Nvidia’s (NASDAQ: NVDA) inception aimed to revolutionize 3D laptop graphics for gaming and multimedia sectors. Initially attaining success with numerous chips, the corporate made a major leap in 1999 with the introduction of the Nvidia GeForce 256, the world’s first graphics processing unit (GPU).

This milestone had culminated within the newest GeForce RTX 40 Collection, which may ship life-like graphics to digital content material with the assistance of Deep Studying Tremendous Sampling (DLSS), an unimaginable innovation by Nvidia. DLSS makes use of artificial intelligence (AI) to create extra frames in a online game scene and improve picture high quality.

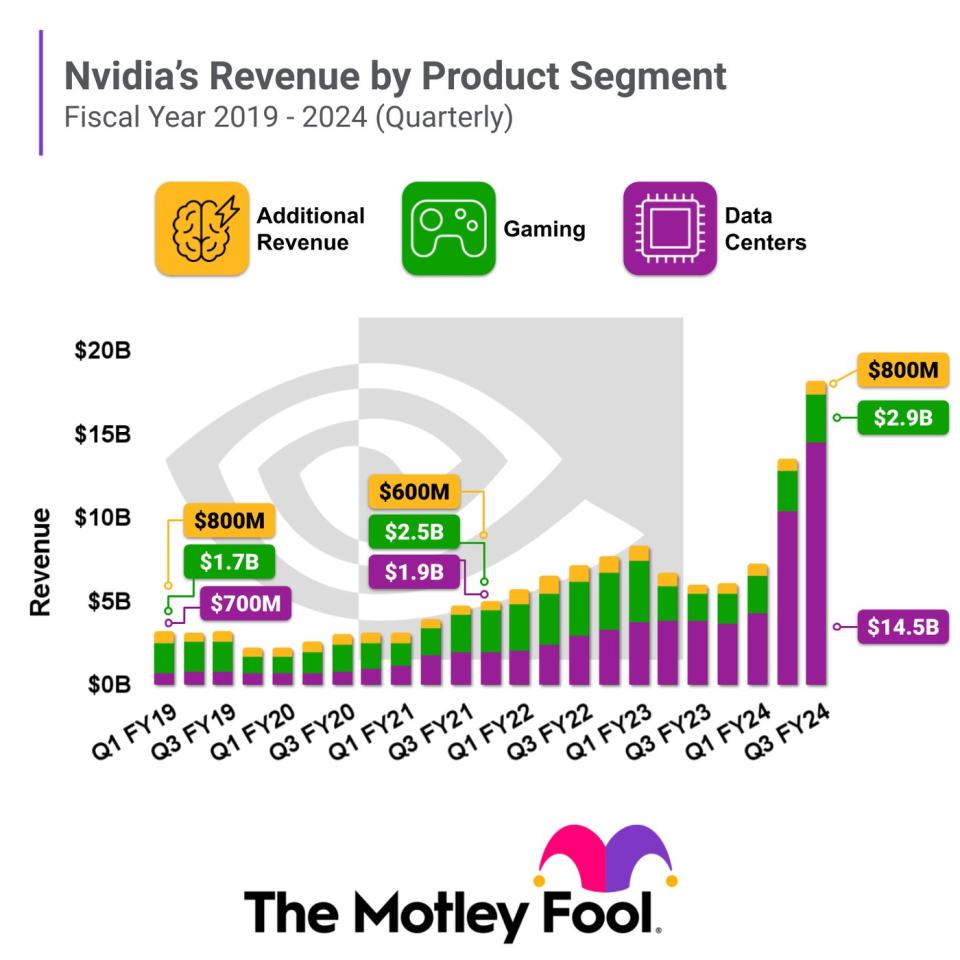

Till fiscal 2022 (ended Jan. 30, 2022), gaming was routinely Nvidia’s largest income driver. The phase generated $12.5 billion in gross sales that yr, which accounted for 46% of the corporate’s whole income. However then, all the pieces modified:

Synthetic intelligence is reworking the information middle

Information facilities was the place firms saved priceless data, however have since developed to change into centralized hubs for on-line operations (in any other case generally known as cloud computing). At the moment, knowledge facilities are residence to highly effective chips designed by Nvidia to course of AI workloads.

The shift started in 2016 when Nvidia delivered the primary AI supercomputer to OpenAI, which it used to develop the early generative AI fashions that culminated within the well-known ChatGPT on-line chatbot.

Now, Nvidia’s main H100 knowledge middle GPUs promote for as much as $40,000 a pop. With centralized knowledge middle operators like Microsoft and Amazon ordering a whole bunch of hundreds of them to provide cloud clients the computing energy they should develop AI.

It despatched Nvidia’s knowledge middle income hovering 279% yr over yr within the fiscal 2024 third quarter (ended Oct. 29, 2023). The information middle phase now accounts for 80% of Nvidia’s whole income, leaving the gaming phase within the mud.

Nvidia is now a $1.8 trillion behemoth, and $1 trillion of that worth was created within the final 12 months alone. The excellent news is that Nvidia stock could probably still go higher from right here.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 5, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Idiot has a disclosure policy.

Gaming Was Nvidia’s Largest Business. Now, 80% of Its Revenue Comes From Somewhere Else Entirely was initially printed by The Motley Idiot