In the case of synthetic intelligence (AI), the “Magnificent Seven” shares — Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta Platforms, and Tesla — all the time appear to search out their names within the headlines.

Amongst this small group, maybe Nvidia is essentially the most carefully adopted. The corporate manufactures high-end semiconductor chips referred to as graphics processing items (GPUs). GPUs are utilized in a wide range of generative AI purposes, together with the coaching of enormous language fashions and machine studying.

Certainly one of Nvidia’s closest allies is a a lot smaller firm referred to as Tremendous Micro Laptop (NASDAQ: SMCI). Whereas Nvidia creates the know-how powering semiconductors, Tremendous Micro Laptop performs an integral function behind the scenes associated to how these chips match into IT structure comparable to server racks and storage clusters.

Buyers have taken word of Tremendous Micro’s vital function inside the synthetic intelligence (AI) panorama and have eagerly purchased up the inventory. During the last yr, shares of Tremendous Micro are up virtually 800%. Given such a magical run, some buyers could also be considering it is too late to take a position on this “stealth Nvidia” enterprise.

Let’s dig into Tremendous Micro’s operation and perceive why the inventory has loved a lot investor enthusiasm. Extra importantly, by looking on the long-term outlook, buyers could come to grasp that Tremendous Micro’s run may simply be getting began.

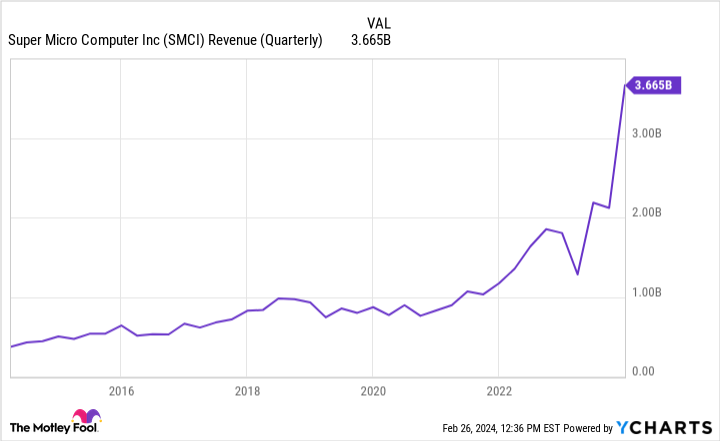

Gross sales are hovering, however there’s extra to the image

The chart beneath makes one factor overwhelmingly apparent: Tremendous Micro’s income is off the charts (virtually actually!). One of many clearest indicators of this income development is the corporate’s sturdy ties to Nvidia. Since demand for Nvidia’s GPUs is excessive, the necessity for Tremendous Micro’s IT structure designs is extra vital than ever.

Whereas it’s straightforward to turn into enamored by Tremendous Micro’s potential, there may be way more to the image than simply strong gross sales development. The corporate is definitely a low-margin enterprise. For the second quarter of its fiscal 2024, ended Dec. 31, 2023, Tremendous Micro reported a gross margin of 15.4%. By comparability, its gross margin was 18.7% in the identical interval final yr.

Administration attributed the margin deterioration to hefty investments in development. Extra particularly, as GPUs turn into extra refined, optimum design structure additionally turns into more and more complicated — this can be a pricey endeavor as Tremendous Micro is firing on all cylinders to amass extra market share.

I perceive the necessity to make investments at present to attain sustained development in the long term. Nonetheless, if demand for AI chips begins to wane, Tremendous Micro’s profitability profile may expertise a extra pronounced dip.

What goes up, should come down

Following its blowout earnings report in January, Tremendous Micro shares continued to soar. Whereas shares are up over 200% to this point in 2024, buying and selling exercise has truly began to chill down after briefly eclipsing $1,000 per share earlier this month.

I see a few objects at play right here. First, practically the entire megacap tech firms have reported earnings at this level. Buyers now have quite a lot of knowledge factors to digest and sift via. It will take a while to evaluate which firms are finest positioned to proceed using the AI wave. And there could possibly be some issues for Tremendous Micro particularly.

For starters, Nvidia not too long ago shed some gentle on its provide chain woes — an issue it is had for fairly a while. There is a danger that this drawback may have a domino impact on Tremendous Micro.

One other certainly one of Tremendous Micro’s sturdy relationships is with Nvidia’s high rival, Superior Micro Units. After it reported combined earnings earlier this yr, some buyers have official issues about AMD’s long-term development prospects. Once more, ought to demand for AI chips plateau, each Nvidia and AMD will undergo, and that can have an effect on Tremendous Micro.

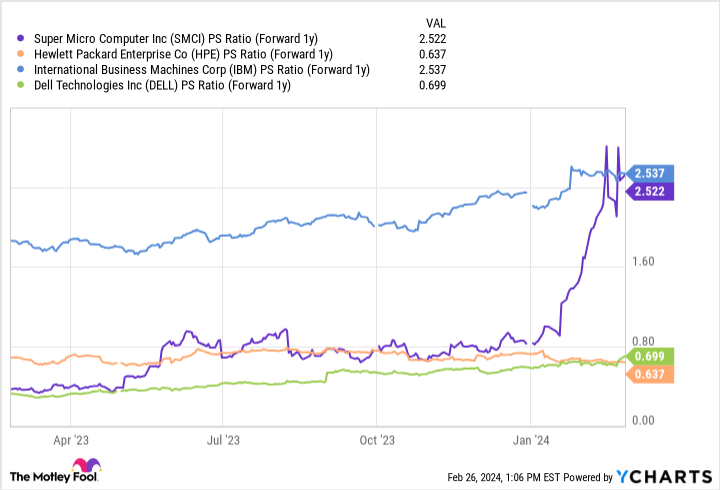

The valuation is hard to decipher

The chart above illustrates the ahead price-to-sales (P/S) ratio of Tremendous Micro Laptop in opposition to a cohort of different IT structure designers. At a ahead P/S of two.5, Tremendous Micro is valued in keeping with Worldwide Enterprise Machines. That is peculiar as a result of IBM is a a lot bigger, extra prolific enterprise that sells software program and consulting providers along with {hardware}.

Wall Road’s expectations for Tremendous Micro range tremendously. The consensus worth goal of $652 implies that Tremendous Micro inventory is presently overvalued — and significantly so. Nonetheless, Hans Mosesmann of Rosenblatt Securities is asking for 48% upside from present ranges and has a Road-high worth goal of $1,300.

I believe Tremendous Micro nonetheless has quite a lot of room to run, however I might additionally not be stunned to see a pullback in demand in some unspecified time in the future. For that reason, I might be cautious about scooping up shares in Tremendous Micro proper now.

It may symbolize a hedge to different AI shares in your portfolio, and I see the corporate as a winner in the long term. Nonetheless, valuation is a official concern, and shopping for into momentum shares can include quite a lot of danger. Probably the most prudent factor to do proper now could also be to evaluate the corporate’s ongoing earnings experiences and maintain a detailed eye on different companies concerned within the AI chip market as properly.

Do you have to make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Tremendous Micro Laptop wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends Tremendous Micro Laptop and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

Is It Too Late to Buy Super Micro Computer Stock Now? was initially revealed by The Motley Idiot