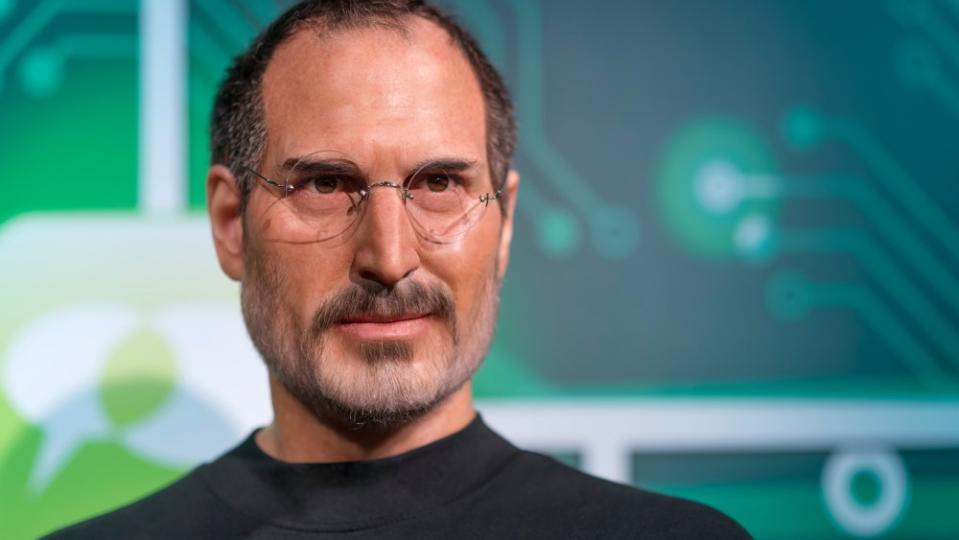

Warren Buffett shared a glance right into a dialog with Steve Jobs about Apple Inc.’s monetary technique throughout a 2012 look on CNBC’s “Squawk Field.”

Within the “Ask Warren” phase, Buffett stated, “It was an attention-grabbing dialog as a result of I hadn’t talked to him in a very long time. He stated, ‘We’ve received all this money. What ought to we do with it?’ So we went over the options. It was sort of attention-grabbing.”

This dialogue between two titans of business sheds gentle on the decision-making course of at one of many world’s most dear firms.

Jobs, identified for his transformative position in making Apple a worldwide know-how chief, reached out to Buffett to hunt recommendation on the corporate’s cash-management methods. Buffett, a legendary investor and chairman of Berkshire Hathaway Inc., outlined the 4 major choices accessible for deploying money: inventory buybacks, dividends, acquisitions or holding onto it.

Do not Miss:

-

For a lot of first-time patrons, a home is about 3 to five instances your family annual revenue – Are you making enough?

-

Are you rich? Right here’s what Individuals assume you have to be thought of rich.

Regardless of Jobs’s acknowledgment that Apple’s inventory was undervalued, indicating that buybacks may very well be a clever selection, he in the end determined towards taking any motion, preferring to keep up the corporate’s money reserves.

“I went by means of the logic of every factor. He informed me they’d not have the possibility to make huge acquisitions that will require numerous cash,” Buffett stated. “After which I requested him the query, I stated, ‘I’d use it for buybacks if I believed my inventory was undervalued.’ And I stated, ‘How do you are feeling about that?’ The inventory was 200-and-something. He stated, ‘I believe my inventory could be very undervalued.’ I stated, ‘Properly, what higher to do together with your cash?’”

Jobs favored having the money and that was what he in the end determined was his most suitable choice. Buffett added that Jobs interpreted their dialog as Buffett endorsing his choice to carry onto the money. “I later discovered that he stated I agreed with him to do nothing with the money,” Buffett stated.

Trending: The typical American couple has saved this a lot cash for retirement — How do you compare?

The dialog between Jobs and Buffett highlights a cautious strategy to monetary administration, contrasting sharply with the actions taken by Jobs’s successor Tim Prepare dinner. Below Prepare dinner’s management, Apple has aggressively pursued inventory buybacks, spending over $500 billion on them within the final decade. Based on Enterprise Insider, this expenditure surpasses the market capitalization of main companies like Visa Inc., JPMorgan Chase & Co., and ExxonMobil Corp., underscoring the dimensions of Apple’s dedication to repurchasing its shares.

Apple’s buyback technique has enhanced shareholder worth and elevated the stake of Berkshire Hathaway within the tech big with out extra funding. Berkshire Hathaway, proudly owning practically 6% of Apple, has seen its possession stake develop because of these buybacks.

Buffett has publicly supported Apple’s repurchase efforts, noting in his 2021 letter to shareholders the optimistic influence of the buybacks on each Berkshire’s holdings and Apple’s broader ecosystem.

“A lot of what the corporate retained was used to repurchase Apple shares, an act we applaud,” Buffett wrote. “Tim Prepare dinner, Apple’s sensible CEO, fairly correctly regards customers of Apple merchandise as his old flame, however all of his different constituencies profit from Tim’s managerial contact as effectively.”

Whereas Jobs exhibited a choice for liquidity and monetary flexibility, Prepare dinner has leveraged Apple’s monetary energy to actively handle its capital construction, reinforcing the corporate’s place as a frontrunner within the know-how sector and delivering worth to its shareholders and stakeholders alike.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & all the pieces else” buying and selling software: Benzinga Professional – Click here to start Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text Warren Buffett Says Steve Jobs Once Called Him Asking For Advice On How To Invest Apple’s Cash — Then He Completely Ignored The Advice initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.