(Bloomberg) — Bond buyers who had been as soon as satisfied that the Federal Reserve would begin chopping rates of interest this week are painfully surrendering to a higher-for-longer actuality and a murky path ahead for the market.

Most Learn from Bloomberg

Treasury yields spiked in current days and are on the cusp of setting new highs for the 12 months as information continues to level to persistent inflation, which is inflicting merchants to push again their timetable for US financial easing.

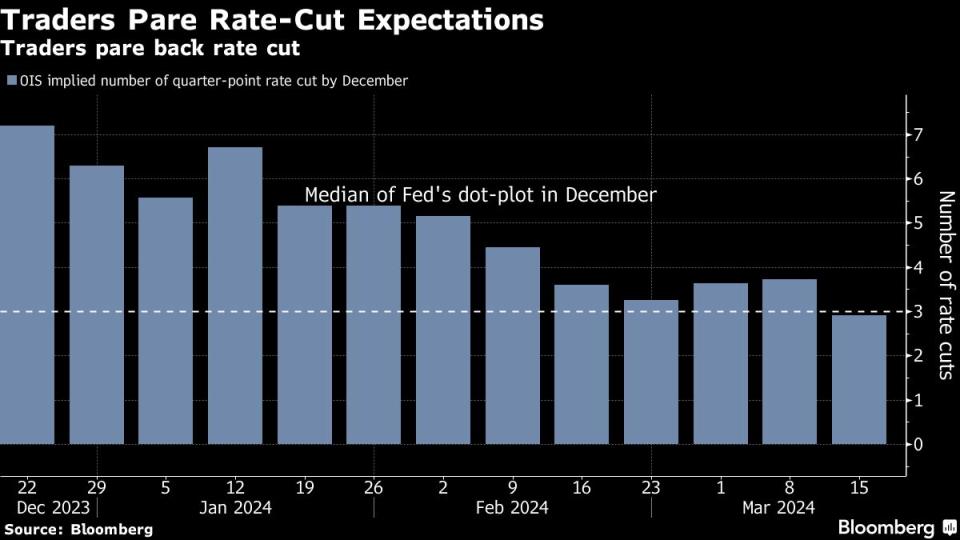

Curiosity-rate swaps now mirror market expectations for fewer than three quarter-point charge cuts this 12 months. That’s lower than the Fed’s median projection in December and a shade of the six reductions that had been priced in on the finish of 2023. And the primary transfer decrease? Buyers are now not assured that it’ll even occur within the first half of the 12 months.

The shift underscores mounting worries that US central bankers led by Fed Chair Jerome Powell might sign a fair shallower easing cycle at this week’s two-day gathering, which begins on Tuesday. Already, economists at Nomura Holdings Inc. scaled again their estimate for Fed charge reductions this 12 months to 2 cuts from three. And up to date buying and selling flows in choices markets present buyers are in search of safety towards the chance of upper long-term yields and fewer charge cuts — even when their longer-term view is for charges to finally come down.

“The Fed desires to ease however the information isn’t permitting them,” mentioned Earl Davis, head of fastened earnings and cash markets at BMO International Asset Administration. “They need to keep optionality to ease in summer time. However they are going to begin to change, if the labor market is tight and inflation stays excessive.”

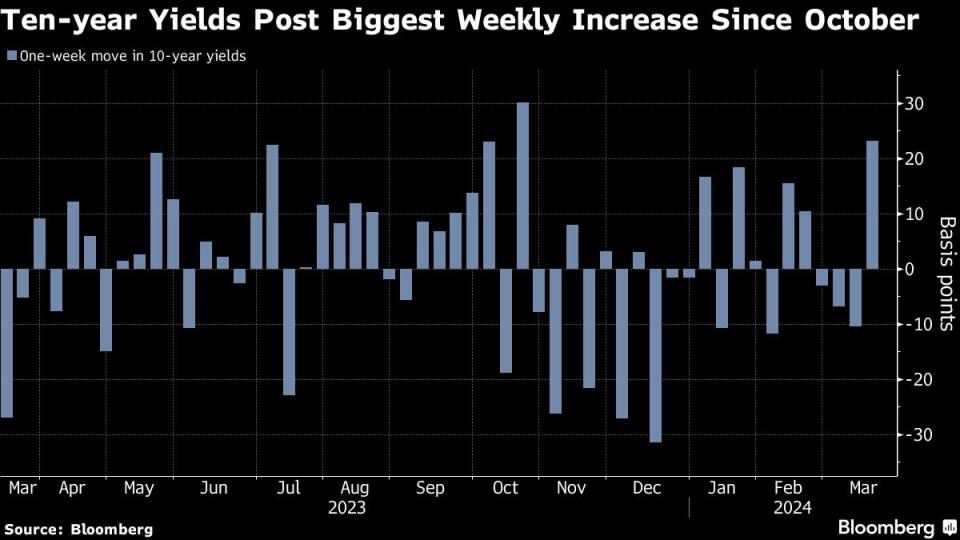

US 10-year yields jumped 24 foundation factors final week, probably the most since October, to 4.31% — nearing their year-to-date excessive of 4.35%. Davis sees 10-year yields rising towards 4.5% a transfer that might finally provide an entry level for him to purchase bonds. The benchmark rose above 5% final 12 months for the primary time since 2007.

Each two- and five-year US yields surged greater than 20 foundation factors, for his or her greatest rise since Might. The selloff prolonged Treasuries’ losses for the 12 months to 1.84%.

As not too long ago as December, bond merchants had been all however sure the Fed would begin to ease at this week’s assembly. However after a raft of surprisingly robust information on progress and inflation, they see zero probability of motion this week, slim odds of a transfer in Might and solely a 60% risk of a reduce in June. For the 12 months, merchants have penciled in expectations for a complete discount of 71 foundation factors, that means a 3 full-quarter-point reduce is now not seen as assured.

For its half, Nomura now sees the Fed easing in July and December, as a substitute of in June, September and December. “With little urgency to ease, we anticipate the Fed will wait to see whether or not inflation is slowing earlier than starting a rate-cut cycle,” economists together with Aichi Amemiya wrote in a observe.

The margin to shift the Fed’s median charge projections on its so-called dot-plot is skinny. It could take solely two policymakers switching to 2 cuts this 12 months from three for the central financial institution’s median forecast to maneuver larger.

Learn extra: Bond Merchants Prep for Dot Plot, With Three Cuts in Query

“It’s not going to take lots” for the median dots to maneuver larger, mentioned Ed Al-Hussainy, a charges strategist at Columbia Threadneedle Funding. “What I’m nervous about is the entrance finish of the curve. It’s super-sensitive to the near-term coverage path.”

Even when 2024 median charge projections stay intact, the dots in 2025 and 2026 in addition to the long-term “impartial” charge — the extent seen as neither stoking progress or holding it again — might transfer larger, a situation will immediate merchants to cost in much less charge reductions, in line with Tim Duy, chief US economist at SGH Macro Advisors LLC.

“We don’t assume market individuals want to attend for the Fed’s permission” to cost in much less cuts, wrote Duy. If the two-cut situation doesn’t materialize this week, it could come by the June assembly, “or a minimum of that market individuals will worth it as coming by June,” he added. “The dangers at this second are decidedly uneven.”

What Bloomberg Intelligence Says …

“Modifications are prone to be incremental, although the knee-jerk response to a transfer larger within the 2024 dot could also be shortly discounted if the 2025 dots are largely unchanged. …the market is delicate to the tip of subsequent 12 months dots, that means charge markets might deal with 2025.”

— Ira Jersey, chief US interest-rate strategist

As an alternative of sweating over two or three reductions, buyers shouldn’t lose the massive image that the Fed’s subsequent transfer is a reduce, not a hike, mentioned Baylor Lancaster-Samuel, chief funding officer at Amerant Investments Inc. Meaning it’s time to purchase bonds and take the interest-rate, or “length” danger, in Wall Avenue parlance.

“You possibly can debate the timing, however in our opinion, the Fed continues to be prone to reduce someday this 12 months,” mentioned Lancaster-Samuel. “In that setting, we expect the extent of charges doesn’t have an excessive amount of danger of ratcheting larger from right here. So we consider the chance price of not taking length is larger than the chance of taking it.”

Choices merchants are much less sanguine. On the heels of final week’s stronger-than-expected information on producer costs, merchants rushed to purchase hawkish safety for this 12 months and subsequent in choices linked to the Secured In a single day Financing Fee, a measure which intently tracks the central financial institution coverage charge.

“Increased inflation readings, coupled with outsize deficits, the potential for the Fed to stay on maintain longer, lends itself to a different transfer towards the 2023 yield highs,” mentioned Gregory Faranello, head of US charges buying and selling and technique for AmeriVet Securities.

What to Watch

-

Financial information:

-

March 18: New York Fed providers enterprise exercise; NFIB housing market index

-

March 19: Constructing permits; housing begins; TIC flows

-

March 20: MBA mortgage functions; FOMC assembly

-

March 21: Present account stability

-

March 21: Philadelphia Fed enterprise outlook; preliminary jobless claims; S&P International US manufacturing PMI; main index; current dwelling gross sales

-

-

Fed calendar:

-

March 21: Vice Chair for Supervision Michael Barr

-

March 22: Chair Jerome Powell, Vice Chair Philip Jefferson and Governor Michelle Bowman at Fed Listens occasion; Barr; Atlanta Fed President Raphael Bostic

-

-

Public sale calendar:

-

March 18: 13-, 26-week payments

-

March 19: 52-week payments; 42-day money administration payments; 20-year observe re-opening

-

March 20: 17-week payments

-

March 21: 4-, 8-week payments; 10-year TIPS re-opening

-

—With help from Edward Bolingbroke.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.