A buyer holds a gasoline nozzle at a Shell fuel station in Hercules, California, U.S., on Wednesday, June 22, 2022. President Joe Biden known as on Congress to droop the federal gasoline tax, a largely symbolic transfer by an embattled president working out of choices to ease pump costs weighing on his get together’s political prospects. Photographer: David Paul Morris/Bloomberg by way of Getty Photographs

Bloomberg | Bloomberg | Getty Photographs

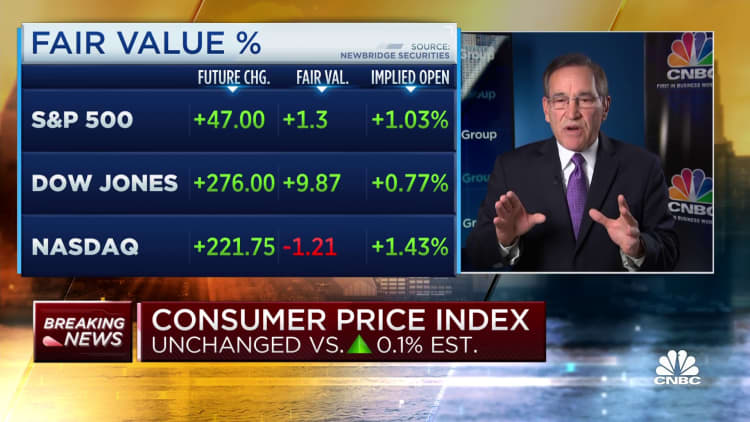

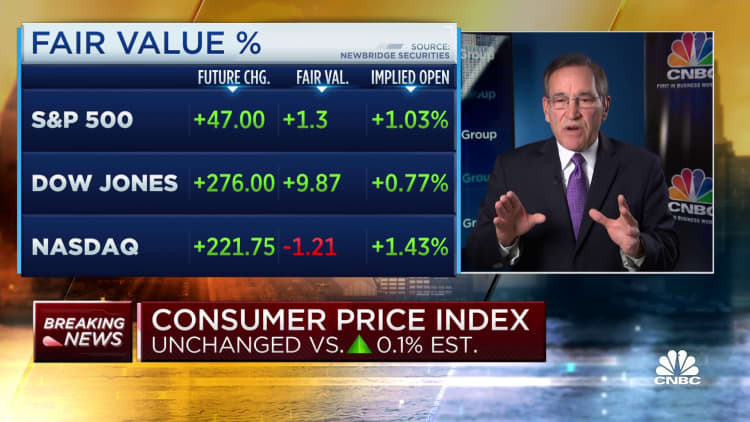

Inflation declined in October, persevering with a broad slowdown as gasoline costs retreated through the month. Nevertheless, worth pressures stay underneath the floor and it might take some time for them to return to their pre-Covid pandemic baseline, economists mentioned.

“The disinflationary development is in place,” mentioned Sarah Home, senior economist at Wells Fargo Economics. “However we’re getting right into a tougher a part of the cycle.”

In October, the patron worth index elevated 3.2% from 12 months earlier, down from 3.7% in September, the U.S. Bureau of Labor Statistics said Tuesday.

The CPI is a key barometer of inflation, measuring how shortly the costs of something from vegatables and fruits to haircuts and live performance tickets are altering throughout the U.S. financial system.

The October studying is a major enchancment on the pandemic-era peak of 9.1% in June 2022 — the very best charge since November 1981. Costs are subsequently rising rather more slowly than they’d been.

“Inflation is slowly however steadily moderating, and all of the development strains look good,” mentioned Mark Zandi, chief economist at Moody’s Analytics. “It appears like by this time subsequent 12 months inflation shall be very near the [Federal Reserve’s] goal, and one thing the American client will really feel comfy with.”

The Fed goals for a 2% annual inflation charge over the long run.

Gasoline costs fell in October

Gasoline costs dropped 5% in October, in keeping with Tuesday’s CPI report.

Costs for regular-grade gasoline declined by about 33 cents a gallon between Oct. 2 and Oct. 30, from $3.80 a gallon to $3.47, in keeping with the U.S. Energy Information Administration.

They’ve fallen additional since then. Common costs on the pump have been $3.37 a gallon nationwide as of Nov. 13, in keeping with AAA.

Extra from Private Finance:

Attempt a journey ‘dupe’ to economize in your 2024 journey

‘Sea change’ could also be coming for funding recommendation about 401(okay)-to-IRA rollovers

How bank card debt grew to become a $1.08 trillion downside

The month-to-month pullback is an enchancment from August and September, when gasoline was a significant contributor to will increase in total inflation readings. In August, for instance, costs on the pump spiked 10.6% largely resulting from dynamics available in the market for crude oil, which is refined into gasoline.

“We had an enormous improve in gasoline costs again in August” and are actually seeing an “unwinding of that,” Home mentioned.

“What fuel costs give us one month, they will taketh away in one other,” she added.

What’s taking place underneath the floor

Vitality costs can whipsaw inflation readings resulting from their volatility. Likewise with meals.

That is why economists like to have a look at a measure that strips out these costs when assessing underlying inflation tendencies.

This pared-down measure — often known as the “core” CPI — fell to an annual charge of 4% in October from 4.1% in September. It is the smallest 12-month change since September 2021, the BLS mentioned.

Shelter — the typical family’s biggest expense — has accounted for greater than 70% of the full improve within the core CPI over the previous 12 months. Housing inflation declined in October, to six.7% relative to a 12 months earlier, and has fallen from a peak over 8% in March 2023, in keeping with BLS data.

A continued moderation in housing prices was “probably the most encouraging side” of the October report and will proceed to sluggish in coming months, Zandi mentioned.

“It is obtained a protracted method to go to get again to one thing I believe we might really feel comfy with,” he added. “However we’re heading in that route.”

Meals inflation was maybe the one “small blemish” in October, Zandi mentioned. Grocery costs rose 0.3% in October, on a month-to-month foundation, up from 0.1% in September. Nevertheless, on an annual foundation “meals at house” inflation elevated 2.1% in October, down considerably from a pandemic-era peak over 13% in August 2022, in keeping with BLS data.

Different classes with “notable” will increase up to now 12 months embrace motorcar insurance coverage (which elevated 19.2%), recreation (3.2%), private care (6%), and family furnishings and operations (1.7%), in keeping with the BLS.

Why inflation is returning to regular

At a excessive stage, inflationary pressures — which have been felt globally — are resulting from an imbalance between provide and demand.

Vitality costs spiked in early 2022 after Russia invaded Ukraine.

Provide chains have been snarled when the U.S. financial system restarted through the Covid-19 pandemic, driving up costs for items. Shoppers, flush with money from authorities stimulus and staying house for a 12 months, spent liberally. Wages grew at their quickest tempo in many years, pushing up enterprise’ labor prices.

Now, these pressures have largely eased, economists mentioned. Provide chains have normalized and the labor market has cooled.

Plus, the Federal Reserve has raised rates of interest to their highest stage since the early 2000s to sluggish the financial system. This coverage instrument makes it dearer for customers and companies to borrow, and might subsequently tame inflation.

Fed Chair Jerome Powell final week mentioned the U.S. nonetheless “has a protracted method to go” earlier than getting again to a sustainable 2% inflation goal. Fed officers do not expect that to occur till 2026.

Do not miss these tales from CNBC PRO: