China is the world’s No. 2 financial system and residential to dozens of corporations that commerce within the U.S. Proper now, Tesla (TSLA) rival BYD (BYDDF), in addition to gaming big NetEase (NTES), e-commerce performs PDD Holdings (PDD) and Vipshop (VIPS) and specialty retailer Miniso (MNSO), are China shares value watching or probably shopping for.

X

After China lastly eased strict Covid restrictions in late 2022, there was numerous optimism a few Chinese language financial revival. However progress has sputtered in current months, whereas the long-ailing property sector is worsening. Regardless of Chinese language officers vowing to help the financial system, precise stimulus has been restricted.

U.S. tensions are a priority. In current months, the White Home has barred shipments of key chip know-how to China, including to tariffs and different curbs on Chinese language items. Beijing has retaliated.

Buyers ought to take note of many different Chinese language shares, together with e-commerce titan Alibaba (BABA), messaging and gaming participant Tencent (TCEHY), search big Baidu (BIDU), in addition to China EV makers Li Auto (LI) and XPeng (XPEV).

High Chinese language Shares To Purchase Or Watch

| Firm | Ticker | Business Group | Composite Score |

|---|---|---|---|

| Miniso | MNSO | Retail-Low cost & Selection | 98 |

| BYD | BYDDF | Auto Producers | n.a. |

| Vipshop | VIPS | Retail-Web | 92 |

| NetEase | NTES | Pc Software program-Gaming | 96 |

| PDD Holdings | PDD | Retail-Web | 98 |

Miniso Inventory

Miniso is a Chinese language specialty retailer, with a treasure hunt side for customers. It boasts over 5,500 places, together with greater than 2,000 abroad, with a rising quantity within the U.S.

Miniso earnings surged 130% within the second quarter, with income progress accelerating to 30%.

MNSO inventory broke out of lengthy consolidation in late July, however then moved sideways across the purchase zone. On Aug. 22, shares gapped out of a multiweek shelf on the robust Q2 outcomes. Shares ran up till mid-September, then pulled again to the 21-day line.

Shares have been hugging the 21-day for a month and has just lately been discovering help across the rising 50-day/10-week line.

On Tuesday, shares blasted increased. breaking a trendline. However shares pulled again rapidly. MNSO inventory now has a brand new base with a 29.92 purchase level. However a deal with may quickly type to supply a decrease official entry.

Backside line: MNSO inventory will not be a purchase.

BYD Inventory

BYD is a China EV and battery big. It is the world’s largest EV maker, together with its long-range hybrids, although it nonetheless trails Tesla in absolutely electrical BEVs. It is the No. 1 automaker in China and No. 10 on this planet.

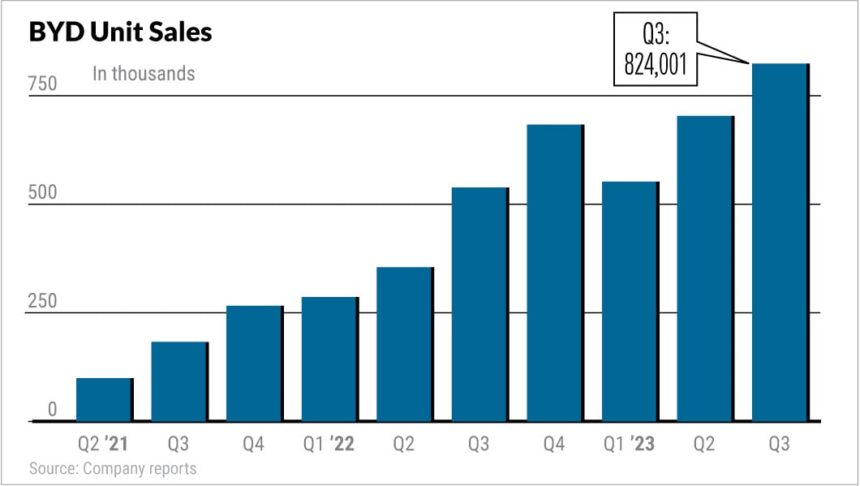

BYD bought 287,454 EVs in September, one other document and up 43% vs. a yr earlier. Of the non-public autos, 151,193 had been all-electric BEVs and 134,710 had been plug-in hybrids. For the quarter, BYD bought 824,001 autos, together with 431,603 private BEVs.

That was just under Tesla’s 435,059. There is a robust likelihood that BYD will high Tesla in BEV gross sales in This autumn.

BYD will launch October gross sales figures close to the beginning of November.

On Oct. 30, BYD reported robust third-quarter progress, consistent with some preliminary outcomes. Internet revenue got here in at RMB 10.41 billion ($1.41 billion), up 82% vs. a yr earlier and almost 53% vs. Q2, in native forex phrases. Income swelled 38.5% vs. a yr earlier to RMB 162.15 billion ($22.6 billion), up 38.5% vs. Q3 2022.

BYD dominates within the low-to-affordable EV market, however is increasing by way of the premium Denza model. It is also launched the “F-Model” and super-premium Yangwang. The Yangwang U8, a $150,600 off-road automobile, is about to start deliveries by the top of October.

The overwhelming majority of gross sales stay in China, however exports are booming. Abroad gross sales surged to a document 25,023 in August from 18,169 in July and 10,536 in June. That ought to ramp up as extra fashions are despatched abroad.

BYD is constructing its first EV plant exterior of China in Thailand, which is about to start operation in mid-2024. The EV big plans to construct EVs in Brazil and is anticipated to call a location for a plant in Europe earlier than year-end.

A European plant may assist BYD keep away from any future EU restrictions on made-in-China EVs.

BYD inventory tumbled for a lot of August and has struggled to get and keep above the 50-day line since then. Shares have a consolidation with a 36.27 purchase level.

On Oct. 17, U.S. shares of BYD popped from the 50-day line on the preliminary revenue figures. Shares pulled again however are barely above the 50-day. BYD has traded tightly in current days and weeks.

Buyers may use 32.76 as an early entry, primarily based on the Oct. 12 excessive.

Backside line: BYD inventory will not be a purchase.

Vipshop Inventory

The specialty e-commerce agency is far smaller than Alibaba, JD.com and PDD Holdings. However it’s worthwhile, with EPS progress accelerating up to now two quarters to 62% in Q2. Gross sales progress has returned, although simply to five% in Q2.

VIPS inventory is in a consolidation with a 19.13 purchase level, engulfing a previous flat base that failed. Shares have largely gone sideways since mid-January.

Shares are simply just under all the important thing transferring averages. A transfer above the Oct. 10 excessive of 16.73, which might even be a decisive clearing of all the important thing averages, would provide an early entry for VIPS inventory. However shares are beneath the 50-day and 200-day traces.

Backside line: VIPS inventory will not be a purchase.

NetEase Inventory

NetEase is a number one on-line sport supplier.

Earnings progress is accelerating, however flat Q2 income got here in a little bit low.

Video video games accounted for 78% of Q2 income. NetEase provides a search engine, streaming music and different web providers.

NTES inventory broke previous a 94.99 flat-base purchase level in June, then topped a 99.78 shelf entry on July 12. Shares peaked at 110.82 on Aug. 1,

NTES inventory works now has a brand new flat base with a 110.82 purchase level. Shares roared up the fitting of the bottom in early October, flashing an early entry and nearing the purchase level. Shares fell again to only beneath the 50-day, however have shot up from that key degree once more.

The RS line is already at a brand new excessive.

Backside line: NetEase inventory will not be a purchase.

PDD Inventory

PDD Holdings is the guardian of Chinese language e-commerce big Pinduoduo. It additionally operates the fast-growing U.S. web site Temu.

On Aug. 29, PDD simply beat Q2 views, with income leaping 66%. Q1 earnings spiked 117% per ADS with income up 46%.

PDD inventory gapped out of a seven-month cup-with-handle base with a 92.79 purchase level on Q2 earnings. Shares then consolidated across the purchase zone.

On Oct. 6, PDD surged out of a brief consolidation, which traders additionally may deal with as an alternate deal with to the lengthy cup.

Shares pulled again progressively in gentle quantity to the 21-day line, however have bounced off that degree once more.

Ideally, PDD inventory would forge a real base or pull again to the 50-day/10-week line.

Backside line: PDD inventory will not be a purchase.

Please comply with Ed Carson on X/Twitter at @IBD_ECarson, Threads at @edcarson1971 and Bluesky at @edcarson.bsky.social for inventory market updates and extra.

YOU MAY ALSO LIKE:

Why This IBD Software Simplifies The Search For High Shares

Finest Chinese language Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation In the present day

Apple, Fed Loom For Battered Market; Three Causes To Like These 4 Shares