It isn’t been a very nice month for Apple (NASDAQ: AAPL) shareholders. Anxious about lagging iPhone gross sales, the inventory was downgraded by Barclays on the very starting of the yr, after which downgraded once more by Piper Sandler simply a few days later.

The shares bounced again a bit from their early January stumble, however they’re weakening once more now. Certainly, it has been a lackluster previous few months for shareholders with the inventory sliding again to the place it was priced in July of final yr. Possibly the corporate’s age and sheer measurement is lastly catching up with it.

Or perhaps not. Here is a rundown of causes you may wish to use the present lull to load up on Apple inventory for the lengthy haul.

1. Apple inventory is down for all of the mistaken causes

As Barclays analyst Tim Lengthy explains of his firm’s downgrade, “We’re nonetheless choosing up weak spot on iPhone volumes and blend, in addition to a scarcity of bounce-back in Macs, iPads, and wearables.” Piper Sandler’s fear is extra broad-based. Analyst Harsh Kumar notes, “We imagine that first-half 2024 shall be difficult for the analog market, handset, and client finish markets.”

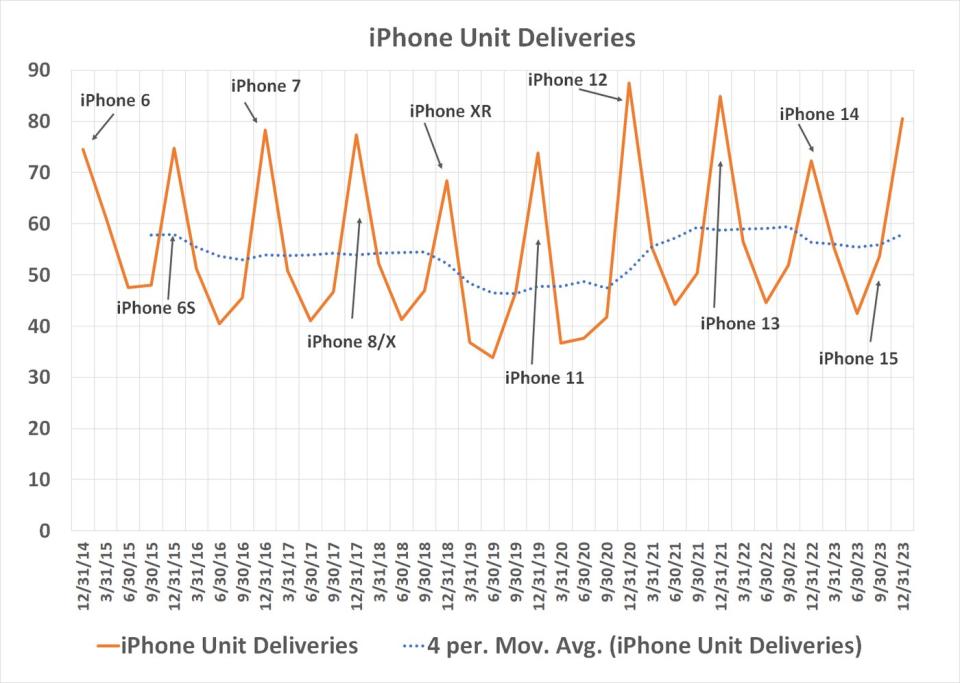

In each circumstances, so-so demand for the iPhone 15 now portends so-so prospects for the iPhone 16 more likely to debut later this yr. And it is not like the concern is an unreasonable one; the analysts’ factors are effectively taken.

In each circumstances, nevertheless, the issues look previous a key quirky level in regards to the iPhone. That’s, demand for the gadget ebbs and flows not a lot with the calendar or the economic system, however with the gadget’s longevity and functionality. Some observers counsel many shoppers could also be holding out for the iPhone 16, which is broadly anticipated to boast extra reminiscence, a greater processor, and a superior digicam.

On this identical vein, Morgan Stanley analysts famous final yr that there is unimaginable “pent-up demand from shoppers deferring their iPhone buy from FY23 [ended in September].” Morgan Stanley’s number-crunching additional suggests the iPhone’s alternative cycle now stands at a record-breaking 4.4 years, that means many iPhone followers merely cannot wait for much longer to improve their gadget.

In different phrases, Apple’s iPhone gross sales may very well be pleasantly shocking come late 2024. And for what it is value, even the demand for Apple’s iPhone 15 could also be higher than among the latest rhetoric suggests. Expertise market analysis outfit IDC reported that after the inventory’s two massive downgrades, fourth-quarter shipments of iPhones jumped to a two-year excessive of 80.5 million.

Maybe Morgan Stanley’s argument for pent-up iPhone demand holds extra water than it is getting credit score for in the present day.

2. It is cash-rich with modest debt

It is likely to be growth-challenged proper now, however there is no firm higher geared up to shrug off the affect of such a headwind.

As a reminder, Apple is not simply the world’s largest firm, sporting a market capitalization of slightly below $3 trillion. It is also nonetheless the world’s most worthwhile firm. It turned final fiscal yr’s income of $383 billion into web earnings of $97 billion, roughly mirroring the prior yr’s outcomes. That is enormous. It is also obtained a bit of over $60 billion value of money or extremely liquid cash-like holdings on its books.

However what about debt? It is sitting on just a bit lower than $100 billion in long-term debt, and one other $49 billion in different long-term liabilities. That is additionally enormous — by different firm’s requirements. For a enterprise of Apple’s measurement and caliber, nevertheless, it is enviable. This mega-company’s balance sheet and dependable earnings stream imply it is not pressured to make short-term choices simply to outlive, solely to create greater issues down the highway.

Mentioned one other means, entry to present and future money move supplies Apple with a strategic benefit lots of its opponents merely do not have proper now.

3. Apple’s enterprise mannequin — and mindset — is evolving

The third cause to purchase Apple inventory like there is no tomorrow? It is a bit philosophical, however evident if you make a degree of searching for it. That’s, the corporate’s enterprise mannequin is evolving from one merely centered on gadgets to a cultural, solutions-oriented one.

This concept is not readily evident with only a superficial look. The iPhone nonetheless accounts for a bit of over half of the corporate’s income, in any case. Dig deeper, although. Apple’s doing issues to broaden its digital ecosystem that drives a mixture of {hardware} and software program gross sales.

Sure, the expansion of its providers arm is an instance of this shift. Whereas digital items and providers could solely account for about 20% of its whole prime line, revenue margins for this enterprise are about 3 times wider than they’re on gross sales of bodily merchandise. That is solely a sampling of the paradigm shift underway, nevertheless.

Shopper-oriented cloud storage, high-performance video gaming, the continued improvement of its digital actuality tech known as Apple Imaginative and prescient (regardless of any obvious significant demand for it), ongoing tinkering with synthetic intelligence, and even semi-autonomous automobiles are all tasks nonetheless on Apple’s plate, even once they do not must be.

This diploma of speculative R&D is comparatively new for Apple. Maybe with out even totally understanding how or when these efforts may repay, the corporate is positioning itself to be an vital expertise participant in an ever-changing future.

4. An important cause continues to be crucial cause

The fourth and last cause to step into new stakes in Apple inventory proper now, nevertheless, is not a brand new one in any respect. That’s, that is nonetheless Apple. Its model and identify stay among the many world’s best-known — and for good cause. It is fostered unimaginable loyalty to its services and products by constructing superior merchandise and delivering superior service. Its tech simply works.

That does not essentially imply the inventory’s proof against an occasional bout of weak spot. It is gone nowhere for the previous six months, as a reminder, and was lately on the receiving finish of a few key analyst downgrades — analysts who had been involved about its near-term numbers.

This is not the type of stuff long-term buyers ought to sweat an excessive amount of, although. True long-termers ought to goal to personal stakes in high quality corporations, utilizing near-term weak spot of their underlying shares to ascertain these positions. And Apple at its worst continues to be higher than many corporations at their finest.

In different phrases, now’s your probability to get into an excellent decide at a little bit of a reduction.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Apple wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple. The Motley Idiot recommends Barclays Plc. The Motley Idiot has a disclosure policy.

4 Reasons to Buy Apple Stock Like There’s No Tomorrow was initially revealed by The Motley Idiot