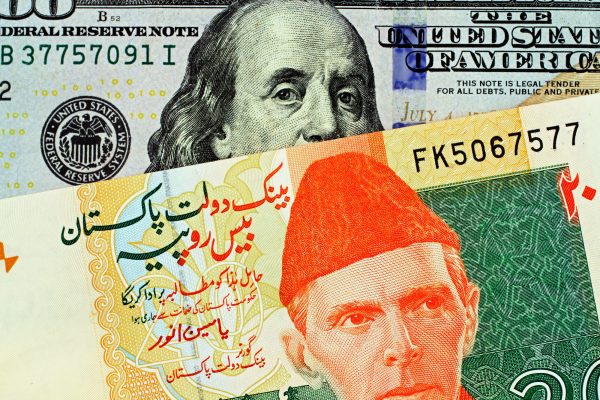

Pakistan is caught in a basic sovereign debt entice: an excessive amount of overseas foreign money denominated exterior debt, too few overseas change sources and too little overseas foreign money money circulation to fulfill contractual periodic curiosity and principal funds on such money owed. The present strategy to easing the excruciating ache of the debt entice is to hunt reduction by two routes: (1) tackle extra new exterior debt to fund present debt service necessities, and (2) restructure present exterior debt to service debt. by a mixture of capitalization of accrued curiosity funds, resetting required principal funds, and lengthening the time period of debt.

Fairly bluntly, the present path is a detour to a useless finish – what lies on the finish of the rainbow is a extra bearable type of the debt straitjacket, not a means out of the debt entice. It is time to assume outdoors the field, taking into consideration Shakespeare’s prudent recommendation in “Hamlet”: “Neither a lender nor a borrower.” The important thing to escaping Pakistan’s sovereign debt entice is in plain sight: deleveraging.

Merely put, deleveraging is debt-free financing by two channels: grants and fairness. Multilateral collectors such because the Worldwide Financial Fund (IMF), World Financial institution and Asian Improvement Financial institution would convert present loans to Pakistan into grants, whereas non-public holders (e.g. portfolio funding funds, sovereign wealth funds and company traders) of present Pakistani sovereign overseas foreign money denominated debt would change this debt for shares of state-owned firms that shall be privatized. Any new funding can be within the type of grants and/or fairness.

The deleveraging shifts the main target from Pakistan’s means to pay to Pakistan’s development potential and goals to make sure monetary resilience. Deleveraging displays the evaluation that within the brief and medium time period (as much as 10 years) there’s more likely to be financial and monetary stress, and maybe misery, however in the long run (10-20 years) financial and monetary restoration and development shall be. yr). What Pakistan wants is affected person capital – within the type of grants and fairness – keen to share draw back dangers in return for the potential upside advantages of financial development and improvement.

Deleveraging: a vote of confidence

Pakistan is clearly on its means edge of default and monetary chapter, resulting from a “good storm” of stagflation, a worsening of the already heavy exterior debt burden resulting from quickly rising rates of interest to combat inflation, the devastating consequences of the August 2022 floodsand political tensions (each inside, with nationwide elections seemingly earlier than the tip of the yr, and exterior, with the continued conflict between Russia and Ukraine). All three main worldwide credit standing businesses are unanimous of their evaluation of a really excessive chance of default and are at present ranking Pakistan’s sovereign debt accordingly: Customary & Poor, CCC+; Moody, Caa3; and Fitch, CCC.

Not surprisingly, the commerce in Pakistani authorities debt displays its “junk bond” standing. For instance, Pakistan’s authorities bond, 7.375 p.c bonds due April 2031 ($1.4 billion excellent), is currently trading at a few 66 p.c low cost. So, $1 par worth of Pakistan’s overseas nationwide debt is valued at simply 34 cents within the worldwide monetary markets.

Regardless of the present plight, Pakistan, a geostrategically necessary nuclear-armed state, will not be a failed state in terminal decline, neither is it doomed to endure a misplaced decade. The World Financial institution, in its latest economic growth forecasts, estimates that Pakistan’s GDP development shall be an anemic 0.4 p.c for fiscal yr (FY) 2023, however will regularly get well to 2 p.c in FY2024 and three p.c in FY2025. With a gentle restoration as a foundation, the potential for sturdy medium-term financial development could be unlocked. If there’s consensus on political adjustment and the executive and political will to implement accepted financial reforms, the long-term advantages of financial development and improvement could be reaped.

In December 2022, Coca-Cola Icecek (the Coca-Cola bottler for Turkey, Central Asia and the Center East) determined to extend its funding in Coca-Cola Pakistan from a 50 p.c possession stake to a one hundred pc possession stake by a $300 million money buy of the remaining curiosity in Coca-Cola Pakistan held by its companion, The Coca-Cola Firm. The transfer is an early signal that skilled fairness traders accustomed to working in difficult rising markets consider in Pakistan’s long-term development prospects.

Privatization and the answer to the debt entice

A constant chorus from the IMF, World Financial institution and Asian Improvement Financial institution – the three largest multilateral lenders to Pakistan – is the advice to denationalise state-owned enterprises (SOE). Privatization would have two goals: to boost money by the sale of state property and to cut back the budgetary burden of supporting underperforming loss-making state-owned enterprises.

With that in thoughts, swapping Pakistan’s present exterior sovereign debt held by non-public collectors for fairness in state-owned enterprises can obtain three goals: cut back Pakistan’s exterior sovereign debt (i.e. promote the aim of deleveraging), improve funding in overseas company and institutional portfolios. in Pakistani enterprises that shall be privatized and cut back the budgetary burden of supporting state-owned enterprises. It’s price contemplating how such a sovereign debt-to-equity change program could possibly be structured within the context of deleveraging and privatization.

According to the IMF, Pakistan’s complete overseas change debt of about $99.1 billion in 2021 was about 28 p.c of GDP. Pakistan’s complete overseas foreign money debt held by overseas industrial collectors is estimated to be roughly $19.7 billion (20 p.c) with a steadiness of $79.4 billion (80 p.c) held by multilateral and bilateral collectors. A program for the change of Pakistani sovereign debt into fairness within the context of deleveraging and privatization would goal overseas industrial collectors with the intention of persuading them to change their holdings of Pakistani sovereign debt denominated in foreign exchange for widespread shares of state-owned firms that may anticipated to be privatized (i.e. the fairness curiosity of the Authorities of Pakistan can be lowered in full or to an insignificant minority curiosity). To this finish, the Pakistani authorities would draw up an inventory of state-owned firms to be privatized, a few of which can already be listed on the inventory change.

A debt-to-equity change program could be structured to have two tracks: (1) particular person SOE transaction to switch management (i.e., at the very least 51 p.c fairness curiosity) to a overseas firm, and (2) transactions with already listed or anticipated to be listed on the Pakistan Inventory Trade (with the Authorities of Pakistan promoting a few of its holdings with the acknowledged goal of decreasing its possession stake to lower than 50 p.c). A selected concern of Pakistani authorities debt can be recognized as an applicable instrument for debt-to-equity swap functions in relation to a selected transaction. As an instance, the Bonds of 7.375 percent due April 2031 ($1.4 billion excellent; listed on the Frankfurt Inventory Trade) shall be used as a debt instrument.

An instance of a person transaction to switch management of a state owned firm to a overseas firm is the sale of Pakistan Worldwide Airways (PIA) to a overseas airline. For argument’s sake, let’s assume that primarily based on a mutually agreed upon valuation, a one hundred pc stake in PIA would quantity to $300 million. International airline X would purchase an applicable quantity of seven.375 p.c bonds on the present market value and provide such notes to the Authorities of Pakistan at a mutually agreed valuation (someplace between the present market worth and the face worth of the observe) as cost for the one hundred pc fairness curiosity in PIA.

The identical sample would apply within the case of a overseas portfolio investor in search of to buy from the Authorities of Pakistan a portion of the shares of State Life Insurance coverage Company of Pakistan for $300 million forward of a potential IPO and itemizing on the Pakistan Inventory Trade.

For the avoidance of doubt, the foregoing examples are merely illustrative. However deleveraging by way of debt-to-equity swaps is not a new concept – Chile used such an strategy within the Eighties with appreciable success.

Whereas deleveraging by debt-to-equity swaps is pushed by monetary and financial issues, deleveraging by the conversion of debt into grants is pushed by different issues, equivalent to philanthropic impulses or geostrategic priorities. Multilateral monetary establishments such because the IMF, World Financial institution and ADB have typically forgiven money owed within the identify of poverty alleviation. Apparently, Pakistan will not be thought-about poor sufficient to generate the philanthropic impetus of multilateral establishments.

As a substitute, resulting from its geographic location (it borders India, China, Iran, Afghanistan and overlooks the confluence of the Arabian Sea and the Persian Gulf), Pakistan might monetize its geostrategic worth. Islamabad can attempt to persuade the controlling shareholders of the multilateral establishments that, within the context of the tectonic shift from unipolarity to multipolarity, it’s of their geostrategic curiosity to transform Pakistan’s debt to such establishments into subsidies. The IMF, World Financial institution and ADB are managed by a gaggle of 10 nations that collectively maintain a majority of voting shares: america, Japan, Germany, the UK, France, Canada, Italy, the Netherlands, Australia and Spain. Whereas there isn’t any assure {that a} realpolitik strategy shall be profitable, it’s properly price making such an effort.

Pakistan has the important thing to flee its sovereign debt entice and may use it.