The market has rallied impressively over the previous a number of months, with the S&P 500 index reaching all-time highs that verify a new bull market is underway in stocks. With this latest rally, some inventory valuations could also be stretched, making it more durable to search out offers. Excellent news for you: There are nonetheless loads of offers available available in the market at present.

Financial institution shares have been sluggish to get better amid the excessive rate of interest surroundings, which has been a headwind to companies. Nevertheless, there are at the very least three financial institution shares that also commerce at extremely low cost valuations and could possibly be poised to take off.

1. Citigroup

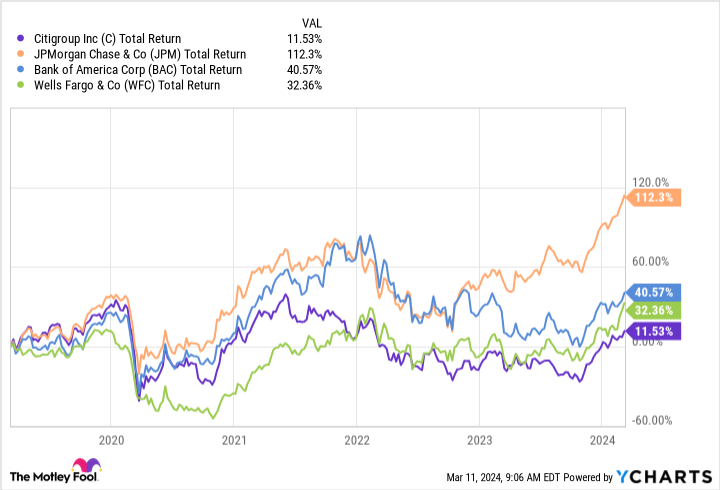

Citigroup (NYSE: C) is likely one of the largest banks within the U.S. however has struggled lately as its wide-ranging worldwide enterprise endeavors has unfold it too skinny. Not solely that, however a couple of years in the past, the financial institution was fined $400 million for deficiencies in inner controls, danger administration, and information governance. In consequence, Citigroup’s efficiency struggled in contrast with that of its banking friends.

Due to its latest historical past of underperformance, Citigroup trades at a dust low cost 33% low cost to its tangible ebook worth. Compared, Financial institution of America and Wells Fargo commerce at a 44% and 54% premium to ebook worth, respectively.

Citigroup’s low cost valuation is one facet that makes it interesting. Nevertheless, the steerage of CEO Jane Fraser, if applied, might give Citigroup the next valuation. Fraser took over as CEO in 2021 and laid out plans to get rid of much less worthwhile operations whereas leaning into these that can increase its effectivity. As a part of this transfer, it introduced it could wind down 13 international client franchises, scale back its workforce, consolidate operations, and streamline its enterprise.

Some analysts are fairly optimistic about its technique. For instance, Wells Fargo analyst Mike Mayo believes Citi’s inventory worth might attain $100 over the following three years. Whereas Citigroup has its work lower out for it, its low cost valuation supplies some margin of security and makes it appear like a very good worth inventory to purchase at present.

2. Goldman Sachs

Rising rates of interest have dampened funding banking exercise over the previous a number of years, impacting Goldman Sachs (NYSE: GS), one of many largest funding banks on the planet.

In 2022, rising rates of interest created an air of uncertainty round markets, together with these for preliminary public choices (IPOs) and mergers and acquisitions, each bread-and-butter companies for funding bankers. In accordance with the consulting agency PwC, the IPO markets over the past two years had been a number of the lowest-volume years within the U.S. In whole, there have been 175 IPOs up to now two years, effectively beneath 2021, which noticed a whopping 951 IPOs.

Goldman Sachs’ funding banking income plummeted 56% over two years ending in 2023. It has additionally made different strikes to consolidate its operations, like winding down its client enterprise, which has been struggling for the previous a number of years. The tough surroundings has made it powerful to be optimistic about Goldman Sachs. At this time, the funding financial institution trades at 16.8 instances earnings and simply 9.9 instances one-year forward earnings.

Nevertheless, IPO markets are displaying indicators of life, with Reddit, Stripe, and Klarna being a number of the most anticipated IPOs that would occur later within the yr. In the event that they launch efficiently, it could possibly be a very good signal that danger urge for food is again. If that is the case, Goldman Sachs appears to be like like a superb discount inventory to select up at present earlier than we see an additional pickup in exercise.

3. Lending Membership

Lending Membership (NYSE: LC) is a consumer-focused lender that helps customers refinance their debt and roll it up into private loans. With bank card debt topping $1.13 trillion, customers have racked up debt at a time when bank card rates of interest are close to an all-time excessive.

This rising client debt might create a large alternative for Lending Membership. The corporate began as a peer-to-peer lending platform in 2006 however has remodeled right into a client lender and a financial institution following its acquisition of Radius Bancorp in 2021. In consequence, it holds about 15% to 25% of its highest-quality loans on its books, which might generate web curiosity revenue along with the income it earns for originating and promoting its remaining loans to the market.

LendingClub CEO Scott Sanborn advised traders, “We have been making ready our private loans franchise to satisfy the historic refinance alternative forward.” To take action, Lending Membership is growing merchandise that enable members to comb bank card balances into fee plans. In different phrases, clients can “prime up” an present private mortgage, making it simple to handle their debt steadiness.

Customers might consolidate their loans, particularly if rates of interest fall, benefiting LendingClub’s core enterprise. If that is the case, now could possibly be a superb time to scoop up shares, that are cheaply priced at an 18% low cost to tangible ebook worth and 11 instances ahead earnings, forward of this historic refinancing alternative.

Do you have to make investments $1,000 in Citigroup proper now?

Before you purchase inventory in Citigroup, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Citigroup wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. Wells Fargo is an promoting companion of The Ascent, a Motley Idiot firm. JPMorgan Chase is an promoting companion of The Ascent, a Motley Idiot firm. Citigroup is an promoting companion of The Ascent, a Motley Idiot firm. Courtney Carlsen has positions in LendingClub. The Motley Idiot has positions in and recommends Financial institution of America, Goldman Sachs Group, and JPMorgan Chase. The Motley Idiot has a disclosure policy.

3 Incredibly Cheap Bank Stocks to Buy Now was initially revealed by The Motley Idiot