In terms of synthetic intelligence (AI), the “Magnificent Seven” shares most likely come to thoughts. The moniker contains the vast majority of megacap firms main the AI revolution: Apple, Alphabet, Microsoft, Nvidia, Tesla, Meta Platforms, and Amazon.

One firm that is perhaps getting neglected within the AI arms race is Palantir (NYSE: PLTR). Whereas the info analytics firm is greatest identified for its shut ties to the U.S. military and its allies, Palantir is excess of a authorities contractor. It has a growing presence in the private sector and works with clients throughout a wide range of markets.

But regardless of this, the inventory is buying and selling roughly 50% under its all-time highs. And whereas some on Wall Road stay skeptical of Palantir’s long-term potential, one notable investor specifically has been shopping for the dip. The funds of ARK Make investments CEO Cathie Wooden have ratcheted up their shopping for of Palantir as of late.

For the buying and selling interval between Dec. 6 and Dec. 15, Ark funds bought 1.7 million shares in Palantir inventory throughout three exchange-traded funds (ETFs). Whereas the corporate represents only one.2% of Ark’s mixed portfolio, it has an even bigger place than a lot of the Magnificent Seven shares.

With the inventory buying and selling for simply $18 per share as of this writing, now could be a terrific time to evaluate Palantir’s prospects.

What is going on on?

A latest bearish analyst report from funding financial institution William Blair spurred a sell-off in Palantir inventory that wiped practically $4 billion off its market capitalization.

William Blair analyst Louie DiPalma expressed considerations a couple of contract that Palantir has with the U.S. Military, suggesting that the upcoming renewal of that contract could also be for lower than the unique deal’s worth. As of this morning, Dec. 15, Palantir helped curtail these worries because the Military contract renewed for an extra yr. Whereas the preliminary deal was a multiyear contract, long-term traders should not get hung up on the extension being for just one yr. Slightly, there are a number of the reason why traders ought to imagine the sell-off was overblown and could possibly be a shopping for alternative.

Demand for AI-powered providers is off the charts

It is essential to remember the fact that the Military contract is only one deal. The developments Palantir has made in synthetic intelligence have led to a surge in demand for its providers that I feel is being neglected. Earlier this yr, it launched a brand new product known as the Palantir Synthetic Intelligence Platform (AIP), which makes use of generative AI and large language models (LLMs) to assist resolve complicated operational challenges.

Whereas this may occasionally sound much like the options provided by among the huge tech giants, Palantir could have an edge due to its artistic lead generation technique. The corporate has been internet hosting immersive seminars it calls “boot camps,” at which potential clients can take a look at out its software program platforms. The purpose of those occasions is to shortly establish use instances for its providers, giving Palantir a possibility to promote merchandise and increase gross sales to clients as time goes on.

Whereas the boot camps are nonetheless a brand new innovation for the corporate, demand to attend them is off the charts. Throughout Palantir’s third-quarter earnings name, Chief Technoloyg Officer Shyam Sankar mentioned, “we’re operating extra boot camps per 30 days than we had U.S. business pilots all final yr.” The corporate had carried out boot camps for 200 organizations by way of November.

These boot camps signify a method for Palantir to doubtlessly seize a chunk of the rising AI marketplace for little value, and maybe shorten its gross sales cycle considerably. As firms attend the seminars and convert into paying clients, Palantir has a possibility to cross-sell and upsell merchandise at a sooner fee. In concept, this could assist it speed up its income progress whereas maintaining its spending on gross sales, advertising, and buyer retention low.

Is Palantir’s valuation justified?

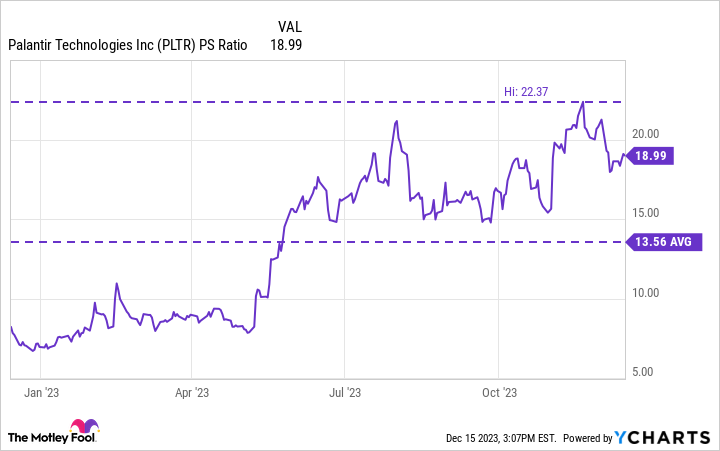

The chart under reveals that Palantir’s price-to-sales (P/S) ratio of 19 is at the moment properly above its one-year common and inching towards prior highs. Whereas this may occasionally appear a little bit wealthy, I see Palantir as deserving of a premium.

In contrast to a lot of its software-as-a-service (SaaS) cohorts, Palantir is already worthwhile on a GAAP (typically accepted accounting rules) foundation. In reality, given its constant earnings, Palantir is eligible for inclusion in the S&P 500, an enormous milestone for any firm. The factor long-term traders ought to be contemplating right here is the tempo at which Palantir’s choices are being adopted and deployed.

For example, throughout Q3 Palantir practically tripled its AIP customers. Based on administration, since its launch 5 months in the past, 300 distinctive organizations have deployed AIP. Whereas it is clear that the boot camps are driving curiosity in Palantir’s merchandise, traders ought to remember the fact that these prospects are contributing little to no income for Palantir at the moment. Slightly, it is the rising curiosity in attending and testing out AIP that might function a proxy of what Palantir’s future might appear to be. It is these long-term secular tailwinds that appeal to traders like Wooden, and underscore her conviction to purchase when the inventory falls off a cliff.

In the long term, Palantir’s skill to speed up income progress whereas additionally sustaining earnings appears to be like achievable. Because the inventory experiences some pronounced promoting exercise, now appears to be like like an unimaginable alternative to start dollar-cost averaging right into a long-term place for this AI disrupter.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Palantir Applied sciences wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 11, 2023

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Datadog, Meta Platforms, Microsoft, MongoDB, Nvidia, Palantir Applied sciences, ServiceNow, Snowflake, and Tesla. The Motley Idiot has a disclosure policy.

Cathie Wood Just Made a Big Purchase of This Artificial Intelligence (AI) Stock. You Could Follow Her Lead for Less Than $20 per Share. was initially revealed by The Motley Idiot

:max_bytes(150000):strip_icc()/VWFit-healthy-travel-tips-7559114-59f006bd20b44eaea438049925d787b8.jpg)