-

The inventory market’s once-in-a-generation purchase alternative is approaching, RBA mentioned.

-

The funding agency pointed to expectations for anemic large tech earnings over the subsequent 12 months.

-

The tech bubble bursting means different areas of the market may see positive factors as management evens out.

Bearish alerts are flashing for the market’s hottest group of shares, and it is a signal {that a} can’t-miss funding alternative is on the horizon, in response to Richard Bernstein Advisors.

The funding agency has been saying for months {that a} once-in-a-generation opportunity is coming, and it may lastly be shut at hand, RBA deputy CIO Dan Suzuki mentioned.

The thesis, which the agency first proposed at the end of last year, hinges on the intense market management of a handful of shares broadening out to the broader market, with stronger positive factors coming for the opposite 493 names within the S&P 500 following a dominant stretch for the so-called Magnificent Seven.

Whereas tech shares have taken an outsize share of the positive factors out there during the last 15 years, company earnings for large tech corporations are set to decelerate over the subsequent quarter, Suzuki mentioned.

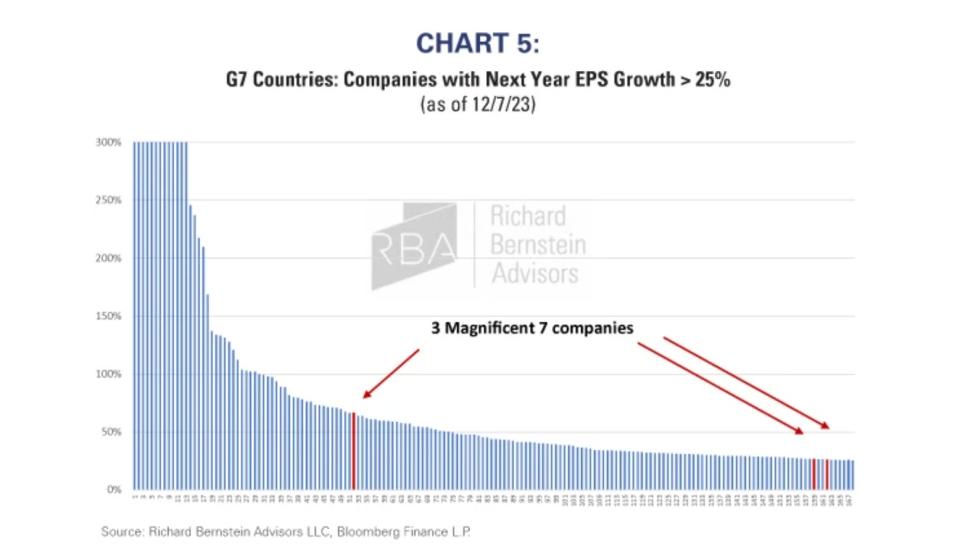

Of the Magnificent Seven – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta Platforms – solely three are anticipated to have greater than 25% earnings progress in 2024, RBA mentioned in a current note.

That differs from areas like small caps, industrials, power, and rising markets shares, the place earnings are anticipated to speed up within the coming 12 months.

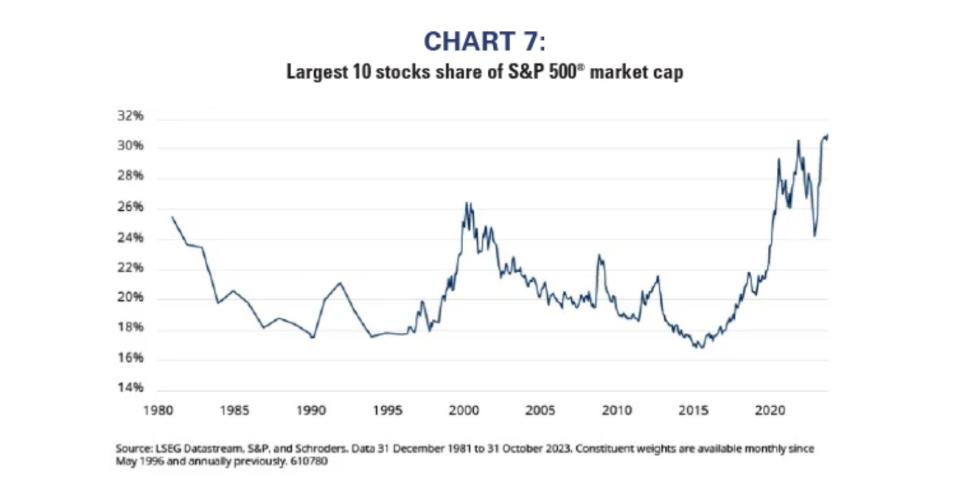

In the meantime, valuations and investor focus in mega-cap tech corporations are trying excessive, much more so than what was seen in earlier inventory market bubbles, in response to Suzuki. The highest 10 shares within the S&P 500 now take up over 30% of the index’s complete market cap, the most important share seen in over 40 years:

At this degree of exuberance, these corporations danger underperforming, inflicting buyers to leap ship to different areas of the market, Suzuki mentioned. He pointed to the dot-com bubble that burst within the early 2000s, which was adopted by a decade of anemic returns.

“I believe ultimately you will see a bear market,” Suzuki mentioned of large-cap tech shares in an interview with Bloomberg on Friday. “I’ve gone as far as to say that I believe this can be a bubble, and I do not use that time period calmly. So ultimately that implies that there is going to be a reckoning.”

However that is truly nice information for just about each different space of the market, in response to RBA, as buyers will lastly rotate into different shares and ship the pendulum swinging within the different path.

Whereas the Nasdaq cratered in the course of the dot-com crash, under-loved sectors like power and rising markets truly noticed “monster” returns over the next years, RBA founder Richard Bernstein instructed Enterprise Insider in an interview in December.

The agency expects the identical phenomenon to play out as excessive valuations of tech shares look poised to tug again. Bernstein mentioned he believed the Magnificent Seven stocks could end up wiping out 20%-25% of their worth over the subsequent decade, whereas small-caps within the Russell 2000 may achieve about the identical quantity.

“I believe that that is a kind of once-in-a-generation alternatives,” Suzuki mentioned.

Different specialists on Wall Avenue have warned of a serious correction coming to tech shares, which have rebounded to dizzying heights as buyers soar in on the hype for generative AI. Investing veteran Invoice Smead known as the Magnificent Seven inventory increase a “speculative orgy” that would quickly come to an finish, resulting in what he describes as a “inventory market failure.”

Learn the unique article on Business Insider