Whereas double-digit dividend yields could appear engaging to earnings buyers, it is vital to train warning when approaching these ultra-high-yielding names.

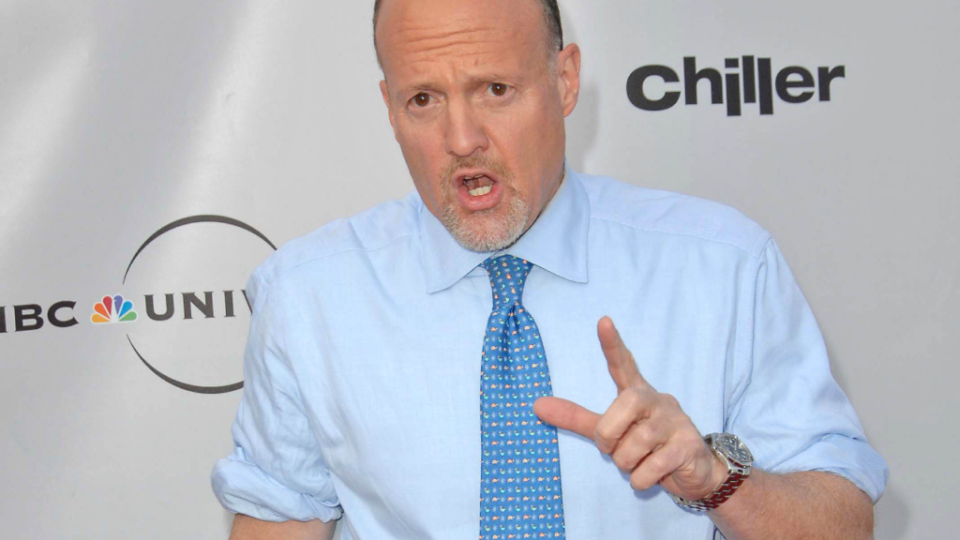

In a latest Lightning Spherical section of CNBC’s “Mad Cash” program, a viewer requested host Jim Cramer about Annaly Capital Administration Inc. (NYSE:NLY) — a mortgage actual property mutual fund (mREIT) with eye-popping returns.

The corporate pays quarterly dividends of 65 cents per share, giving the inventory an annual return of 14%.

However Cramer just isn’t a fan.

“That is a inventory that I feel is a entice,” he stated. “It all the time looks as if it has a excessive yield, however the truth is it has been a horrible performer for years and years. I need to avoid it.”

Whereas Cramer has warned buyers concerning the potential pitfalls of this high-yield inventory, there are different dividend performs out there. Listed here are three that Wall Avenue finds notably engaging.

Trying out:

Realty Revenue (NYSE:O)

Realty Revenue is a REIT that payments itself as “The Month-to-month Dividend Firm,” and it deserves that title. All through its 54-year firm historical past, the corporate has declared 636 consecutive month-to-month dividends.

Higher but, Realty Revenue has elevated its payout 121 occasions since going public in 1994.

At the moment, the REIT pays month-to-month dividends of 25.5 cents per share, which interprets into an annual return of 5.1%.

The quantity is not fairly as excessive because the 14% yield that Annaly Capital affords, however take into account that the common dividend yield of S&P 500 firms is presently simply 1.6%.

Stifel’s Simon Yarmak has a Purchase ranking for Realty Revenue and a value goal of $71.25, implying a possible upside of 19%.

Whereas publicly traded REITs are in style, new firms have give you methods for folks to do exactly that earn passive income on the true property market. This is how invest in rental properties with just $100 whereas remaining fully hands-off.

First Power Corp. (NYSE:FE)

FirstEnergy is an electrical utility firm headquartered in Akron, Ohio. It has 10 electrical distribution firms serving prospects in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York.

Utilities have lengthy been a staple of dividend buyers due to their reliability. It doesn’t matter what occurs, folks will all the time need to activate their lights at evening.

FirstEnergy has a quarterly dividend fee of 39 cents per share, which equates to an annual return of 4% on the present share value.

Within the first quarter, the corporate earned internet earnings of $292 million, or 51 cents per share. In its outcomes launch, FirstEnergy reaffirmed its long-term goal of annual development in working earnings per share of 6% to eight%.

Shares are down 7% to this point, however Morgan Stanley analyst Stephen Byrd sees a restoration on the horizon. Byrd has an Chubby ranking on FirstEnergy and a value goal of $45 — about 15% above the place the inventory presently stands.

Power Switch LP (NYSE:ET)

Power Switch owns one of many largest portfolios of power belongings within the US

With roughly 120,000 miles of pipeline and related power infrastructure, the partnership has a strategic community spanning 41 states and all main manufacturing basins within the nation.

In April, Power Switch introduced a quarterly money fee of 30.75 cents per unit. On the present unit value, the quantity interprets into an annual return of 9.7%.

Within the first quarter, Power Switch’s distributable money stream (DCF) attributable to companions was $2.01 billion, which exceeded the quantity required to pay money distributions to companions for the quarter.

“Based mostly on prices incurred, we had a DCF surplus of $640 million after distributions of $967 million and development capital of $407 million,” stated Power Switch Co-CEO Tom Lengthy on the earnings convention name.

JP Morgan analyst Jeremy Tonet has an Chubby ranking on Power Switch and a value goal of $18. Because the inventory is presently buying and selling at $12.75, the value goal implies a possible upside of 41%.

There are various high-yield performs within the midstream power area. When you want a diversified strategy relatively than selecting particular person shares, chances are you’ll need to look into exchange-traded funds that target the sector. The USCF Midstream Energy Income Fund (NYSE:UMI), for instance, seeks “a excessive degree of present earnings” and capital appreciation and affords publicity to a variety of midstream power belongings. Power Switch is presently the second largest holding firm.

Learn extra:

Do not miss real-time alerts about your shares – be part of us Benzinga Pro free! Try the tool that helps you invest smarter, faster and better.

This text Jim Cramer says these 14% yield stocks are a trap – here are 3 dividend plays that could be more reliable initially appeared on Benzinga. com

.

© 2023 Benzinga.nl. Benzinga doesn’t present funding recommendation. All rights reserved.