A lot ado has been made about Malaysia’s relationship with China, and nowhere is that this extra obvious than in commerce. By now, it ought to be self-evident that Malaysia and China have sturdy financial ties: in 2023, bilateral commerce reached $99 billion whereas Malaysia’s inventory of Chinese language international direct funding (FDI) was nearly $8 billion. Each governments purpose to deepen this relationship additional, recently emphasizing digital and inexperienced improvement.

In response, some observers, each in Malaysia and overseas, have raised alarm, framing Malaysia’s relationship with China as one among “overreliance” or as reflecting a “tilt” towards Beijing. Others go additional, concluding that Malaysia is now unabashedly “pro-China.” Nonetheless, an analysis of bilateral and multilateral financial patterns, grounded in information quite than rhetoric, paints a extra nuanced image.

Gravity Issues

China has been Malaysia’s largest trading partner since 2009, a reality that’s typically cited in assist of claims of financial overdependence. Throughout his March 2023 go to to Beijing, Prime Minister Anwar Ibrahim addressed this dynamic, remarking, “Given the precedence, we come to China first. However as a buying and selling nation, we should preserve wonderful relationship[s] with all, together with the US.”

In its essence, Anwar’s remark, regardless of inadvertently creating room for sensationalist misinterpretation, alludes to the gravity model of trade, an empirically backed commentary that commerce flows lower with geographical distance, all else being equal. In different phrases, it shouldn’t be stunning that China is such an necessary buying and selling accomplice for Malaysia, given its measurement and proximity to the nation, earlier than even contemplating the financial buildings and comparative benefits of each nations.

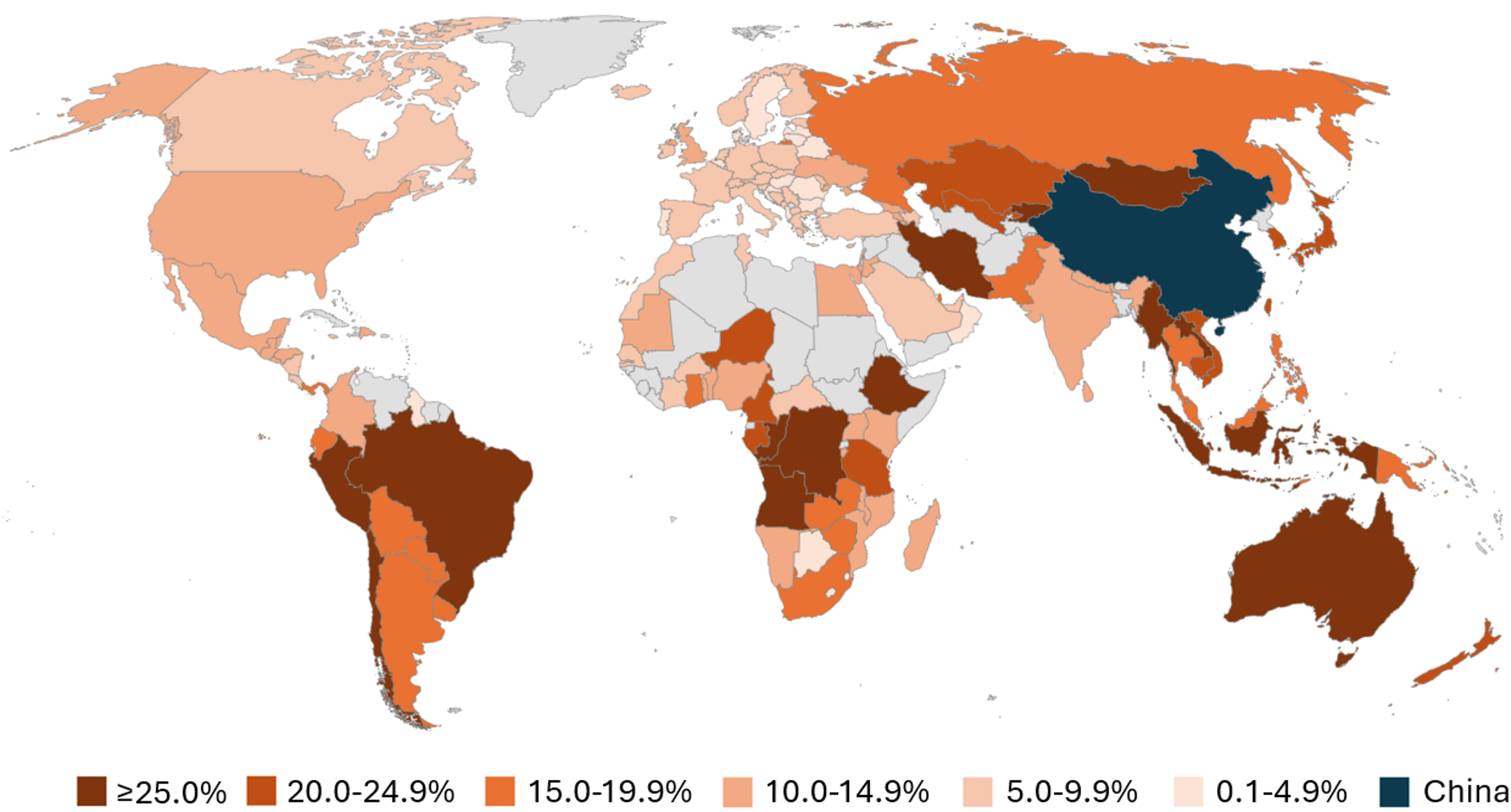

The Malaysian case just isn’t distinctive; certainly, it mirrors international traits. In response to information extracted from the U.N. Comtrade database, mainland China is the biggest buying and selling accomplice of 55 international locations worldwide, greater than some other particular person nation. This contains a lot of the Asia-Pacific in addition to Brazil, Egypt, Germany, and huge swathes of sub-Saharan Africa. Throughout Asia, the principle exceptions are small international locations nearer to a bigger neighboring accomplice’s financial sphere of affect, together with Nepal with India, Timor-Leste with Indonesia, and Laos with Thailand.

Subsequently, the notion of “coming to China first” merely displays international commerce realities. For Malaysia, the close by Chinese language market, with its financial and inhabitants measurement, is an important supply of shopper demand and intermediate items. What issues just isn’t avoiding shut ties with China however constructing resilience by various commerce linkages throughout sectors, a objective Malaysia has demonstrably achieved, as outlined under.

It’s All Relative

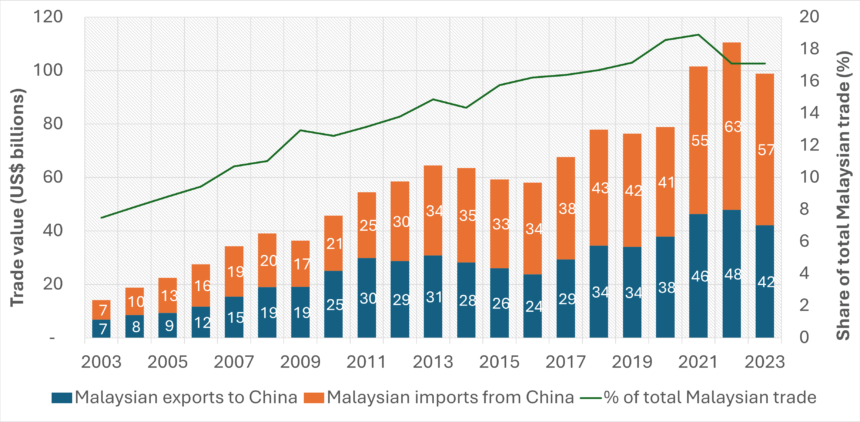

One other commentary is that China’s relative significance to Malaysian commerce has in reality declined lately. The share of Malaysia-China exports and imports to whole Malaysian commerce has decreased from its peak of 19 % in 2021 to 17 % in 2023, roughly on par with pre-pandemic traits (Fig. 1).

Supply: Writer’s calculations based mostly on U.N. Comtrade (2024)

This commerce share started to say no in 2022, the identical yr that bilateral commerce peaked at almost $111 billion. Since 2021, Malaysia’s total commerce development has outpaced its commerce with China, marked by an increase in ASEAN’s share of Malaysian commerce from 26 % to 27 %. Collectively, these traits spotlight Malaysia’s resilience amid studies of a Chinese language financial slowdown, as slower commerce with China has not had a direct, proportional influence on Malaysian commerce outcomes.

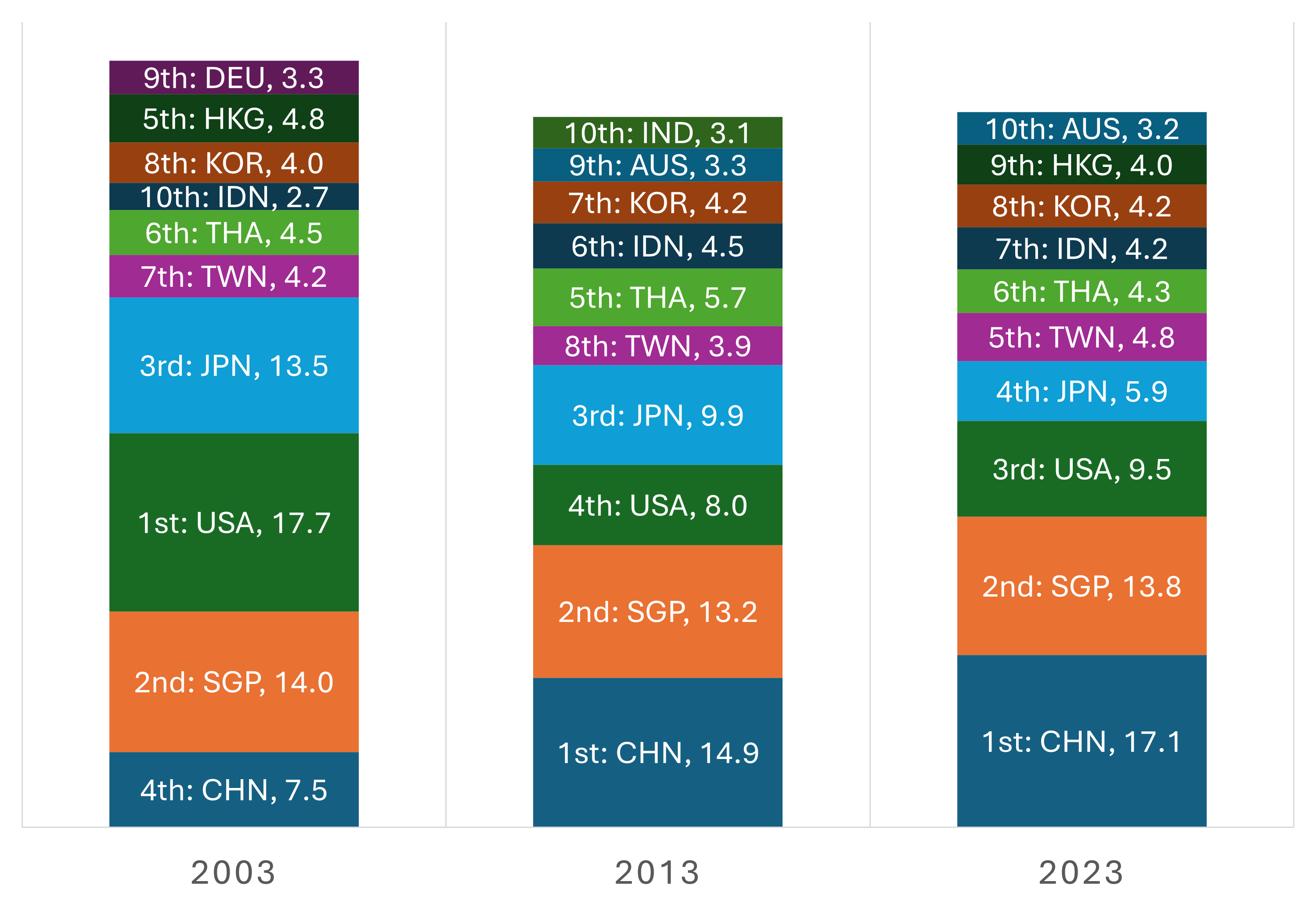

Wanting additional again, Malaysia’s commerce has diversified. China’s position in Malaysia’s commerce has grown since 2003, however right now’s total commerce focus is decrease than twenty years in the past (Fig. 2). For one, China’s present commerce share is under that of the US again in 2003, when the latter was Malaysia’s prime buying and selling accomplice. Moreover, Malaysia’s 5 largest buying and selling companions now account for 51 % of whole commerce, down from 58 % in 2003.

Malaysia’s commerce depth with China is near ASEAN’s common of 16 %, and effectively inside one normal deviation of the worldwide common of 13 %. Primarily based on information sourced from the U.N. Comtrade database, 40 different economies, together with Australia (29 %), Indonesia (25 %), Japan (20 %) and South Korea (22 %), have a considerably increased commerce reliance on China (Fig. 3), however considerations over perceived financial alignment with Beijing not often prolong to those circumstances.

Sectors and Sensibilities

The argument that Malaysia is overdependent on commerce with China is even much less compelling on the sectoral degree, as some industries work together extra with Chinese language companies than others.

In response to U.N. Comtrade information, Malaysia’s six largest business/commodity sectors by commerce worth in 2023 are electrical equipment and tools (33 % of whole Malaysian commerce), mineral fuels (18 %), equipment and mechanical home equipment (9 %), scientific devices (4 %), fat and oils (3 %), and plastics (3 %).

China is Malaysia’s largest buying and selling accomplice in solely three of those six sectors, with various commerce intensities. For plastics, China is the first import supply, accounting for 1 / 4 of sectoral commerce, over twice that of the following accomplice, Singapore at 11 %. In equipment and mechanical home equipment, 22 % of commerce includes China, with Singapore second at 15 %. For electrical equipment and tools, China leads at 19 %, however Singapore (16 %) and the U.S. (14 %) comply with intently, displaying no important overreliance on China on this strategic sector.

Within the three different sectors – mineral fuels (primarily petroleum), fat and oils (largely palm oil), and scientific devices – China’s commerce footprint is smaller. For fuels, China ranks fourth (9 %), at half the worth of Malaysia-Singapore commerce. In fat and oils, Malaysia exports extra to India than to China. For scientific devices, the U.S. ranks first (22 %), with China second (14 %).

This sectoral breakdown exhibits minimal proof of an unhealthy commerce dependence on China. Whereas claims of overreliance are sometimes imprecise, the info largely means that Malaysia has averted placing all its eggs within the Chinese language basket because of a various mixture of companions and merchandise. China’s primacy is noticed solely in plastics, a sector affected by international considerations over Chinese overcapacity, a problem Malaysia is trying to handle by commerce cures, as mentioned under.

Supply: Writer’s calculations based mostly on U.N. Comtrade (2024). Three-digit nation codes mirror ISO 3166 requirements.

Past Commerce

Claims of “overdependence” additionally prolong into areas past commerce like FDI. Concerns revolve round China’s stake in Malaysian infrastructure tasks by the Belt and Highway Initiative (BRI). This line of argument is two-fold: first, that China is Malaysia’s largest investor; and second, that BRI-linked FDI perpetuates “debt-trap diplomacy” amongst accomplice international locations like Malaysia.

These claims don’t align with the information. China just isn’t Malaysia’s foremost supply of FDI. As of 2023, China’s FDI inventory in Malaysia was $7.6 billion, lower than 4 % of the overall, effectively behind Singapore, the U.S., and Japan (Fig. 4a). China’s annual FDI inflows to Malaysia in the meantime quantity to simply $900 million for a similar yr, in comparison with the nationwide whole of $8.8 billion (Fig. 4b). Briefly, Chinese language funding constitutes a modest a part of Malaysia’s FDI portfolio.

Moreover, Malaysia’s exterior debt owed to China is minimal, estimated at 0.2 percent of GDP in 2017. Evaluation of AidData’s 2023 Global Chinese Development Finance dataset additionally signifies that almost all of Chinese language tasks in Malaysia contain non-public gamers or government-linked companies (GLCs) motivated by business concerns.

Corroborating this, a Chatham House report finds no proof of Chinese language geoeconomic maneuvering by the BRI. Certainly, Malaysia initiated most BRI tasks and has renegotiated some to go well with altering home priorities, as with the $16 billion East Coast Rail Link. Essentially, this signifies Malaysian company in making an attempt to maximise the BRI’s advantages according to home pursuits quite than any undue affect from Beijing.

Supply: Writer’s calculations based mostly on U.N. Comtrade (2024)

Lastly, the “debt-trap” narrative presupposes that Chinese language funding is inherently problematic. Removed from it, final yr’s accredited Chinese language FDI alone is predicted to create over 10,000 new jobs for Malaysians within the years to return, in line with the Malaysian Investment Development Authority. As well as, the Worldwide Financial Fund judged the nation’s exterior debt to be “manageable” in its March 2024 macroeconomic evaluation, countering the debt-trap considerations.

Company in Motion

The overdependence camp additionally claims repeatedly that Malaysia is “too deferential” to China, which overlooks Malaysia’s use of commerce cures and safeguards consistent with the multilateral rules-based order. As of the top of 2023, Malaysia had extra antidumping measures in place against China than towards some other nation, primarily duties on sure metal merchandise, according to recurring considerations about Chinese language overcapacity. In August 2024, Malaysia’s Ministry of Funding, Commerce, and Business opened a probe into plastic imports from China and Indonesia over alleged dumping. Any accusation that Malaysia kowtows to Chinese language financial pursuits due to this fact ignores Malaysia’s company in prioritizing nationwide pursuits when these are at odds with Chinese language actions.

Company extends to Malaysia’s pragmatic pursuit of broad international financial partnerships. Relations with China don’t preclude engagements with different international locations, as seen in Malaysia’s participation in financial frameworks such because the Complete and Progressive Settlement for Trans-Pacific Partnership (CPTPP) and the U.S.-led Indo-Pacific Financial Framework, which don’t contain China. Equally, Malaysia’s acceptance of BRI doesn’t impede its assist for different initiatives, just like the European Union’s International Gateway. The $16 billion Lumut Maritime Industrial City mission, as an illustration, is predicted to profit from EU funding. With the U.S., Malaysia has a memorandum of cooperation on semiconductor provide chain resilience, bolstered by its standing because the largest source of American semiconductor imports.

Company can be mirrored in intensified efforts to diversify commerce by better South-South cooperation, past Malaysia’s headline-grabbing BRICS membership application. For instance, Malaysia has formalized a bilateral Joint Trade Committee with Brazil, agreeing to strengthen semiconductor and vitality collaboration. With India, relations had been upgraded in August to a comprehensive strategic partnership, encompassing better authorities and enterprise engagement. Furthermore, because the upcoming ASEAN chair, Malaysia has additionally highlighted its curiosity in championing growth in intra-ASEAN trade.

Malaysia’s implicit geoeconomic strategy due to this fact demonstrates a balanced strategy, avoiding alignment with any single energy, whether or not China or the U.S.

The Overdependence Fable

On the finish of the day, studies of Malaysia’s overdependence on China have been drastically exaggerated. Imprecise and poorly outlined, these claims unravel upon shut examination of bilateral and multilateral commerce and funding information. Relatedly, there’s a flawed tendency to misconstrue Malaysia’s sturdy ties with China as an unbridled embrace of Beijing, which is perceived to return on the expense of Washington or Brussels. This reasoning overlooks the financial cooperation that Putrajaya has established with myriad international companions. It additionally fails to acknowledge Malaysia’s company in safeguarding its financial pursuits.

In the end, Malaysia’s strategic positioning transcends simplistic zero-sum narratives, showcasing its means to have interaction China with out pivoting away from both the West or the remainder. As a substitute, it displays the geoeconomic realities of a extremely open economic system navigating a posh, interconnected world.