Redwood Belief (NYSE: RWT) pays a reasonably attractive dividend. The mortgage-focused actual property funding belief (REIT) at present yields 8.8%. That is a number of instances above the S&P 500‘s 1.5% dividend yield.

Nonetheless, as alluring because the mortgage REIT‘s yield might sound, traders ought to overlook about that big-time payout. That is as a result of they will earn even larger yields from Power Switch (NYSE: ET) and MPLX (NYSE: MPLX). The power master limited partnerships (MLPs) at present yield over 9%. Additional, these MLPs usually tend to enhance their already high-yielding distributions sooner or later, which is not one thing traders can depend on Redwood doing.

A spotty dividend monitor file

Redwood Belief is a mortgage REIT centered on investing in loans for single-family and rental properties. It focuses on jumbo loans used to finance properties which are too costly for a traditional conforming mortgage ($766,500 in most counties for 2024). It additionally engages in business-purpose lending by offering traders with rental property loans. Whereas these are smaller niches than typical mortgage loans, they’re nonetheless very giant market alternatives. Additional, these markets might be very worthwhile (Redwood can earn a double-digit return on its belongings utilizing leverage).

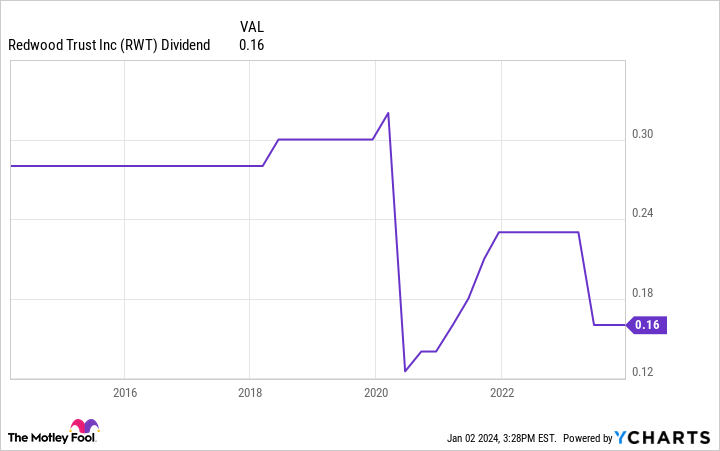

The difficulty with Redwood Belief is that its revenue might be risky attributable to modifications in rates of interest and mortgage defaults. That variability has compelled the REIT to chop its dividend a number of instances through the years:

The corporate most just lately lower its payout in June by round 30%. In commenting on the discount, CEO Christopher Abate said, “We imagine the Board’s determination to align the widespread dividend with our anticipated near-to-medium time period earnings profile enhances our capacity to capitalize on development alternatives throughout our companies and is supported by our sturdy liquidity place.” The corporate hopes these growth-related investments will drive larger returns so it will possibly enhance its dividend sooner or later. Nonetheless, because the above chart reveals, it has a spotty dividend development file. Due to that, it isn’t the best choice for these searching for a sustainable and rising dividend.

The gasoline to proceed rising their dividends

Power Switch and MPLX have performed a a lot better job distributing money to their traders. MPLX has elevated its payout each single 12 months because it got here public in 2012, together with by 10% final 12 months. Whereas Power Switch hasn’t been fairly that constant, it has steadily elevated its payout through the years, exterior of a slight blip through the pandemic when it briefly lowered its distribution to retain more money. It shortly returned its payout to its pre-pandemic degree and has since resumed its development.

Their secure and rising money flows are a giant driver of their steadily rising payouts. The pipeline firms generate a lot of recurring revenue backed by long-term contracts and government-regulated fee buildings. They sometimes distribute greater than half of that money to traders. They keep the remaining to fund growth tasks and keep strong stability sheets to allow them to make acquisitions.

Power Switch made two notable acquisitions final 12 months. It additionally has just a few billion {dollars} of growth tasks underneath development (and a number of other extra tasks underneath growth). These and future growth-related investments will enhance the MLP’s money movement. That rising money movement fuels the corporate’s expectation that it will possibly enhance its 9.1%-yielding distribution by round 3% to five% per 12 months.

In the meantime, MPLX has a number of growth tasks at present underneath development that ought to come on-line over the following two years. It additionally has a really sturdy cash-rich stability sheet, giving it the flexibleness to make acquisitions as alternatives come up. These investments ought to develop its money movement, giving it extra gasoline to extend its 9.3%-yielding distribution.

Go for the rising payouts

Redwood Belief has had hassle paying a sustainable dividend through the years. It has lower its payout a few instances, together with by 30% final 12 months. Whereas the corporate hopes that its newest discount will allow it to retain more money to fund growth-related investments so it will possibly enhance its payout sooner or later, that may not occur.

Due to that, income-focused traders ought to overlook about Redwood Belief and contemplate Power Switch or MPLX as an alternative. The MLPs provide higher-yielding payouts that they need to have the ability to proceed rising sooner or later. That ought to enable their traders to earn extra revenue over the long run.

Do you have to make investments $1,000 in Redwood Belief proper now?

Before you purchase inventory in Redwood Belief, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Redwood Belief wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Matthew DiLallo has positions in Power Switch. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

Forget This 8.8%-Yielding Dividend Stock. Consider These Even Higher-Yielding Payouts Instead. was initially revealed by The Motley Idiot