In search of out high-growth companies that may generate market-beating returns could be fairly entertaining. Nonetheless, plainly, as a rule, growth stocks carry quite a lot of volatility, which could be unnerving at instances.

Investing in regular, slower-growth companies could be the extra prudent possibility. By splitting up a complete funding of $125,000 into the 4 excessive dividend yield corporations mentioned beneath, you would possibly be capable of add as a lot as $10,000 of dividend revenue to your portfolio this yr.

Let’s try the professionals and cons of every firm and assess why 2024 may very well be an excellent alternative to open positions.

1. Rithm Capital: 9.7% dividend yield

The primary firm on the record is actual property funding belief (REIT) Rithm Capital (NYSE: RITM). REITs usually carry excessive dividend yields as a result of they’re required by legislation to pay out not less than 90% of their annual taxable revenue to shareholders. At a 9.7% yield, one-fourth of the proposed $125,000 funding might generate roughly $3,000 of dividend revenue.

One of many core themes of the present state of the macroeconomy is excessive rates of interest. Given this dynamic, conventional banks have develop into extra stringent of their lending requirements. This strategy has opened the doorway for Rithm, offering the corporate with ignored alternatives in industrial actual property, mortgage loans, and even leases.

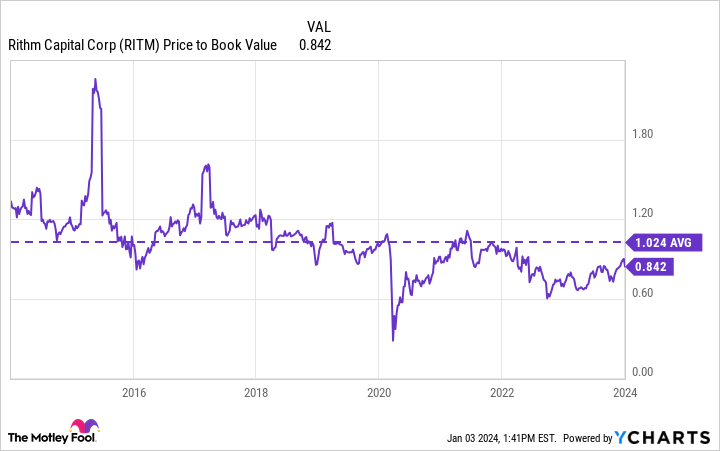

As of the time of this text, Rithm inventory traded at a price-to-book (P/B) a number of of 0.84 — effectively beneath its 10-year common. Moreover, two of the corporate’s rivals, Starwood Property Belief and Annaly Capital Administration, every commerce at a P/B a number of of barely greater than 1.

I’ve a hunch that the markets are overlooking Rithm, given the corporate’s publicity to rate of interest coverage set by the Federal Reserve. Whereas I perceive these issues, I believe they’re short-sighted. Lengthy-term buyers in Rithm inventory have loved a complete return of greater than 140% throughout the previous decade. Given the corporate’s diversified roster of companies, coupled with a novel alternative to make the most of disparities within the market given present credit score underwriting insurance policies at banks, I believe Rithm is about as much as proceed its sturdy efficiency.

2. Altria: 9.5% dividend yield

The second firm I am exploring is tobacco big Altria (NYSE: MO). Certainly, demand for tobacco merchandise has been on the decline for a few years as shoppers develop into extra well being acutely aware. Furthermore, present macroeconomic circumstances, hallmarked by excessive borrowing prices and inflation, have precipitated client spending to drop in sure areas. Altria has not been immune to these trends, and its monetary profile displays that.

However, as the perfect corporations usually do, Altria has discovered methods to fight the shrinking recognition of conventional tobacco merchandise. Extra particularly, the corporate is making inroads within the smokeless tobacco and vaping markets because it appears to diversify its product choices. Whereas time will inform if these investments will repay, present buyers might wish to make the most of the corporate’s depressed share value.

Altria inventory presently trades at a ahead price-to-earnings (P/E) a number of of 8.3, far beneath the S&P 500‘s 21.7. It certain appears like buyers have soured on Altria and don’t anticipate a lot from the corporate. However maybe what makes Altria essentially the most distinctive firm on this record is its esteemed place among the many Dividend Kings, or corporations which have raised their dividends for 50 consecutive years or extra.

Lengthy-term buyers ought to zoom out and take into consideration your complete image right here. Whereas tobacco merchandise are falling out of favor, Altria has confronted its share of uphill battles all through its lengthy historical past and has all the time discovered methods to reward loyal shareholders.

Given its 9.5% yield, one-fourth of the proposed $125,000 funding might generate greater than $2,900 of dividend revenue to your portfolio. Traders might wish to critically contemplate a place in Altria at its present valuation, all whereas reaping passive revenue from an organization that has persistently raised its dividend.

3. Verizon Communications: 6.8% dividend yield

Coming in at No. 3 is telecommunications supplier Verizon Communications (NYSE: VZ). I am going to admit, the telecommunications sector is not essentially the most glamorous. The services provided by these corporations are usually commoditized, thus forcing main gamers to compete on value. Furthermore, as streaming companies acquire momentum, corporations like Verizon are continually battling subscriber churn. It should not come as a shock that Verizon inventory has fallen about 3% throughout the previous yr.

But regardless of a difficult aggressive panorama, Verizon nonetheless manages to generate sturdy free money stream. In flip, the corporate has the monetary flexibility to persistently reward shareholders. In truth, again in September, the corporate raised its dividend for the seventeenth consecutive yr. I believe these dynamics are discounted by buyers who’re searching for extra profitable progress prospects.

So, whereas Verizon inventory is probably going not going to handily outperform the broader markets, dividend buyers nonetheless would possibly just like the inventory. At a 6.8% yield, one-fourth of the proposed $125,000 funding might deliver in additional than $2,100 of dividend revenue.

4. AT&T: 6.4% dividend yield

The final firm on the record is Verizon competitor AT&T (NYSE: T). What makes AT&T a bit extra engaging is the truth that it’s really rising income, not like Verizon.

Furthermore, AT&T’s sturdy money stream technology has allowed the corporate to wash up its steadiness sheet and repay debt. By enhancing its liquidity profile, you would possibly assume that the corporate is incomes cheers from Wall Road. However this is not the case.

Again in 2022, AT&T minimize its dividend by roughly half. Naturally, buyers soured and certain began doubting AT&T’s means to handle the enterprise effectively. As of the time of this text, AT&T inventory is buying and selling close to a few of its lowest ranges in three many years.

Whereas it is comprehensible for buyers to query administration’s working capabilities after such a drastic transfer as slicing the dividend, I see the present value motion within the inventory as a shopping for alternative. Given the corporate’s enhancing web debt place, I believe the dividend is comparatively protected. At a 6.4% yield, the ultimate one-fourth of the proposed $125,000 funding would produce $2,000 of dividend revenue, bringing the whole quantity of passive revenue to $10,000.

Must you make investments $1,000 in Rithm Capital proper now?

Before you purchase inventory in Rithm Capital, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Rithm Capital wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Adam Spatacco has no place in any of the shares talked about. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure policy.

Investing $125,000 in These 4 High-Yield Dividend Stocks Could Add $10,000 in Passive Income to Your Portfolio in 2024 was initially printed by The Motley Idiot