Palantir Applied sciences (NYSE: PLTR), which is deeply concerned with analytics and synthetic intelligence (AI), has been rising each its business and authorities operations over time.

Nevertheless, some buyers are involved that maybe it’s too depending on the federal government for its progress. A change in administration may deliver completely different insurance policies, and that would influence contract renewals. On the similar time, nonetheless, authorities prospects generally is a nice supply of constant and recurring income.

Beneath, I will have a look at how a lot of Palantir’s income has come from authorities versus business prospects and what’s been driving its progress.

The income combine has been shifting — barely

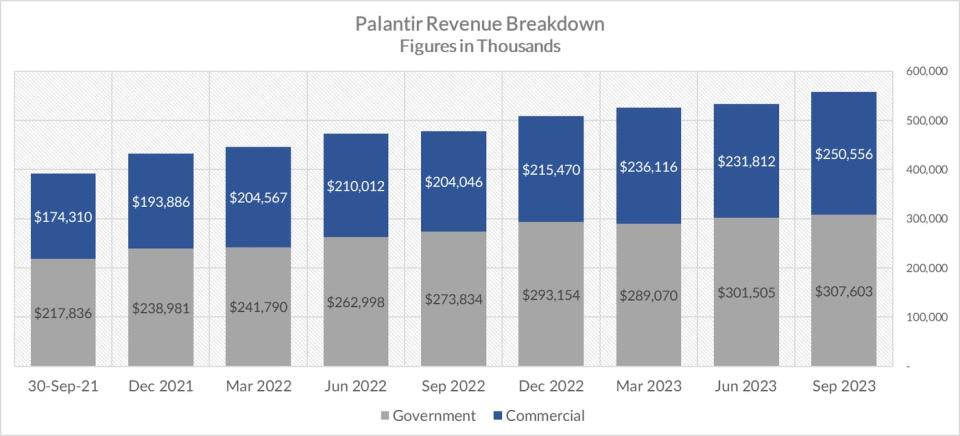

In Palantir’s most up-to-date quarterly outcomes, the corporate’s authorities income totaled a bit of beneath $308 million, which was 23% greater than the $251 million in income its business shoppers introduced in.

Two years in the past, the income was barely extra tilted, with authorities income of $218 million being 25% increased than the $174 million the corporate reported on the business aspect. Whereas technically, Palantir has turn out to be much less dependent on authorities income since then, there hasn’t been an enormous change.

Why the combination may change sooner or later

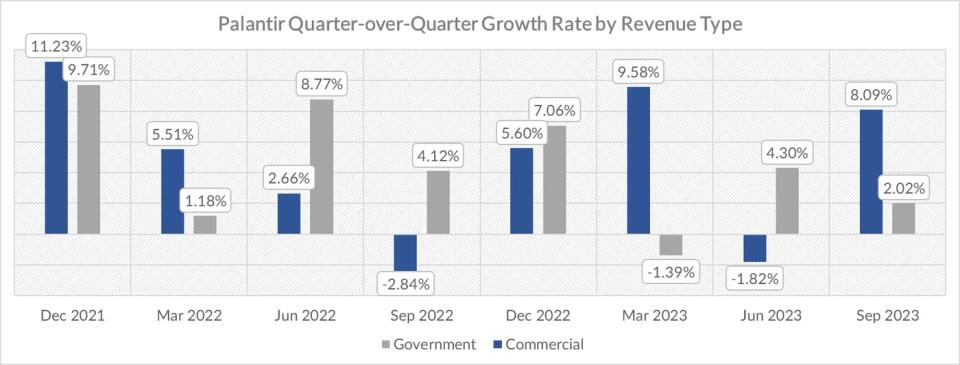

Now that AI has turn out to be extra mainstream and companies wish to do extra with knowledge, Palantir has been experiencing a major uptick in demand. And final quarter, it skilled a notable soar in business income.

There was a good bit of volatility in quarter-over-quarter income progress. However take into account that ChatGPT launched in November 2022. That is when the AI hype actually began to take off. When you simply have a look at the final three quarters, for the reason that begin of 2023, it is clear that the business enterprise has been doing a lot better, with no less than 8% quarter-over-quarter income progress in two of the previous three quarters.

With the corporate not too long ago launching AI bootcamps in a bid to assist companies discover use circumstances for AI by making an attempt out Palantir’s software program, this can be a development that would very effectively proceed into 2024 and past.

Whereas the corporate remains to be producing most of its income from authorities contracts, that might not be the case in the long term, which is why I do not suppose Palantir’s publicity to authorities must be an enormous concern for buyers.

Must you put money into Palantir’s inventory?

Palantir has been a sizzling inventory to personal this yr, and its shares are up by 175%. The one downside is that the inventory is not low cost, buying and selling at 19 instances income and 12 instances its ebook worth. Even based mostly on future earnings estimates, it is at a a number of of greater than 60 instances profitability.

Granted, the corporate has solely not too long ago turn out to be worthwhile, and its earnings ought to enhance, however these are excessive premiums buyers are paying for the enterprise. And which means a whole lot of future progress is already priced into the inventory.

So long as you are prepared to purchase and maintain shares of Palantir for a number of years, the AI stock can nonetheless make for a great funding in the long term. However buyers ought to mood their expectations as 2024 seemingly will not be a repeat efficiency of 2023.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Palantir Applied sciences wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure policy.

Is Palantir’s Growth Too Dependent on Government Contracts? was initially printed by The Motley Idiot