With the third quarter winding down, and the ultimate quarter of the 12 months nearly upon us, it’s time to take inventory of inventory markets. The place are we more likely to go within the subsequent few months, and what are the doubtless forces to influence buying and selling? In some current feedback on CNBC, Citi strategist Scott Chronert lays out his personal perception that we’re more likely to see some additional beneficial properties.

Chronert first factors out that fears of a tough recession have pale, or as he places it, “We’ve been pricing in a comfortable touchdown because the first a part of June.” Backing this, Chronert states that the Fed’s price cycle is close to its peak, and that company earnings are more likely to stay resilient. At his backside line, Chronert provides, “I believe all instructed the stability remains to be to the upside into the top of the 12 months, and we’re going to fall again on our ongoing view that the elemental underpinning for the S&P stays fairly optimistic at this level.”

Working with this optimistic sentiment, the analysts at Citi pinpointed three names that they see as poised to ship over 40% beneficial properties. We ran this trio of Citi-recommended names by the TipRanks database to seek out out what the remainder of the Road has to say about them. It seems that every one three are rated as Buys by the analyst consensus. Let’s discover out why.

Tenting World Holdings (CWH)

We’ll begin within the leisure sector, with Tenting World Holdings, one of many largest corporations within the out of doors recreation area of interest. Tenting World is especially a seller in new and used leisure autos, in addition to RV leases, however the firm additionally offers in RV equipment, for each inside and outdoors the autos, in boats and different watercraft, in moveable turbines, and in tenting tools and equipment.

The corporate is a holding agency and operates primarily by two manufacturers: its eponymous Tenting World and the Good Sam model. By means of these subsidiaries, Tenting World Holdings has turn into the US leisure market’s largest RV seller and a pacesetter in associated out of doors and tenting merchandise. The agency makes a degree of figuring out its prospects and adjusting product traces to satisfy their preferences. It has been in enterprise since 1966.

Turning to firm outcomes, we discover that CWH reported record-level gross sales of used car items in 2Q23, the latest quarter reported. Nevertheless, the corporate’s top-line income of $1.9 billion fell greater than 13% year-over-year and missed the forecast by $70 million. On the backside line, Tenting World Holdings had a non-GAAP EPS of 73 cents per share, 3 cents beneath expectations.

Tenting World Holdings gives traders common share dividends and has a historical past of adjusting the fee to adapt to present situations. The latest declaration for 3Q23 set the widespread share fee at $0.125 per share or 50 cents annualized, giving a 2.3% yield. The fee is scheduled for September 29. The present dividend represents an 80% discount from the earlier quarter.

Shares on this veteran leisure firm tumbled after the earnings launch and dividend lower. The inventory is down 31% from pre-release ranges. For Citi 5-star analyst, James Hardiman, nevertheless, this discount in share worth marks a possibility for traders to purchase in.

“CWH is our High Decide within the RV house and we consider it’s one of the simplest ways to play an RV trade restoration, each time it arrives, as the corporate has a long-term macro-independent market share story pushed by M&A and scale in a fragmented trade. The RV trade is exhibiting preliminary indicators of stabilization and restoration that we consider will start to play out over the course of 2024 and past. We count on pricing/margin to stay below strain for RV producers in 2024, which may assist spur demand for RV sellers. In the meantime, shares have offered off just lately, offering what we consider is a pretty entry level from a valuation perspective,” Hardiman opined.

Primarily based on that bullish stance, Hardiman charges CWH inventory a Purchase and provides it a $32 worth goal, implying a one-year upside potential of ~48%. (To observe Hardiman’s observe file, click here)

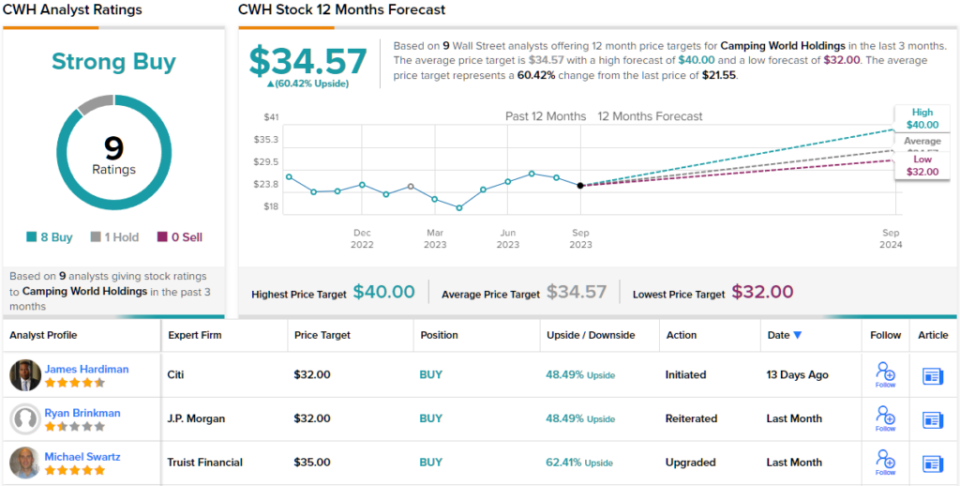

General, the Road stays bullish on CWH. The inventory’s 9 current analyst evaluations break down 8 to 1 favoring Buys over Holds, for a Sturdy Purchase consensus score, and the $34.57 common worth goal suggests a 60% one-year acquire from the present buying and selling worth of $21.55. (See CWH stock forecast)

Sociedad Quimica Y Minera de Chile (SQM)

Subsequent below the Citi microscope is SQM, a Chilean mining agency with a robust presence within the lithium trade. SQM is the world’s single largest producer of lithium and can also be identified for its work within the chemical trade, the place it produces iodine and potassium utilized in plant fertilizers and industrial chemical substances. The corporate has famous that lithium gross sales volumes are at file ranges, pushed by elevated demand – notably within the electrical car market.

Along with manufacturing work, SQM additionally distributes lithium. This 12 months, the corporate has entered into new agreements with Ford Motor Firm and LG Power Options for the long-term provide of lithium, a transfer that guarantees to maintain the corporate’s gross sales at excessive ranges. Decrease spot costs within the Chinese language lithium markets, nevertheless, are having a miserable impact on SQM’s backside line.

That is mirrored in misses in each revenues and earnings within the firm’s final reported outcomes. Particularly, SQM’s second-quarter topline of $2.05 billion was down 21% year-over-year and missed the estimates by $74.5 million. On earnings, the Q2 EPS of $2.03 was 61 cents beneath expectations.

SQM shares have declined greater than 21% up to now this 12 months. That decline doesn’t trouble Citi analyst Carolina Cruzat, nevertheless, who believes that SQM is promoting effectively beneath the place it ‘ought to.’

“Considering that SQM has been an underperformer within the native market and present valuations appear to be on the underside, we consider the share low cost to be extreme, contemplating: (i) strong mid-term fundamentals on the lithium market; and (ii) the inventory is at present priced beneath the worth of the money flows till 2030, with a related upside in the event that they get honest renewal situations on their lease settlement with Corfo. We consider traders internalize a really damaging situation relating to the potential consequence from the proposed new lithium regulatory framework, even when it means dropping the concession over the Salar de Atacama,” Cruzat defined.

Including that the primary dangers listed here are already priced in, Cruzat charges the inventory a Purchase. Her worth goal, of $85, factors towards a 42% upside potential on the one-year horizon.

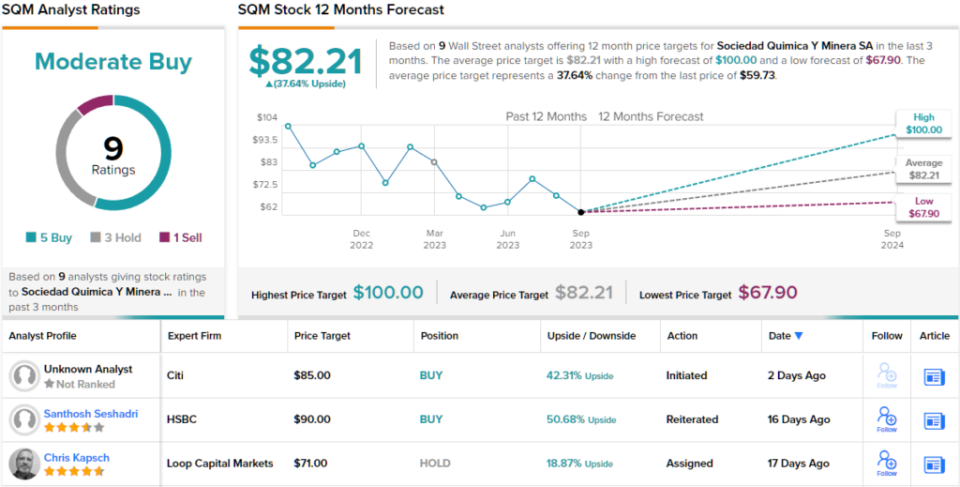

What does the remainder of the Road assume? Trying on the consensus breakdown, opinions from different analysts are extra unfold out. 5 Buys, 3 Holds and 1 Promote add as much as a Reasonable Purchase consensus. As well as, the $82.21 common worth goal signifies ~38% upside potential from present ranges. (See SQM stock forecast)

Sunrun, Inc. (RUN)

Final however not least is Sunrun, a pacesetter within the discipline of residential solar energy installations. Sunrun is named a full-service supplier within the house photo voltaic area of interest, designing, constructing, and putting in package deal photo voltaic offers and made-to-order installations for single-family houses. Their packages embody every little thing wanted for a selected set up, from rooftop photovoltaic panels to native grid connections, in addition to good management methods and energy storage batteries.

Along with house photo voltaic installations, Sunrun additionally gives financing companies. Prospects can select to pay in full upfront or amortize the complete price of the set up as a lease on the tools, with long-term or month-by-month fee choices. Sunrun payments itself because the #1 firm within the US residential solar energy market, with over 800,000 prospects throughout 22 states plus Puerto Rico and $1.1 billion in annual recurring income.

This sturdy basis is the results of Sunrun’s ongoing efforts to increase its presence available in the market. Whereas income in 2Q23, the final reported, elevated by just one% year-over-year to $590.2 million, the corporate achieved notable milestones. Gross sales exercise exterior the state of California, the place the corporate has its largest footprint, grew by 25% year-over-year. Furthermore, the full put in storage capability elevated by 35% year-over-year, reaching 103 megawatt hours. The corporate’s most stunning achievement, nevertheless, was posting a web revenue of 25 cents per diluted share in Q2, surpassing the anticipated web loss by 64 cents per share.

The corporate’s non-California development caught the attention of Citi analyst Vikram Bagri, who sees that as an vital issue supporting the inventory going ahead.

“Increased charges and NEM impacts seem like largely priced-in, however RUN is just not getting due credit score for 1) market share beneficial properties from TPO shift, 2) path to FCF era, 3) no company degree fairness raises, 4) projected element price deflation, 5) ITC adder advantages, and 6) demonstrated success in promoting battery storage (>80% connect price on new gross sales in CA and >30% nationally). CA will face headwinds in ’24 however RUN’s main >60% TPO market share and financing runway means consensus expectations for ~6% MW set up development in FY24 seem achievable as shoppers hunt down photo voltaic+storage to avoid wasting on utility payments. As well as, we consider there may be upside to web subscriber worth estimates,” Bagri opined.

“We obtained a number of questions on valuation for RUN and consider the inventory is conservatively value ~$21/sh within the LT,” Bagri provides, mentioning a strong backside line to his stance.

General, the analyst’s Purchase score and $21 worth goal point out confidence in a 48% acquire going ahead into subsequent 12 months. (To observe Bagri’s observe file, click here)

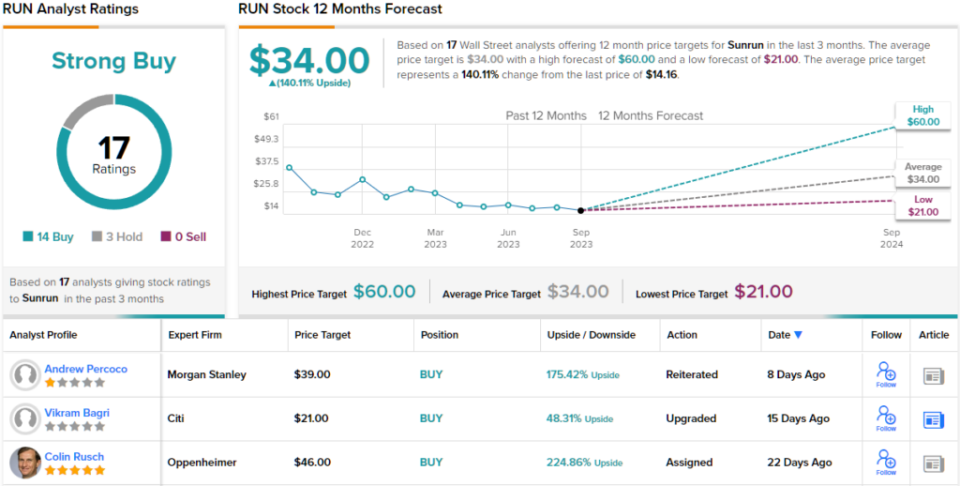

The Citi view could turn into the conservative have a look at Sunrun – the inventory’s Sturdy Purchase consensus score relies on 17 analyst evaluations that embody 14 Buys and three Holds. The shares are priced at $14.16 and the $34 common worth goal suggests a strong upside of 140%. (See RUN stock forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.