-

Traders gravitate towards the identical shares to their detriment, a brand new report signifies.

-

Firms that Wall Road analysts disagree about are likely to outperform over time.

-

Listed below are 30 shares that analysts are break up about proper now, in line with UBS.

There’s an outdated saying that is still related to buyers: If all of us suppose alike, nobody is pondering.

Groupthink is prevalent in all places, together with on Wall Road. Apart from a number of outspoken contrarians, buyers are likely to ride the stock market’s momentum as an alternative of going in opposition to the grain since lacking a large rally could be expensive — particularly for fund managers.

Nonetheless, selecting the identical shares as everybody else can hinder outperformance.

Shares that fairness analysts agree both have a shiny or dismal future have traditionally lagged behind people who the Road is break up on, in line with a mid-March report from UBS.

The agency discovered that corporations with the next so-called scores dispersion from analysts have overwhelmed these with low dispersions by 1.6% a 12 months because the finish of 2010. Excessive-dispersion shares have outperformed their low-dispersion friends 74% of the time in that span, UBS famous.

For reference, high-ratings-dispersion shares’ returns are higher than excessive development over low development and excessive momentum over low momentum. Even nonetheless, this technique is often missed.

Inside this high-dispersion technique, corporations tied to expertise or adjoining sectors are likely to carry out greatest, in line with UBS. One more reason to contemplate this technique is that it has a low correlation to different shares, which is a risk-management plus.

30 shares that Wall Road is break up on

Since analyst alignment could be a unhealthy omen for corporations, it follows that buyers ought to search for companies that may spark debates amongst those that comply with them.

Under are 30 shares with the best dispersion in scores from analysts, sorted alphabetically by sector and inside their sector, if relevant. Together with every identify is its ticker, market capitalization, and sector. Be aware that UBS does not essentially suggest these corporations.

1. Digital Arts

Ticker: EA

Market cap: $36.6B

Sector: Communication Providers

2. Paramount World

Ticker: PARA

Market cap: $8.1B

Sector: Communication Providers

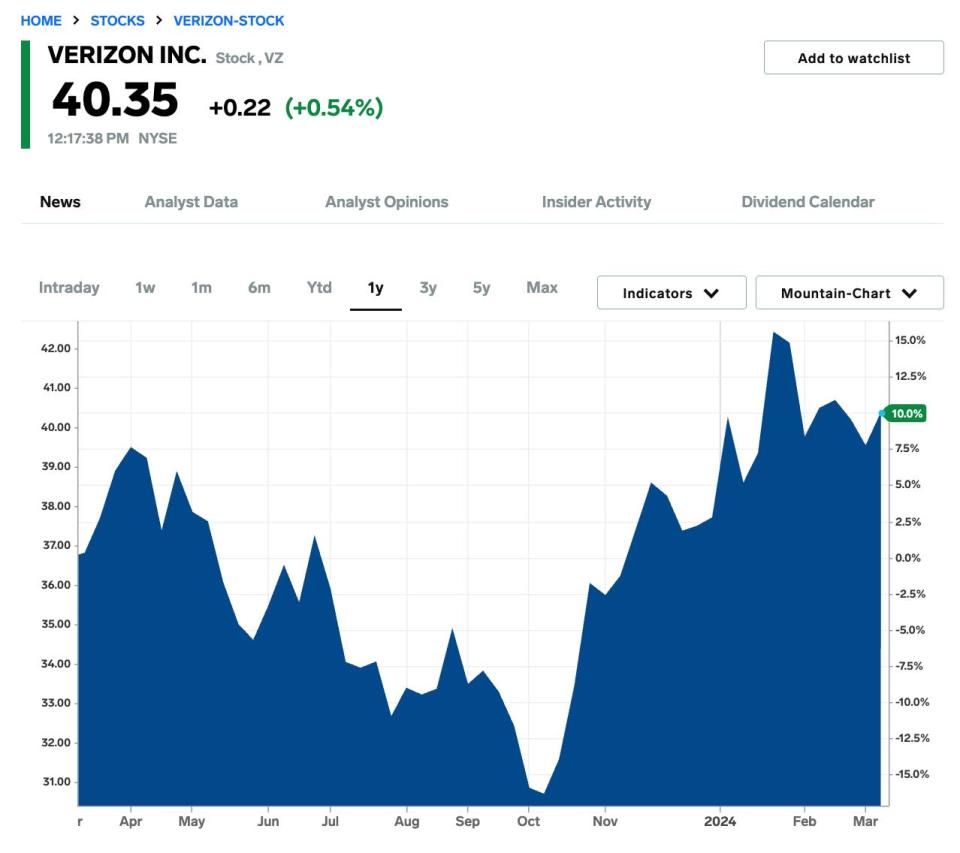

3. Verizon Communications

Ticker: VZ

Market cap: $169.4B

Sector: Communication Providers

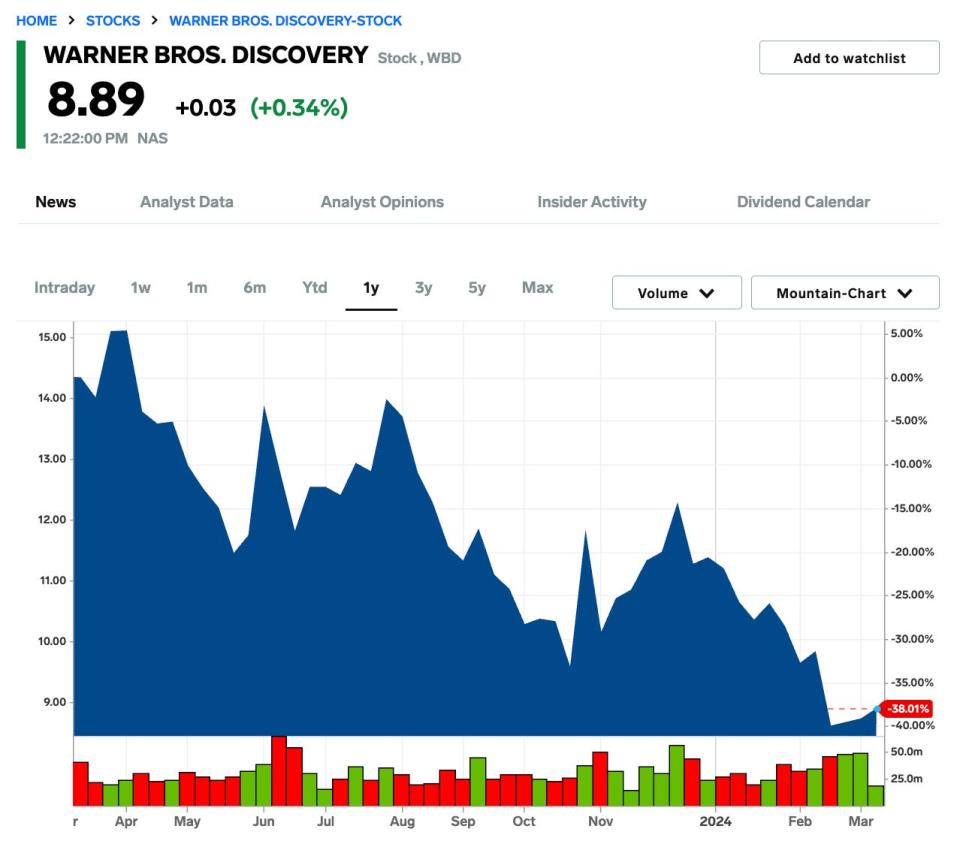

4. Warner Bros. Discovery

Ticker: WBD

Market cap: $21.7B

Sector: Communication Providers

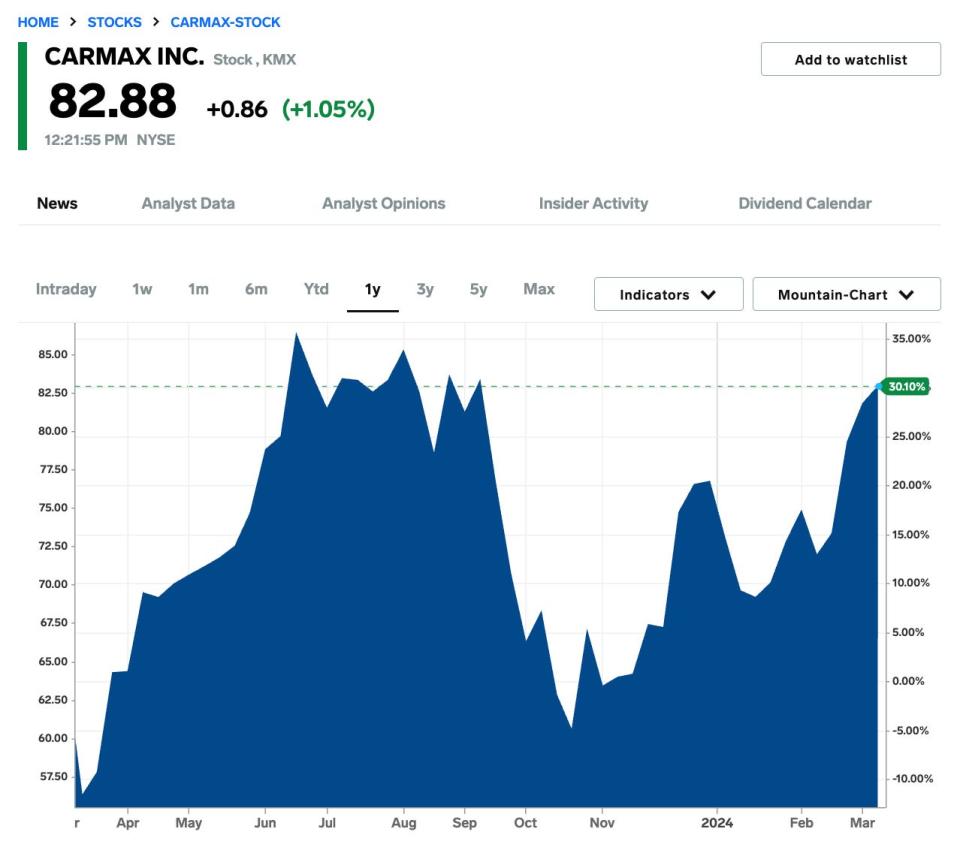

5. CarMax

Ticker: KMX

Market cap: $13.1B

Sector: Shopper Discretionary

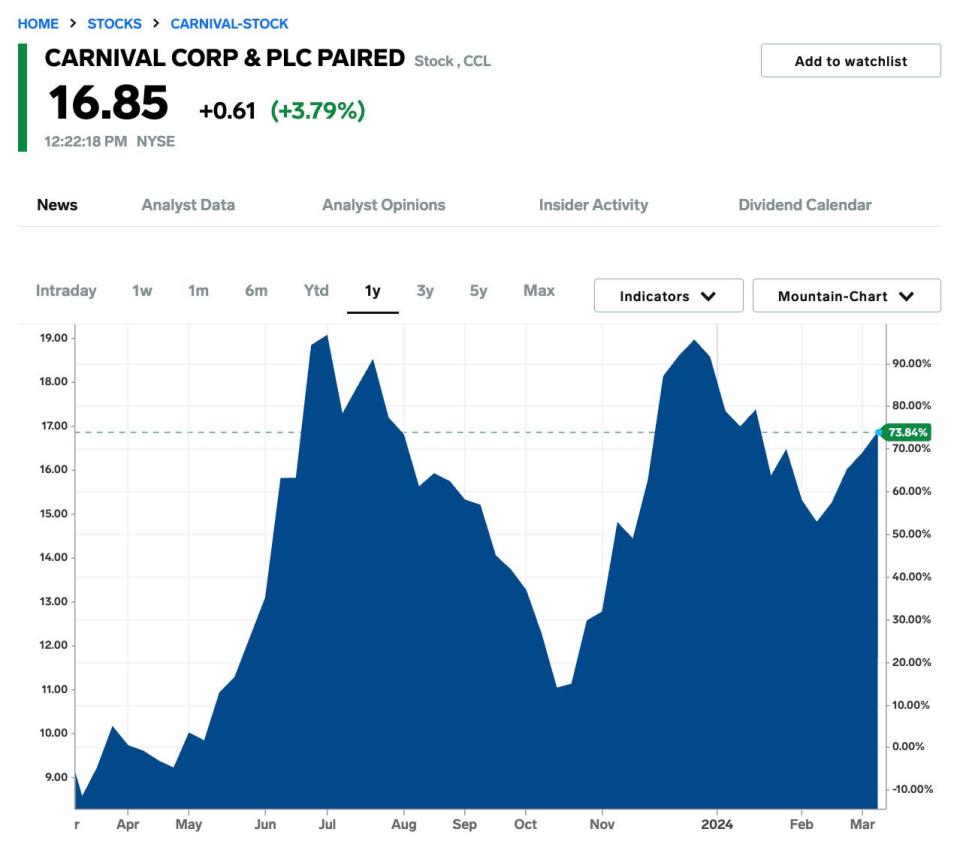

6. Carnival

Ticker: CCL

Market cap: $21B

Sector: Shopper Discretionary

7. Ford Motor

Ticker: F

Market cap: $49.4B

Sector: Shopper Discretionary

8. Lululemon Athletica

Ticker: LULU

Market cap: $56.8B

Sector: Shopper Discretionary

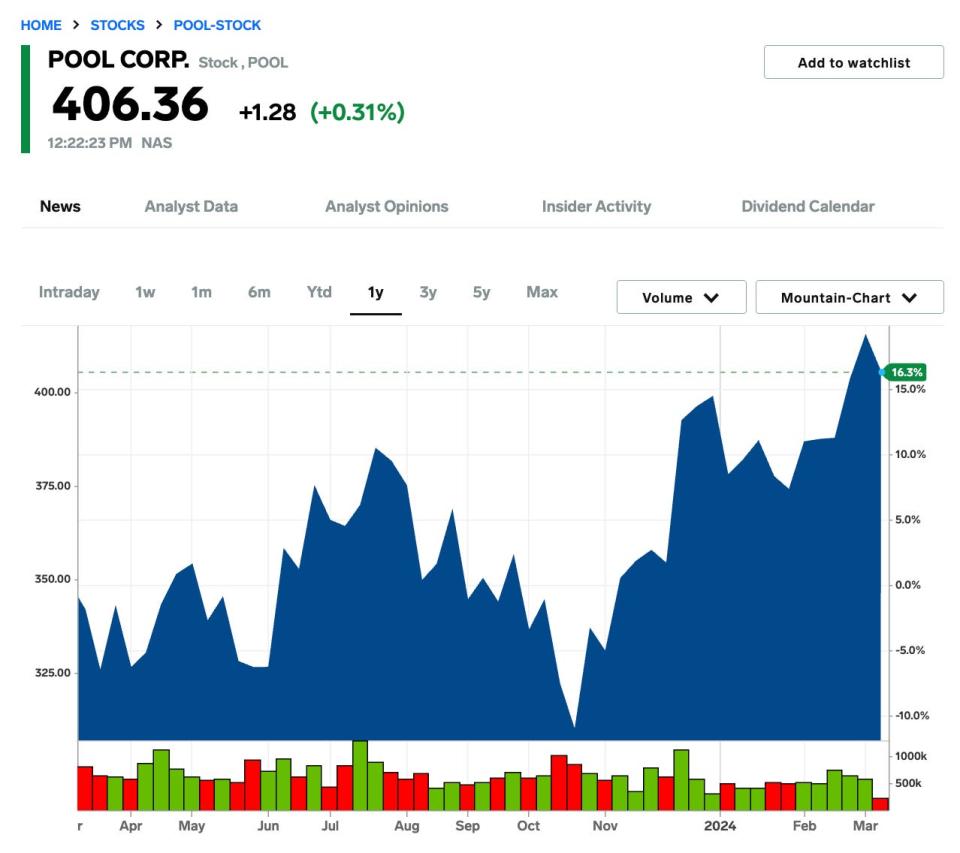

9. Pool

Ticker: POOL

Market cap: $15.5B

Sector: Shopper Discretionary

10. Tesla

Ticker: TSLA

Market cap: $538.8B

Sector: Shopper Discretionary

11. APA Corp.

Ticker: APA

Market cap: $9.8B

Sector: Vitality

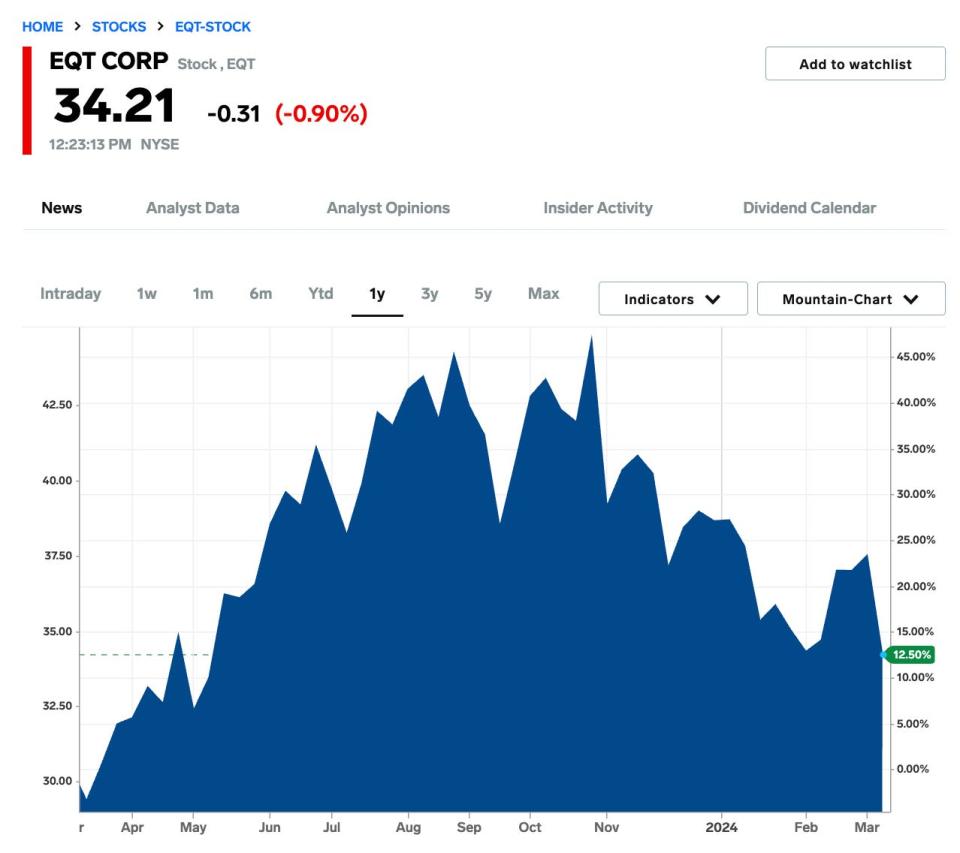

12. EQT Corp.

Ticker: EQT

Market cap: $15.1B

Sector: Vitality

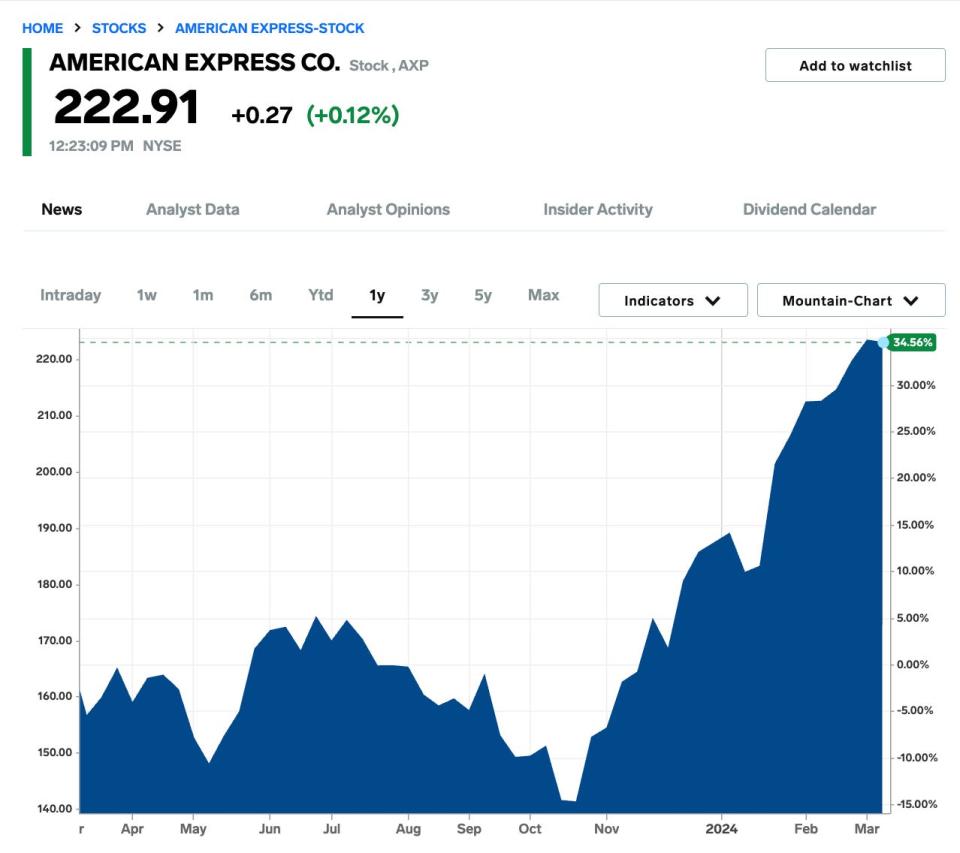

13. American Specific

Ticker: AXP

Market cap: $161.4B

Sector: Financials

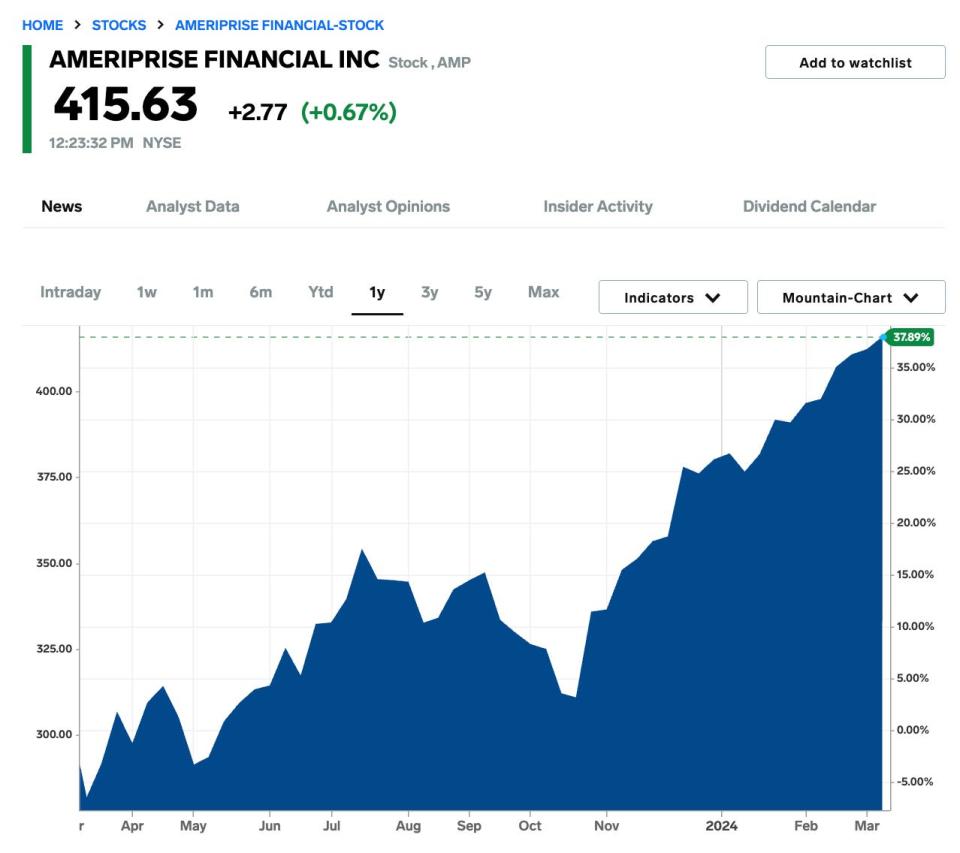

14. Ameriprise Monetary

Ticker: AMP

Market cap: $41.6B

Sector: Financials

15. CME Group

Ticker: CME

Market cap: $78.6B

Sector: Financials

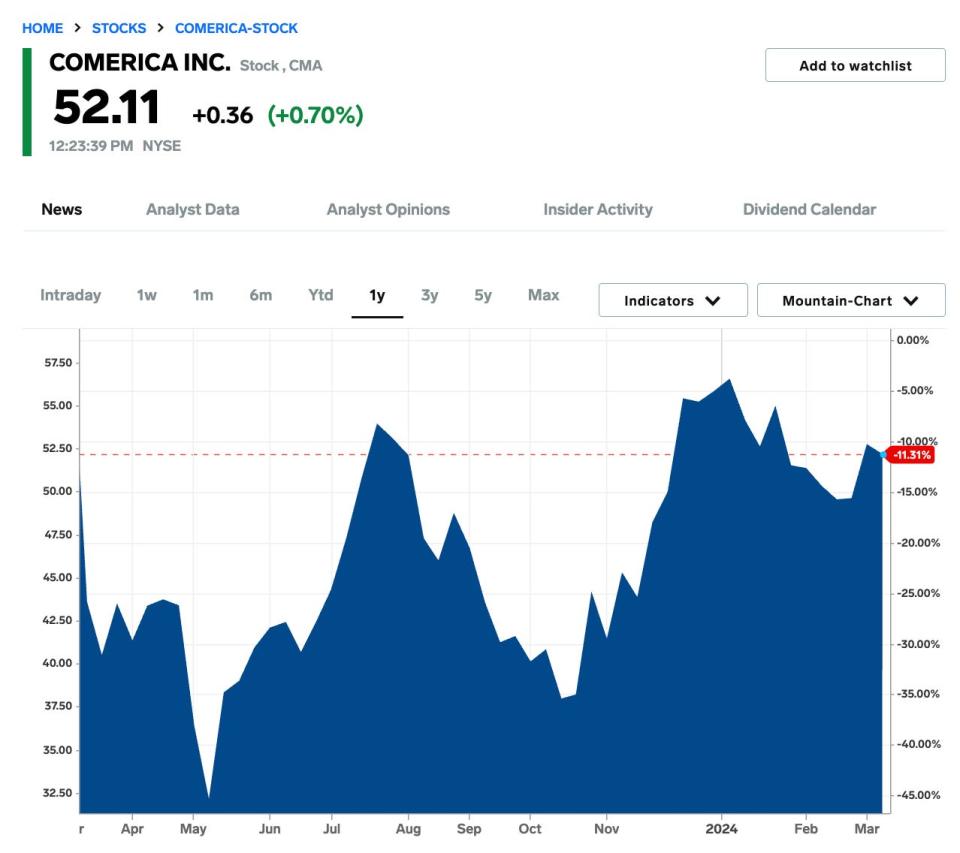

16. Comerica

Ticker: CMA

Market cap: $6.9B

Sector: Financials

17. Northern Belief

Ticker: NTRS

Market cap: $16.8B

Sector: Financials

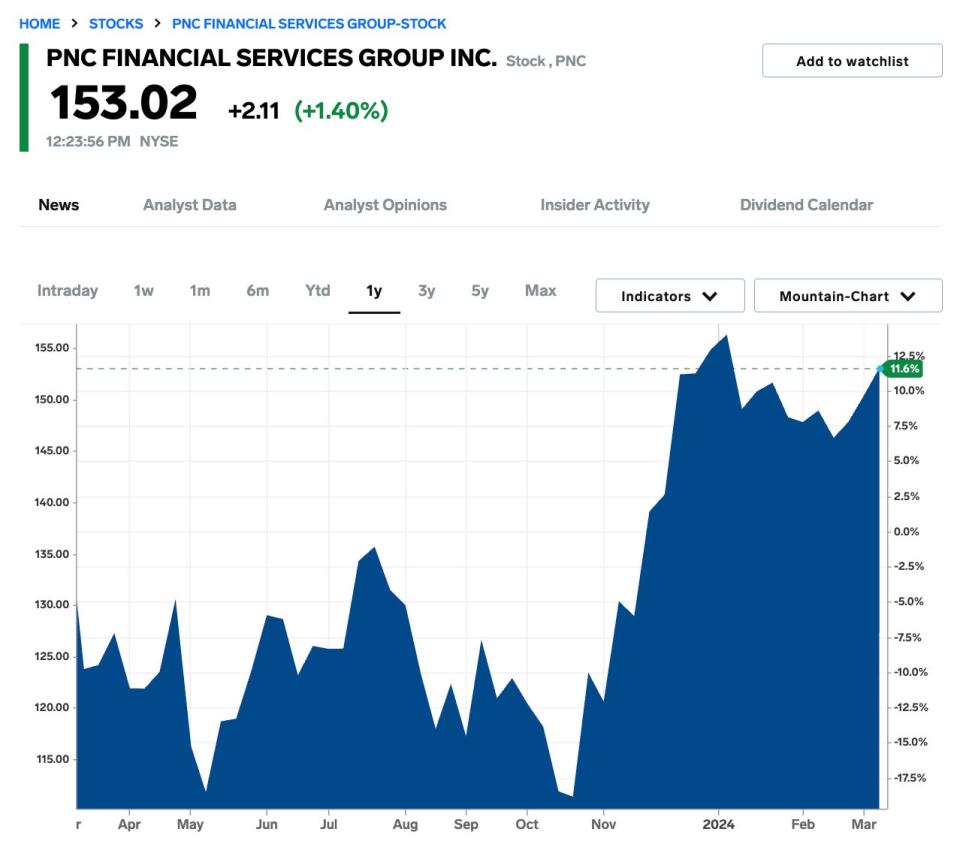

18. PNC Monetary Providers

Ticker: PNC

Market cap: $60.9B

Sector: Financials

19. Align Know-how

Ticker: ALGN

Market cap: $24B

Sector: Healthcare

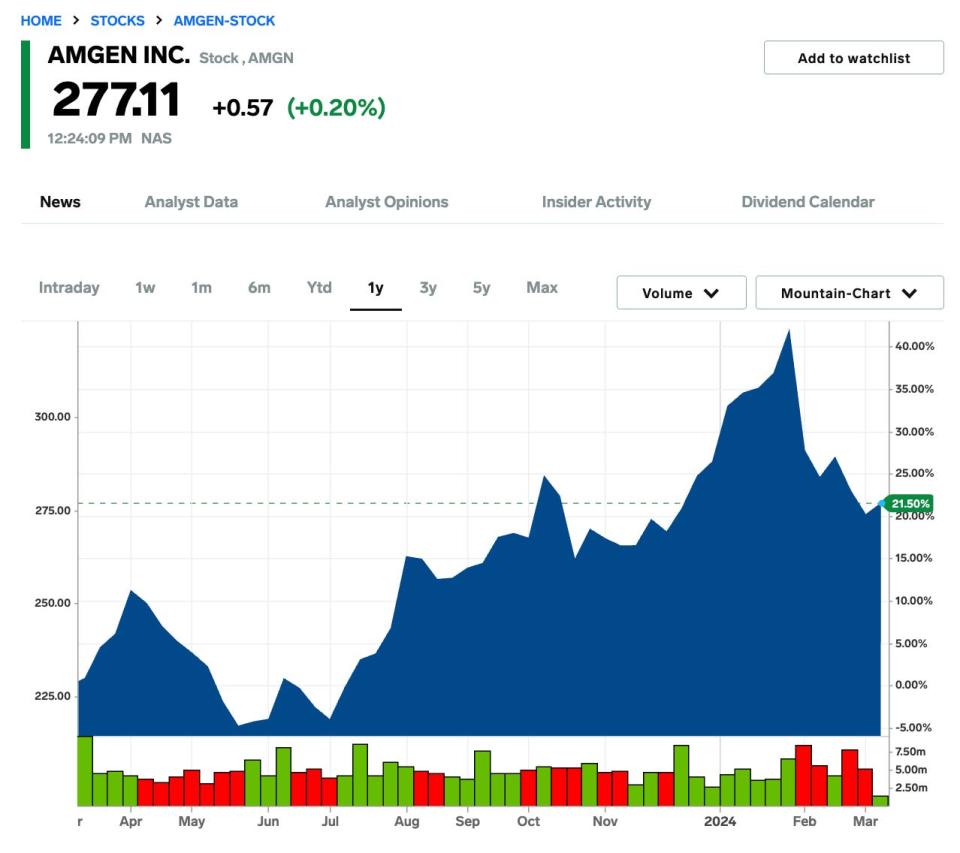

20. Amgen

Ticker: AMGN

Market cap: $148.3B

Sector: Healthcare

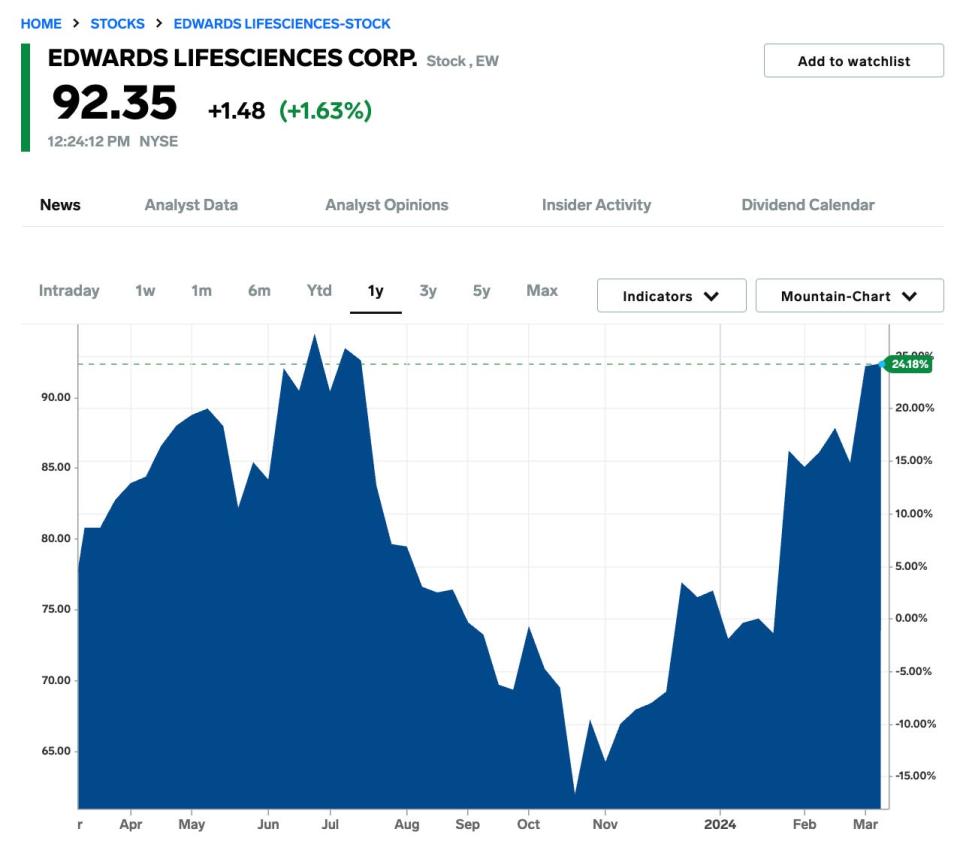

21. Edwards Lifesciences

Ticker: EW

Market cap: $55.5B

Sector: Healthcare

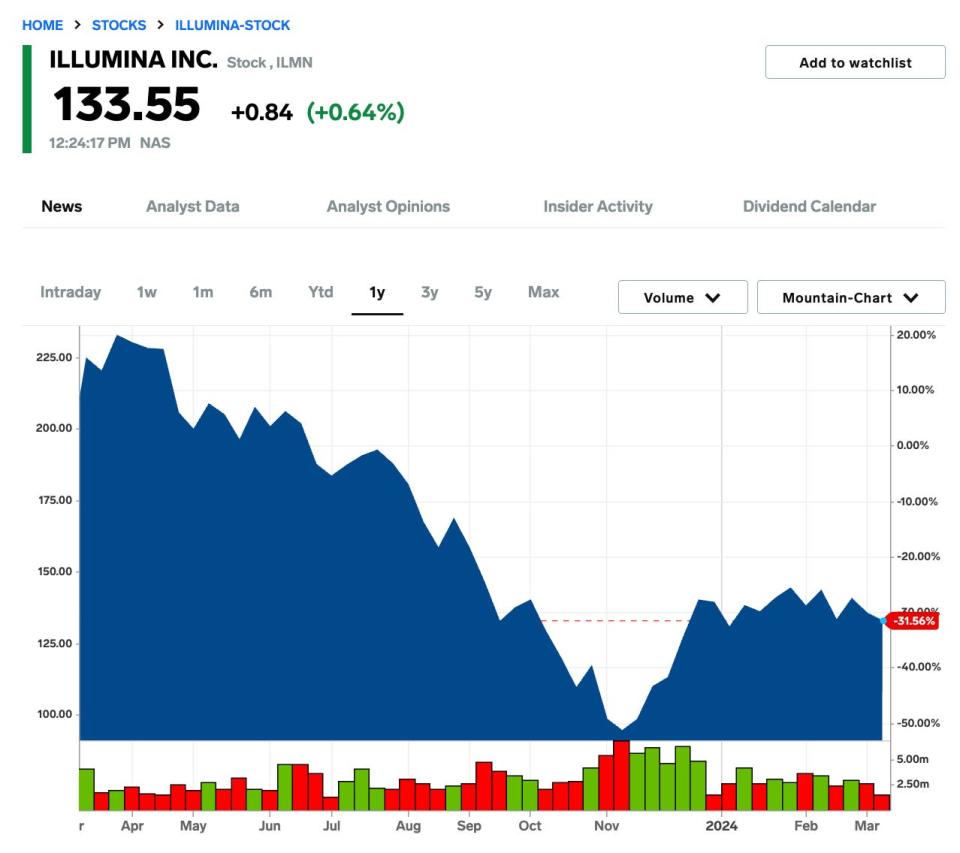

22. Illumina

Ticker: ILMN

Market cap: $21.1B

Sector: Healthcare

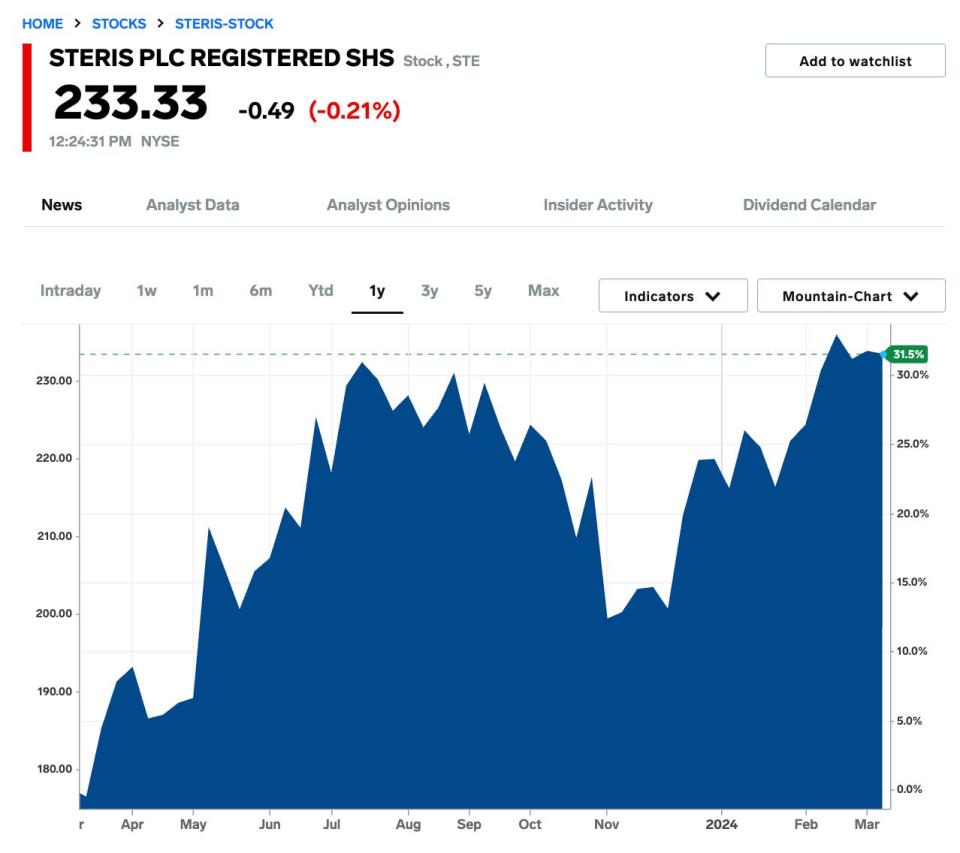

23. Steris

Ticker: STE

Market cap: $23B

Sector: Healthcare

24. Vertex Prescribed drugs

Ticker: VRTX

Market cap: $107B

Sector: Healthcare

25. Service World

Ticker: CARR

Market cap: $52.6B

Sector: Industrials

26. Caterpillar

Ticker: CAT

Market cap: $170.9B

Sector: Industrials

27. Generac

Ticker: GNRC

Market cap: $7B

Sector: Industrials

28. Outdated Dominion Freight Line

Ticker: ODFL

Market cap: $47.8B

Sector: Industrials

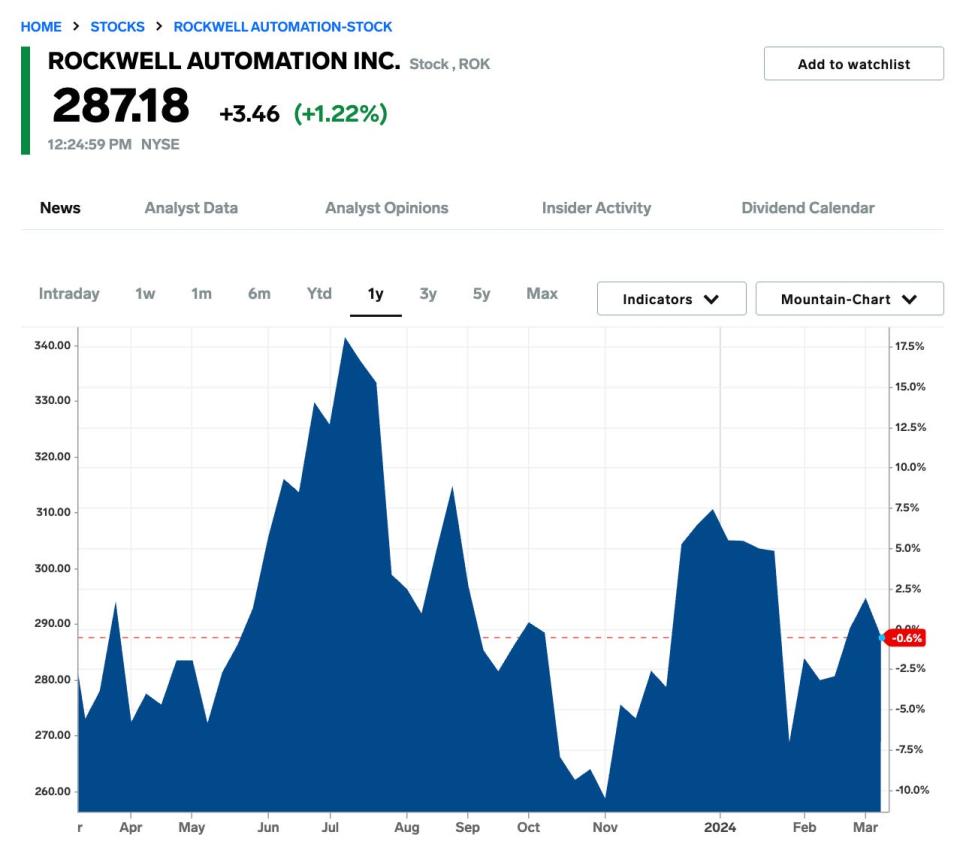

29. Rockwell Automation

Ticker: ROK

Market cap: $32.9B

Sector: Industrials

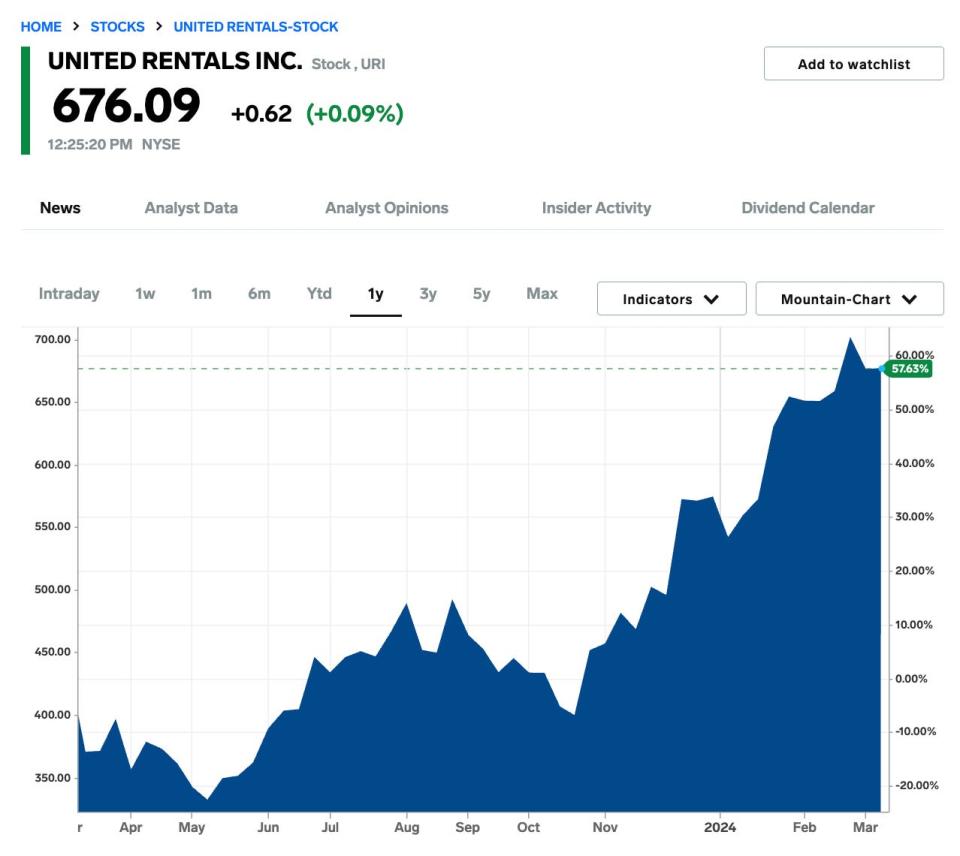

30. United Leases

Ticker: URI

Market cap: $45.5B

Sector: Industrials

Learn the unique article on Business Insider