-

Bonds are trying extra engaging than shares for the primary time in years.

-

The ten-year Treasury yield topped 5% for the primary time since 2007 this week.

-

There are three the explanation why it could possibly be a very good time to plow money into ultra-safe Treasurys.

For the primary time in years, bonds are trying engaging relative to shares as yields soar on ultra-low-risk US authorities debt.

The yield on the 10-year Treasury topped 5% for the primary time since 2007 this week, and the plunge in bond costs represents one of many worst market crashes of all time, in response to Financial institution of America.

However consultants say that yields at 5% ought to look engaging to traders with money on the sidelines, particularly when contemplating the long-standing fame of Treasurys as an extremely low-risk investment.

Listed here are three the explanation why now could possibly be a very good time for traders to leap into the Treasury bond market, in response to a few of Wall Road’s high investing consultants.

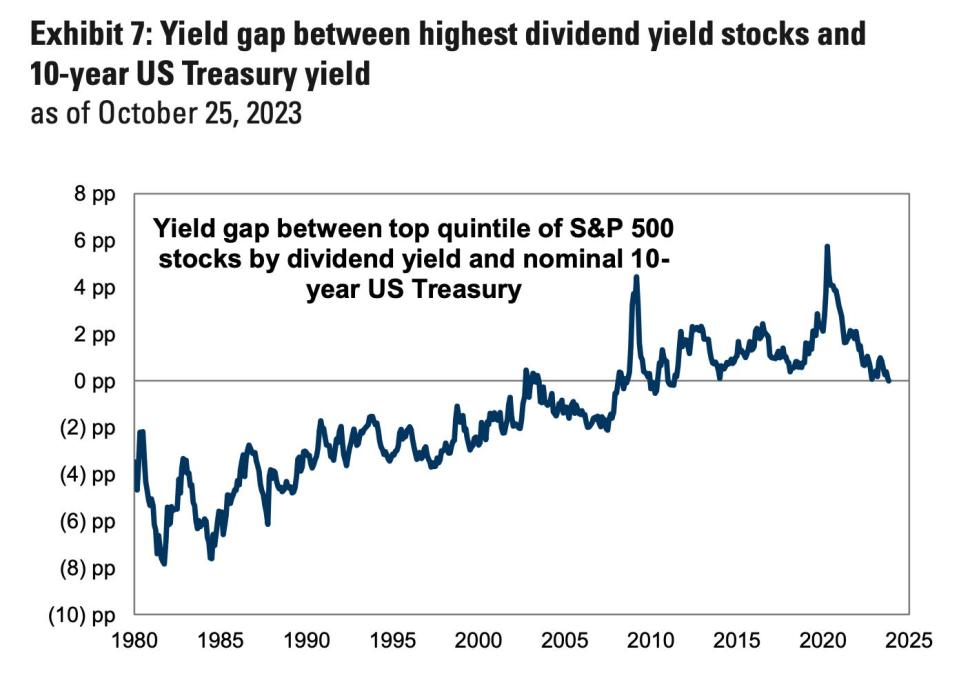

1. Treasury yields are actually in keeping with the best dividends paid by S&P 500 corporations

The yield on the 10-year Treasury is about the identical as the most important dividends paid by S&P 500 corporations, in response to Goldman Sachs strategists.

The distinction between the dividend yield of the highest 20% of S&P 500 dividend payers and the yield on the 10-year US Treasury has narrowed from one proportion level in Might to to zero this week, strategists mentioned in a be aware on Friday.

As that unfold has narrowed, traders have been pulling cash from dividend inventory funds in 2023. Outflows from US fairness dividend funds have greater than doubled that of the broader market to date this yr, in response to Goldman Sachs information.

2. Bond yields most likely aren’t falling quickly

Treasury yields are seemingly staying elevated, because of the Fed’s committement to conserving a lid on inflation. Central bankers have raised charges 525 basis-points over the previous yr to decrease excessive costs, which has helped pushed Treasury yields greater.

BlackRock mentioned in a be aware this week that it was obese short-term Treasury bonds. Strategists at Vanguard, in the meantime, pointed to long-term US Treasuries as a aggressive funding choice, as they permit traders to lock in assured yields, which is able to stay greater as rates of interest keep elevated.

“Bond yields are more likely to revert to the low ranges of current historical past, and we count on they’ll stay greater for longer. Do not forget that greater charges imply higher long-term bond returns,” Vanguard mentioned in a current be aware.

“That does not imply bonds will essentially ship outsized returns over the following three months, as there’s nonetheless appreciable uncertainty. What it does imply is that, with actual yields at their highest ranges in 15 years, bonds as we speak can supply extra vital worth in whole returns to a portfolio,” strategists later added.

3. The outlook for shares is unsure

The outlook for shares is not as optimistic with rates of interest staying greater for longer. Larger borrowing prices weighed shares down closely in 2022, inflicting the S&P 500 to notch its worst performance since 2008. Whereas shares have carried out higher in 2023, they’ve offered off lately amid the chaos within the bond market, which might rear its head once more relying on what the Fed does in response to financial situations.

“We predict the present macro backdrop is not pleasant for broad fairness exposures. Larger charges and stagnant progress have weighed on markets, however the transfer decrease in shares exhibits they’re adjusting to the brand new macro regime,” BlackRock strategists mentioned this week.

In the meantime, dividend progress amongst S&P 500 corporations is more likely to shrink over the following yr, Goldman Sachs strategists forecasted. That is partly on account of a sluggish 1% progress in company earnings anticipated this yr, in addition to the shortage of “dividend paying capability” in the true property and monetary sectors.

“Our economists count on that the Fed won’t ship the primary lower to the Fed Funds price till the tip of 2024. We consider that traders ought to wait till coverage price cuts are extra clearly in view to start shopping for dividend payers,” the financial institution mentioned.

Different market forecasters have warned of extra bother forward in equities, particularly as greater bond yields draw traders away from the inventory market. Stocks are following patterns eerily close to previous market crashes, some veteran consultants warn, all whereas the chance of a recession nonetheless looms over the US financial system.

Learn the unique article on Business Insider