It hasn’t been straightforward to be a inventory investor lately. The COVID-19 pandemic despatched numerous tech and retail shares hovering in 2021 as lockdowns noticed shoppers spend money on residence workplaces and leisure {hardware}. Nonetheless, spikes in inflation curbed spending the next yr, with a sell-off main the Nasdaq Composite to plunge 33% in 2022.

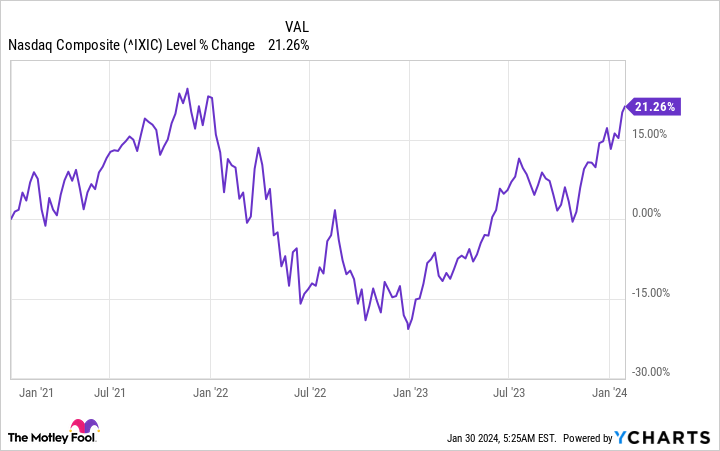

A restoration in 2023 noticed the market swing the alternative means as soon as once more, with the identical index rising 43% final yr. The chart under illustrates the yo-yo movement the market has taken during the last three years.

Latest developments would recommend the Nasdaq Composite is in for an additional sell-off in 2024 after hovering excessive final yr. Nonetheless, easing inflation and a return to development for a lot of firms point out this yr will lastly break the sample.

But it surely’s not a foul concept to stay cautious and spend money on firms price holding indefinitely. Regardless of current volatility, the Nasdaq Composite has nonetheless risen 21% because the starting of 2021, highlighting the significance of a long-term mindset relating to the inventory market.

Listed here are two magnificent shares that I am “by no means” promoting.

1. Costco

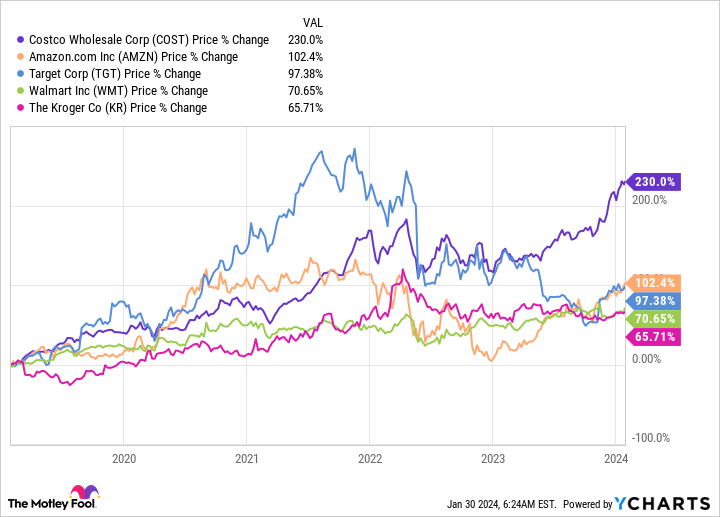

In response to Statista, Costco Wholesale (NASDAQ: COST) ranks third among the many 100 largest U.S. retailers, behind solely Walmart and Amazon (NASDAQ: AMZN). But it has massively outperformed its rivals in inventory development.

This chart exhibits that, during the last 5 years, shares of Costco have delivered greater than double the expansion of its largest U.S. rivals.

The corporate has turn out to be a favourite amongst shoppers, successful over consumers with its distinctive enterprise mannequin of charging an annual subscription payment for entry to market-low costs in a wholesale setting. And it hasn’t simply received within the U.S. — Costco’s 873 places span 14 nations, with plans to increase additional.

Furthermore, Costco’s mannequin has solved a serious challenge in retail, in that product gross sales do not really quantity to a lot in revenue. Like Amazon’s Prime, Costco’s annual membership is a serious development driver for earnings. In fiscal 2023, Costco hit greater than $6 billion in income, with membership charges making up 73% of that determine. Alongside a 90% subscription renewal fee, the corporate will seemingly proceed having fun with constant positive aspects for years.

Along with constant development, Costco has saved buyers proud of shock dividends which can be considerably greater than its ordinary dividend yield of 0.61%. On Jan. 12, the corporate paid out a dividend of $15 per share, with its final particular dividend launched in 2020 for $10 per share.

Costco’s forward price-to-earnings ratio of 44 makes it a barely costly choice proper now, with 20 or under often thought-about worth. Nonetheless, the corporate’s long-term reliability and recognition amongst shoppers means it’s price its excessive valuation, and a gorgeous inventory to carry indefinitely.

2. Amazon

Because the fifth-most-valuable firm on the planet with a market cap of $1.7 trillion, it is in all probability not shocking that Amazon is on this listing. The corporate is a behemoth in retail and tech due to its fashionable e-commerce web site and cloud platform, Amazon Internet Companies (AWS).

Nonetheless, the most effective causes to by no means promote this inventory is the retail large’s capability to efficiently navigate a market downturn. Amazon was hit notably laborious by macroeconomic headwinds in 2022, which led its inventory to fall almost 50% through the yr alongside steep revenue declines.

The difficult interval noticed Amazon instantly start restructuring its operations, with a precedence on income. Value-cutting strikes like closing dozens of warehouses, 1000’s of layoffs, and shuttering unprofitable initiatives like its telehealth platform Amazon Care have been instrumental to the corporate’s restoration.

Within the third quarter of 2023, Amazon posted income development of 13% yr over yr, beating Wall Road forecasts by $1.5 billion, whereas working earnings greater than tripled. In the meantime, the tech agency’s free money circulation has skyrocketed 427% during the last yr to $17 billion.

Moreover, Amazon has a promising outlook within the booming AI market. AWS’ main 32% cloud market share might see it leverage its huge cloud knowledge facilities and steer the generative synthetic intelligence (AI) market in its favor.

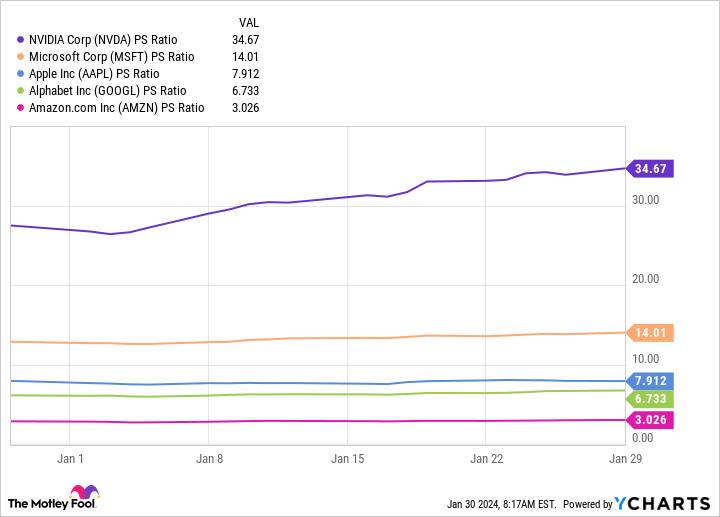

This chart exhibits Amazon may very well be one of many largest bargains in tech proper now. Its price-to-sales ratio is the bottom amongst heavy-hitters like Nvidia, Microsoft, Alphabet, and Apple, indicating shares in Amazon presently provide probably the most worth.

With its dependable long-term development and promising prospects in AI, the corporate is a superb choice to purchase now and by no means promote.

Do you have to make investments $1,000 in Costco Wholesale proper now?

Before you purchase inventory in Costco Wholesale, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Costco Wholesale wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 29, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, Goal, and Walmart. The Motley Idiot recommends Kroger. The Motley Idiot has a disclosure policy.

2 Magnificent Stocks That I’m Never Selling was initially revealed by The Motley Idiot