While you grow to be a digital nomad or long-term traveler, you understand that surprising issues can occur and also you all the time should be insured.

Contemplating the choice of touring with out insurance coverage is NO GO! Even a easy physician’s go to or medical check-up out of the country as a vacationer might be very costly.

With out insurance coverage, you’ll be able to find yourself in a giant debt if one thing critical occurs to you. Additionally, having your gear stolen could also be an annoying downside to your pockets and likewise your enterprise or distant job should you “journey and work from wherever“.

Greatest Digital Nomad Insurance coverage for Well being & Journey:

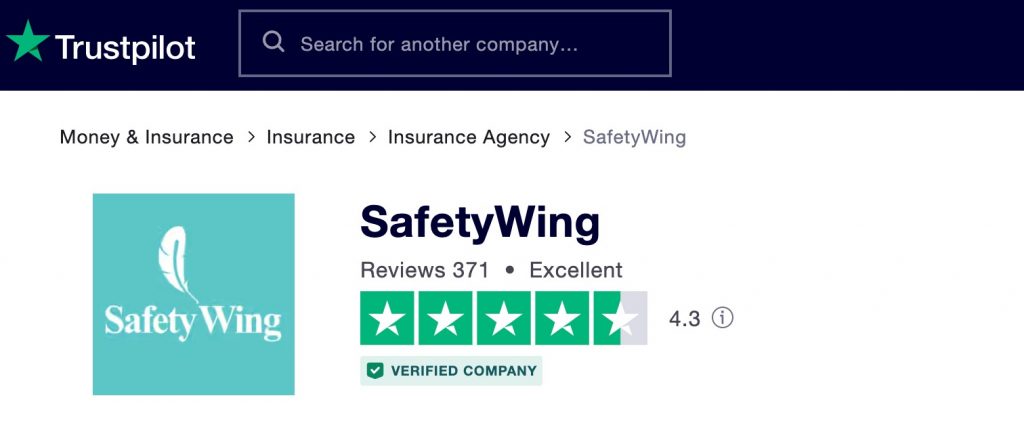

SafetyWing is a distant working firm that’s quickly gaining new shoppers. Their specialty is offering major medical insurance for nomads.

1. Important Plan

Good for vacationers who want dependable short-term protection overseas.

- Covers journeys as much as 364 days at a time

- Consists of emergency medical remedy, hospital stays, surgical procedures, and medicines

- Safety for misplaced baggage, journey delays, and emergency evacuations

- Provides as much as 30 days of medical protection in your house nation

- Beginning at $56.28 each 4 weeks for ages 18–39

Very best for: Quick-term vacationers and distant staff searching for inexpensive medical safety whereas overseas.

2. Full Plan

Complete, long-term medical insurance designed for full-time vacationers and distant professionals.

- Consists of all the pieces within the Important Plan, plus ongoing, renewable protection

- Covers routine and emergency medical care worldwide

- Provides wellness therapies, psychological well being help, and most cancers remedy

- Protects towards housebreaking, canceled lodging, and delayed baggage

- No protection restrictions in your house nation

- Beginning at $161.50 per 30 days for ages 18–39

Very best for: Digital nomads and expats searching for full, indefinite well being and journey safety wherever on the earth.

PassportCard Nomads gives versatile insurance policy tailor-made to the wants of digital nomads, freelancers, and frequent vacationers. Whether or not you’re on a brief journey or residing overseas full-time, these plans are designed to supply peace of thoughts with immediate protection and 0 paperwork.

1. Starter Plan

Good for short-term vacationers or these simply starting their nomad journey.

- Covers emergency medical remedy, hospital stays, surgical procedures, and prescriptions

- Consists of medical evacuation and repatriation in case of significant emergencies

- Entry to 24/7 multilingual help and an immediate fee card for lined bills

- Possibility to increase protection or improve to a better plan anytime

- Very best for journeys as much as 6 months

Greatest for: Vacationers who need important, inexpensive medical protection with out long-term commitments.

2. Distant Plan

Designed for long-term digital nomads who stay and work overseas full-time.

- Consists of all the pieces within the Starter Plan, plus protection for non-urgent and specialist care

- Entry to routine checkups, diagnostics, and follow-up therapies

- World protection throughout international locations — no have to reset or repurchase when shifting places

- Psychological well being help and wellness therapies are included in choose areas

- Versatile renewal and cancellation choices immediately via the PassportCard app

Greatest for: Distant staff and full-time nomads searching for dependable, renewable well being safety worldwide.

3. Consolation Plan

A premium, expat-style insurance coverage plan for vacationers who need full medical and life-style protection.

- Every part within the Distant Plan, plus complete well being advantages for long-term residing overseas

- Covers continual situations, maternity, wellness applications, and preventive care

- Consists of different medication choices corresponding to acupuncture, osteopathy, and chiropractic care

- Protection for housebreaking, misplaced or delayed baggage, and canceled lodging

- No restrictions in your house nation — steady world safety wherever you might be

Greatest for: Skilled nomads and expats who need all-inclusive protection and premium advantages year-round.

3. Insured Nomads

Insured Nomads is a contemporary insurance coverage resolution constructed for digital nomads, expats, and frequent vacationers who stay life with out borders. With a concentrate on security, comfort, and world mobility, it gives complete safety that goes far past conventional journey insurance coverage.

World Explorer Plan

Very best for short-term vacationers, backpackers, and journey seekers.

- Protection for single or a number of journeys, as much as 364 days

- Consists of emergency medical, evacuation, and journey safety

- Journey actions lined underneath most tiers

- Beginning at round $45 per 4 weeks for ages 18–39 (value varies by vacation spot and protection stage)

Greatest for: Vacationers who want inexpensive, versatile protection for journeys underneath one 12 months.

Distant Well being Plan

Designed for digital nomads, distant professionals, and expats who stay overseas full-time.

- Complete world medical insurance, renewable indefinitely

- Consists of routine care, hospitalization, maternity, psychological well being, and wellness protection

- Telemedicine entry and worldwide physician community

- Beginning at round $155 per 30 days for ages 18–39 (relying on protection tier and area)

Greatest for: Lengthy-term vacationers and distant staff who need full, year-round well being protection wherever on the earth.

4. Heymondo Journey Insurance coverage

Heymondo Journey Insurance coverage is a complete journey insurance coverage supplier designed to supply vacationers peace of thoughts throughout their journeys. They supply protection for medical emergencies, journey cancellations, baggage loss, and different travel-related incidents, guaranteeing you might be protected regardless of the place you go.

Commonest plans embody:

Fundamental Plan: Covers important medical bills, journey cancellation, and baggage safety. Pricing begins from roughly €20-€30 for brief journeys (as much as 7 days) for vacationers underneath 30 years previous, with costs rising based mostly on age and protection period.

Commonplace Plan: Provides further protections like higher medical protection limits, emergency help, and elective protection for sports activities actions. Costs begin round €40-€60 for related journey lengths and age teams.

Premium Plan: Provides in depth protection, together with excessive medical limits, journey interruption, 24/7 emergency help, and elective protection for high-risk actions. Pricing sometimes begins at €70-€100 relying on journey particulars and traveler age.

Disclaimer: Affiliate hyperlinks are hyperlinks that permit web site homeowners to earn a fee on any gross sales generated by a click on from their web site. It’s essential to notice that a few of the hyperlinks on this web site could also be affiliate hyperlinks, which implies that should you click on on the hyperlink and make a purchase order, I’ll obtain a fee.