-

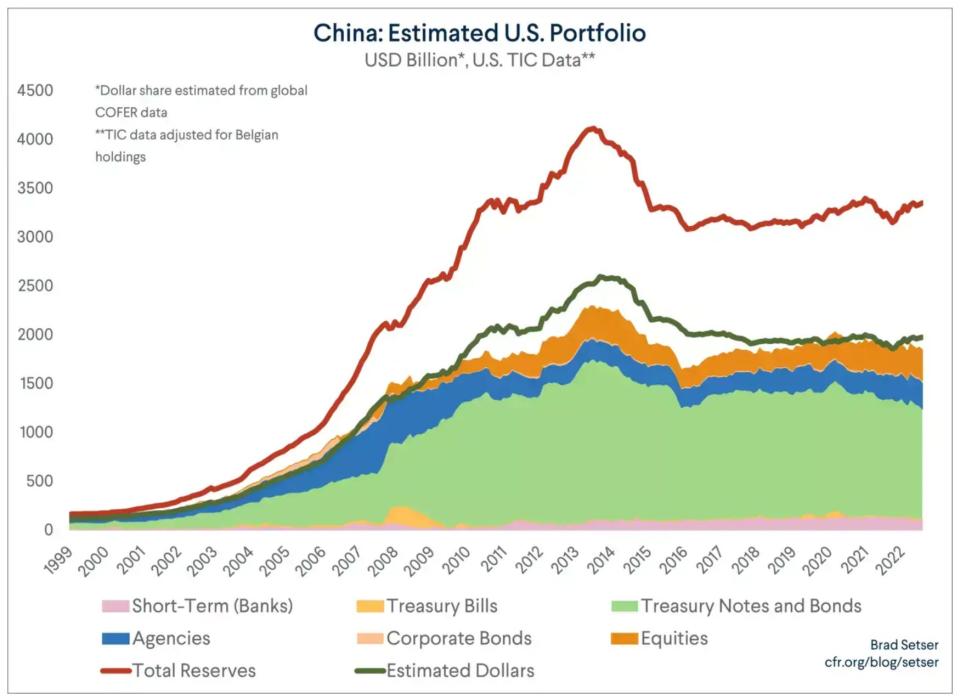

China just isn’t dumping its stockpile of US bonds, Brad Setser, a former Treasury official, wrote.

-

A big a part of China’s holdings just isn’t accounted for in official US information, he stated.

-

Whereas it has offered some Treasurys, Beijing has purchased up US debt within the type of company bonds.

China is not fueling the bond-market rout with a big sale of its Treasury holdings however is as a substitute reshuffling its US debt property, Brad Setser, a former Treasury official, wrote for the Council on Foreign Relations.

After US Treasury yields surged to highs not seen in 16 years, economists have appeared for explanations for what’s now one of the worst market crashes in history.

Apollo World Administration’s Torsten Sløk additionally pointed to China not too long ago, citing official US information that confirmed the country had sold $300 billion value of Treasurys since 2021. And in August, a $21.2 billion dump of US property by China was largely made up of Treasurys.

However Setser stated such information offered an incomplete image. Drawing on different sources, he estimated that China’s total US-bond holdings had been comparatively steady since 2015.

Although China’s holdings look like slipping in official US Treasury Worldwide Capital information, the metric displays solely international holdings in US custodians, or the monetary establishments that safeguard the property, Setser stated.

“If a easy adjustment is made for Treasuries held by offshore custodians like Belgium’s Euroclear, China’s reported holdings of US property look to be mainly steady at between $1.8 and $1.9 trillion,” he wrote.

Added to that, the US information fails to seize US asset holdings that had been handed over to third-party administration. China’s State Administration of Overseas Change is understood to carry accounts at world bond and hedge funds, in addition to private-equity corporations, Setser stated.

He added that even the place China had diminished its Treasury holdings, the gross sales had been a lot smaller than different information instructed and purchases of US debt in different varieties, such company bonds, had elevated.

Company bonds are issued by government-sponsored enterprises, and a number of the prime issuers are US-backed corporations comparable to Fannie Mae and Freddie Mac.

In actual fact, Beijing’s company bonds as soon as outpaced its Treasury property, Setser stated. Although it moved away from that market in the course of the Federal Reserve’s quantitative-easing period, hovering yields on company debt have introduced again China’s shopping for behavior.

In 2022 and the primary six months of 2023, China bought over $100 billion in company debt and offered simply $40 billion in Treasurys, he estimated.

“Backside line: the one fascinating evolution in China’s reserves up to now six years has been the shift into Businesses,” he wrote. “That has resulted in a small discount in China’s Treasury holdings — nevertheless it additionally reveals that it’s a mistake to equate a discount in China’s Treasury holdings with a discount within the share of China’s reserves held in US bonds or the US greenback.”

Learn the unique article on Business Insider