complete funding earnings, got here in at $456 million, a determine that was up 15% year-over-year and $11.56 million forward of forecasts. The underside line EPS, in non-GAAP phrases, was 81 cents per share, which was 6 cents per share higher than had been estimated.

Even higher for dividend traders, this firm’s backside line supplies full protection for the common dividend. Within the Q1 report, FS/KKR declared a complete dividend cost of 70 cents per frequent share. This included a 64 cent base cost and a 6 cent supplemental distribution, and it was paid out earlier this month. Taken collectively, the 70 dividend annualizes to $2.80 and offers a powerful yield of 13.85%. Together with this excessive dividend cost, FS/KKR additionally declared a 15 cent particular distribution, with the cost scheduled in three tranches of 5 cents every: one in Might, one on the finish of August, and one on the finish of November.

Checking in with Bryce Rowe, we discover the B. Riley analyst taking an upbeat view of this inventory, and giving specific notice to the earnings help for the excessive dividend, and the corporate’s seemingly means to keep up that cost going ahead. Rowe writes of FS/KKR, “We see the chance/reward profile as favoring reward given the deep P/NAV low cost that ought to seemingly restrict draw back, the supportive earnings backdrop, a dividend yield of [approximately] 14% primarily based on projected dividends 3Q23-2Q24, a horny capital construction, adequate liquidity, and FSK’s positioning to learn from debtors shifting from extra conventional sources for financing options to personal debt suppliers.”

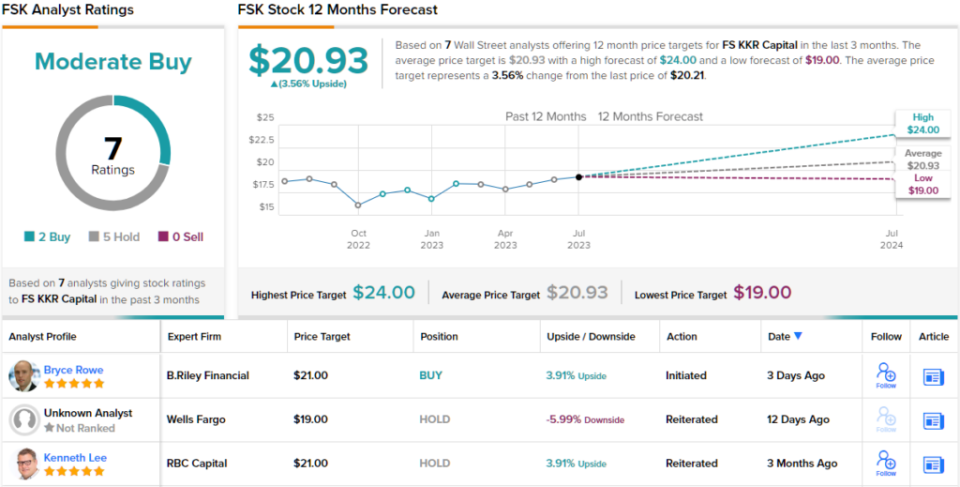

Taking his stance ahead, Rowe charges FSK inventory a Purchase, with a $21 worth goal pointing towards a roughly 4% upside on the one-year horizon. The true attraction for traders right here is the sturdy dividend yield.

Total, FSK will get a Reasonable Purchase ranking from the consensus of Wall Road analysts, primarily based on 7 latest opinions that break all the way down to 2 Buys and 5 Holds. (See FSK stock forecast)

To search out good concepts for dividend shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely necessary to do your personal evaluation earlier than making any funding.