Initially, there have been the flashy Influencers, flaunting opulent yacht events to their followers, who have been enduring pandemic-related lockdowns. Following that, there was an inflow of Russian wealth, comprising money and cryptocurrencies, in search of a sanctuary away from burdensome sanctions within the aftermath of the Ukraine invasion.

The current inflow of rich digital nomads in Dubai seems to be made up of prosperous Western hedge fund professionals, as evidenced by the notable exodus of expertise from corporations akin to Millennium Administration and ExodusPoint Capital Administration. The emirate and its neighboring metropolis of Abu Dhabi are actively luring the wealthy and influential with engaging provides akin to tax-free standing, relaxed laws, and a time zone that favors exchanges with Asia.

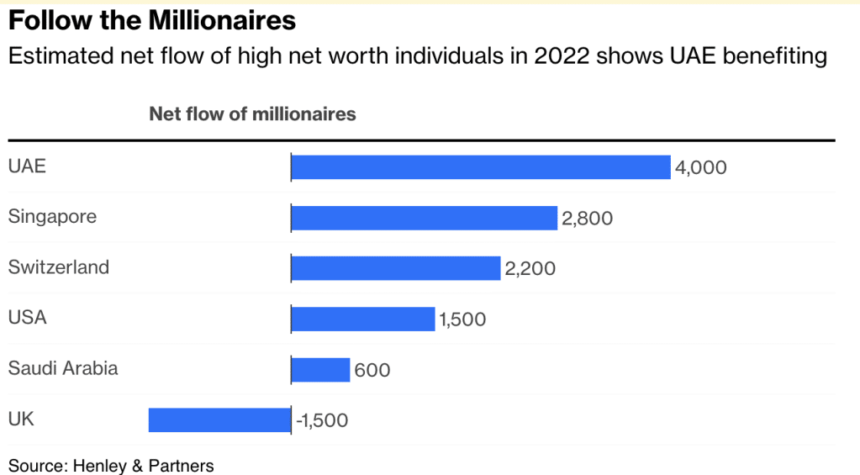

For some, this example could evoke a way of “déjà vu” that appears incongruous with the hedge fund trade’s lackluster progress, poor efficiency, and difficult fundraising surroundings over the previous yr. Nonetheless, in a world dominated by geopolitics and battle, the Gulf area is prone to show a vital take a look at case within the competitors for high-net-worth expertise. This improvement is certain to draw the eye of tax authorities in Western nations, particularly at a time when budgets are already strained.

The panorama has modified significantly since Dubai’s earlier formidable effort to ascertain itself as a world monetary middle. Again then, town’s aspirations led to a speculative actual property bubble fueled by debt and constructed on shaky floor. Throughout a go to to Dubai within the midst of the monetary disaster in 2009, Lionel Laurent witnessed quite a few international buyers lose important sums by means of actual property hypothesis. When the bubble inevitably burst, Abu Dhabi, the neighboring metropolis with a extra conservative strategy, stepped in to avoid wasting and management the scenario.

The United Arab Emirates has the well-known Louver in Abu Dhabi, the world’s tallest constructing in Dubai, and has turn out to be a monetary middle that’s attracting the eye of hedge funds on the lookout for options to conventional facilities like Zug or Geneva, the place banking secrecy and Credit score Suisse accounts are not accessible. In keeping with experiences, some 50 hedge funds, which collectively handle greater than $1 trillion in belongings, are actively in search of a license in Dubai. The emirate strategically touts its attractiveness with a “zero private revenue tax regime,” which is a marked distinction from the highest tax charges of 45% to 55% widespread in European nations. As well as, Dubai positions itself as a “impartial ally” for each the West and the East in occasions of battle.

Dubai’s rising recognition will be attributed to its thriving tourism trade, lack of revenue tax, and standing as a vacation spot freed from Russia sanctions.

Nevertheless, there is no such thing as a single answer that explains this success. The UAE will not be merely an old style tax haven. In an effort to diversify its income sources away from oil revenues, the nation has taken steps to stage the enjoying area, together with the introduction of a company revenue tax for the primary time. As well as, the UAE has responded to stress from Western sanctions by taking decisive motion to shut native Russian banks. The nation, described by Jared Cohen of Goldman Sachs Group Inc. as a “geopolitical swing state,” advantages from its strategic geopolitical significance.

The rise in power costs has given the nation an abundance of capital and a willingness to make use of it for strategic functions, together with financing ventures. As well as, the continued battle in Ukraine has given the nation important leverage. Germany has been pressured to ask Abu Dhabi for assist in securing fuel provides throughout the winter season. On the identical time, Washington DC is keen to make use of its affiliation to extend its affect, presumably resulting in a disregard for cash laundering dangers, as reported by Politico.