2024 is off to a red-hot begin. The S&P 500 has soared to report ranges as mega-cap tech shares, specifically, proceed to gas the bogus intelligence (AI) narrative.

The benchmark had final bottomed round October 2022. A lot of the market rebound since, particularly in 2023, was influenced by enthusiasm in AI, and this optimistic sentiment has thus far poured over into this yr.

Particularly, the “Magnificent Seven” shares, Microsoft, Alphabet, Apple, Amazon, Tesla, Meta Platforms, and Nvidia (NASDAQ: NVDA), have performed a serious position in pushing the market larger. Of this unique membership, Nvidia could also be an important. Demand for the corporate’s graphics processing models (GPUs) is off the charts, as generative AI has grow to be the forefront of IT budgets.

Regardless of a 264% surge within the inventory worth over the past yr, many traders see even brighter days forward for Nvidia. Hans Mosesmann of Rosenblatt Securities has a worth goal of $1,400 for Nvidia inventory — implying about 61% upside from present buying and selling ranges.

Let’s dig into why Nvidia could possibly be headed even larger and assess if now is an effective alternative to scoop up some shares.

Nvidia is a money-printing machine

On the core of Nvidia’s record-setting progress are its A100 and H100 GPUs. These GPUs are serving to spearhead generative AI functions in machine studying, accelerated computing, and extra.

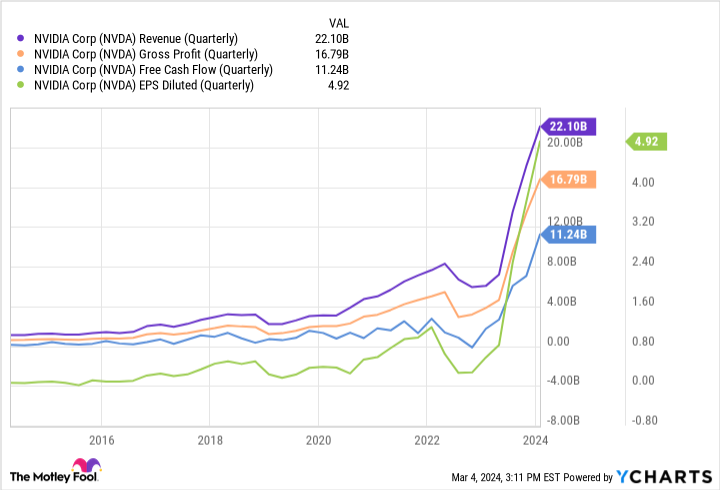

The graph above illustrates simply how a lot progress Nvidia is witnessing in the meanwhile. Whereas income is growing over 100% yearly, it is the corporate’s margin profile and cash-flow technology that basically has me excited.

Nvidia’s free money circulation grew greater than sixfold final yr, whereas gross margin expanded by practically 16 proportion factors. One of many greatest drivers for Nvidia proper now’s its superior pricing energy. The corporate’s semiconductor chips are extensively thought-about to be the most effective within the trade — outperforming fierce competitors from the likes of Superior Micro Gadgets and Qualcomm.

Whereas the above evaluation paints an encouraging image, Nvidia is much from only a chip producer. The corporate has been quietly dropping hints about the place it sees additional progress.

Some catalysts to regulate

In simply the previous couple of weeks, traders have gotten a glimpse into how Nvidia is deploying its newfound money circulation. Following a 13F submitting in mid-February, traders discovered that Nvidia has an investment in voice-recognition software developer SoundHound AI. For the time being, SoundHound AI is a small operation — solely producing about $46 million in income in 2023. The extra curious facet of this deal is why Nvidia could also be on this space of synthetic intelligence.

Apple has invested closely in voice-powered assistants, demonstrated by its acquisitions of Siri and Shazam. Furthermore, Amazon and Alphabet each leverage related expertise of their Web-of-Issues (IoT) sensible dwelling home equipment. Whereas the specifics of Nvidia’s funding are nonetheless topic to hypothesis, I’m intrigued by its curiosity in voice-recognition software program given its cohorts have built-in the expertise throughout many features of their respective companies.

On prime of the SoundHound AI stake, Nvidia additionally invested in a unicorn start-up known as Determine AI. Determine AI is creating a humanoid robotic, just like Tesla’s Optimus. Humanoid robots are nonetheless in early levels of improvement, however their potential to disrupt the labor market mustn’t go ignored.

Goldman Sachs not too long ago referred to humanoid robots as an “AI accelerant” and sees an addressable market of $38 billion by 2035. That is greater than a sixfold enhance in market measurement potential from Goldman’s preliminary analysis a yr in the past. The funding financial institution’s rising forecast credited higher-than-anticipated spend in areas together with massive language fashions (LLMs) and capital expenditures (i.e., {hardware}). These are each areas that Nvidia will not be solely disrupting, however dominating.

Lastly, an space that I consider may be very ignored proper now with regards to Nvidia is software program. The corporate is greatest recognized for its chips — for now. However in the course of the fourth-quarter earnings name, traders discovered that Nvidia has a $1 billion run charge enterprise software program enterprise. This might find yourself being an especially profitable supply of progress in the long term as software program progress ought to assist any margin deterioration from the legacy {hardware} operation as competitors within the chip house rises.

A well-deserved premium valuation

Nvidia at the moment trades at a price-to-earnings (P/E) a number of of 72.7 — far above its 10-year common of 55.5. Given the staggering rise within the inventory worth in a brief period of time, this premium should not come as a shock.

The larger query to be fascinated by is that if Mosesmann’s forecast might come true, or if it is a lofty projection outdoors of actuality. My opinion? Nvidia inventory is headed larger. Whether or not it reaches a worth goal of $1,400, nonetheless, is much less of a priority to me.

The corporate is dominating the marketplace for AI-powered chips. And whereas I count on competitors to rise, I’m inspired and impressed by the corporate’s investments in different progress areas. I believe Nvidia is setting itself as much as be a full-spectrum answer for AI functions — from information facilities, chips, and software program. Regardless of its premium valuation in comparison with historic ranges, I believe now’s pretty much as good a time as ever to purchase shares in Nvidia. The long-term experience appears to be like prefer it’s simply getting began.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 8, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Goldman Sachs Group, Meta Platforms, Microsoft, Nvidia, Qualcomm, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

A Bull Market Is Here. 1 Magnificent Artificial Intelligence (AI) Stock to Buy With 61% Upside, According to 1 Wall Street Analyst was initially revealed by The Motley Idiot